Welcome to this week’s edition of our Crypto & Market Weekly Recap, where we delve into the most significant events and market movements that are shaping the investment landscape. This week has been particularly eventful, with major political and economic developments influencing market trends and creating new opportunities for investors. In this article, we’ll explore the impacts of these events on safe-haven assets, the cryptocurrency market, and potential investment opportunities.

1. Overview

1.1. Weekly Recap

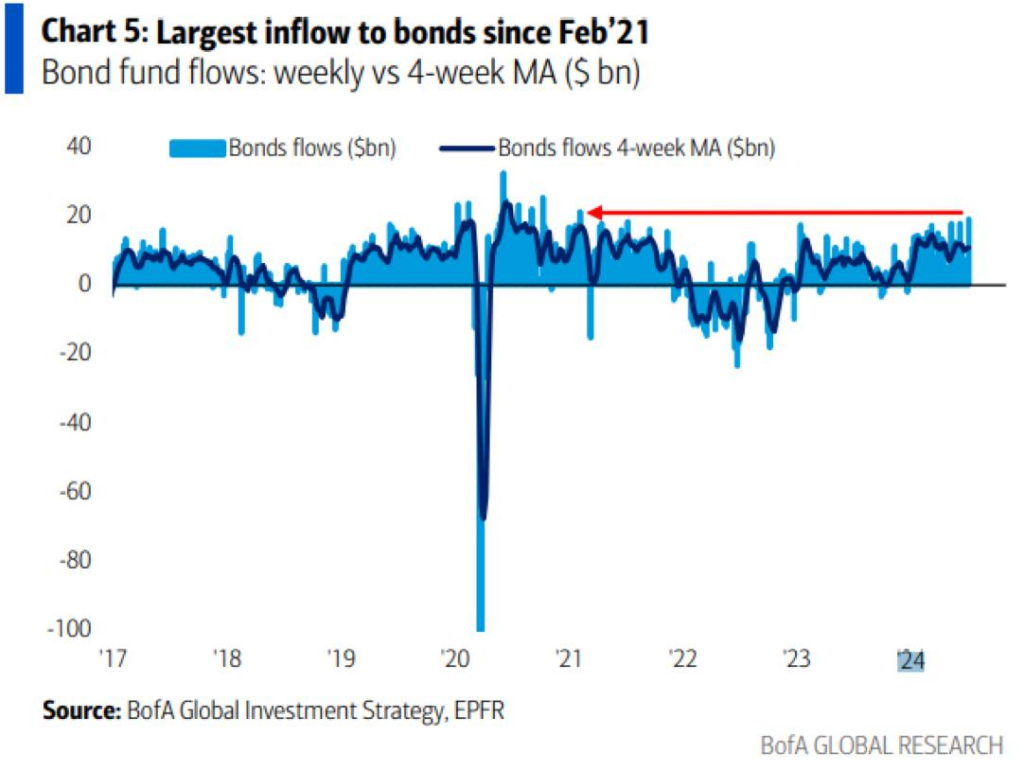

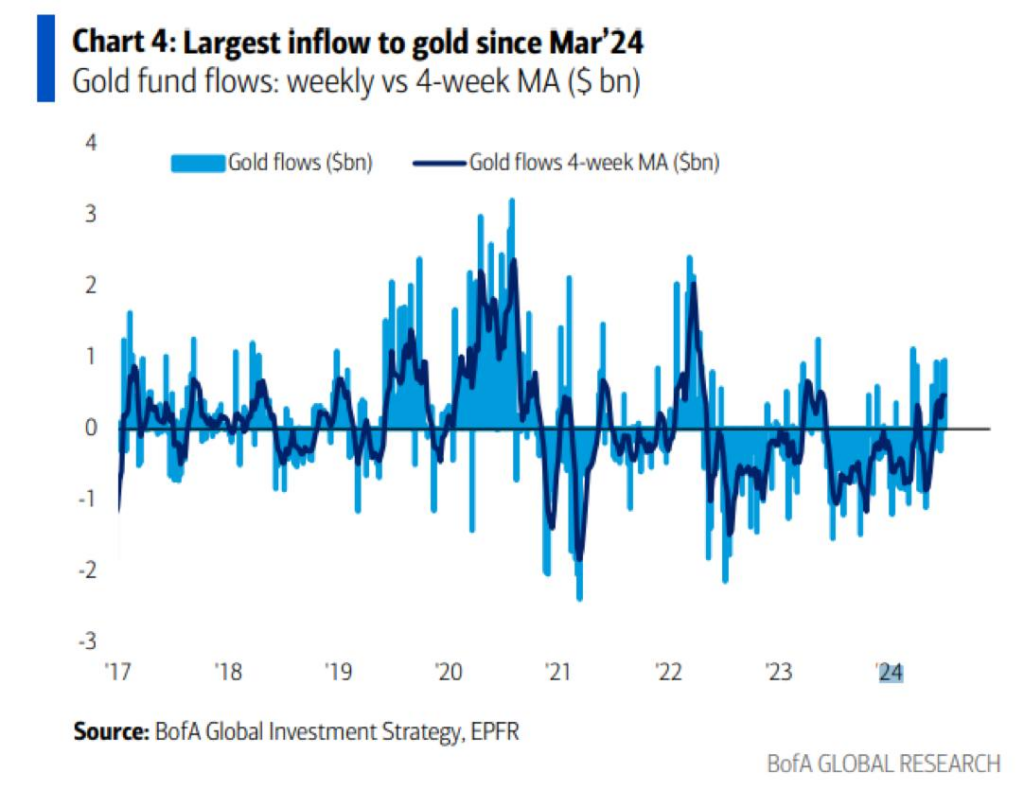

- The recent assassination attempt on U.S. presidential candidate Donald Trump has heightened political violence, driving demand for safe-haven assets such as U.S. Treasuries and Gold.

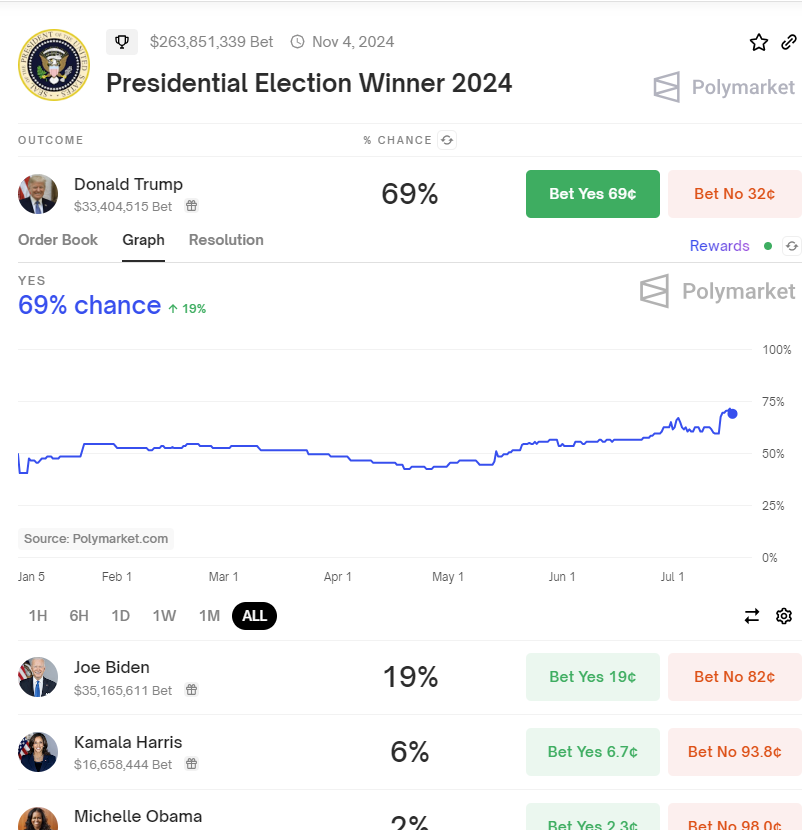

- Following the incident, Trump’s chances of winning the upcoming election surged to 69% in prediction markets.

- The crypto community is optimistic about a potential Trump presidency due to his supportive stance on cryptocurrencies. His campaign is the first to accept crypto donations, and he is scheduled to speak at the Bitcoin Conference in Nashville later this month. Should Trump win the presidency, it is anticipated that his administration will implement regulations that foster crypto innovation and adoption.

1.2. Market Reactions

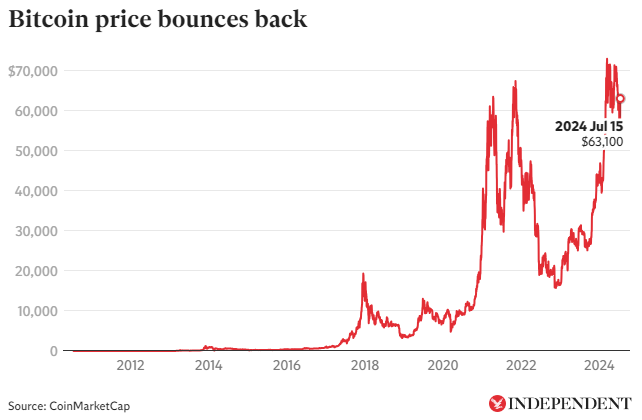

- Since the assassination attempt on Trump, the price of Bitcoin has increased by approximately 10%, reaching over $65,000, a two-week high after dipping to $53,000 earlier this month.

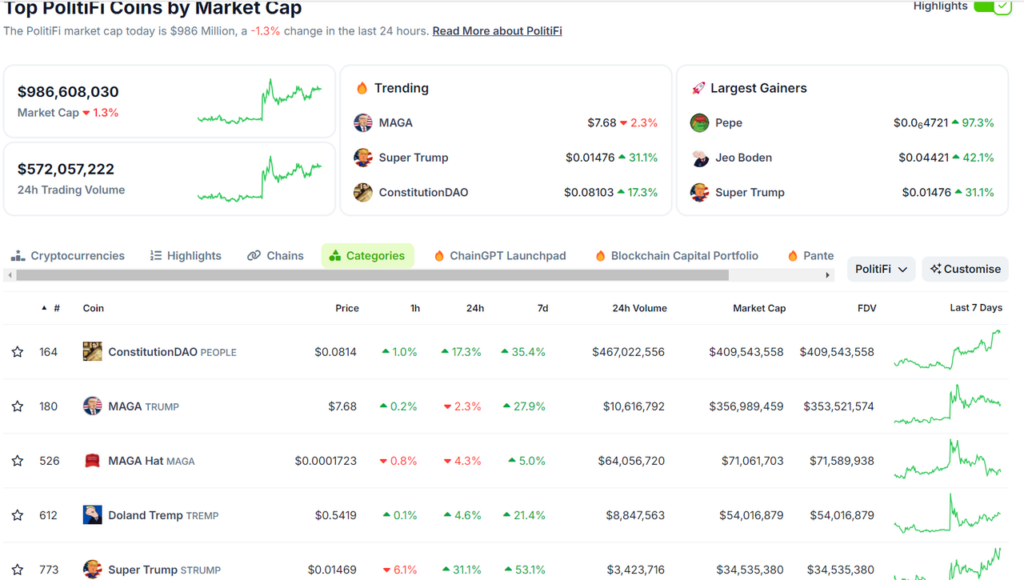

- Politically themed cryptocurrencies, particularly those linked to Trump, have also seen significant surges. Examples include $TRUMP (+45%), $MAGA (+36%), $STRUMP (+32%), and $PEOPLE (+18%) over the past seven days. Thus, you should pay attention to PolitiFi-meme groups in the short term.

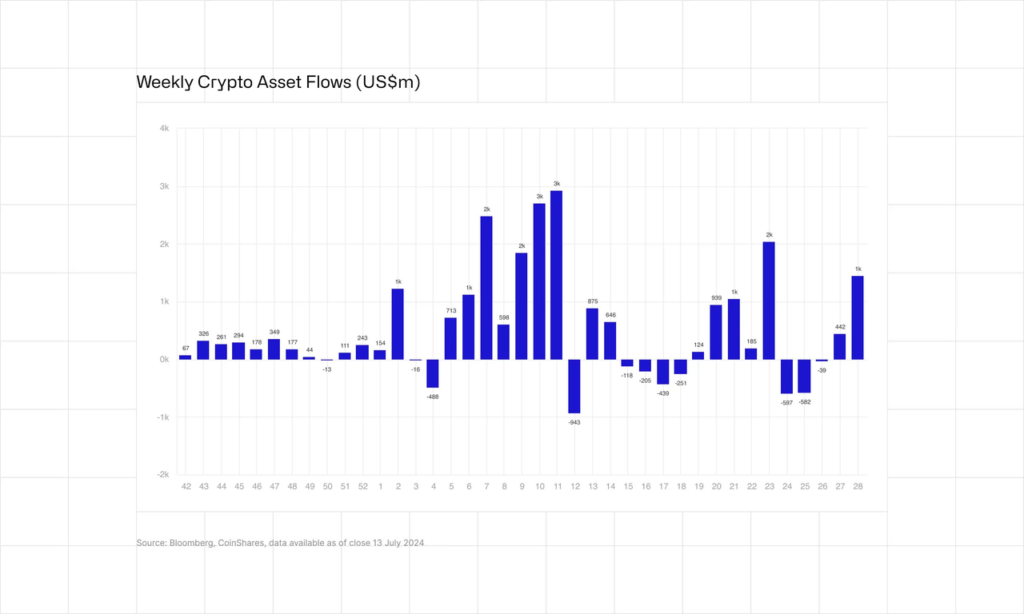

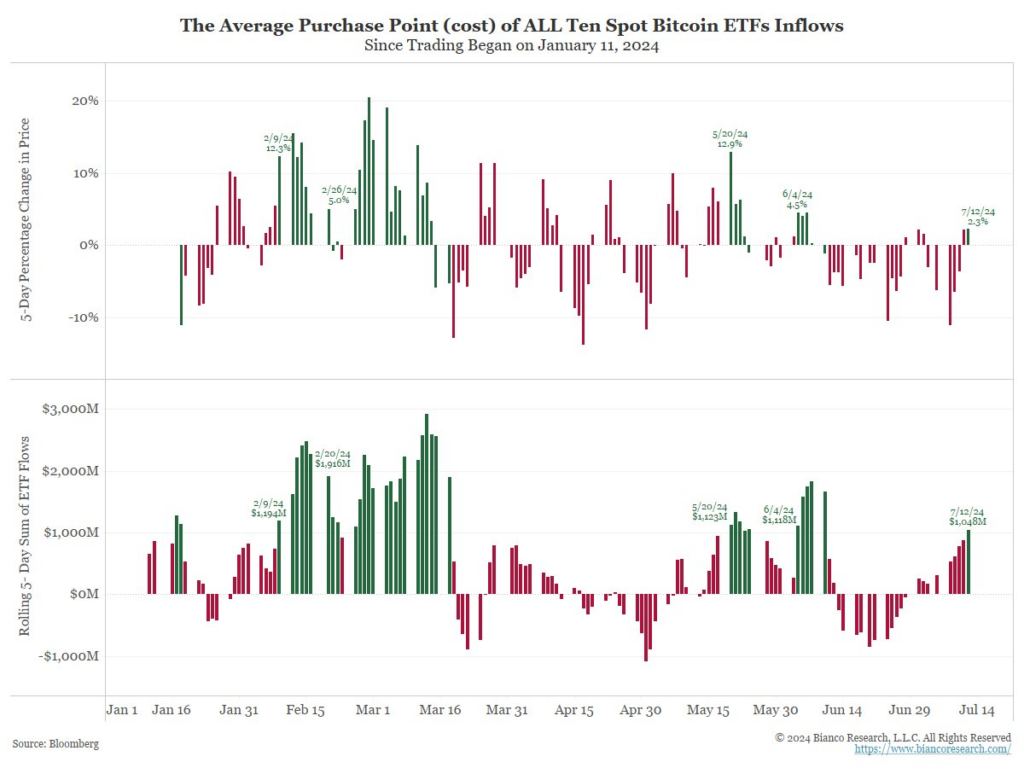

- In addition to Trump-related momentum, Bitcoin is experiencing a surge as investors pour money into spot Bitcoin ETFs, despite a $3 billion (50,000 BTC) sell-off from Ger GOV. More details, US Bitcoin spot ETFs attract over $1 billion in net inflows in a week. This indicates that products like ETFs attract investors willing to invest against market cycles.

- Historically, every time ETF flows topped $1 billion (as indicated by the first green bar), Bitcoin increased by 5-13% over the same five-day period.

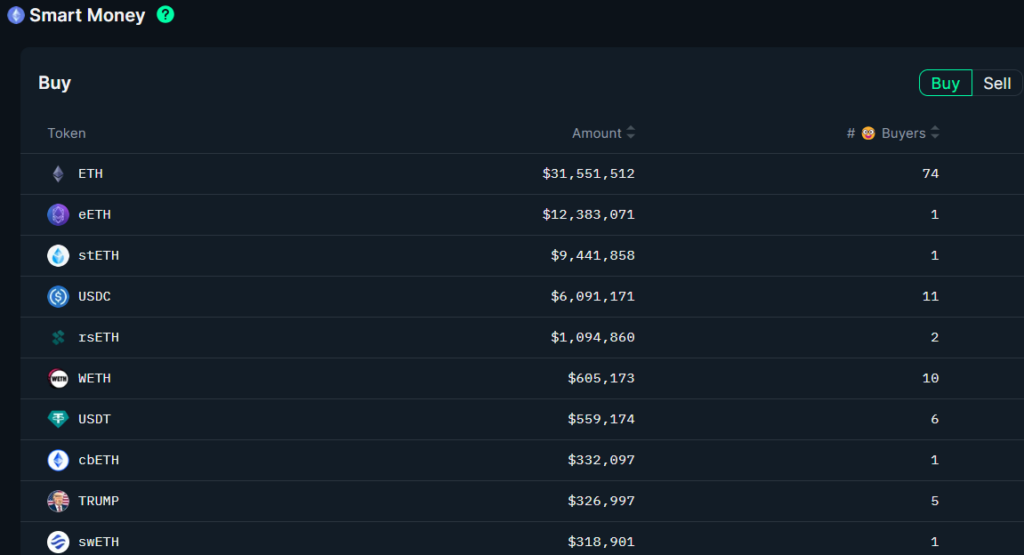

- Smart money is also moving towards Ethereum, a shift from last month’s focus on meme tokens. This suggests an expectation for Ethereum ETFs and signals the onset of altcoin season.

2. Conclusion

2.1. Investment Opportunities

- A Trump presidency could benefit crypto stocks, gun stocks, and shares of private prison operators.

- Bitcoin and Ethereum are leading the market, with altcoins showing limited growth. Currently, three-quarters of the market capitalization is concentrated in Bitcoin and Ethereum.

2.2. Future Market Movements

- Once Ethereum ETFs are launched, there is expected to be a rotation from Bitcoin to Ethereum as Bitcoin prices peak. Following this, capital is likely to flow into various altcoins, driven by market trends.

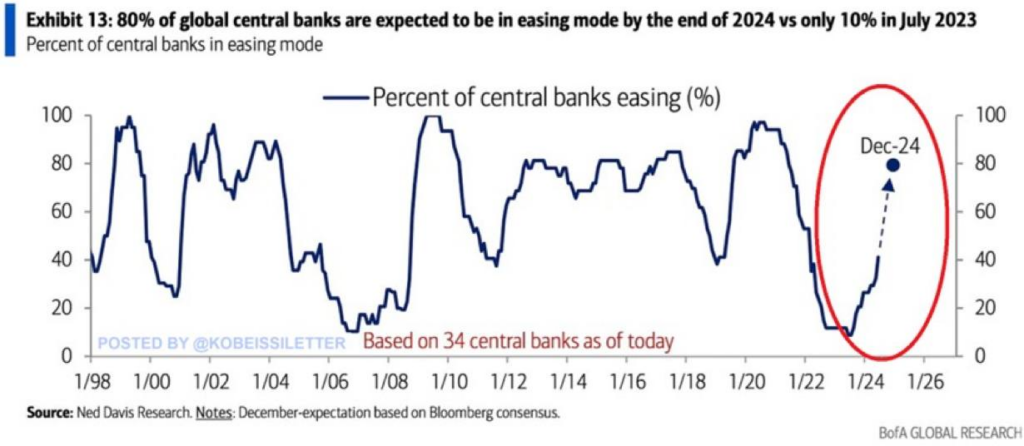

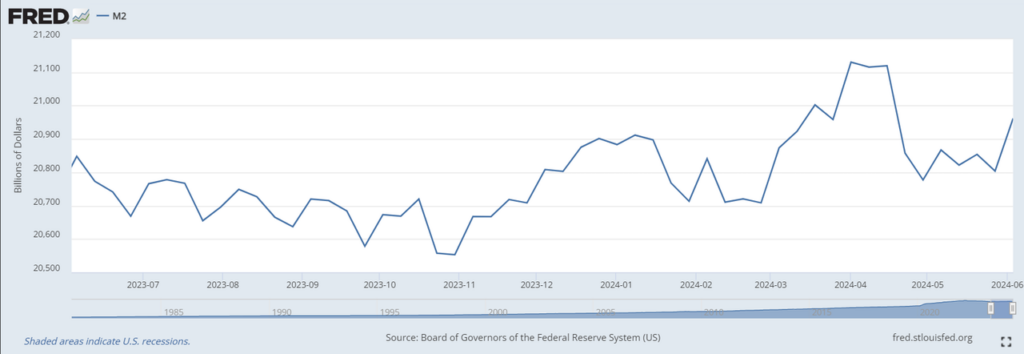

- The market is poised for a bullish Q4, with multiple catalysts including the launch of Ethereum ETFs, potential rate cuts, global liquidity recovery, an increase in M2 money supply, heightened crypto adoption due to the U.S. election, and possibly more favorable crypto policies or ETF introductions from China.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.