The latest Bitcoin rally has sparked excitement, but is there more to come? This report delves into on-chain data, market cycles, and macro liquidity trends to explain why Bitcoin may be poised for its next big leap. Dive deeper into the cycle and price dynamics in our latest report.

1. Overview

- Bitcoin’s Rally Faces Resistance Near $100,000: After briefly hitting $99,692, Bitcoin pulled back to $91,100 on November 26. Despite this, the outlook for Q4 2024 and 2025 remains bullish. Below, we provide the data that supports this optimistic forecast.

2. Bitcoin Current Dynamic and Outlook

2.1. Institutional Adoption

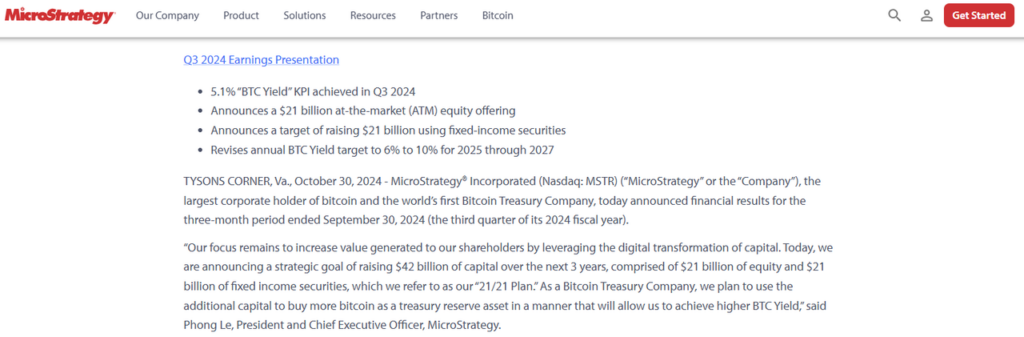

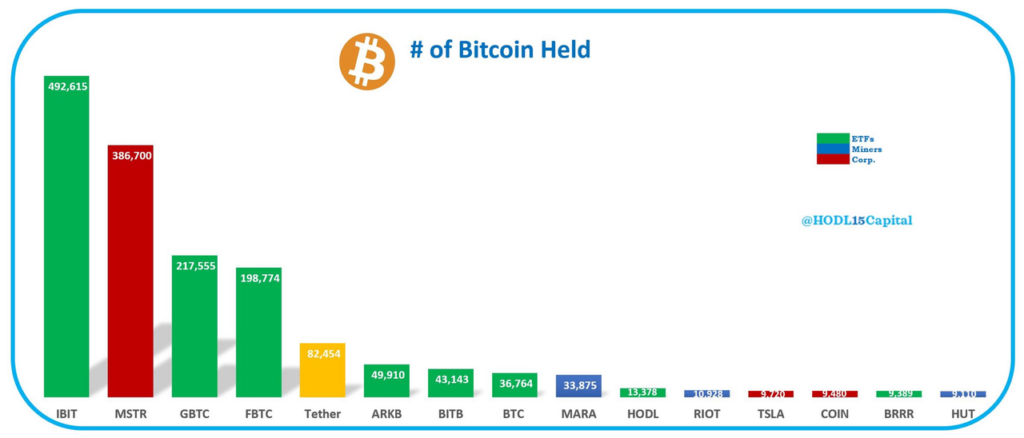

- Key players like BlackRock IBIT, Grayscale, and MicroStrategy dominate Bitcoin’s institutional landscape, reflecting growing institutional demand. MicroStrategy’s significant holdings position it as a Bitcoin Treasury company, further cementing Bitcoin’s role in corporate strategies.

2.2. Nation-State Game Theory

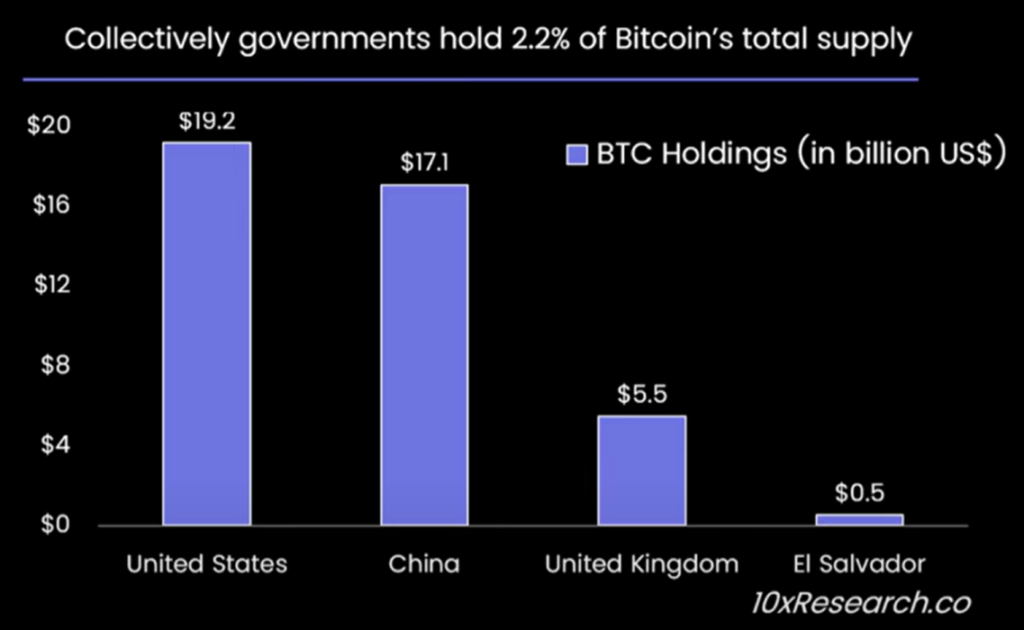

- Bitcoin is increasingly viewed as a strategic asset by sovereign nations. The U.S. and China lead, driven by seizures from illicit activities. Since the U.S. election, Bhutan’s Bitcoin holdings have increased from $200 million to $1.1 billion. Governmental reserves highlight Bitcoin’s emerging role in global financial geopolitics, potentially sparking competition among nations to accumulate Bitcoin as a reserve asset.

2.3. Strong Macro Backdrop

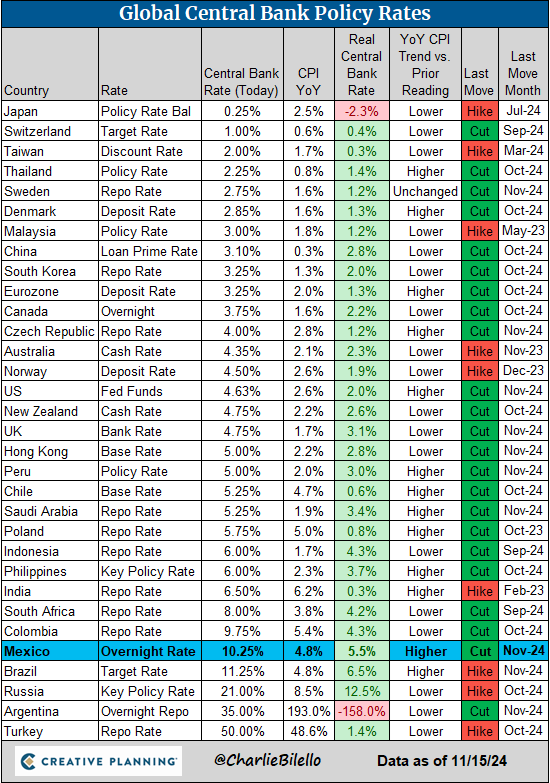

- The global economy is entering a rate-cutting cycle, with central banks shifting toward monetary easing. This pro-liquidity environment is driving a risk-on sentiment, encouraging capital flows into high-risk, high-reward assets like Bitcoin.

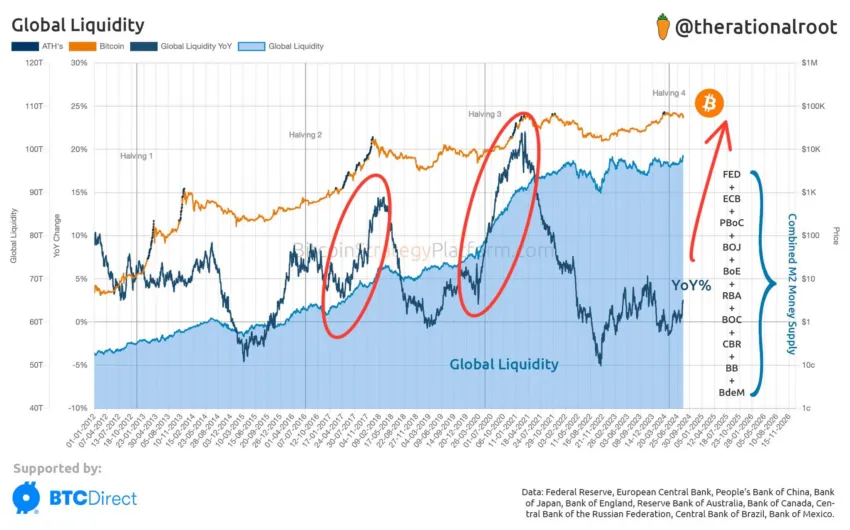

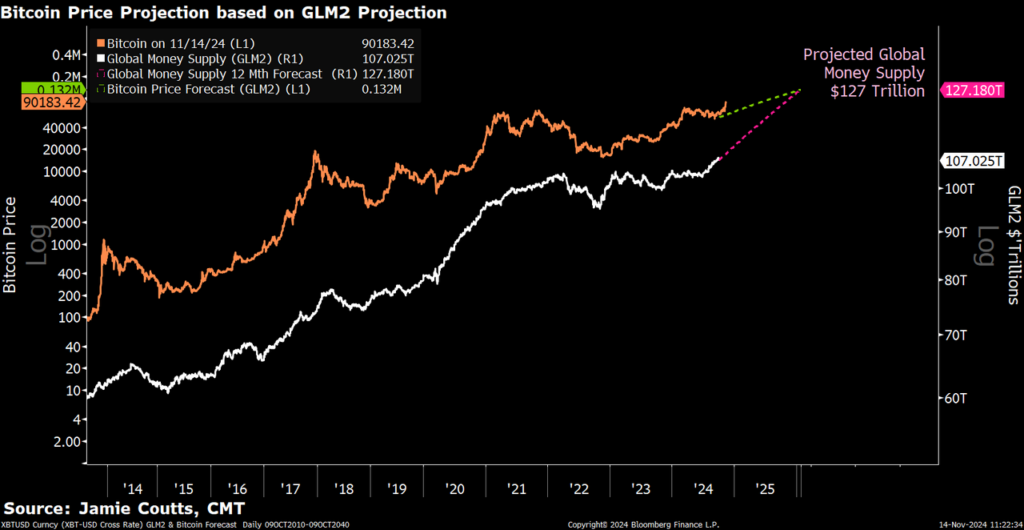

- Historically, Bitcoin bull markets have coincided with periods of rapid global liquidity expansion, as increased money supply boosts demand for “risk assets.” With global liquidity now rising amid rate cuts, we expect this trend to continue, potentially peaking by late 2025 and sustaining a prolonged Bitcoin rally.

2.4. Halving Cycle Dynamics

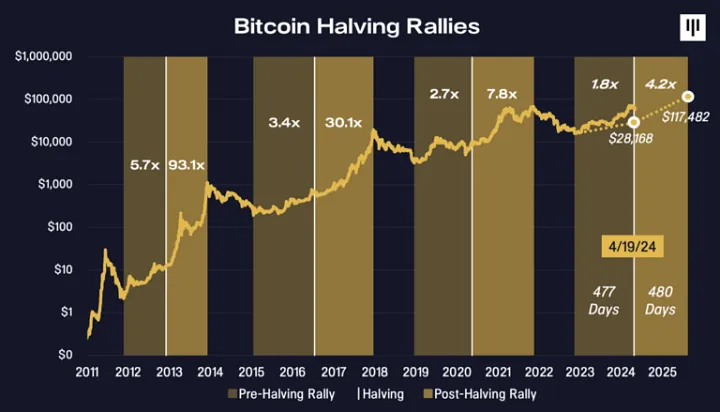

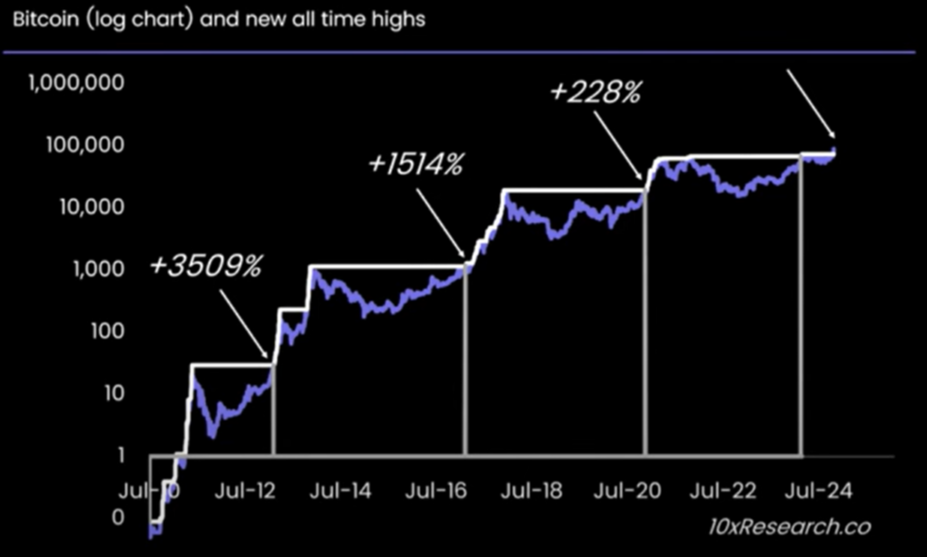

- Historically, Bitcoin’s price has seen significant multipliers following halving events (2012, 2016, and 2020). Market peaks typically occur 15–18 months after a halving, suggesting the next peak may emerge in late 2025, coinciding with the expected peak of the global liquidity cycle.

2.5. Supply and Demand Dynamics

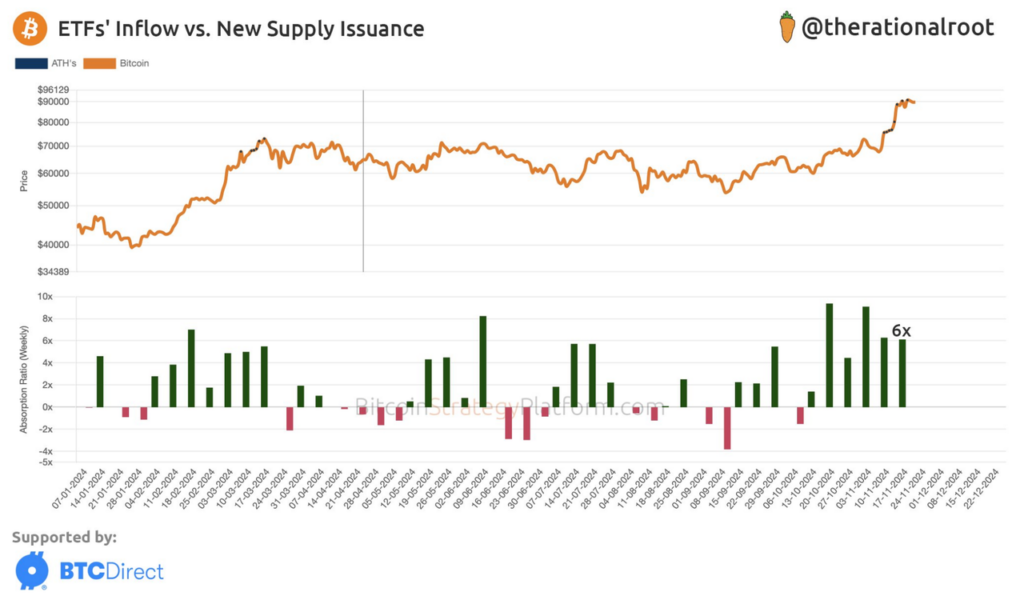

- Demand for Bitcoin is at an all-time high, with $7 billion flowing into Bitcoin spot ETFs since the U.S. election. Continued inflows into Bitcoin-linked products are likely, driven by Trump’s pro-crypto administration, a favorable U.S. Congress, and Fed rate cuts.

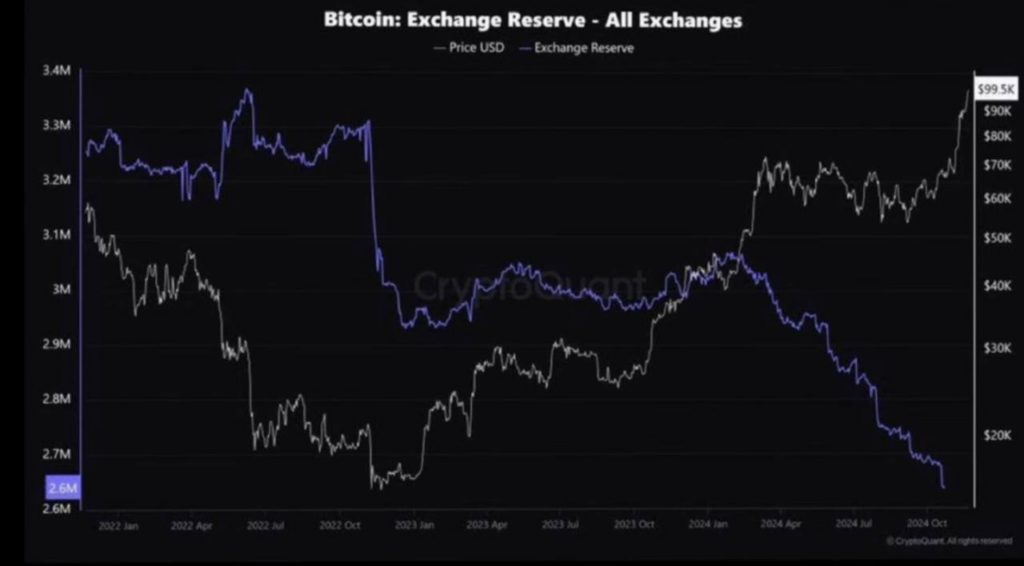

- On the supply side, Bitcoin balances on exchanges have dropped to historic lows (2.6M), signaling a supply shock. This pressure is expected to intensify with April’s halving event, further supported by macroeconomic tailwinds as we approach 2025.

2.6. Trump’s Agenda

- Trump has pledged a pro-crypto stance, promising friendlier regulations and the establishment of a national Bitcoin stockpile. With Republican control of both the White House and Congress likely for at least two years, we anticipate swift implementation of supportive policies.

- Banks may gain greater freedom to engage with digital assets, and approval for crypto ETFs beyond Bitcoin and Ether (e.g., XRP, SOL, ADA, LTC) could expand. This signals the beginning of a broader institutional embrace of crypto.

2.7. Policy and Regulatory Frameworks

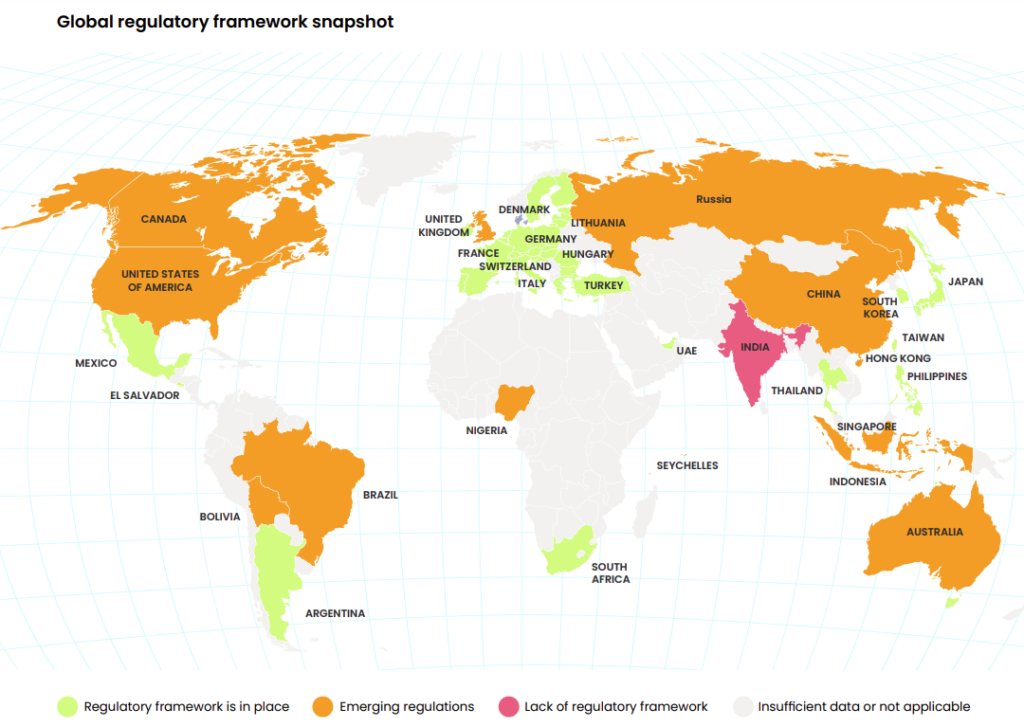

- The global crypto regulatory landscape is maturing rapidly. In the U.S., key milestones include Wyoming’s DUNA and the FIT21 Act. And EU, the landmark MiCA regulation, the first comprehensive crypto framework, is set to take full effect by year-end.

- In Asia, optimism is rising as regions like Singapore and Hong Kong push to establish themselves as digital asset hubs. Meanwhile, demand persists in China’s gray markets despite Beijing’s ban, driven by investment opportunities, currency hedging, and remittance efficiency. In summary, regulatory clarity is crucial for building investor confidence, fostering institutional participation, and attracting capital to the ecosystem.

2.8. Bitcoin Mass Adoption on the Horizon

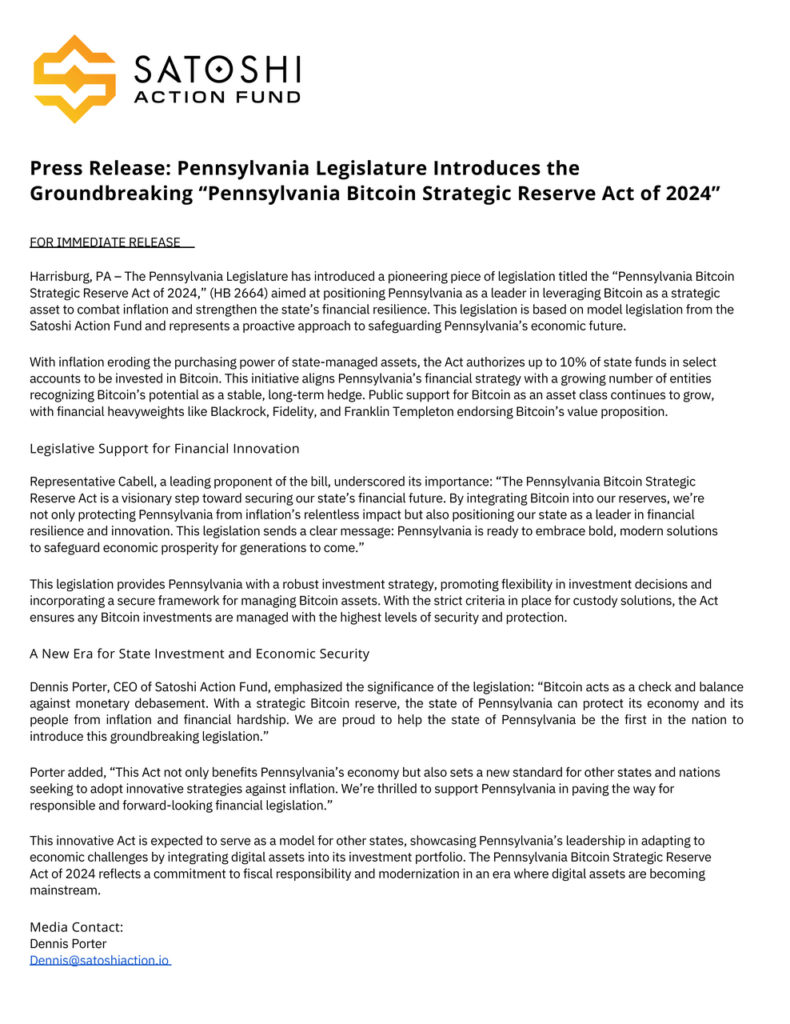

- Satoshi Action has proposed legislation for a “Strategic Bitcoin Reserve” in Pennsylvania, highlighting growing interest at both state and federal levels in mining Bitcoin or establishing reserve funds.

- Major financial institutions, including Charles Schwab, are preparing to enter the crypto market pending regulatory clarity, supported by Trump’s pro-crypto agenda. Consistent Bitcoin accumulation by these players could drive demand significantly beyond supply, fueling substantial price increases.

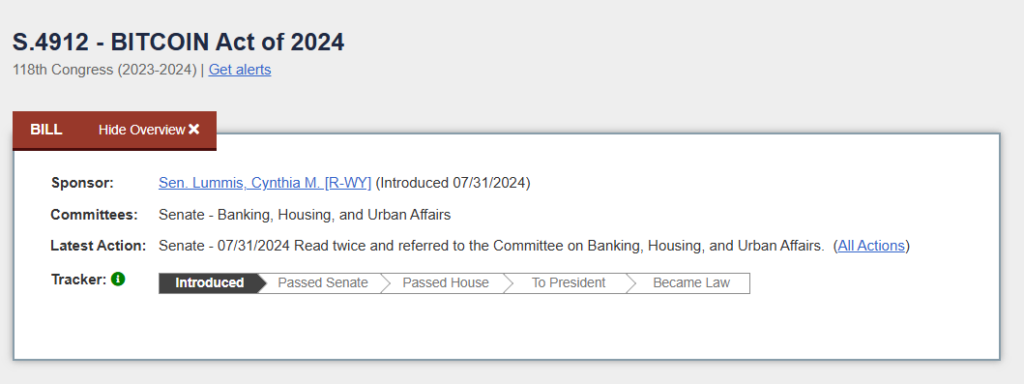

- Republican lawmakers, led by Senator Cynthia Lummis, are advocating for Bitcoin to become a U.S. strategic reserve asset. With Republican control of Congress and the Presidency, the likelihood of such legislation passing is high. If enacted, the U.S. government could accumulate 1 million BTC over five years by purchasing 550 BTC daily.

- MicroStrategy’s $42 billion, three-year Bitcoin investment plan involves buying 400 BTC daily, totaling 438K BTC over the same period. Together with U.S. government accumulation. This could create a massive supply shock, driving institutional buying and triggering retail FOMO.

3. How far will Bitcoin go?

A mountain of money on the sidelines

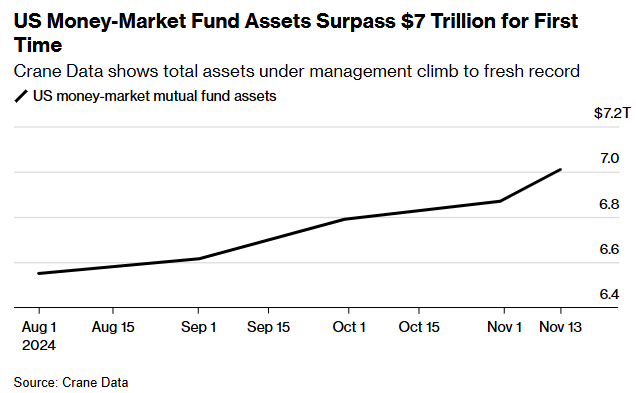

- U.S. money market fund assets have surged to $7 trillion, fueled by $2 trillion in inflows over the past two years. However, as global liquidity rises and the Federal Reserve continues cutting interest rates, demand for money funds is expected to decline by 2025.

- We think Trump’s victory will drive a surge in crypto investment, prompting corporations to redeploy idle cash. Institutional investors, who account for half of the $700 billion inflows into money funds this year, could lead this shift.

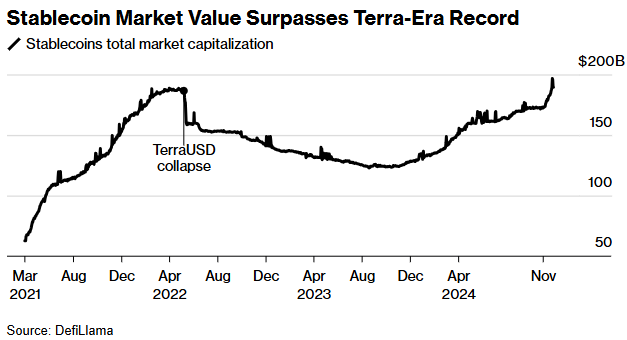

- Stablecoin market capitalization has grown 46% this year to a record $190 billion, with minting activity at its fastest pace since 2021. This reflects a high demand for liquidity to fuel crypto investments. With Trump’s pro-crypto administration turning regulatory headwinds into tailwinds, stablecoin growth is set to accelerate further, creating a strong catalyst for market expansion.

- In our view, growing ETF investments and anticipated U.S. regulatory clarity are expected to stabilize Bitcoin’s market cycles, reducing the steep declines seen in previous cycles. While diminishing returns are evident, the last cycle achieved +228%, and a +100% return this cycle appears achievable.

- Global liquidity (GLM2) is forecasted to reach $127 trillion, boosting Bitcoin’s scarcity-driven appeal. With rising adoption and reduced supply, Bitcoin could achieve new all-time highs, potentially reaching $132K in the current cycle.

4. Closing Thoughts

- This week’s Bitcoin pullback near the $100,000 milestone was largely due to profit-taking—a tactical move. However, strong fundamentals as we mentioned above suggest Bitcoin will soon break this historic level.

- Despite Bitcoin’s inherent volatility, investors should view BTC and other cryptocurrencies as long-term investments. The growing optimism from industry leaders, policymakers, regulators, and institutional investors supports this perspective.

- A convergence of unique factors is creating a perfect storm for explosive growth in the crypto market over the next 6–12 months. We recommend fully engaging with the market and maximizing your opportunities to capitalize on this momentum.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.