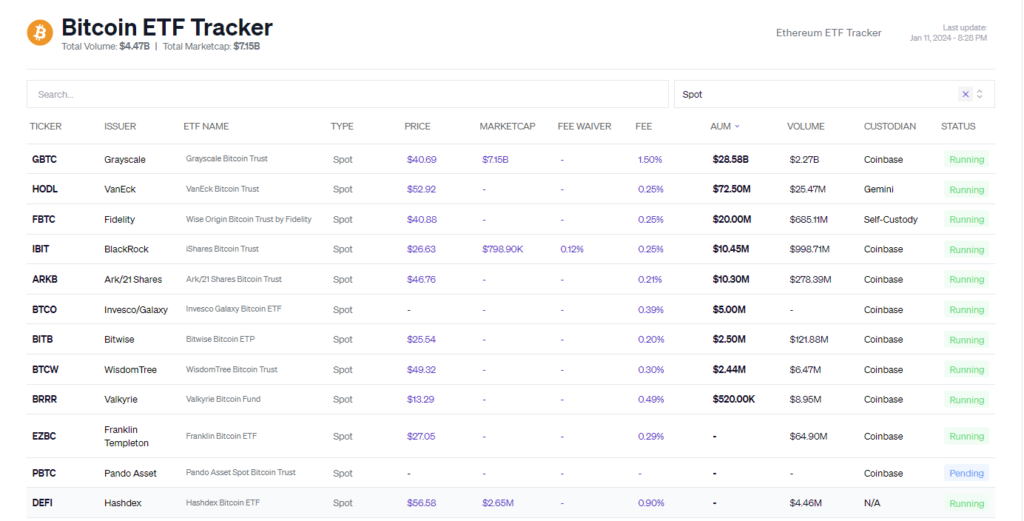

On the first day of spot Bitcoin ETFs, trading volumes surged to almost $4.6 billion, with BlackRock’s fund alone reaching over $1 billion. The Ethereum community is brimming with optimism as the prospects for spot Ether ETFs show significant improvement. According to Bloomberg analyst Eric Balchunas, there’s a 70% likelihood of SEC approval by May. The price of Ether has jumped 8% in two days and has climbed 20% in the past week.

Bloomberg ETF analyst Eric Balchunas said that he cannot envision a scenario where spot Bitcoin ETFs are approved while spot Ether ETFs are not. According to him, “The Ether spot is tied to the hip of the Bitcoin spot for sure. It’s gonna go wherever it goes. It’s basically like a 15-foot rope following it.” Balchunas also mentioned that he had heard informally, “on the back channels,” that spot Ether ETFs “will be fine.”

Industry giants join the fray: renowned names like BlackRock, Fidelity, and VanEck are among the applicants for approval, lending further legitimacy and confidence to the ETF cause. BlackRock’s stellar track record with the SEC (575 approvals, 1 rejection) adds to the positive outlook. While current SEC Chair Gary Gensler hasn’t been vocal about Ether, his predecessor’s statements and the approval of Ether futures ETFs suggest a potential path to acceptance.

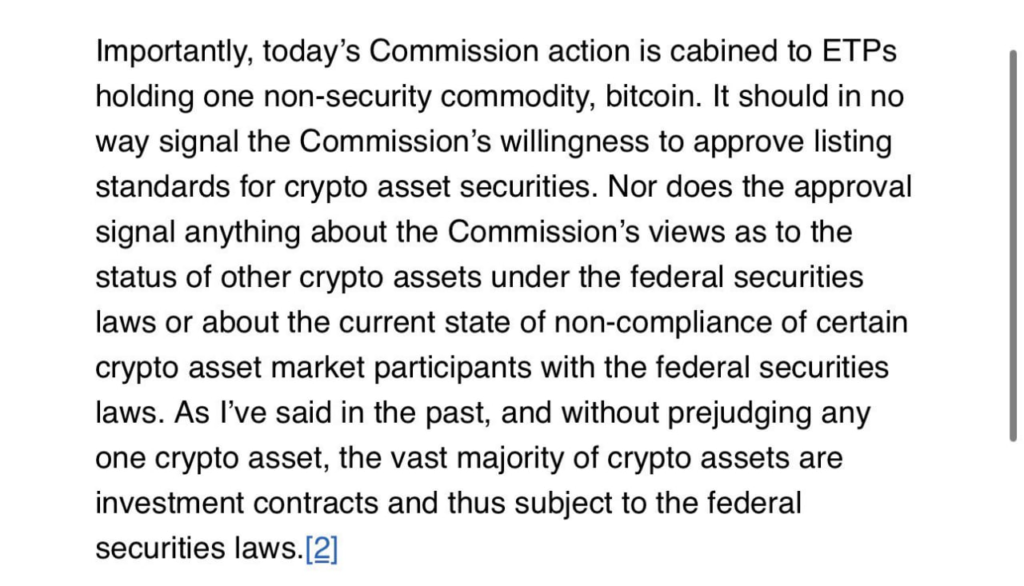

Despite the encouraging signs, uncertainties remain, such as Gensler’s skepticism towards most cryptocurrencies except Bitcoin, which could throw a wrench in the works. However, the possibility of Ether’s decentralized nature influencing the decision keeps hope alive. Even with the May deadline for some applications, the actual launch dates remain unclear, potentially prolonging the wait.

Nevertheless, the potential impact of a spot Ether ETF is undeniable. Increased accessibility, market stability, and institutional involvement could propel Ethereum to new heights. With a 70% chance of approval by May, the next few months promise to be pivotal for the future of Ether and the broader crypto landscape.

BlackRock, VanEck, ARK 21Shares, Fidelity, Invesco Galaxy, Grayscale, and Hashdex are among the spot Ether ETFs applicants for SEC approval. The SEC must decide on VanEck’s application by May 23, ARK 21Shares by May 24, Hashdex by May 30, Grayscale by June 18, and Invesco by July 5. Fidelity and BlackRock’s applications must be decided by Aug. 3 and Aug. 7.