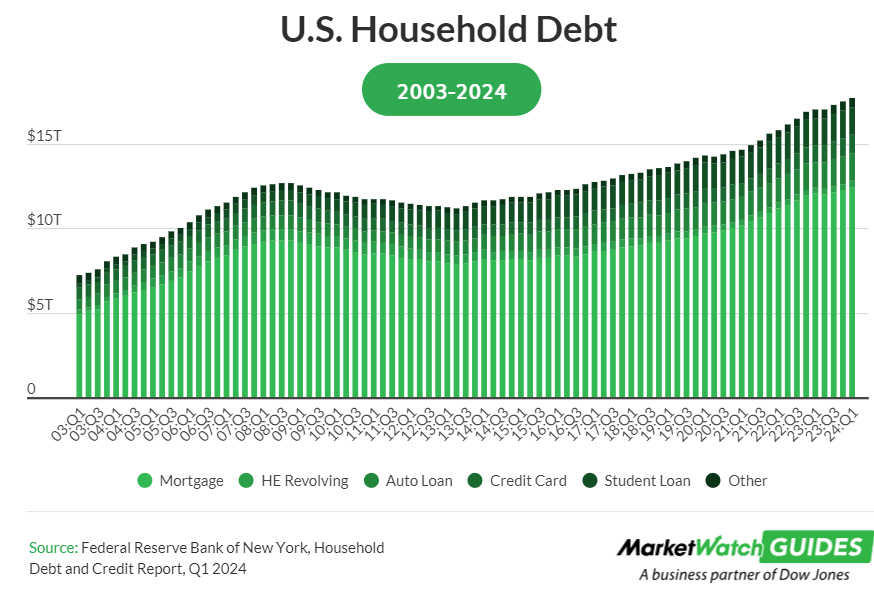

Consumer debt has hit record highs, raising concerns about the future of U.S. spending and economic growth. As debt pressures grow, will U.S. households continue to power the economy, or are we facing a slowdown? Dive into our research to uncover the answers.

1. Overview

The labor market has significantly cooled, with notable declines in both hiring and job openings (as highlighted in our previous analysis). An uptick in job losses could lead to reduced consumer spending, potentially slowing the economy—especially given the current financial challenges facing U.S. consumers.

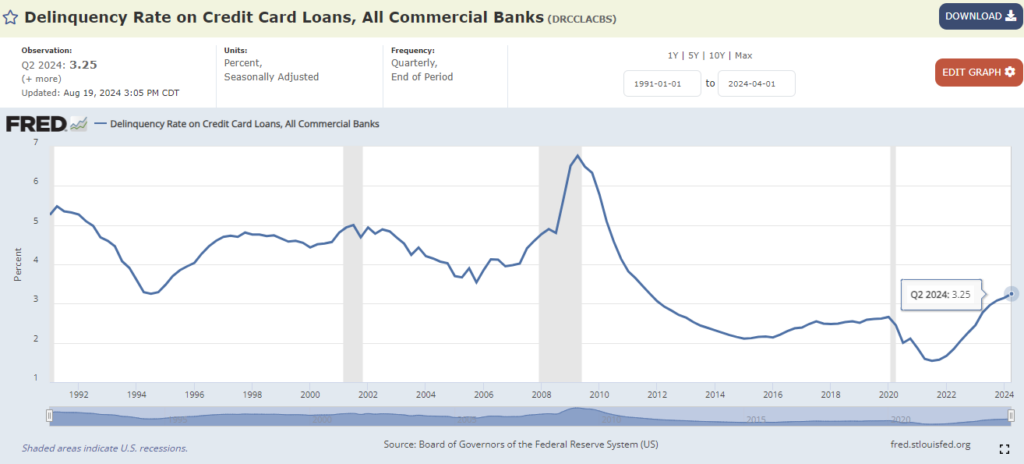

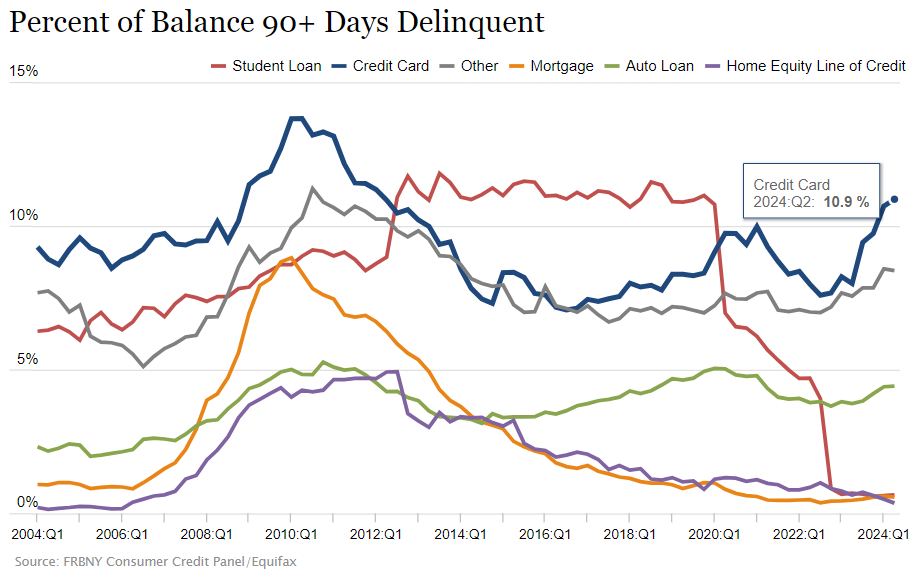

In the second quarter, the delinquency rate for credit cards rose to 3.25%, indicating that more Americans are falling behind on credit card and auto loan payments. This is a marked increase from the pre-pandemic rate of 2.62% in Q4 2019.

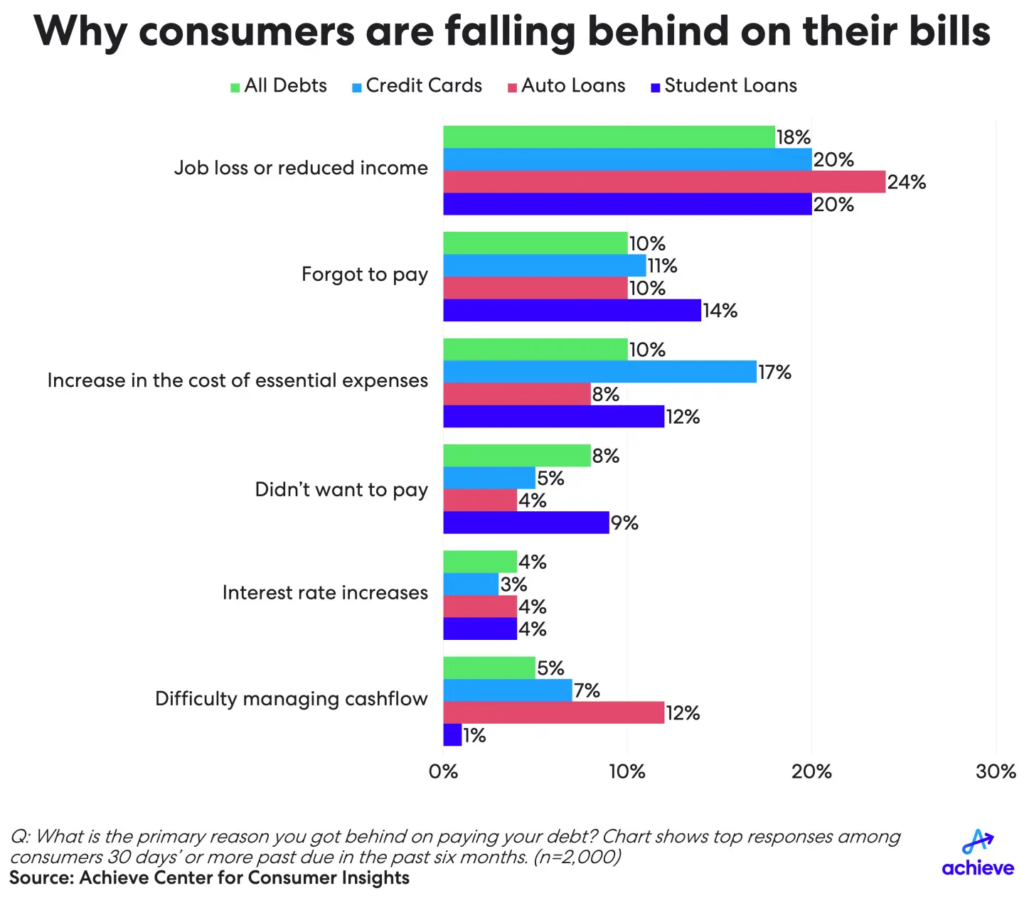

Currently, 57% of consumers rely on credit cards to meet everyday expenses. According to a survey by Achieve, job losses or reduced income were the primary reasons consumers have recently fallen behind on their bills.

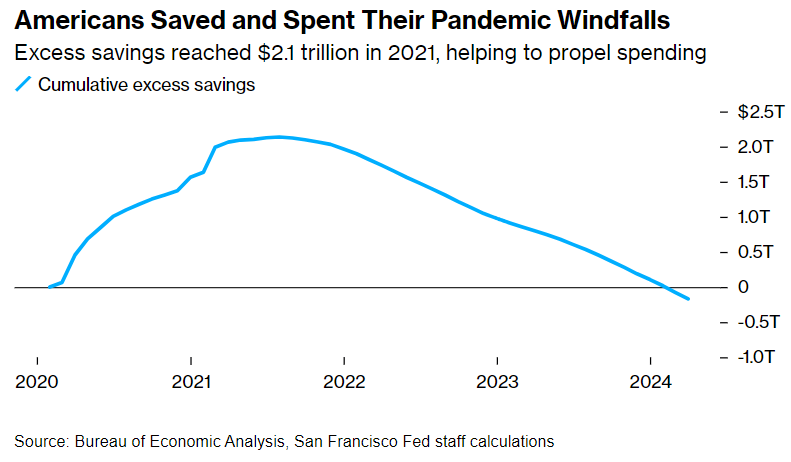

Additionally, the $2 trillion in excess savings accumulated by Americans during the COVID-19 pandemic has been fully depleted as of March 2024. This depletion, combined with increasing credit card delinquency rates, raises concerns about the durability of consumer spending and will eventually prompt American consumers to cut back. So we expect consumer spending growth to slow shortly.

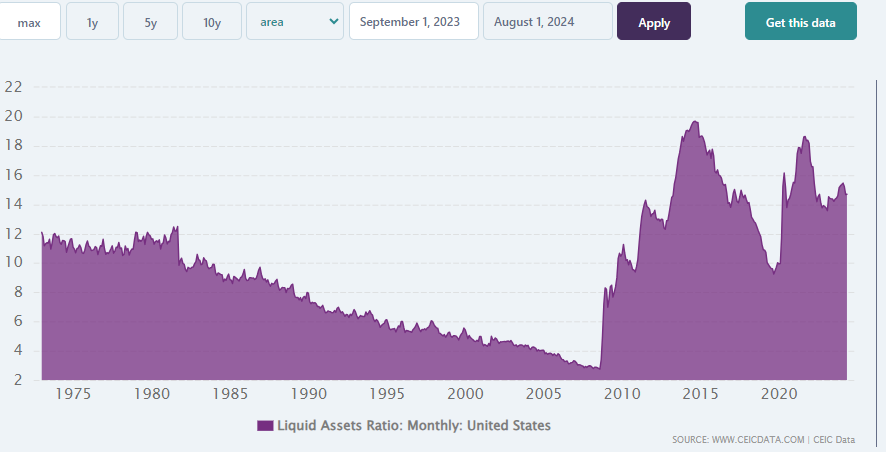

Despite these troubling signs, there are some positive indicators regarding household financial health. First, the ratio of liquid assets to liabilities for Americans remains elevated, suggesting that household finances are still relatively stable. Before the 2008 Global Financial Crisis, this ratio had fallen to historic lows, forcing households to liquidate assets to meet their debt obligations when the economy weakened.

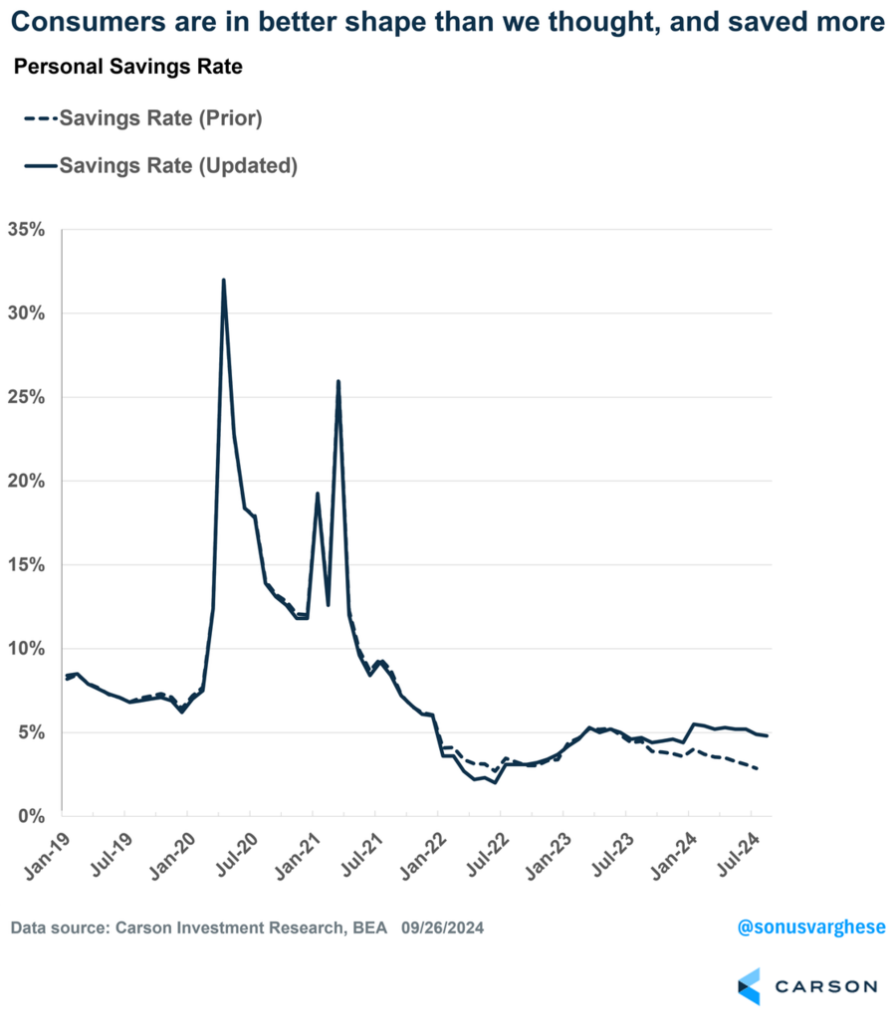

Second, consumers appear to be in better shape than previously thought. The personal savings rate, which measures the percentage of disposable income set aside by households, has been revised upward. In August, the savings rate stood at 4.8%, and in July at 4.9%, compared to the pre-revision estimate of 2.9% for July. This suggests that consumer spending remains resilient.

2. Closing thoughts

While the rise in credit card delinquency rates is concerning, it’s important to note that at 3.25%, it remains below the historical average of 3.73%. This may pose challenges for lower-income households, but it is unlikely to significantly impact the broader macroeconomy. As it stands, the broader economy remains stable.

Additionally, placing too much emphasis on the depletion of excess savings could be misleading. The outlook for consumer spending will be more influenced by labor market conditions. The Federal Reserve’s focus on maintaining a healthy labor market is crucial, as the resilience of American consumers—and their continued willingness to spend—has been a cornerstone of the U.S. economy’s strength.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.