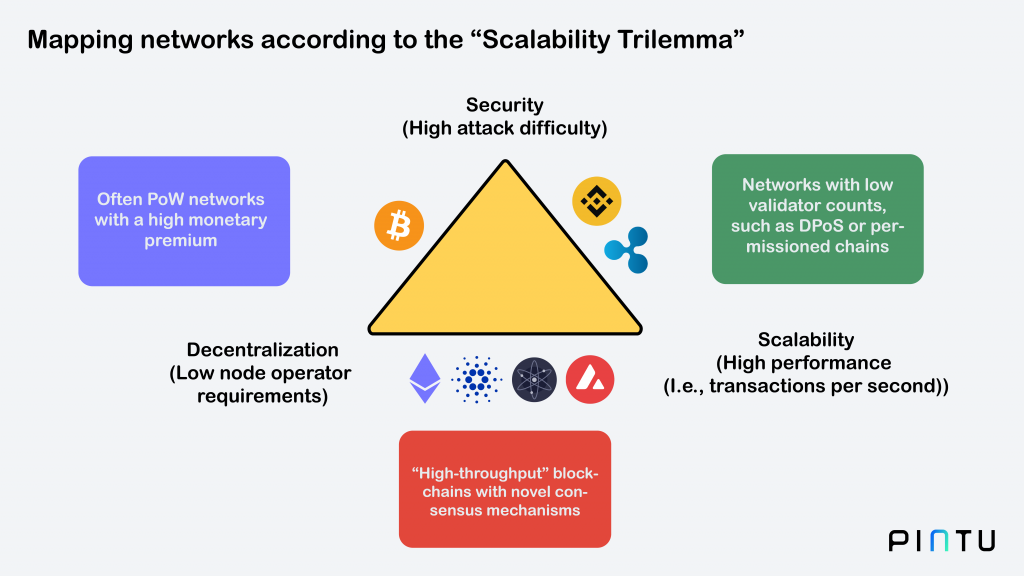

The blockchain landscape has seen its share of challenges, with the original trilemma forcing builders to choose between decentralization, scalability, and security. In this paradigm, no blockchain could offer all three at once—at best, users had to settle for two.

However, a new challenge is emerging in the blockchain world, one that shifts the focus away from technological constraints to a different set of priorities: products, customers, and regulatory approval. This new trilemma, as explained by EY’s Paul Brody, presents a similar dilemma—companies are forced to prioritize only two out of these three critical factors.

1. The Evolution from Technology to Market Constraints

The original blockchain trilemma focused heavily on the technical limitations faced by platforms like Ethereum. At the time, Ethereum was known for its strong decentralization and robust security but struggled to achieve the level of scalability needed for widespread adoption. As blockchains have evolved, technological advancements like Ethereum’s shift from PoW to PoS, and the rise of layer 2 solutions, have alleviated many of these challenges. Now, most users see the trade-offs between decentralization, scalability, and security as “good enough,” at least from a functional perspective.

However, with these technical hurdles becoming more manageable, a new challenge has emerged that revolves around the commercial and regulatory landscape of blockchain adoption. With key events such as the approval of Bitcoin and Ethereum ETFs in the U.S. and the launch of the Markets in Crypto Assets (MiCA) regulation in Europe, the focus is shifting. Now, companies in the blockchain space face a new dilemma: how to balance product offerings, build a customer base, and navigate regulatory approval.

2. The New Trilemma: Products, Customers, and Regulatory Approval

The new blockchain trilemma can be seen in the way firms are structured and the challenges they face in scaling their businesses. Many digital asset companies fall into one of three categories:

- Companies with Products and Customers, but No Regulatory Approval: Many blockchain-native companies operate outside major regulated markets. These firms have built substantial product offerings and have a loyal customer base, but they lack the necessary regulatory approvals to expand into larger, more profitable markets. A significant portion of the crypto trading landscape—more than 70%—occurs offshore, limiting these companies’ ability to reach broader audiences or secure long-term growth in regulated environments.

- Companies with Products and Regulatory Approval, but No Customers: Some firms have successfully navigated the regulatory maze, receiving approval to operate in major markets. However, they often lack a customer base to sell their products to, as their focus on regulatory compliance has come at the cost of building a user community. While they may be ahead in terms of product readiness for the regulated market, they are behind in establishing a meaningful presence or customer base.

- Established Financial Institutions with Customers and Regulatory Approval, but No Products: On the opposite end of the spectrum, traditional financial institutions like banks possess massive customer bases and are deeply embedded in the regulatory frameworks of major markets. However, most of these institutions have yet to offer digital asset products, leaving them behind in the race to capture a growing segment of the market. Their existing infrastructure and compliance expertise give them an advantage, but they need to develop or acquire the right digital asset offerings to remain competitive.

3. The Barriers to a Perfect Solution

Just as the original blockchain trilemma had no easy solutions, the new trilemma between products, customers, and regulatory approval presents its obstacles. The first and perhaps most significant barrier is the regulatory bodies themselves. According to Paul Brody, regulators have made it clear that they view certain crypto offerings as too risky for the mass market. While high-risk products might be suitable for sophisticated investors, they are not considered safe for everyday consumers, which limits the range of digital assets that can be approved for public use.

The second major challenge comes from cultural differences between entities in the blockchain and traditional financial sectors. Blockchain-native firms are often entrepreneurial, agile, and willing to take risks, operating in environments where crypto was once dismissed as a scam by many. In contrast, large financial institutions are more conservative, bound by stringent regulations and compliance cultures. These cultural divides create friction when trying to integrate blockchain innovations into mainstream financial ecosystems.

4. A “Good Enough” Future

Just as the technical blockchain trilemma eventually reached a point where the trade-offs became acceptable for most users, the same is likely to happen with this new market-based trilemma. While it may be impossible to offer a perfect combination of products, customers, and regulatory approval, Brody suggests that the market will reach a state of maturity where solutions are “good enough.” Risk-tolerant users will still find opportunities within regulated ecosystems, though perhaps not with the most traditional financial institutions. Meanwhile, more conservative investors and everyday users will gain access to a safer, more curated set of offerings in the digital asset space.

In the end, much like the original trilemma, this new challenge reflects the ongoing evolution of the blockchain industry. Companies will continue to navigate the trade-offs between innovation, customer growth, and regulatory compliance as the market matures and adapts to the needs of different types of investors.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.