1. Arbitrum Latest Roadmap

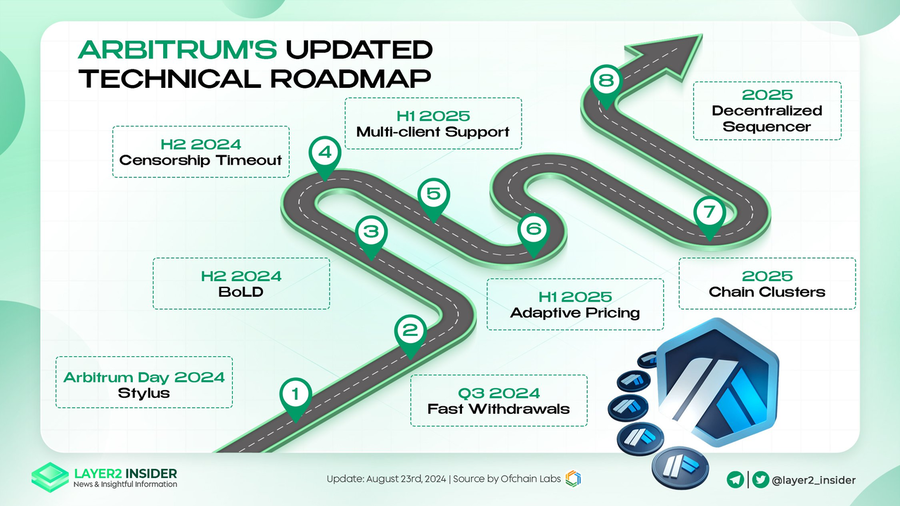

Arbitrum, a leading Ethereum layer-2 scaling solution, has unveiled an ambitious roadmap for late 2024 through 2025. This development focuses on decentralization, scalability, and enhancing user experience, detailed as follows:

- Developer Tools and Support: Stylus will be integrated, enabling the use of languages like Rust, C, and C++ that are compatible with the WASM virtual machine, improving the developer’s experience.

- Advancing Decentralization: 2024 will see the roll-out of the BOLD open authentication mechanism, with a move towards a decentralized Sequencer framework slated for 2025.

- Boosting Scalability: The introduction of a rapid withdrawal process is scheduled for the third quarter of 2024, alongside a Chain Cluster model in 2025 to expedite cross-chain interactions among L2/L3 layers.

- Enhancing Network Efficiency: More client versions will be supported, and a variable fee structure will be implemented by the end of 2025 to better manage network resources.

- Innovative Proof Mechanisms: A new proof model that combines ZK Proof and Optimistic Proof will be deployed, enhancing security and efficiency.

These updates highlight Arbitrum’s commitment to improving its infrastructure to support more robust, efficient, and decentralized applications.

2. Stylus: Expanding Development Capabilities

By enabling smart contracts to be written in languages that compile to WebAssembly (WASM), such as Rust, C++, and C, Stylus broadens the technological capabilities and accessibility of the Ethereum network. This development has profound implications for both the technical landscape and the investment potential within the ecosystem.

2.1. Expanded Developer Pool and Innovation

Stylus makes Ethereum accessible to a broader range of programmers, not just those versed in Solidity, Ethereum’s native programming language. By allowing developers to work in languages with which they are already familiar, Stylus significantly lowers the barrier to entry for blockchain and smart contract development. This inclusivity leads to increased innovation as more developers can contribute to the ecosystem, potentially leading to new applications and use cases that could drive further adoption and value creation within Ethereum.

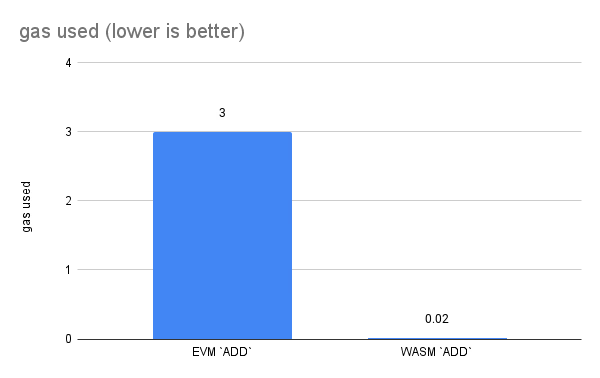

2.2. Enhanced Performance and Efficiency

The performance improvements with Stylus are substantial—operations can be up to 100 times faster and significantly cheaper in terms of gas costs compared to traditional Ethereum operations. Moreover, the reduction in gas costs makes high-frequency, transaction-intensive applications like on-chain gaming and trading platforms more viable, expanding the types of investments that can be pursued on Ethereum.

2.3. Cross-Ecosystem Portability

Stylus facilitates easier migration of applications from other blockchain environments that use Rust-based virtual machines, such as Solana and Cosmos. This capability could lead to a migration of successful projects to Ethereum, enriching the ecosystem and potentially increasing the value of the network.

2.4. Risk Reduction Through Established Technologies

Using established programming languages and their respective robust libraries, especially for cryptographic functions, reduces the risk of deploying new and untested code.

3. Another Key Features and Enhancements

Overall, the features outlined in Arbitrum’s development roadmap impact various aspects of the network.

| Enhancements | Anticipated timeline | Details |

|---|---|---|

| BoLD | Q4 2024 | Multi-client support introduces diversity in Arbitrum’s node software by incorporating clients like Reth, Erigon, and Nethermind. This diversification enhances fault tolerance and network resilience, making it more robust against single points of failure. |

| Censorship Timeout | Q4 2024 | Censorship Timeout addresses potential sequencer failures or attacks, ensuring users can access funds more reliably. These features bolster Arbitrum’s resistance to censorship and improve transaction reliability, providing a more secure environment for users. |

| Fast Withdrawals | Q3 2024 | Fast Withdrawals streamline interactions between L2 and L3 chains, reducing withdrawal times from days to minutes. This enhancement minimizes third-party dependencies, making Arbitrum’s ecosystem more efficient and user-friendly. By enabling quick fund transfers, users can enjoy a more seamless experience. |

| Chain Clusters | 2025 | Chain Clusters facilitate seamless communication between Orbit Chains, reducing latency and enhancing dApp performance. By linking multiple chains, developers can explore new use cases and optimize scalability. This feature allows for horizontal scaling, accommodating higher transaction volumes without sacrificing speed. |

| Decentralized Sequencer | 2025 | The Decentralized Sequencer is a pivotal step toward complete decentralization. It distributes transaction ordering responsibilities across a network of nodes, mitigating censorship risks and enhancing network reliability. This move is crucial for power distribution and increasing trust in the network’s integrity. |

| Multi-Client Support | Q1 2025 | Multi-Client Support introduces diversity in Arbitrum’s node software by incorporating clients like Reth, Erigon, and Nethermind. This diversification enhances fault tolerance and network resilience, making it more robust against single points of failure. |

| Adaptive Pricing | Q2 2025 | Adaptive Pricing dynamically adjusts gas limits based on actual resource use. This feature optimizes network performance during peak demand without increasing node capacity, ensuring stability and efficiency. It allows smart contracts to maximize node resources without incurring additional costs. |

4. Implications for Key Stakeholders

4.1. For Developers

The integration of Stylus is pivotal, supporting languages like Rust, C++, and C that compile to WebAssembly (WASM), thus broadening Ethereum’s appeal to a more diverse developer base. This reduces barriers to entry and enhances innovation potential. Developers benefit from significant performance gains with operations up to 100 times faster and cheaper in gas costs, facilitating the development of complex, transaction-intensive applications.

4.2. For End Users

End users will experience a more robust and efficient ecosystem through faster transaction processing and reduced latency via the Chain Clusters and Fast Withdrawals. These enhancements will significantly improve user experience by enabling quick fund transfers and streamlined interactions between layers, reducing withdrawal times from days to minutes. Moreover, features like the Censorship Timeout and Decentralized Sequencer will enhance transaction reliability and protect against censorship, providing a more secure and trustworthy environment for end users to operate within.

4.3. For Investors

For investors, the roadmap outlines a promising increase in the Ethereum network’s value and functionality. The cross-ecosystem portability enabled by Stylus could attract successful projects from other blockchains, potentially increasing the value and activity on the Ethereum network. The move towards more advanced proof mechanisms and the integration of robust, established technologies diminish risks associated with new, untested code. Furthermore, the shift towards decentralized architecture and enhanced network efficiency could drive broader adoption and longevity of the Ethereum platform, making it a more attractive investment.

5. Conclusion

Arbitrum’s roadmap, featuring the Stylus upgrade and other innovations, sets the stage for a more decentralized, efficient, and developer-friendly blockchain environment. By focusing on user empowerment, enhanced performance, and robust security, Arbitrum is poised to shape the future of blockchain technology. With its commitment to innovation and inclusivity, Arbitrum offers diverse opportunities for developers, users, and investors alike, ensuring that the blockchain ecosystem continues to evolve and meet the demands of the future.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.

[…] BOLD, un sistema para permitir validadores permissionless y descentralizar el secuenciador en 2025 arxiv.org+10insights.blockbase.co+10thecurrencyanalytics.com+10. El protocolo BoLD también mejora la resolución de disputas contra ataques de retraso […]

Comments are closed.