A recent report from Galaxy Research has raised alarms about the long-term viability of Bitcoin layer-2 scaling solutions, particularly “rollups”. Despite their current acclaim as a method to maintain Bitcoin transactions that are affordable, speedy, and decentralized, the report underscores significant sustainability challenges.

Released on August 2, the analysis by Gabe Parker of Galaxy Research identifies the high cost of data posting to the Bitcoin base layer as a central issue for rollups. For these layer-2 networks to remain viable, they must generate significant revenue from transaction fees, relying on a large user base willing to pay for their transactions.

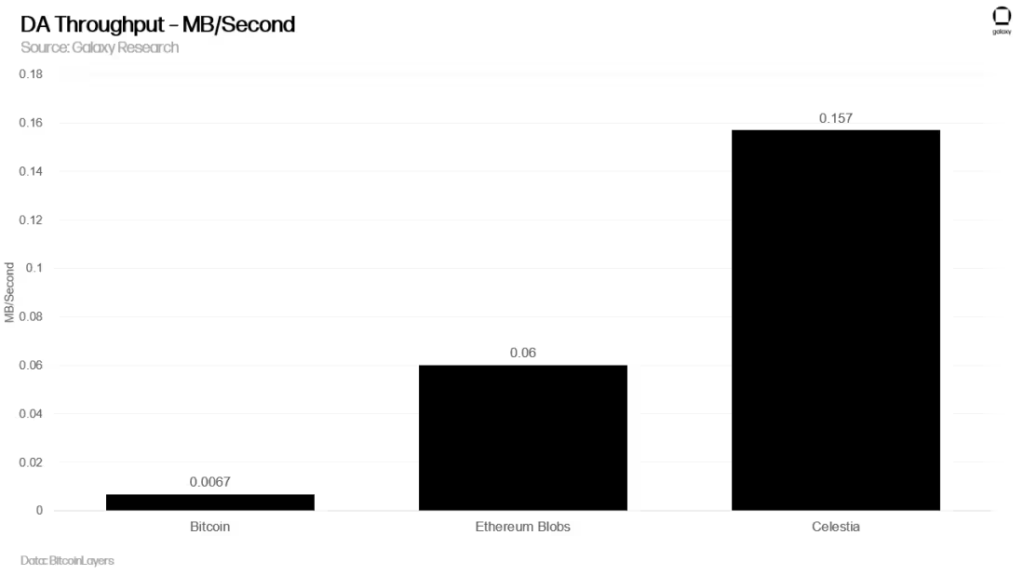

Bitcoin’s block size is capped at 4MB, making its block space extremely scarce. This challenges Rollups, particularly Zero-Knowledge (ZK) Rollups, which aim to use Bitcoin as a data availability layer. ZK-Rollups need to post proof outputs and state differences every 6-8 blocks, but each data posting transaction can consume up to 400KB of block space. This could occupy 10% of a Bitcoin block, intensifying competition for block inclusion and potentially raising transaction fees to economically infeasible levels for Rollups. Rollups must generate significant revenue from their transaction fees to remain viable, but this is challenging given Bitcoin’s current blockspace constraints.

1. Bitcoin as a Data Availability Layer

The concept of leveraging Bitcoin’s blockchain for data availability opens up a range of possibilities. For instance, it could be used for secure record-keeping in legal and intellectual property fields, where data integrity and transparency are paramount. Additionally, Bitcoin’s blockchain could facilitate decentralized data verification and archival storage, offering a novel approach to data management. The use of layer 2 solutions and off-chain storage techniques could further enhance Bitcoin’s capability to handle various types of data without compromising the network’s performance.

However, using Bitcoin for data availability is costly due to its high block space fees. The emergence of Ordinals, inscriptions attached to Satoshis, has further driven up transaction fees. For instance, a 4MB Bitcoin transaction by Taproot Wizards costs $147k in fees. ZK-Rollups posting data to Bitcoin every 6-8 blocks would require about 400KB of block space per transaction, making it an expensive endeavor.

Compared to Ethereum and Celestia, Bitcoin was not designed to handle such data-intensive transactions, making it the most expensive per byte of any blockchain.

2. Economic Viability and Alternatives

To cover data posting costs on Bitcoin, Rollups need to facilitate substantial transaction fees. For example, if Bitcoin’s transaction fees are 10 sats/vByte, monthly expenses could reach $460k, rising to $2.3m if fees increase to 50 sats/vByte. Rollups that can’t cover these costs from their transaction fees might need to use their treasuries or pivot to more cost-effective data availability layers like Celestia, Near, or Syscoin.

However, this would reduce their alignment with Bitcoin, potentially transforming them into Validium chains of alternative networks. Another approach could be restructuring Layer 3 solutions, posting state differences to existing Layer 2s or sidechains, thus reducing costs while maintaining a connection to Bitcoin. Despite the high costs, using Bitcoin for data availability leverages its unparalleled security and decentralization, but only a few Rollups might sustain this model due to economic pressures.

3. Expert Opinions and Broader Context

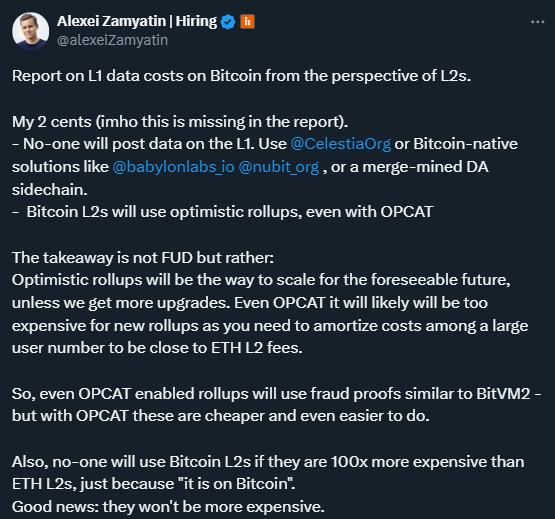

Alexei Zamayatin, co-founder of “Build on Bitcoin” (BOB), a hybrid rollup that connects Ethereum and Bitcoin, argues that Bitcoin rollups can be as cost-effective as their Ethereum counterparts. However, he cautions against using Bitcoin’s main chain for data availability, suggesting alternatives like Celestia or a merge-mined Bitcoin sidechain to reduce costs. This approach, while cheaper, sacrifices some of Bitcoin’s complete decentralization and security.

Responding to the Galaxy report on X, Zamayatin stated, “No one will use Bitcoin L2s if they are 100x more expensive than Ethereum L2s, just because ‘it is on Bitcoin.’ Good news: They won’t be more expensive.”

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.