I. Fluence DAO: Tokenomics

FLT has a total supply of 1 billion tokens, with an initial circulating supply of 50 million tokens. In addition, 450 million tokens will be released over 24 months after the token launch.

Up to now, the circulating supply is approximately 41.88% of the total supply, which includes:

- 5% from the launchpool and market maker

- 2.275%/ 5% from the community reward (linear vesting, 45.5% released after 2 months)

- 34.6% from the DAO treasury

At the time of writing, the estimated market capitalization of FLT is $255.4m

II. Fluence DAO: Buying Pressure

1. This wallet has accumulated over 1.15M $FLT ($653k) at an average price of $0.53. The wallet’s total portfolio value is close to $9m – it appears to be a selective portfolio that currently holds UNI, LINK, ONDO, TRUF, and FLT.

- Wallet Address: 0xcc4366544b3efea03fb804a2320a3a956f08109c

- Accumulation Wallet: 0x4A0B3f93fd35108Fb49747C5EF068b6bE5F0aEb4

2. Market Maker GSR Markets

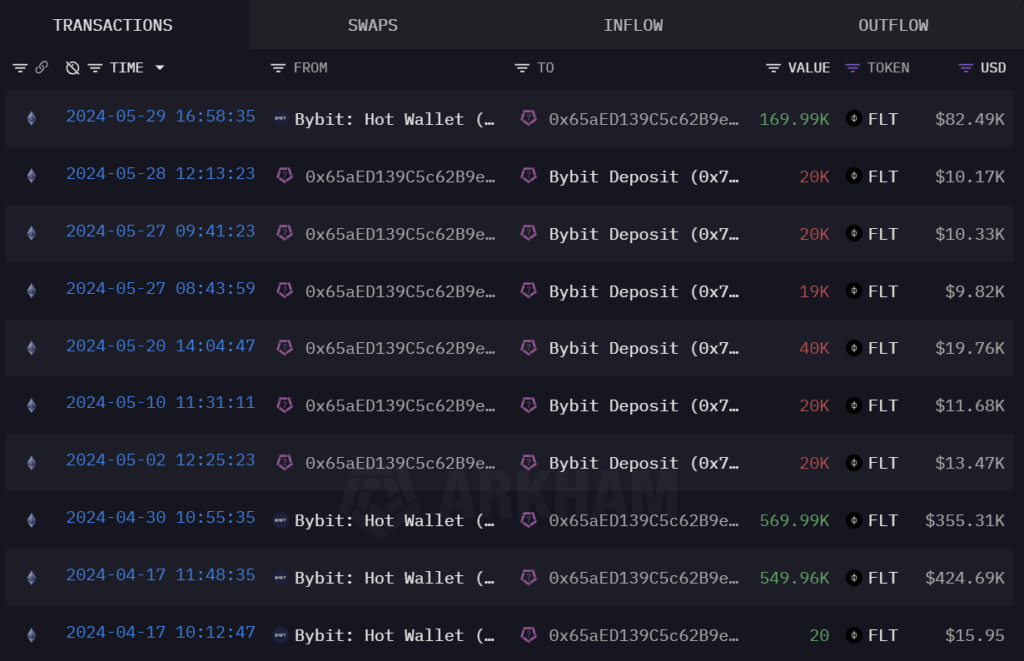

- One wallet, based on its deposit/withdrawal history, has an estimated average entry price of $0.66. It currently holds 1.15M $FLT, which is quite similar to the wallet mentioned above.

Wallet Address: 0x65aed139c5c62b9ee5d7517b23327d58ed898a3f

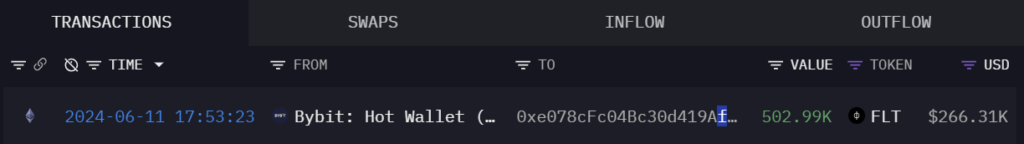

- Another wallet withdraws over 500k $FLT ($266k) from Bybit Exchange at an average entry price of $0.53 two days ago.

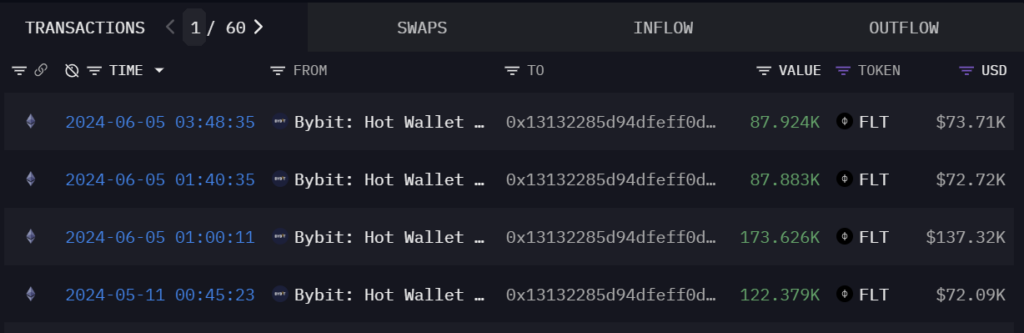

3. This wallet appears to be a VC wallet, based on its transactions with market makers like Wintermute, Jump, and Tokk Labs. It has purchased 471k $FLT at an average price of around $0.76 and holds a sizable portfolio of gaming projects like BEAM, PYR, PIXEL, ACE, etc.

- Wallet Address: 0x13132285d94dfeff0dA3Ad32C5809B0116e62a85

4. A wallet has started withdrawing large amounts of $FLT from the Gate and Bybit exchanges, totaling $3m in $FLT at an average price of $1 so far. It has then distributed the tokens to 3 other wallets to hold, and there has been no selling activity from these wallets. Based on the wallet’s trading history, which involves transactions with several major market makers such as Wintermute, Galaxy Digital, Amber Group, and Cumberland, this wallet can be identified as belonging to the B2C2 Group.

Wallet Addresses:

- Accumulation Wallet: 0xA995910658808c859623c0fE2fF53e432A236739 – $22m total portfolio value

- Sub-Wallet 1: 0x7a3FB4d76315a87907a33dc4A6807034BF518406 – $1.27m total portfolio value

- Sub-Wallet 2: 0xcfCA8540716C114C58d4275CB74A37eA2B94C16D – $206k total portfolio value

- Sub-Wallet 3: 0x41dda7bE30130cEbd867f439a759b9e7Ab2569e9 – $30.8m total portfolio value

III. Fluence DAO: Selling Pressure

The selling originated from a single wallet that sold over $21k on a DEX, triggering panic sell from other retailers that had accumulated the token in the 0.6 – 0.7 range earlier, likely to preserve capital.

- Wallet Address: 0xefd4487586438fa46e5b993a49e6ef3d9311e693

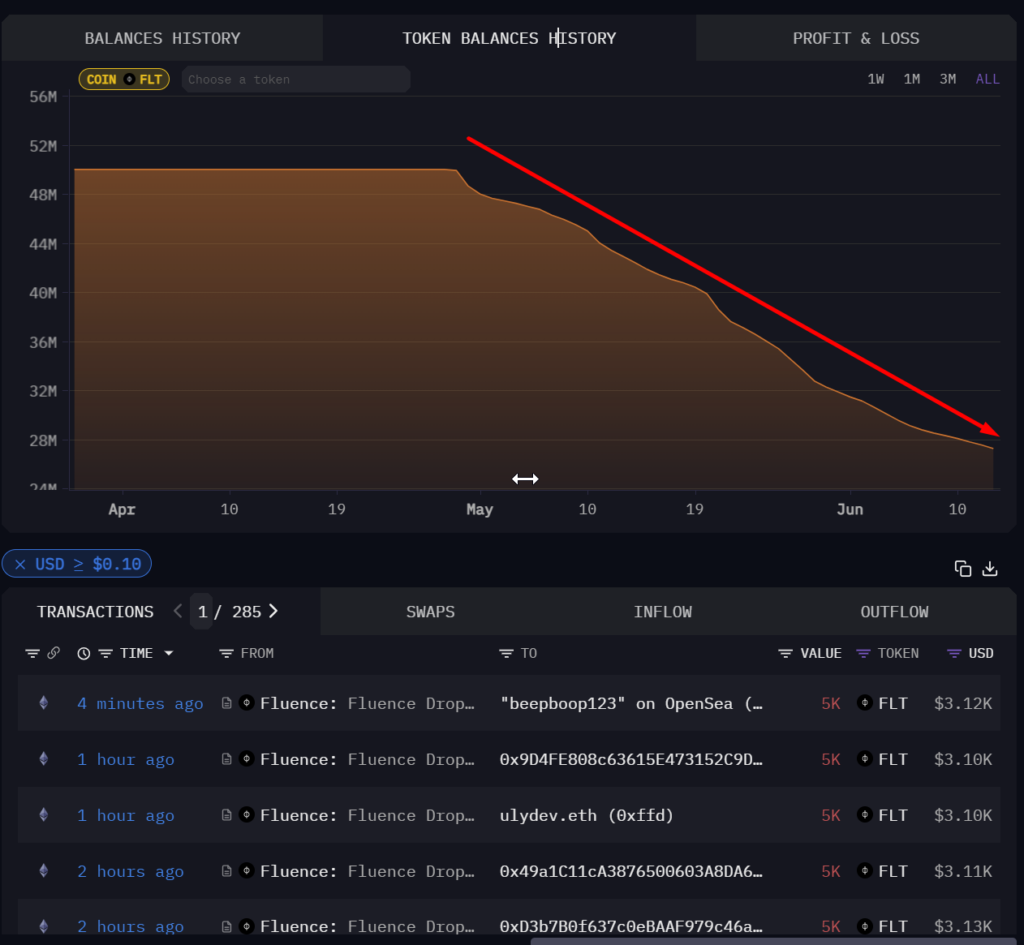

The community reward contract, which had an initial 50m $FLT allocation, is also a source of selling pressure. Currently, only 27m $FLT remains in this contract. Most wallets that received the community rewards have been actively selling on CEXs and DEXs. This selling, combined with the earlier large-scale selling from a single wallet, has contributed to the sharp price decline in $FLT.

IV. Final thoughts

There is a strong accumulation of the token from wallets associated with VC firms and MM.

The selling pressure is coming linearly from the community reward contract. So far, around 22.7m $FLT tokens have been absorbed, with 27.3m $FLT remaining. Additionally, the impressive over 12x ROI achieved by retail participants in the Bybit IDO has also created selling pressure on the market.

According to the token’s vesting schedule, the team’s and investors’ tokens have around 2 years left before unlocking. Combining the observed VC/MM accumulation and the gradual absorption of the community reward contract selling, the current price levels may present a potential entry point.

Multicoin Capital, a prominent venture capital firm, has recently had success with investments in the computing sector, such as Render and Io.net (which listed just a few days ago). Fluence DAO is the project in the same computing sector, and it is in Multicoin’s portfolio. Therefore, this will attract community attention and drive upcoming price growth.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.