In the rapidly evolving world of cryptocurrency, Venture Capital firms are adopting a more cautious approach. Recent insights from venture capitalists reveal a nuanced strategy shift, as investors favor “breakout trends” over high-risk “moonshots”. This change reflects broader market dynamics and investor expectations, signaling a critical juncture for the crypto industry.

1. Evolving Investment Trends

The world of venture capital in cryptocurrency is undergoing a significant transformation. Once characterized by a relentless pursuit of high-risk, high-reward opportunities, the focus has now shifted towards more calculated and stable investments. In the early days of crypto, VCs were eager to back almost any startup with a novel idea, hoping to catch the next Bitcoin or Ethereum. This approach, often dubbed chasing “moonshots”, was driven by the unprecedented returns that early investors in these leading cryptocurrencies experienced. The allure of discovering the next big thing in a rapidly expanding market fueled a period of aggressive investment.

However, the landscape has changed. VCs are now more interested in “breakout trends” – those with clear, predictable growth trajectories—rather than speculative ventures with uncertain outcomes, which reflects a broader maturation of the crypto market, where the emphasis has moved from speculative excitement to strategic, long-term growth. The primary reason behind this shift, according to Adam Cochran, General Partner at Cinneamhain Ventures (CEHV), is the pressure from limited partners (LPs) who are increasingly focused on outperforming index fund returns. The enthusiasm for moonshots has given way to a more measured approach, where VCs seek to balance potential rewards with the risks involved.

2. Bitcoin, Ethereum, and the Changing Venture Capital Strategy

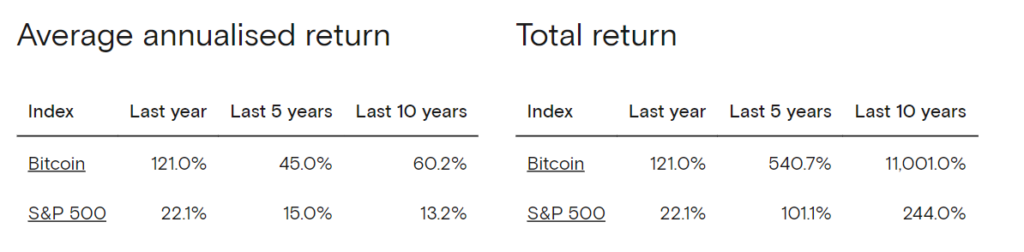

Bitcoin and Ethereum play a central role in this evolving investment strategy. As the two most established and valuable cryptocurrencies, they offer VCs a relatively safe investment vehicle compared to the volatile and often unpredictable world of early-stage startups. Over the past decade, Bitcoin has delivered an impressive annualized return of 60%, a figure that far surpasses traditional investments (the S&P 500 index has averaged a 13.20% return). Ethereum, too, has provided substantial returns, making it a valuable asset for VCs looking to secure their portfolios.

This reliance on Bitcoin and Ethereum is indicative of a broader trend in the crypto market. With these assets, VCs can achieve significant returns without the need to expose themselves to the high risks typically associated with early-stage investments in other industries. This shift has led to a more conservative investment approach, where holding established digital assets is often seen as a safer bet than venturing into uncharted territory with new startups. As a result, the influx of capital into these top cryptocurrencies has grown, while the enthusiasm for early-stage crypto projects has waned.

3. Challenges in Innovation and Growth

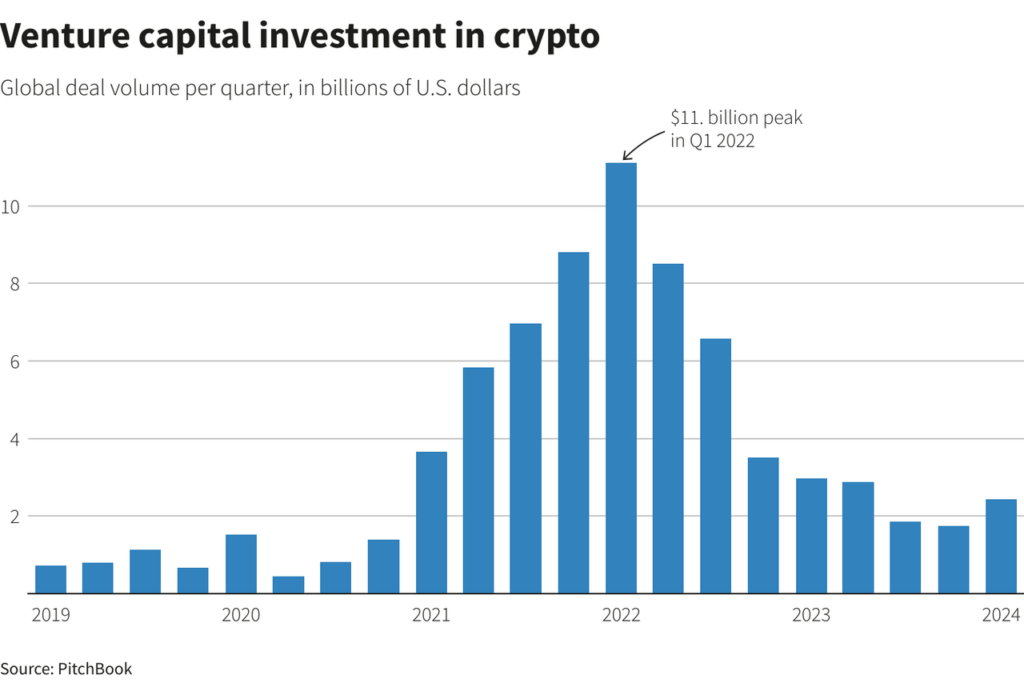

While this shift towards more secure investments offers a measure of stability, it also presents challenges for the innovation and growth of the crypto industry. The focus on “breakout trends” that promise more predictable returns has led to a decrease in funding for groundbreaking, yet unproven, technologies. During the last market cycle, VCs were more active in investing in applications that had already gained traction, such as OpenSea, hoping to capitalize on late-stage consumer growth. Industry insiders have noted that the market’s current saturation and the lack of clear narrative trends have contributed to this slowdown in funding for new ventures.

This conservative approach could potentially stifle innovation, as fewer resources are allocated to exploring truly revolutionary ideas. In the past, VCs were willing to take bold risks, often funding projects that seemed far-fetched or ahead of their time. These investments were crucial in driving the rapid development of the crypto industry. However, as VCs become more risk-averse, the potential for disruptive technologies to emerge may be diminished. The challenge for the industry now is to find a balance between securing reliable returns and fostering the next wave of innovation that can propel the market forward.

"While every VC firm brands themselves as pro-innovation and in the trenches with the builders, most of them don't actually pursue moonshots, they just throw capital at breakout trends. Because they don't actually have enough industry insights to take novel risk."- Adam Cochran

4. Future Outlook: Balancing Risk and Reward

The future of venture capital in crypto will likely involve a delicate balancing act between risk and reward. As the market matures, VCs must carefully navigate the fine line between supporting innovative projects and ensuring reliable returns for their investors. While the current trend favors safer investments in established assets like Bitcoin and Ethereum, the long-term success of the crypto industry will depend on the willingness of VCs to embrace and fund new ideas.

The key to sustaining growth in the crypto space will be the ability of VCs to identify and support projects that, while risky, have the potential to drive significant advancements in the industry. This may involve a return to some of the bolder investment strategies of the past, where VCs were more willing to take chances on unproven technologies. However, it will also require a more strategic approach, where risks are carefully assessed and managed to avoid the pitfalls of the past.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.