1. Introduction

The convergence of technology and finance has continually reshaped our world, standing on the cusp of a revolution poised to redefine societal landscapes. At the helm of this technological innovation is Artificial Intelligence (AI), a branch of computer science dedicated to creating systems that exhibit human-like intelligence and behavior. AI’s breakthrough has permeated various industries, driving transformations in sectors such as healthcare, education, and notably, finance. Concurrently, the financial sector has experienced significant disruption with the advent and growth of cryptocurrencies—digital or virtual currencies secured by cryptographic techniques.

The launch of Bitcoin in 2009 signaled the dawn of cryptocurrencies, pushing the boundaries of traditional banking and financial systems. Presently, there are thousands of cryptocurrencies, with their global adoption increasing rapidly. In tandem, AI technology has advanced considerably, combining with big data to create powerful systems capable of learning from experience, adapting to new inputs, and executing tasks associated with human intelligence.

Despite their apparent differences, the convergence of AI and cryptocurrencies offers a transformative potential for the burgeoning digital economy. This article aims to uncover the roots of the AI and cryptocurrency hype, elucidate core concepts, and explore the synergistic potential of blockchain technology in enhancing AI applications. We will also examine the prospects and strategic implications of the AI and cryptocurrency narrative for investors.

2. How Web2 AI funding affects Web3?

Post-COVID years between 2021 and 2022, big names in the traditional venture capital communities seek a new hype trend to raise new funds and back companies that can give them returns as former glory of food delivery, e-commerce, metaverse, etc. Also in crypto VC, after a hyped and fun bull circle, market leaders prepare for a new season ahead in 2024 timing after the Bitcoin halving moves.

Sam Altman and the OpenAI team shed new light on them, using two large initials that imply a lot: AI.

The statistics showed that the AI trend saved many venture capital funds. After reaching a record high of $97.5 billion in the fourth quarter of 2021, US VC funding steadily declined. It hit a recent low of $35.4 billion in the second quarter of 2023, amid a high interest-rate environment and a sluggish exit market. The recent influx of capital into AI startups has reversed the downward trend, as investors double down on AI foundation model companies as well as applications from code generation to productivity tools.

Then capital started to be injected into the private market and new AI startups started to rise.

According to businessstandard.com in one of their articles:

“US venture capital funding surged to $55.6 billion in the second quarter, marking the highest quarterly total in two years, according to PitchBook data published on Wednesday. The latest figure shows a 47 percent jump from the $37.8 billion US startups raised in the first quarter, largely driven by significant investments in artificial intelligence companies, including $6 billion raised by Elon Musk’s xAI and $1.1 billion raised by CoreWeave.”

“Investors assign a premium to everything the capital intensity of most AI businesses requires outsized funding. As we discover stronger commercial use cases for AI, more AI companies are showing real revenue”, said Casber Wang, partner at Sapphire Ventures.

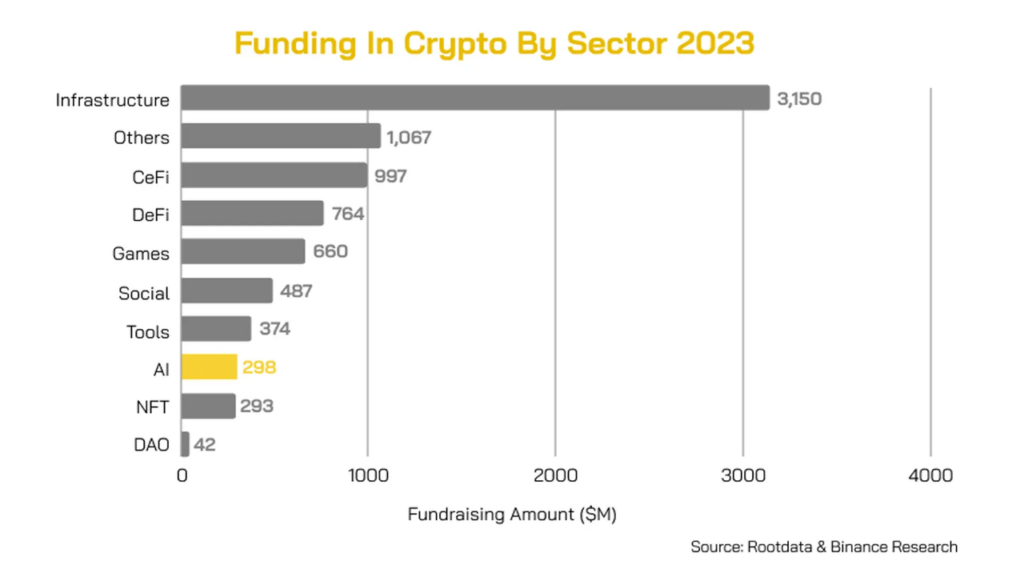

Till the end of 2023, we had 298 million USD invested in AI-related projects in Web3. This is more than the collective funding amount raised for AI projects from 2016 to 2022, at US$148.5M. AI-related tokens have generally experienced positive performance in 2023, with the top five AI coins by market capitalization significantly outperforming BTC and ETH, culminating in gains ranging from 200% to 650% in 2023.

The data may be biased because we haven’t closed out 2024 yet, so it is hard to get a comparison of data about AI sector funding this year to the previous 2023. But we think it is safe for us to conclude that AIxCrypto is a strong narrative and worth watching for investment opportunities and building project potential.

Now we have visited and understood the big picture. Let’s move on to the next chapter.

3. Definition of Artificial Intelligence (AI)

If there is a buzzword in the realm of technology that has consistently stood out in the last decade, it is undoubtedly “Artificial Intelligence” (AI). AI is at the heart of many groundbreaking technologies, from self-driving cars to voice-enabled personal assistants like Siri and Alexa. To understand the investment potential in AI, we must delve into its core components: Machine Learning (ML) and Neural Networks (NN).

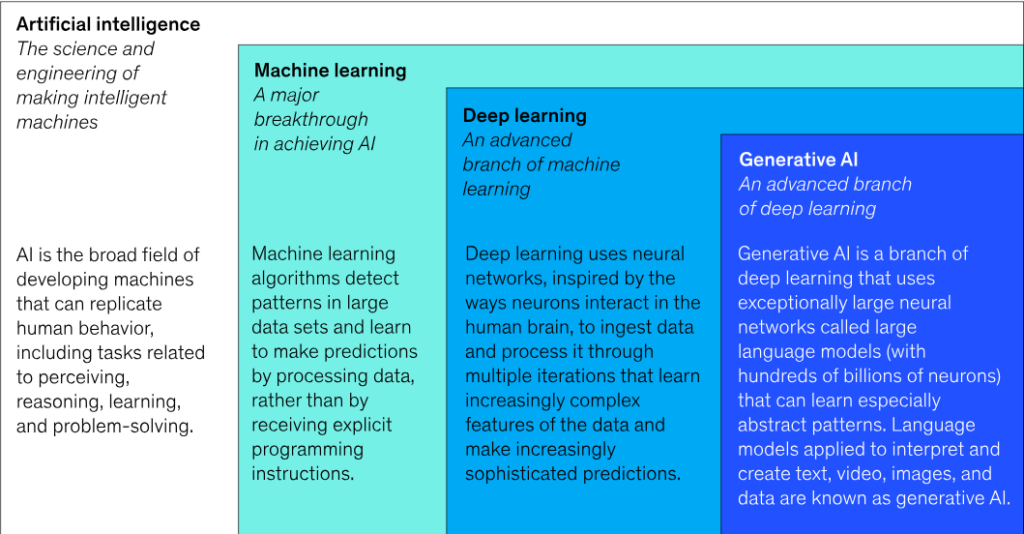

Artificial Intelligence: An Overview

Artificial Intelligence refers to the creation of computer systems capable of mimicking human intelligence through learning, reasoning, problem-solving, perception, and language understanding. AI can be broadly categorized into two types: narrow AI, which is designed for specific tasks such as voice recognition, and general AI (AGI), which holds the potential to outperform humans in various economic tasks by learning, adapting, and applying knowledge across multiple domains.

3.1. Machine Learning: The Power of Learning from Data

Machine Learning is a foundational element of AI, driving its capabilities through data-driven algorithms. ML enables computer systems to learn and improve from experience without explicit programming. By analyzing data, these systems identify patterns and make informed decisions, enhancing performance over time.

There are three primary types of Machine Learning algorithms:

- Supervised Learning: This involves learning from labeled data, where algorithms are trained with input-output pairs. Once trained, these algorithms can make predictions based on new data. This approach is crucial for applications like fraud detection and customer segmentation.

- Unsupervised Learning: This involves analyzing data without predefined labels, and discovering hidden patterns or structures within the data. It is particularly useful for tasks such as market segmentation and anomaly detection.

- Reinforcement Learning: This involves learning by interacting with the environment and receiving feedback in the form of rewards or penalties. This trial-and-error approach is instrumental in applications like robotic control and automated trading systems.

The ability of machines to learn and make decisions is revolutionizing sectors such as finance, healthcare, and marketing, presenting significant investment opportunities.

3.2. Neural Networks: Emulating the Human Brain

Neural Networks are a crucial component of Machine Learning, designed to simulate the way the human brain processes information. These networks consist of interconnected nodes (neurons) organized in layers. Each neuron receives inputs, performs computations, and generates outputs. Neural Networks typically have three layers:

- Input Layer: Receives various forms of information from the external environment.

- Hidden Layer: Processes the received inputs through complex computations.

- Output Layer: Transforms the computations from the hidden layer into the final output.

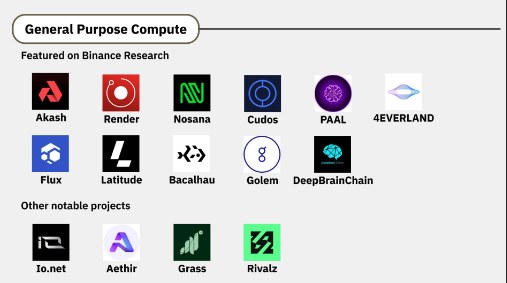

These networks are pivotal in enabling advanced AI applications, from image and speech recognition to predictive analytics. This is where many of the narratives in crypto come into place. Each one of them belongs to a part of this. In terms of DePin computing projects like: IO.net, Aethir, Akash, Render Network,… Or training model marketplace: Singularity, OCEAN, Sentient AI,… Output layers like Sleepless AI, NFPrompt,…

However, it’s essential to remember that though these technologies often seamlessly blend, each serves unique functions in the realm of AI, elevating computing capabilities to an unprecedented level. As technology continues to advance, one thing is clear, machine learning and neural networks, are becoming significant drivers for innovative solutions in various industry sectors, revolutionizing the way we live, work, and interact with the world.

4. Brief explanation of Cryptocurrency and Blockchain technology

At the most fundamental level, a cryptocurrency is a digital or virtual currency that employs cryptography for security. Unlike traditional or fiat currencies, like the dollar or the euro, issued by central banks or governmental bodies, cryptocurrencies are decentralized. They exist on a technology called blockchain, which is a distributed ledger enforced by a network of computers (called nodes) that maintain transaction records.

The primary appeal of cryptocurrencies is their decentralization. Decentralized money means no central authority, such as a government or financial institution, has total control over the currency. Money can be sent directly between two parties without the need to trust or pay intermediaries, reducing costs, and time, and increasing privacy. Following the above definition, we can see that it is hard for these two technologies to even come close and become relevant to each other, so logically, when we discuss AIxCrypto, what we want is AI x Blockchain technology.

Blockchain is a digital ledger technology that offers a secure, transparent, and immutable way of recording transactions across a network of computers. Its decentralization means that no single entity controls the entire network, enhancing the democratic aspect of digital interactions.

Blockchain itself already contains data. It stores data in the most secure ways we can think of and leveraging it is a profound problem. Blockchain’s trustworthiness and AI’s analytical prowess form a potent combination that can address multifaceted business challenges.

5. The application of Blockchain technology helps create better AI models

5.1. General purpose computing

The model may be different between projects and purpose, but the general idea is to create a decentralized infrastructure and reward via crypto, letting teams and startups have access to a wide range of GPU computing resources due to how expensive these GPUs are and using that computing power to train AI models or AI-making related needs.

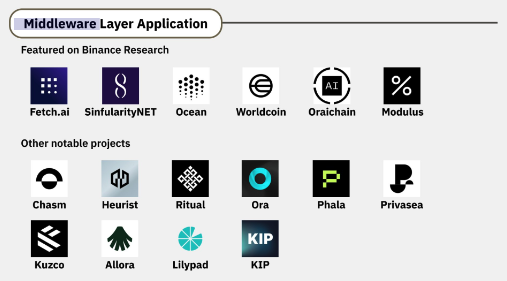

5.2. Middleware Layer

Middleman likes having resources and infrastructure to provide products and services: AI agents, verification, authentication,… An example of this is Worldcoin using an orb to scan and verify people and then using that data to trade for verification methods with big tech companies in need of that data to clean bots and verify real users.

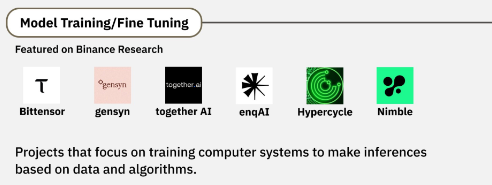

5.3. Model training/fine-tuning

Projects that main purpose is helping train new models using data and algorithms available by blockchain. Below is a good example of this Ora Protocol.

@OraProtocol is Ethereum’s trustless AI that enables AI and any-size computing on blockchains. Ora ensures verifiable ML by verifying and proving that the requested inferences have been performed by the respective models. Enables sustainable funding for open-source AI models and grants users ownership through IMO: Initial Model Offering Verifiable ML Using opML, zkML, and opp/ai, ORA ensures that the inferences have been performed by the respective model (Similar to optimistic / ZK rollups method) IMO (Initial Model Offering) IMO tokenizes AI model on-chain. Token holders will receive the benefits of revenue streams: Model Ownership (ERC-7641) + Inference Asset (ERC-7707)

5.4. Consumer applications

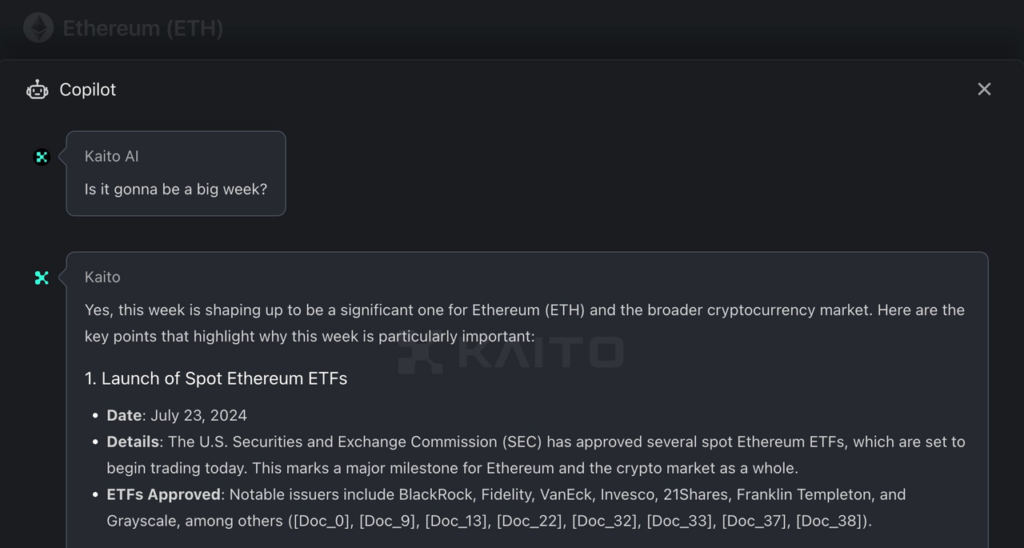

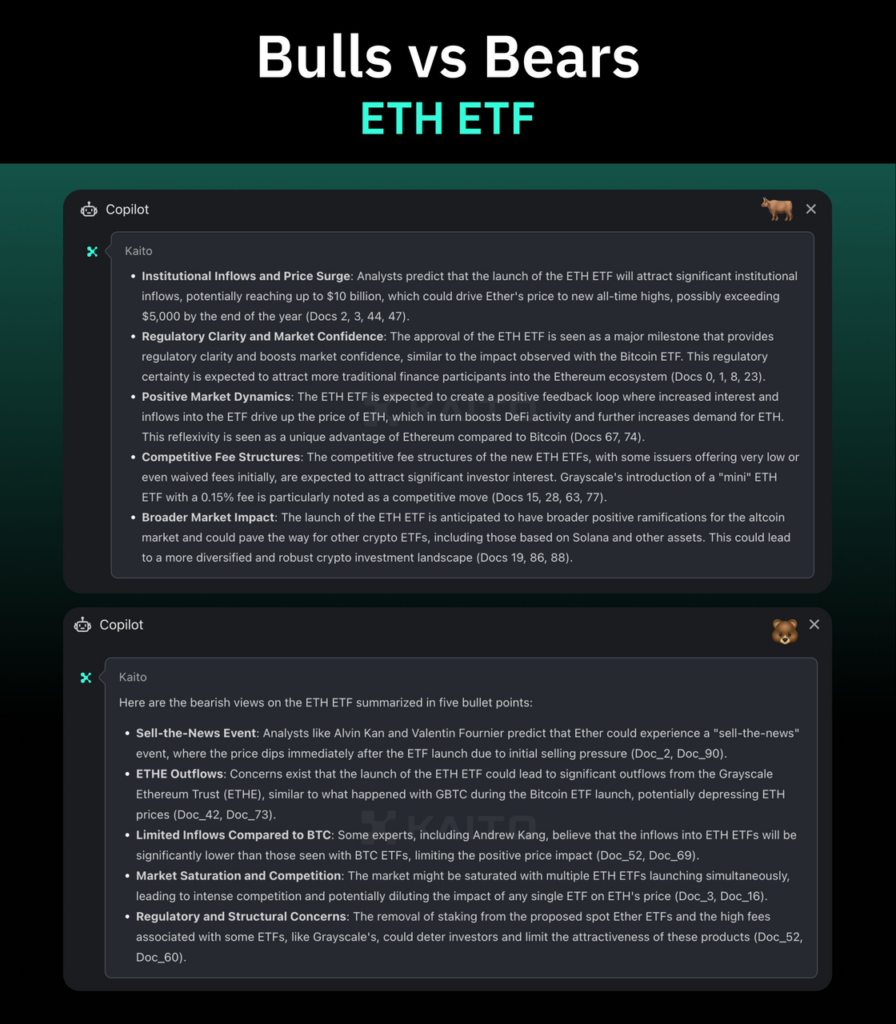

Some products suitable for representing this purpose are 0xScope, and Kaito AI leveraging the Generative AI aspect of AI technology.

With Kaito AI Copilot, it can act like a personal assistant for traders with features that include:

- Debate summaries

- Price reaction analysis

- Counter these for trading

- Key Account & Opinion about a project

- Audio summaries

- Project Comparison

- Bespoke analysis

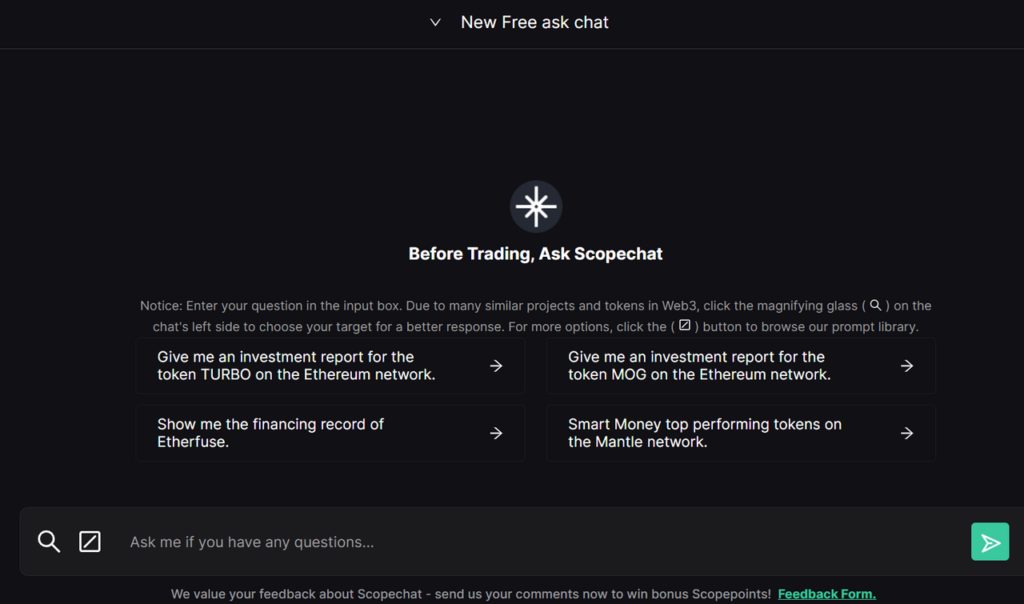

A similar example with 0xScope with its AI assistant features lets you have a chatbot assisting you in trading activities similar to Kaito AI.

6. Conclusion

With the increasing popularity of AI deals, hotter markets are closing in. The AI industry is worth noting for institutional and retail investors in the cryptocurrency market.

We hope that by focusing on project direction and understanding how AI may exploit blockchains, readers will be able to do due diligence on attractive investment prospects in the future. Selecting projects with good fundamentals and compelling problem demands is an excellent method to avoid low-potential and dangerous ventures.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.