BlackRock’s endorsement of Bitcoin signals a profound shift in how institutional investors approach digital assets. No longer viewed solely as a speculative asset, Bitcoin is now recognized for its unique monetary attributes – scarcity, decentralization, and global accessibility. This evolution aligns with its growing role as a key portfolio diversification player and a hedge against macroeconomic instability.

This blog examines BlackRock’s perspective on Bitcoin and its implications for portfolio construction, drawing from their whitepaper, “Bitcoin: A Unique Diversifier.”

1. BlackRock’s Investment Outlook on Bitcoin

1.1. Bitcoin’s Solids Fundamental

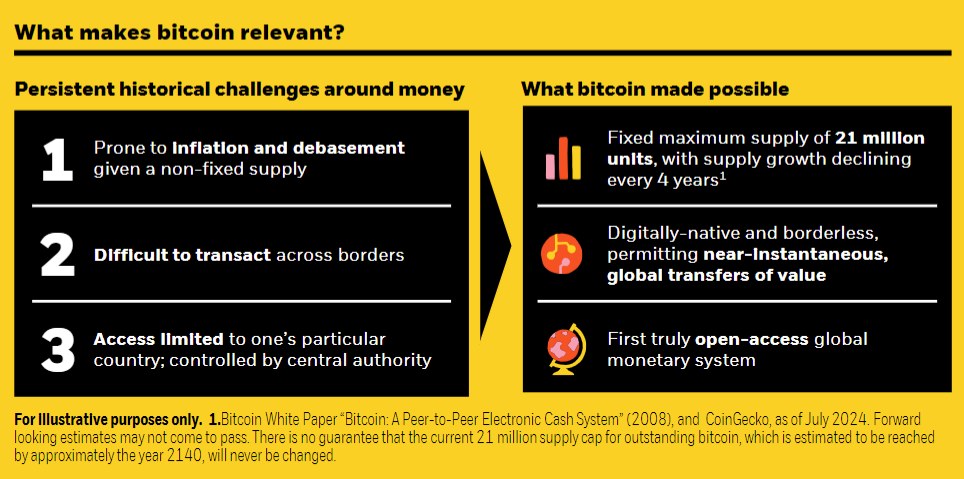

Bitcoin’s solid fundamentals – decentralization, scarcity, and permissionless access – are central to its rise as a credible alternative to traditional fiat currencies. By design, Bitcoin is resistant to inflation due to its fixed supply cap of 21 million coins, and it operates independently of any centralized authority, making it attractive to investors concerned about currency debasement and centralized control over monetary policies. Bitcoin’s ability to transcend geographical borders and bypass traditional financial intermediaries positions it uniquely as a global monetary alternative.

1.2. Bitcoin’s Performance: High Volatility but Extraordinary Returns

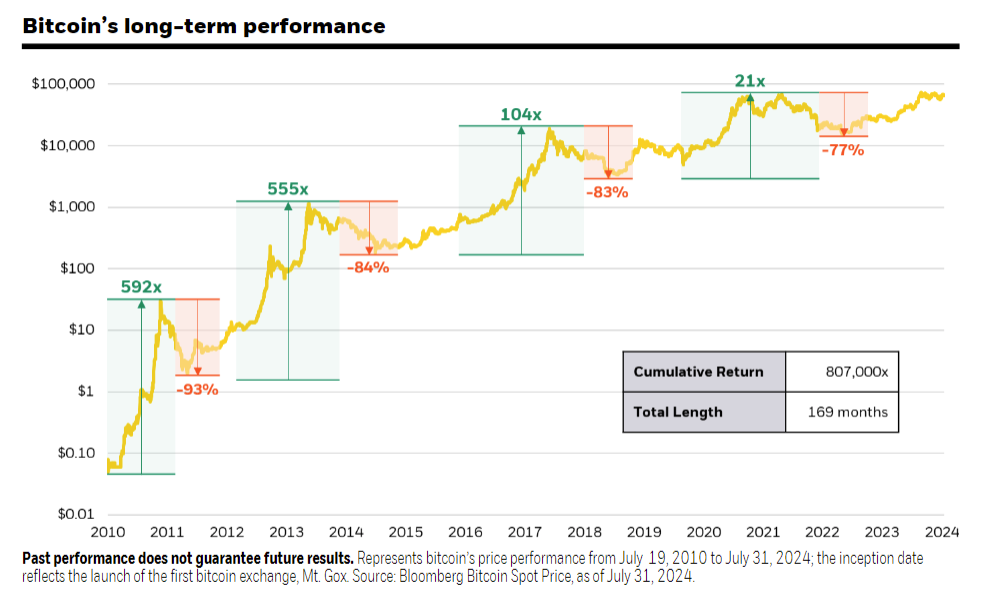

Bitcoin’s historical performance is marked by extreme volatility, but its long-term returns remain unmatched. Despite corrections of up to 80%, Bitcoin has consistently recovered, demonstrating resilience and growth over time. According to BlackRock’s research, Bitcoin has outperformed all major asset classes over the past decade, achieving annualized returns exceeding 100%.

This volatility, while disconcerting for some investors, provides an opportunity for those with a high-risk tolerance to capitalize on Bitcoin’s potential for outsized gains. Over time, Bitcoin has proven its ability to bounce back from significant drawdowns, reinforcing its appeal as a long-term asset with extraordinary upside potential.

1.3. Bitcoin as a Portfolio Diversifier: Low Correlation with Traditional Assets

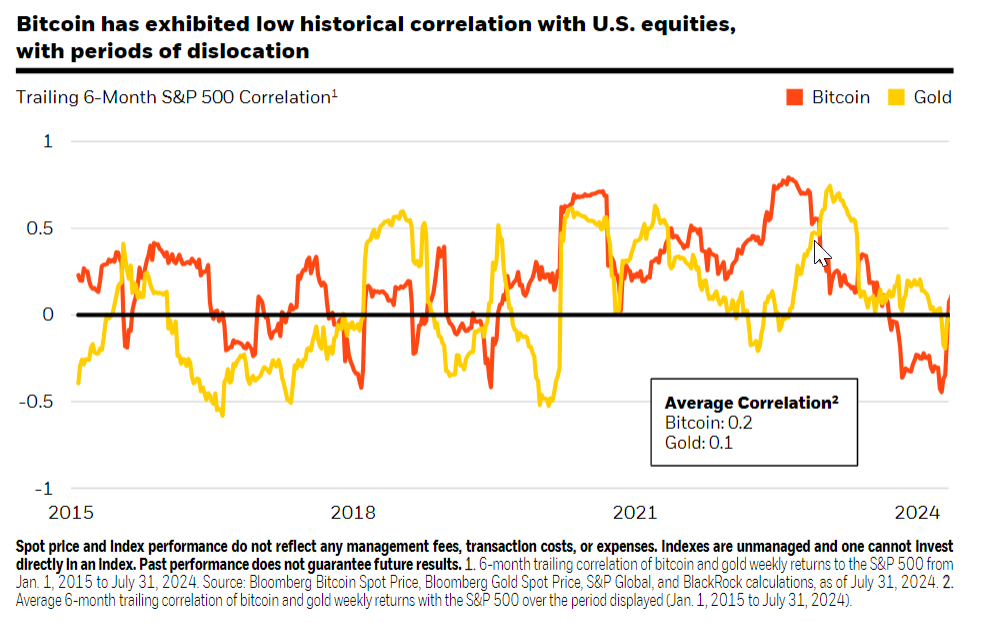

One of the most compelling arguments for Bitcoin’s inclusion in an institutional portfolio is its low correlation with traditional asset classes. BlackRock’s analysis highlights that Bitcoin behaves differently from equities, bonds, and commodities, offering investors a unique risk-return profile.

As outlined in the BlackRock research, Bitcoin has demonstrated periods of non-correlation with macroeconomic events, making it a potential diversifier in times of economic stress. For example, while equities tend to suffer during financial crises, Bitcoin’s performance may diverge, providing a buffer against equity market downturns. This low correlation offers a compelling reason for institutional investors to allocate a small percentage of their portfolios to Bitcoin to achieve greater diversification and reduce overall portfolio volatility.

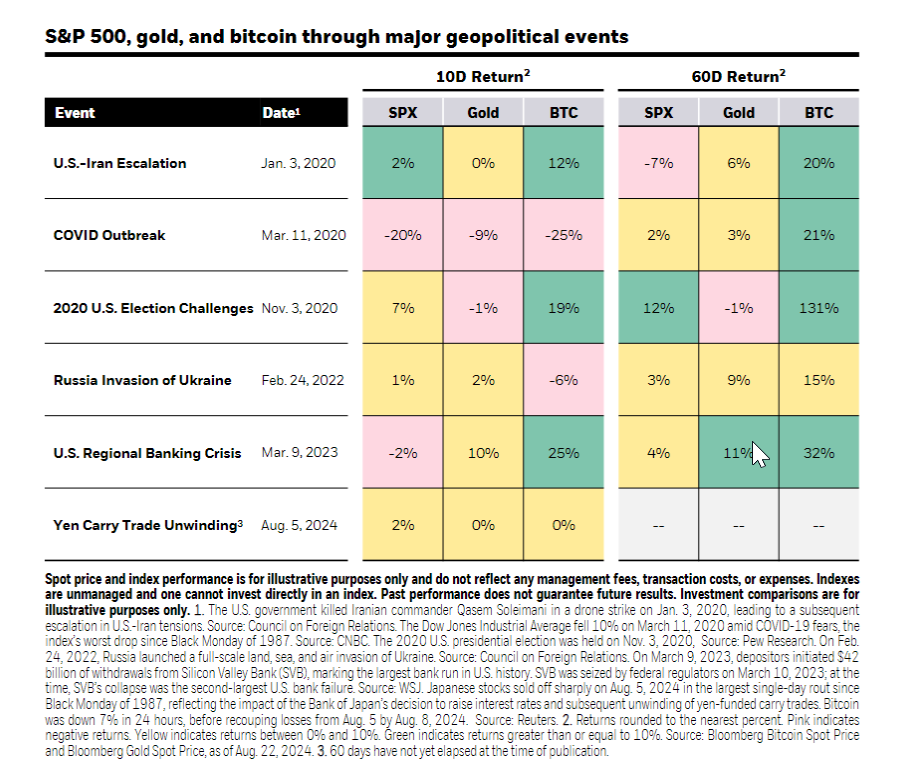

Bitcoin has often been seen as a “flight to safety” asset during times of crisis, with the ability to rebound after initial declines. This was particularly evident during the global market sell-off in August 2024, when Bitcoin initially dropped but quickly recovered to previous levels within days. In many instances, Bitcoin has even rallied beyond its prior levels as investors recognize the long-term potential and fundamental strengths of the asset, especially in response to disruptive global events that emphasize its value as a decentralized and non-sovereign alternative.

1.4. A Hedge Against Macroeconomic Uncertainty

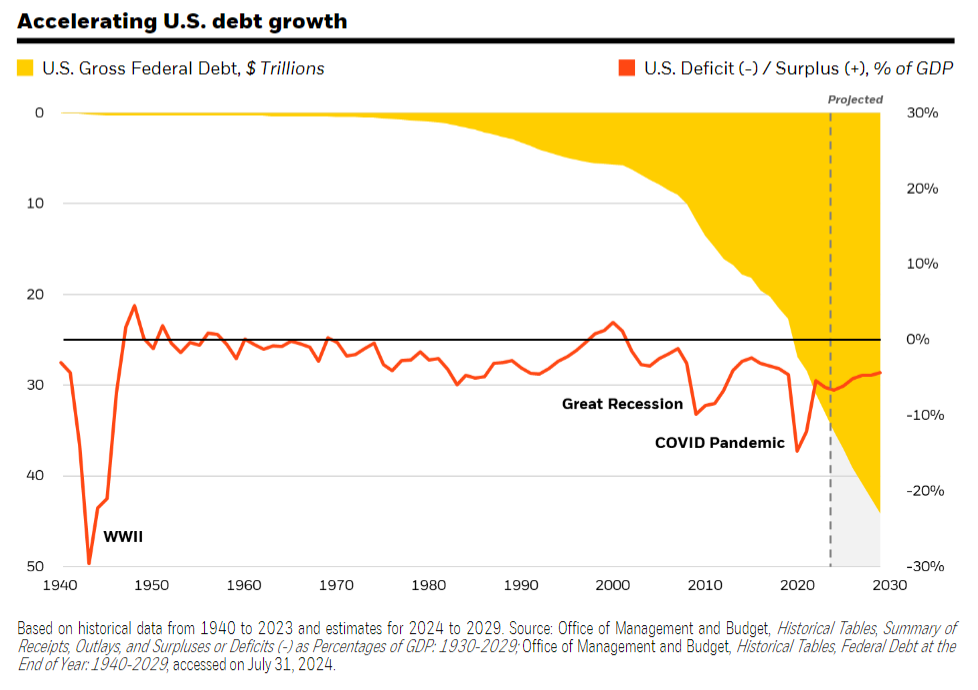

BlackRock sees Bitcoin not only as a diversifier but also as a hedge against macroeconomic uncertainties. With rising inflation, interest rates, and geopolitical risks, Bitcoin is evolving into an alternative reserve asset akin to gold. Its decentralized, deflationary structure and fixed supply make it resistant to the monetary policies of any single government or central bank. As governments continue expansionary fiscal policies, institutional investors may increasingly turn to Bitcoin as a hedge against fiat currency devaluation and financial instability.

1.5. Bitcoin is still a risky asset

While Bitcoin’s long-term potential is clear, BlackRock acknowledges the risks that come with it. The primary concern remains regulatory uncertainty, as governments worldwide are still developing frameworks to govern crypto assets. This regulatory ambiguity, combined with Bitcoin’s inherent volatility, creates challenges for portfolio managers aiming to balance risk and return.

To mitigate these risks, BlackRock advises modest allocations to Bitcoin within a diversified portfolio. This allows investors to benefit from Bitcoin’s growth potential while keeping overall exposure to volatility in check.

2. Final thought

Bitcoin’s scarcity, decentralization, and global accessibility make it a compelling addition to diversified portfolios, particularly in times of economic uncertainty. BlackRock’s perspective marks a paradigm shift among institutional investors, who increasingly recognize Bitcoin’s potential as a store of value and a hedge against macroeconomic risks.

While short-term volatility remains a key characteristic of Bitcoin, its fundamental strengths provide a solid foundation for its long-term role in investment strategies.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.