The global financial landscape witnessed a turbulent week, with significant declines sweeping across major stock indices and the cryptocurrency market. Amidst this volatility, investors wonder whether to brace for a prolonged downturn or see this as a strategic opportunity. In our latest market report, we delve into a comprehensive global macro overview, dissect the factors driving widespread sell-offs, and offer insights on navigating these challenging times. Stay informed, gain a clear perspective on positioning your investments, and understand the critical data that shapes the market dynamics through our research below.

1. What happened?

1.1. Overview

On August 5th, the global stock market experienced significant declines, leading major share indices to tumble just weeks after reaching record highs:

- New York: The S&P 500 finished the trading day down 3%, marking its worst day in nearly two years, closing at 5,186. This extended its decline from its peak to 8.5%.

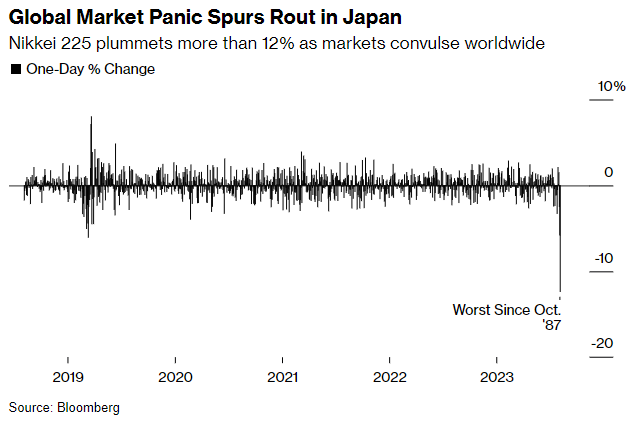

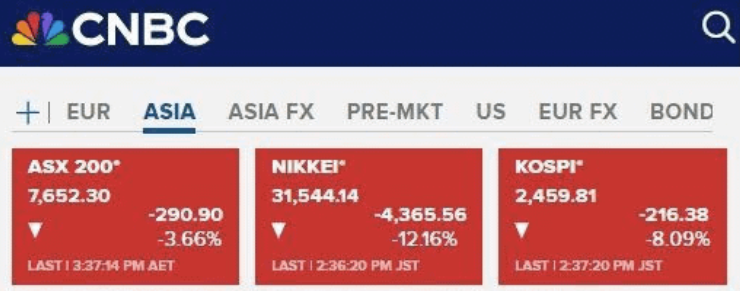

- Tokyo: The Nikkei Index fell by over 12%, the biggest drop since 1987, erasing its gains for the year.

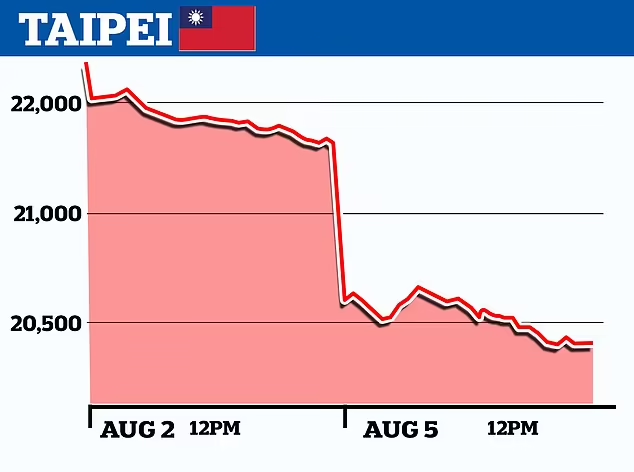

- Taiwan: The benchmark index had its worst day ever.

- Other Markets: Stock indexes in South Korea, India, Australia, Hong Kong, and Shanghai all recorded their biggest declines in four years.

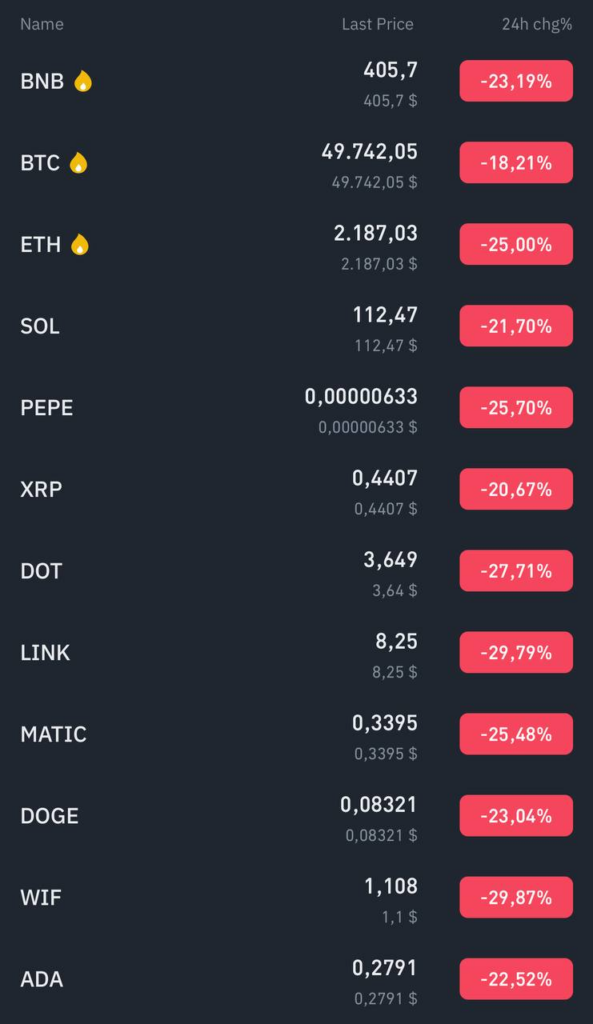

- Global turbulence extended to the cryptocurrency market with the price of Bitcoin falling 18%, reaching $49,742, while the price of Ether dropped as much as 25%, settling at $2,187. Many altcoins experienced losses exceeding 30%.

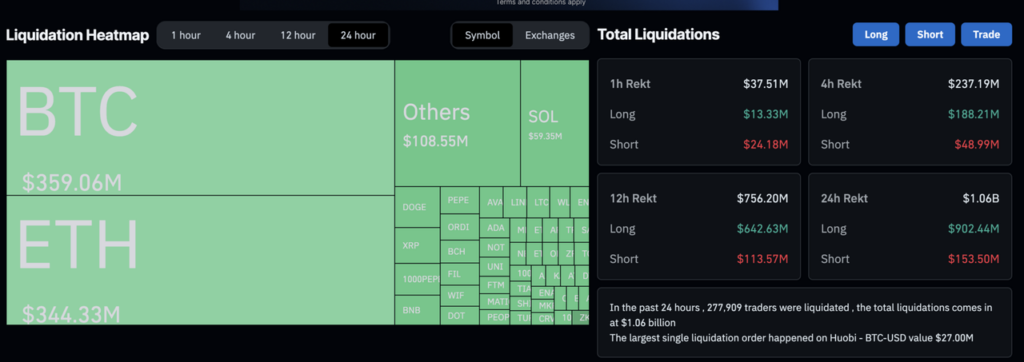

- According to Coinglass data, the total value of 24-hour liquidation in the crypto market surpassed $1 billion, of which long orders had a liquidation of $902M.

1.2. What Caused the Bloodbath?

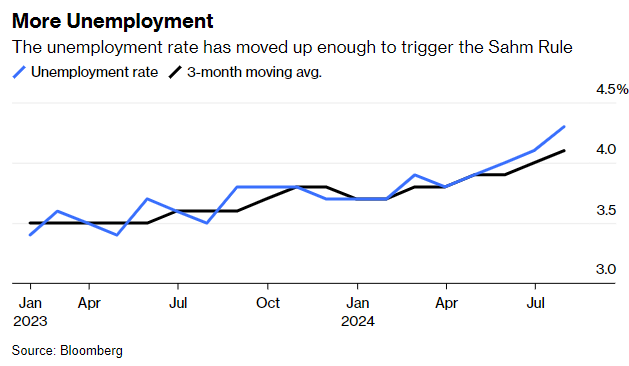

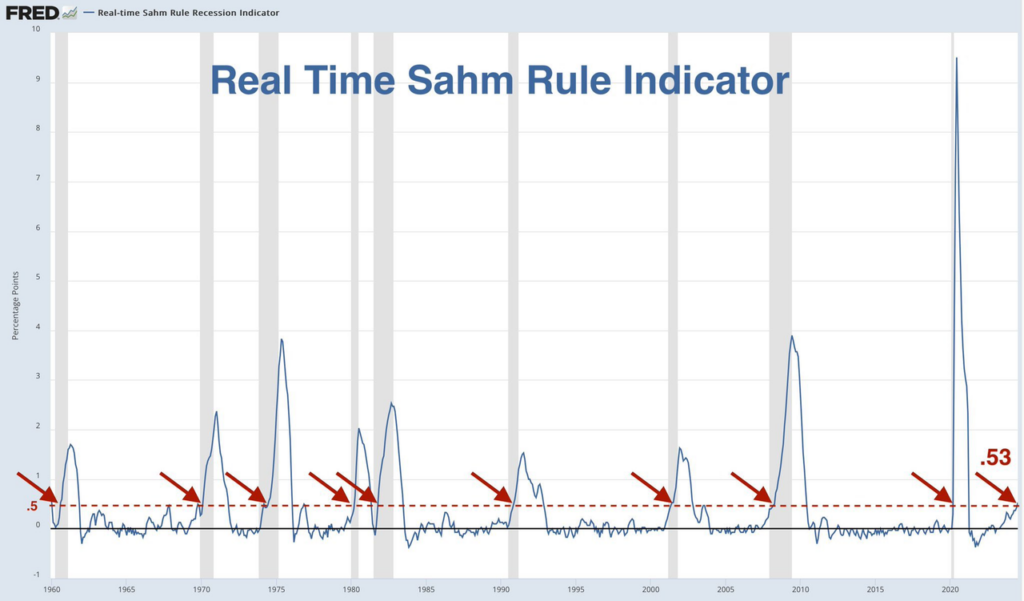

- Fears of US hard-landing: July’s weak jobs report revealed an unemployment rate increase to 4.3%, a nearly three-year high. This triggered the “Sahm Rule,” which indicates a recession when the three-month average unemployment rate is at least 0.5 percentage points higher than the lowest level in the previous 12 months. The current three-month average is 4.1%, compared to the lowest level of 3.5% in the past year, creating a gap of 0.63%, thus signaling a recession.

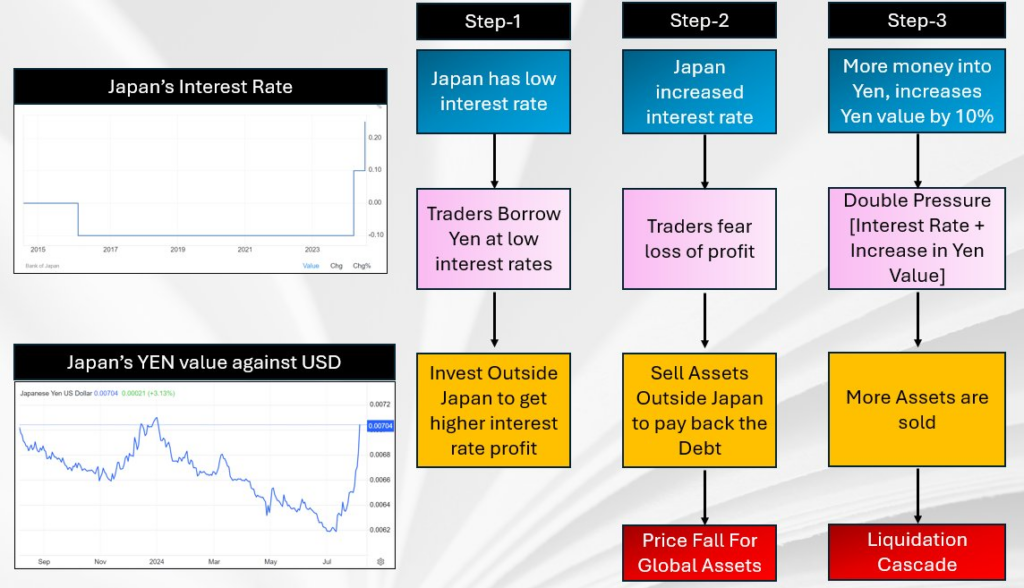

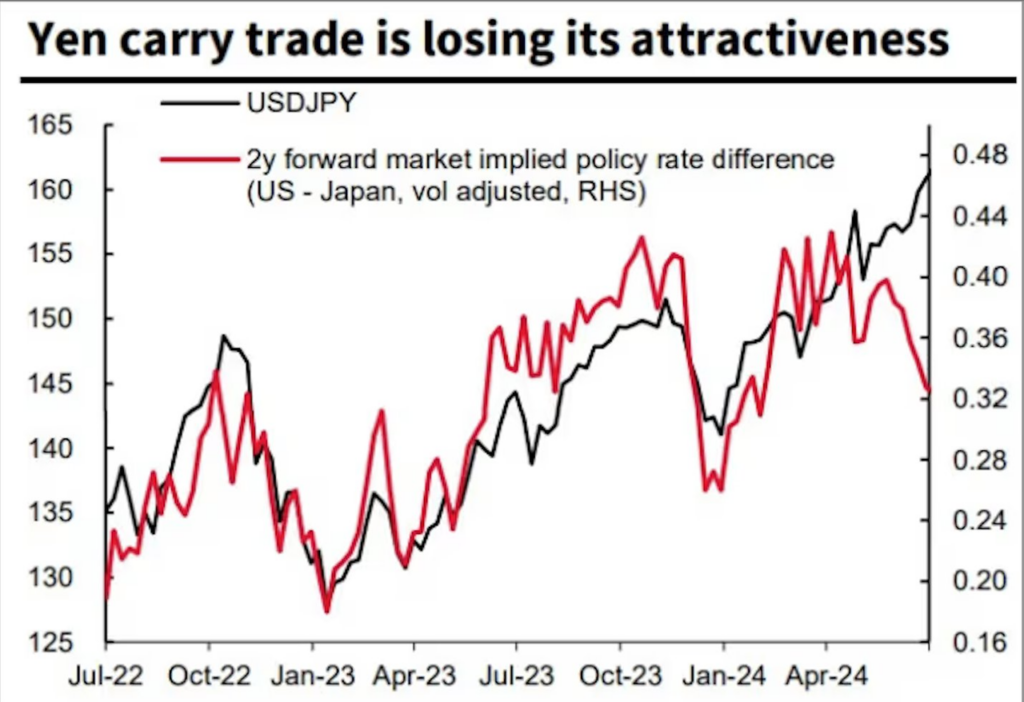

- Unwinding of the Yen carry trades: The Bank of Japan’s rate hike reduced the interest rate differential between Japan and the U.S., causing the yen to rise in value against the dollar by 12% since mid-July. This ended the practice of investors borrowing cheap yen to buy higher-yielding assets, mainly U.S. tech stocks. As a result, investors had to sell these assets to cover their losses, putting downward pressure on tech stocks and contributing to global market declines.

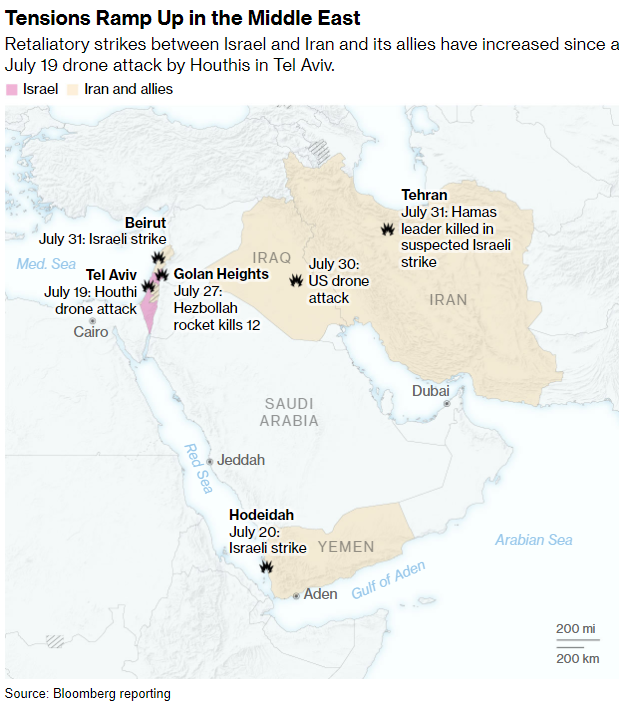

- Political unrest: Middle East tensions have escalated since the killing of a senior Hamas leader on July 31. Anticipated retaliation from Iran and Hezbollah following Israeli strikes has increased fears of a larger conflict. This geopolitical tension has dampened market sentiment and led investors to seek safety over risk assets.

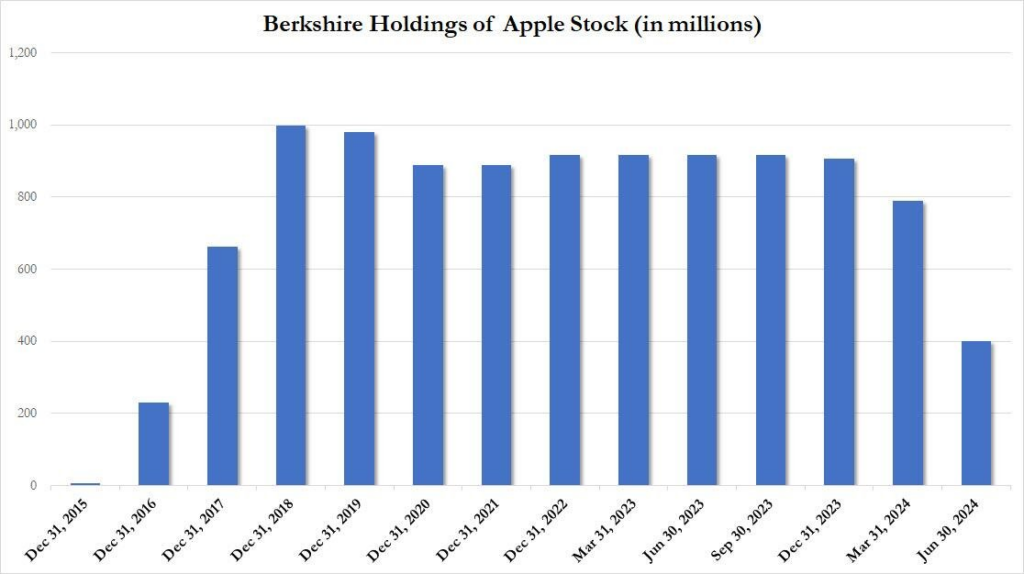

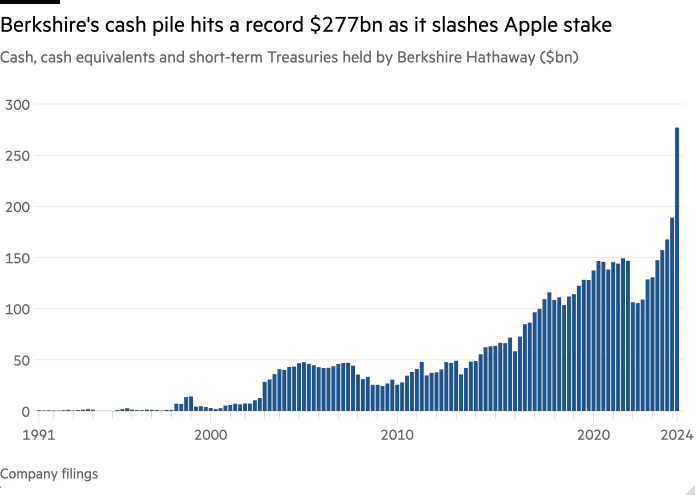

- Berkshire Hathaway’s Stake Reduction in Apple: Warren Buffett added to market anxiety by disclosing that Berkshire Hathaway now holds just 400 million shares of Apple, down 50% compared to Q1. Notably, Berkshire’s cash position has reached a record $277 billion, with significant investments in Treasuries. Global investors see this as a bearish signal from one of the world’s most respected investors, leading to increased market chaos.

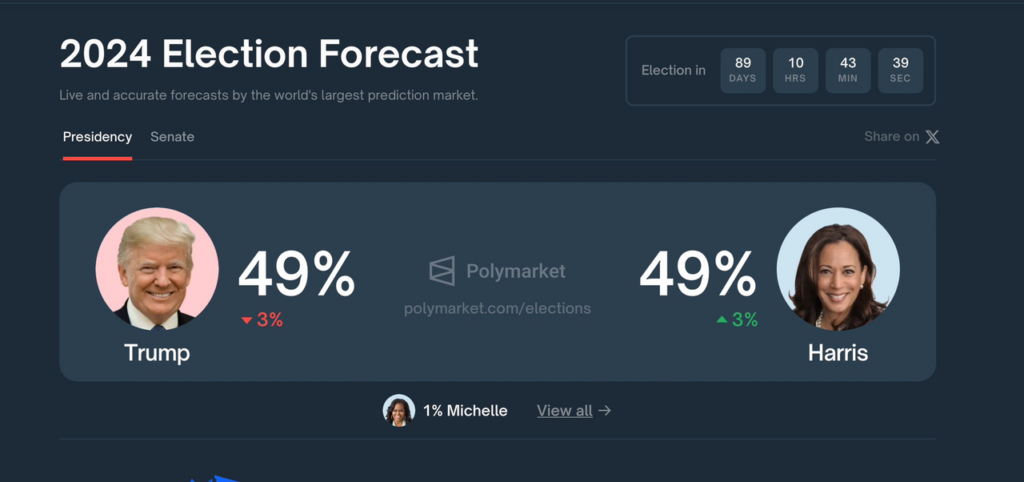

- Political Election Uncertainty: The odds of Donald Trump winning the upcoming elections are now equal to those of Kamala Harris, despite previously having a significant lead. This unexpected shift adds to broader worries about how policies coming out of November could impact markets.

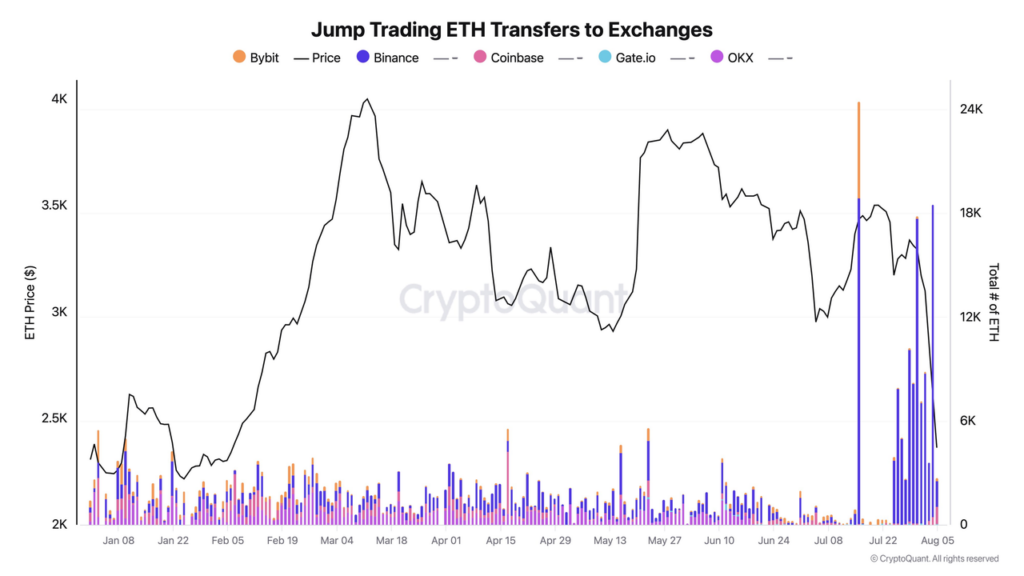

- Jump Trading’s Influence: One of the largest market makers, Jump Trading, began selling their positions over the past two weeks, particularly during weekends when institutional trading was absent. They offloaded over $400 million in ETH, causing Ethereum to drop to its lowest level since January 2024 ($2,100). Rumors suggest that Jump Trading’s sell-off might indicate their exit from the cryptocurrency market due to a U.S. CFTC investigation. Another theory posits that Jump Trading took advantage of the interest rate differential to borrow cheap Japanese yen and invest in cryptocurrency. The BOJ’s rate hikes compelled them to sell assets into USD, convert to yen, and repay the borrowed money.

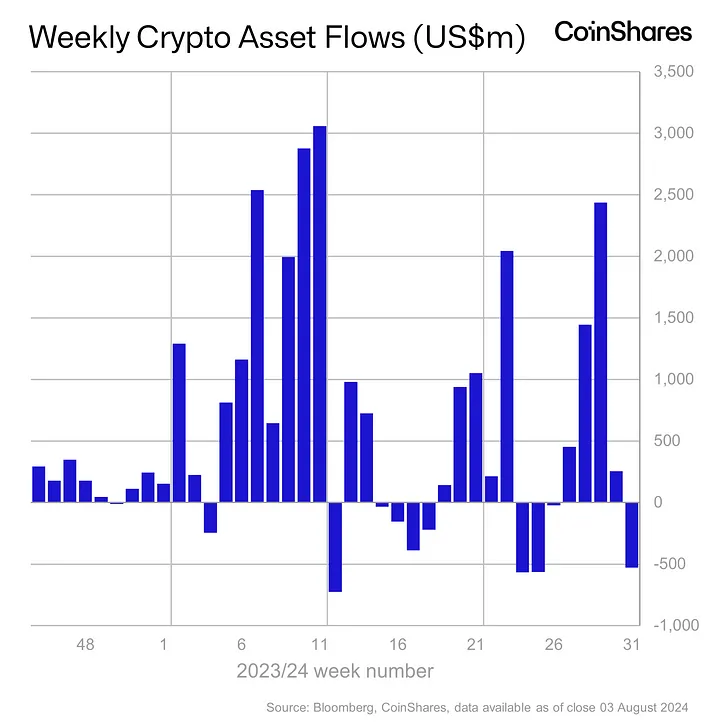

- Selling Pressure from ETFs: Bitcoin experienced $528 million in outflows, making it not immune to the broad asset class sell-off. This was driven by fears of a U.S. recession, geopolitical concerns, and broader market liquidations across most asset classes.

2. What should we do? What’s Next?

Regarding fears of a U.S. recession, it is crucial to watch the labor data next month to see if the trend continues. The rolling 3-month average will provide a better guide. Currently, U.S. labor data indicates modest weakening, not a disaster scenario.

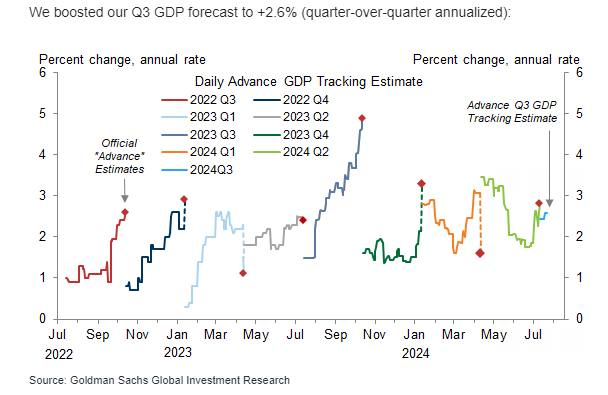

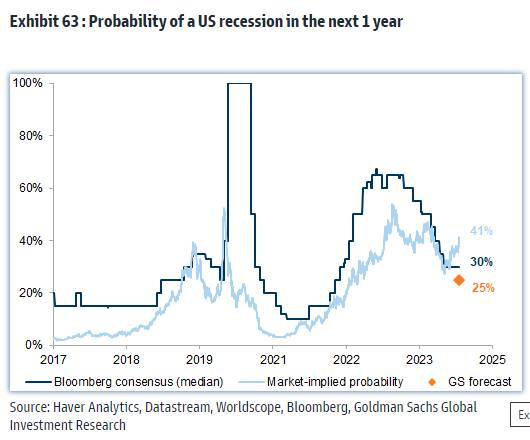

In our view, the recession panic is overblown and the market overreacts. The economy is slowing down, not crashing. The U.S. economy is still growing, with Goldman Sachs forecasting an increase in Q3 GDP. Although the chance of a U.S. recession within the next 12 months has risen. It only increased from 15% to 25%, which remains limited, according to Goldman Sachs.

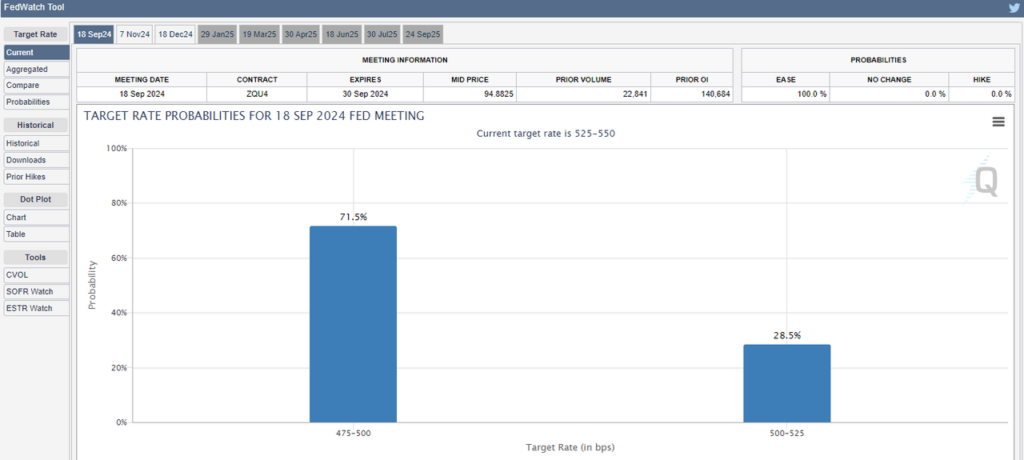

The disorderly market reaction could prompt the Fed to loosen policy soon, with substantial scope to reduce interest rates. The odds of a 50 bps rate cut by September have increased to 71.5%. However, there is always a monetary lag between policy implementation and its impact on the economy (generally between 9-15 months). Even if the Fed starts cutting rates next month, one cut won’t make much difference. Two or three cuts before the end of the year will have an effect by the spring of next year. Overall, we believe risky assets will perform well in a gradually declining interest rate environment.

In terms of the cryptocurrency market, are we likely to experience more pain in the crypto market? We cannot confirm, but there are some positive aspects:

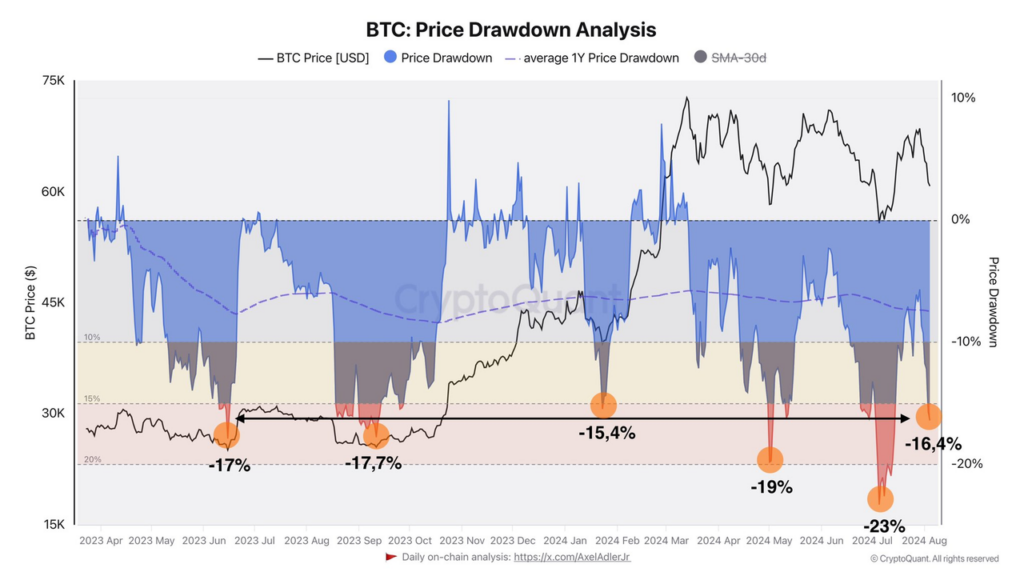

- Historical Precedents: Bitcoin has experienced similar strong drawdowns in the past. Over the last 1.5 years, the average Bitcoin drawdown has been -16.6%, and the current drawdown is -16.4%, while the maximum was -23%.

- Morgan Stanley now allows financial advisers to offer Bitcoin ETFs to wealthy clients. This decision may pave the way for other big banks (JP Morgan, UBS, Wells Fargo, Citibank, etc.) that have been reticent to offer digital assets to consider tapping into the sector. The increasing adoption of digital assets by institutions and retail investors alike is expected to drive the market forward.

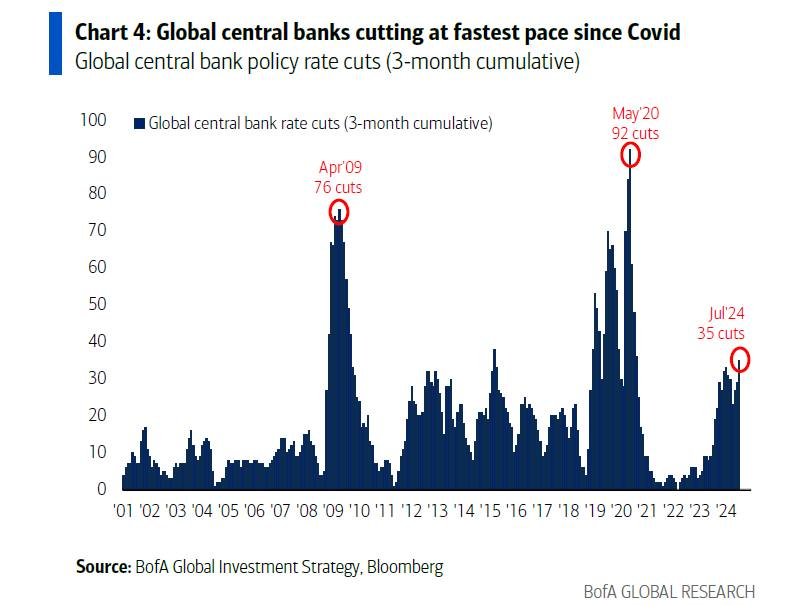

- Investors should focus on the positive prospects of the central bank easing cycle. Fluctuations in global liquidity—cash and credit flows across financial markets—over the past few years have proven to be a predictive guide to future investment performance. U.S. tech shares and Bitcoin are liquidity-sensitive asset prices.

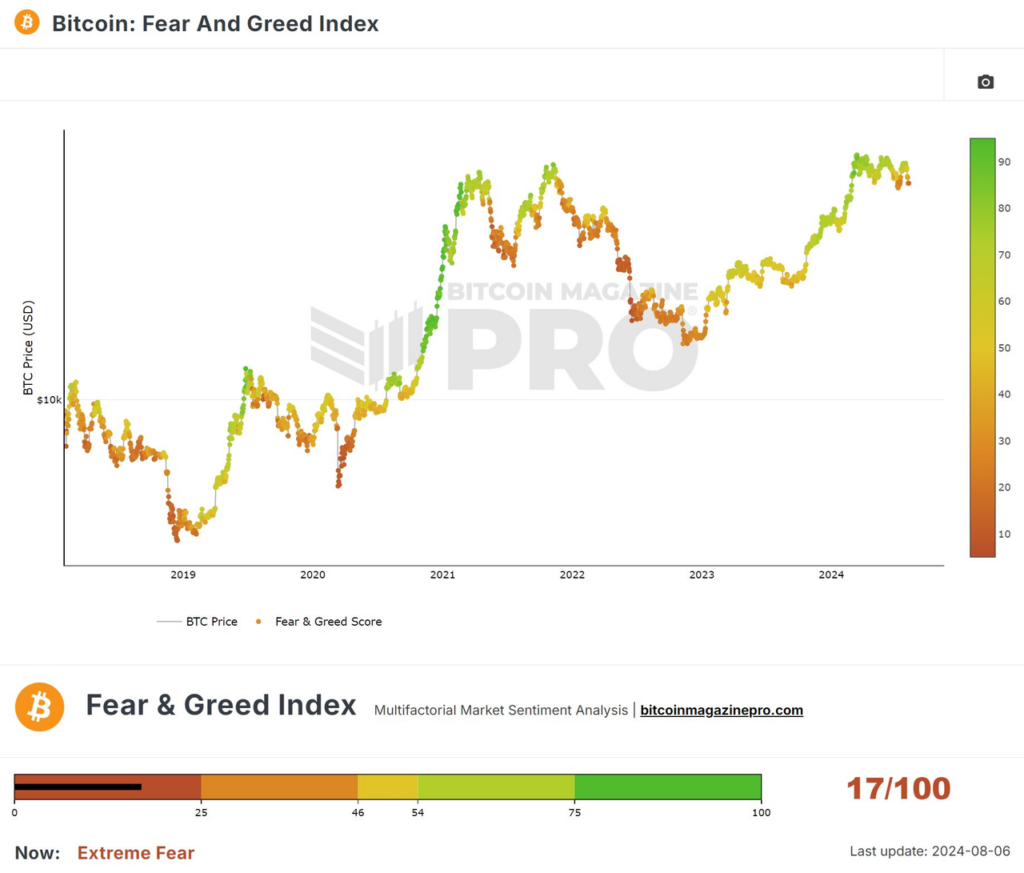

- Bitcoin is currently in the “Extreme Fear” phase of the Fear & Greed Index, scoring 17/100, a 1-year low. It is an excellent buying opportunity. We have been this fearful three times in the last five years: the 2019 bottom, the 2020 bottom, and the 2022 bottom.

3. Conclusion

We do not see the correction in risky assets as the start of a downturn. This type of short-term crisis and panic presents good opportunities for bargain hunting, particularly in equities and crypto, which are now available at bigger discounts. If you have spare money to invest, now may be a good time to do so.

Keep in mind that markets have been rocked by premature recession fears during the current bull market. These fears flared early last year during a U.S. regional banking panic but almost recovered as quickly as the Fed intervened to provide emergency liquidity. This proves that the Fed will ‘fix it’ if the economy worsens. Don’t panic and stick to your investment plan.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.