The launch of Babylon and the introduction of Lorenzo staking mark a significant turning point in the Bitcoin ecosystem, illustrating its ongoing evolution. From the early days of on-chain assets to the current exploration of staking and restaking, Bitcoin is following a path reminiscent of Ethereum’s journey—though with some key differences in execution and leadership.

1. The Evolution of On-Chain Assets in Bitcoin

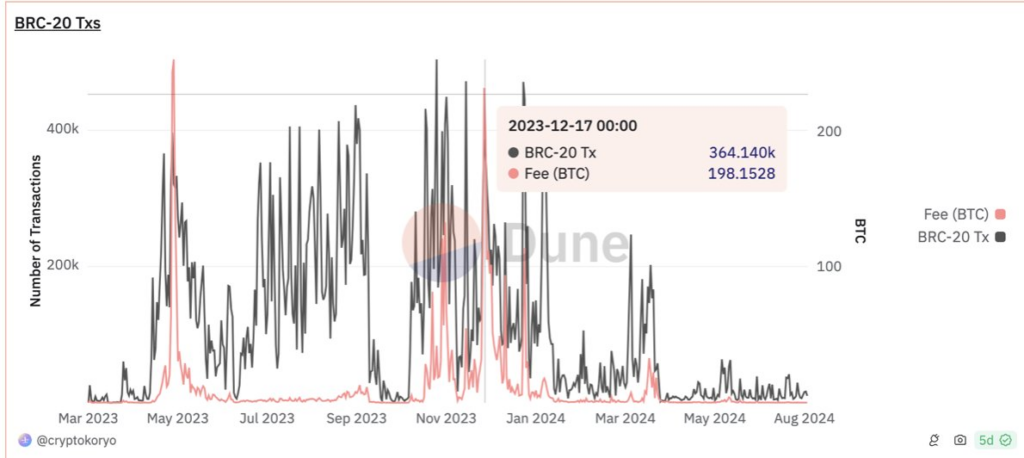

BTC’s venture into on-chain assets began with Ordinals, an inscription protocol that sparked widespread interest, leading to the creation of various “XX20” standards such as BRC20, ARC20, and ORC20. These standards proliferated quickly, signaling the Bitcoin ecosystem’s move toward an active, transaction-heavy network. The excitement surrounding these assets was palpable, as many believed they could solve BTC’s long-term security model by generating enough transaction fees to compensate miners when block rewards diminish after future halving events.

At the peak of this enthusiasm, transaction fees even surpassed block rewards, with fee revenues reaching as high as 300 BTC in a single day. However, this excitement waned by mid-2023, as daily fee revenue dropped to less than 1 BTC, demonstrating the volatility and unpredictability of the BTC ecosystem.

2. Scaling Solutions: Bitcoin’s Response to Ethereum’s Rollups

Following the asset frenzy, attention shifted to scaling solutions, with Merlin taking the lead. Similar to how Ethereum introduced Rollups to address scaling, BTC began exploring its own solutions. Unlike Ethereum, which has the backing of the Ethereum Foundation and a clear roadmap, BTC’s scaling efforts are more experimental and decentralized, with multiple approaches being tested simultaneously.

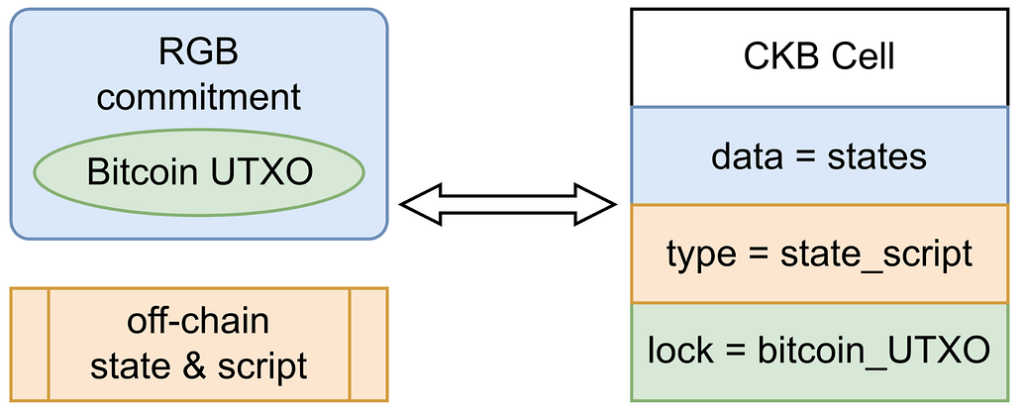

Taproot Assets, for example, enable BTC-native transfers but have limitations compared to more advanced solutions like RGB, a protocol eagerly awaited by the community. In addition to RGB, other projects like RGB++ and UTXO Stack are emerging, alongside Unisat’s Fractal, which has garnered considerable attention. Each of these solutions offers a different approach to scaling, contributing to the diverse and chaotic technical landscape of the BTC ecosystem.

3. Staking and Restaking: Bitcoin’s Path to Yield Generation

The third phase of BTC’s evolution—staking and restaking—addresses a critical challenge: transforming BTC from a non-yielding asset into one that generates interest. This stage seems more aligned with BTC’s “digital gold” narrative than the previous two, as it unlocks the liquidity of BTC and introduces yield generation without conflicting with BTC’s core identity.

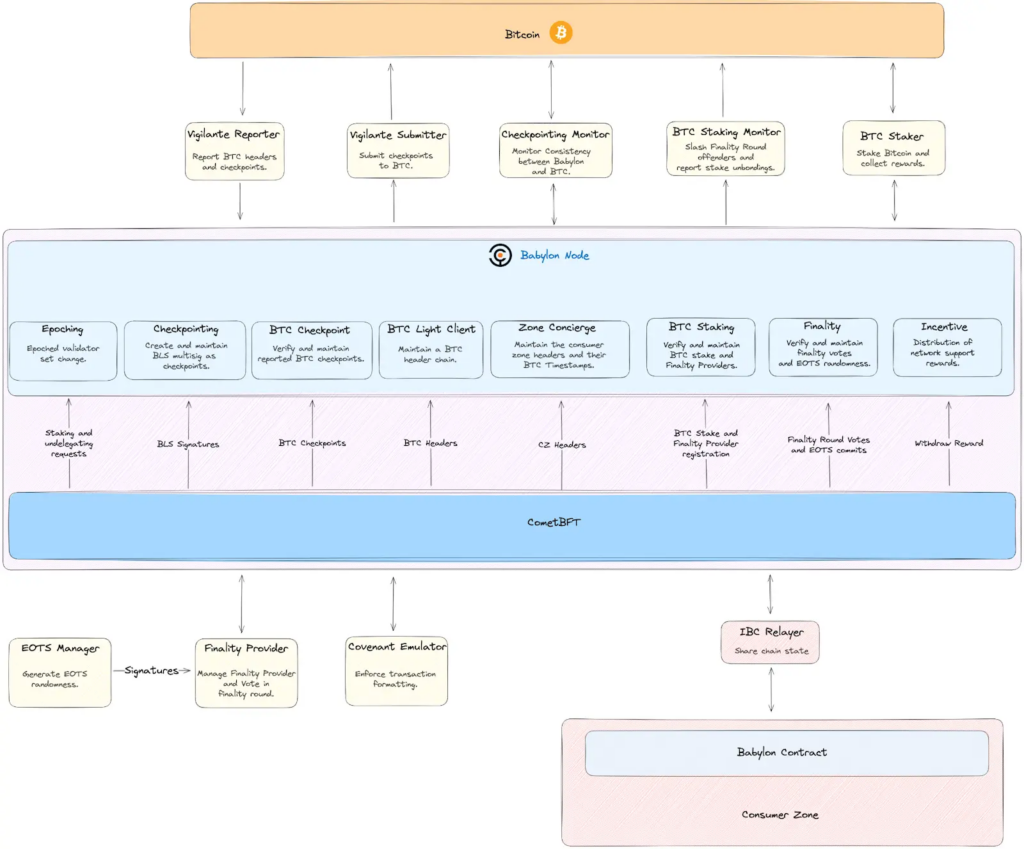

Babylon is the flagship project in this realm, playing a crucial role similar to that of EigenLayer in the Ethereum ecosystem. Babylon’s Trustless Restaking model allows BTC holders to generate yield, offering a lifeline to a network that traditionally didn’t offer staking rewards. This shift could turn BTC into an interest-bearing asset, revolutionizing its role in crypto space.

Other notable projects in this area include Solv and DLC.Link. Solv provides a hybrid Cefi and Defi approach to generate interest on BTC, adding liquidity through SolvBTC. DLC.Link, meanwhile, offers a “Trustless Bridge” using DLC technology to mint dlcBTC, allowing BTC to participate in DeFi ecosystems on other chains like Ethereum and Solana. These projects represent the future of BTC in decentralized finance, providing secure and decentralized alternatives to traditional wrapped BTC products like WBTC.

4. Babylon, Lorenzo, and the Competition for Yield

Babylon occupies a similar niche in the BTC ecosystem as EigenLayer does for Ethereum, with Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) playing key roles in both ecosystems. On the Babylon side, Lorenzo is emerging as a major competitor, offering unique features such as dual incentives for users through YAT tokens and points. This innovation positions Lorenzo as the only LST project offering both principal-based and interest-based tokens for BTC staking.

Lorenzo’s integration with Pendle’s principal-yield separation functionality further enhances its value proposition. By offering dual incentives and a limited staking cap of 250 BTC, Lorenzo provides users with an attractive opportunity for yield generation. This differentiation from other projects like Lombard and Solv, which focus on different aspects of staking and liquidity, highlights the competitive landscape of BTC’s emerging staking ecosystem.

5. The Strategic Importance of Yield and Liquidity in Bitcoin

The introduction of staking and restaking solutions like Babylon and Lorenzo reflects a strategic shift in the BTC ecosystem, emphasizing the importance of yield generation and liquidity. This direction is much more concrete and actionable than previous efforts to scale or issue on-chain assets. As the ecosystem matures, yield-generating solutions are becoming increasingly critical to BTC’s long-term viability.

Major players in crypto space, such as Binance, have recognized this shift, investing heavily in projects like Babylon, Lorenzo, Solv, and Renzo. These investments signal the growing importance of yield generation in BTC’s future, making this a sector that demands serious attention from both investors and developers.

In conclusion, while BTC’s ecosystem has seen chaotic experimentation in on-chain assets and scaling solutions, the move toward staking and restaking offers a more stable and promising path forward. With projects like Babylon and Lorenzo leading the way, Bitcoin is transforming from a static “digital gold” into a dynamic, yield-generating asset, marking a new era of innovation and opportunity in the crypto space.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.