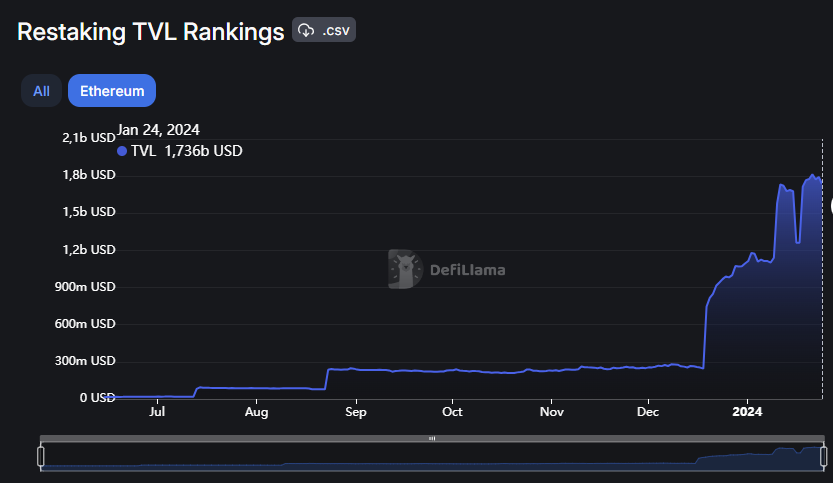

The surging popularity of EigenLayer, an Ethereum restaking protocol, is catalyzing the emergence of a new sector called liquid restaking. EigenLayer not only enables Ethereum stakers to earn extra yields by securing third-party modules but also actively participates in validating the Ethereum network. The protocol has recently witnessed explosive growth, with its Total Value Locked (TVL) skyrocketing by more than 590%, surging from $252 million on December 18 to an impressive $1.74 billion today.

EigenLayer supports both native restaking from Ethereum validators and capped deposits in the form of liquid staking tokens (LSTs), such as Lido’s stETH or Rocketpool’s rETH. The recent growth of EigenLayer can be attributed to the expansion of limits on LST deposits from 120,000 ETH to 500,000 ETH, coupled with the onboarding of six new LSTs, including wBETH (Binance), osETH (Stakewise), swETH (Swell), AnkrETH (Ankr), EthX (Stader), and oETH (Origin ETH). In a strategic move, EigenLayer announced on January 10 that it would integrate three new LSTs with a cap of 200,000 ETH each on January 29, setting the stage for another substantial TVL increase based on current Ether prices.

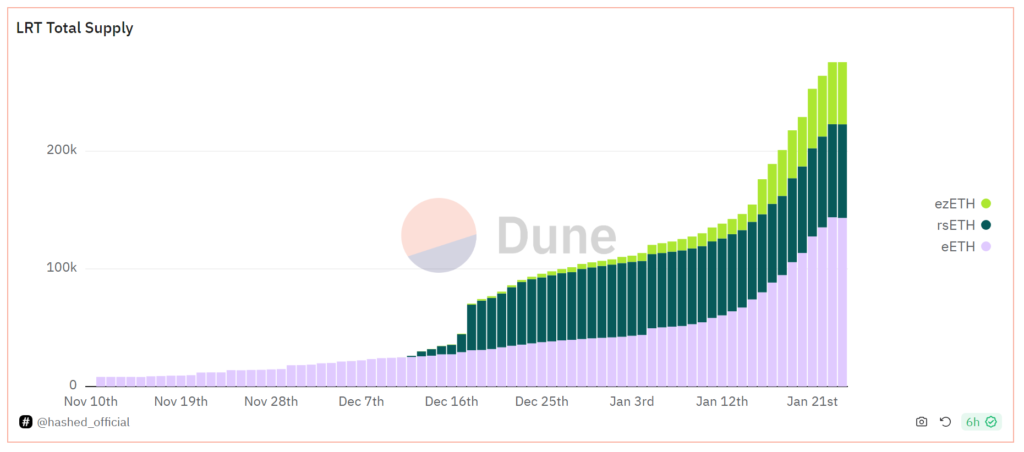

Despite restaked ETH remains illiquid, a wave of protocols like ether.fi, Renzo, and KelpDAO have swiftly introduced LRTs. These tokens enable investors to retain their restaking exposure while obtaining a liquid token deployable across DeFi to earn additional rewards. LRTs represent a relatively new asset class that DeFi investors are flocking to, especially ahead of the mainnet launch of EigenLayer.

https://dune.com/hashed_official/lrt

The market capitalization of liquid restaking tokens has surged by 140% to reach $620 million in January. Notably, Ether.fi, a liquid restaking protocol on Ethereum, has experienced a surge in demand for its eETH token over the past week, with the Total Value Locked (TVL) nearly doubling to $330 million. With EigenLayer imposing limits on deposits for liquid staking tokens but not restricting native restaking, eETH as well as other LRTs are gaining traction as an attractive native option for investors seeking exposure amid the recent hype.

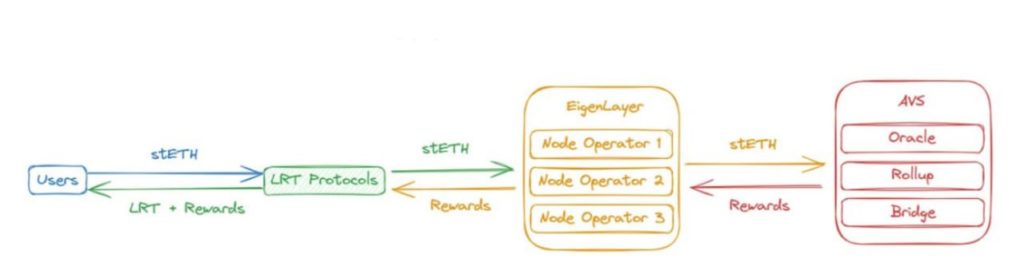

About Liquid Restaking

EigenLayer introduces the innovative concept of ‘restaking,’ enabling users to deposit their staked assets, such as $ETH, to secure protocols built on the EigenLayer infrastructure, referred to as Actively Validated Services (AVS). EigenLayer aggregates security from the Ethereum layer and leverages this economic security to fortify other protocols. With liquid restaking protocols, users deposit ETH or LSTs and, in return, receive a liquid restaking token (LRT). This empowers them to remain active participants in the DeFi ecosystem while earning rewards in the form of yields from AVSs.