In 2024, USD Coin (USDC), the stablecoin issued by Circle, has undergone a significant transformation, emerging from a challenging period to position itself as one of the leading players in the global stablecoin market. After struggling in 2023 due to the aftershocks of the FTX collapse, the US regional banking crisis, and the Federal Reserve’s tightening policy, USDC is now on a recovery trajectory that could redefine its role in the world of digital finance.

1. USDC’s Market Performance

As of December 1, 2024, the stablecoin market capitalization has surged to approximately $193.3 billion, surpassing its previous all-time high of $183.3 billion from April 2022. This growth follows a challenging 2023, marked by liquidity pressures on the broader cryptocurrency ecosystem. The recovery signals an uptick in crypto demand, fueled by institutional interest, particularly after the introduction of spot Bitcoin ETFs in late 2023 and early 2024.

Among the standout performers, USDC has experienced a notable resurgence, growing its market cap by 67.4% to $39.85 billion since December 2023, rebounding from earlier declines. In contrast, Tether (USDT), the market leader, saw a more modest growth of 50.6%, expanding its market cap to $134.53 billion during the same period.

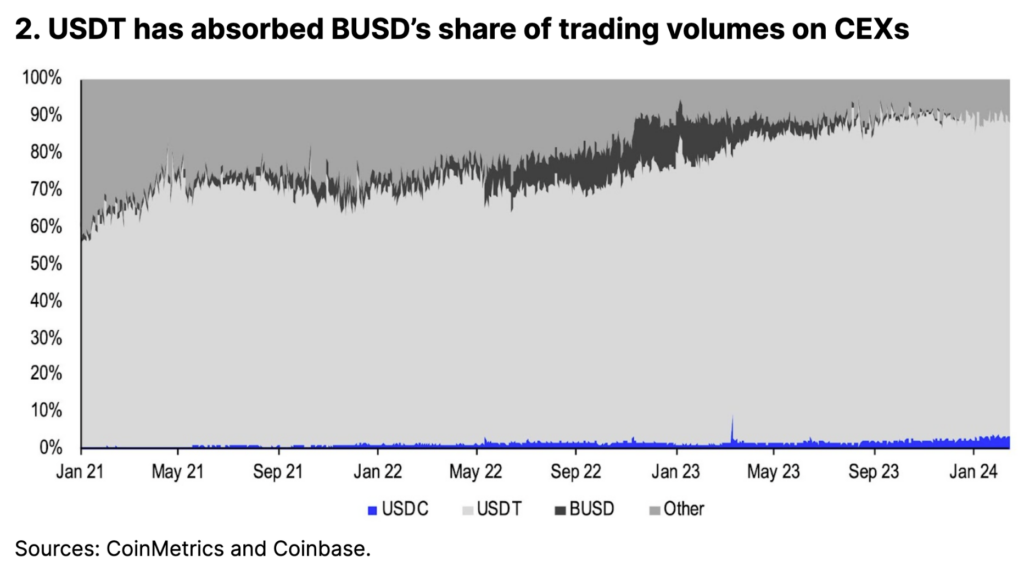

The competition between USDC and USDT has intensified. While Tether benefits from the collapse of BUSD, Paxos’ stablecoin for Binance, USDC has increasingly emerged as a preferred choice in regulated markets. With the shutdown of BUSD, USDT has captured much of its market share, especially in the derivatives sector. As BUSD’s market capitalization plummeted from over $16 billion in February 2023 to less than $100 million by early 2024, USDT’s dominance in the derivatives market has solidified. Currently, USDT holds around 81% of the perpetual futures market open interest on centralized exchanges (CEXs), up from 72% before BUSD’s delisting.

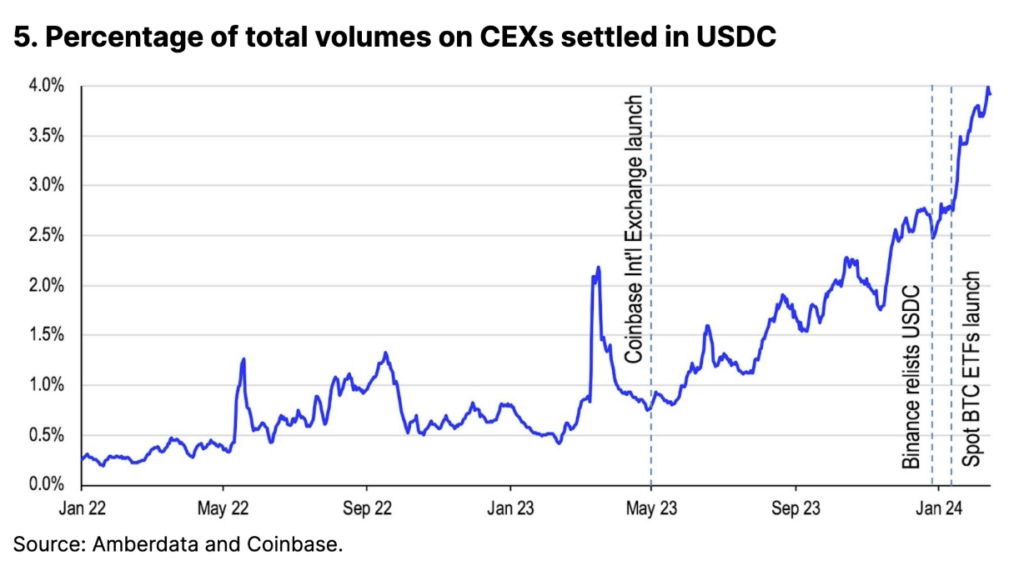

The stablecoin market remains dominated by Tether (USDT), but USDC is increasingly challenging its position, particularly in regulated markets. While Tether leads in derivatives, USDC’s growth has been notable in spot trading, reflecting rising demand for stablecoins that prioritize transparency and regulatory compliance. USDC’s liquidity and availability on global exchanges have surged since mid-2023, driven by the launch of Coinbase International Exchange and the relisting of USDC on Binance.

2. Key Drivers of USDC’s Growth

2.1. Regulatory Compliance and Transparency

One of the primary reasons for USDC’s continued growth in 2024 is its strong commitment to regulatory compliance and transparency. USDC is 100% backed by highly liquid assets, including cash and US Treasury bonds, making it one of the most secure and trusted stablecoins in the market. Circle has ensured that USDC remains fully redeemable 1:1 for US dollars, providing stability and reliability in a volatile market.

The Circle Reserve Fund (USDXX), managed by BlackRock, is at the core of USDC’s reserve structure. The fund is SEC-regulated and invests primarily in short-dated U.S. Treasuries, overnight repurchase agreements, and cash-equivalent assets, providing a high degree of security and liquidity. This reserve structure is crucial for maintaining confidence in USDC, as it is subjected to independent third-party audits, ensuring full transparency to the public.

Circle’s approach has resonated well with both institutional and retail investors who prioritize safety and transparency, particularly as regulatory scrutiny in the cryptocurrency space continues to increase.

2.2. International Expansion and Institutional Adoption

USDC’s global reach has expanded significantly, with major milestones in Europe and Asia. The launch of Coinbase International Exchange and the relisting of USDC on Binance in 2023 have further solidified its position in international markets. Moreover, USDC has gained traction in countries such as Singapore and Hong Kong, where institutions like Standard Chartered are facilitating access to USDC.

The demand for USDC is also growing among institutional investors. Major financial institutions such as BlackRock, JPMorgan, and Goldman Sachs are increasingly adopting blockchain technologies and exploring the use of stablecoins in traditional finance. USDC’s regulatory compliance and transparency have made it the preferred stablecoin for many of these institutions, particularly in cross-border payments, digital asset tokenization, and cash management.

In the DeFi sector, USDC has seen growing usage in lending protocols like Aave, Compound, and Curve, as well as decentralized exchanges like Uniswap. The improved liquidity in the broader crypto market has led to an increase in USDC’s role as collateral for lending and liquidity provision in DeFi platforms.

2.3. USDC’s Role in Bitcoin ETFs

The launch of Bitcoin spot ETFs in 2023 has had a significant impact on the stablecoin market, and USDC has emerged as a critical player in this new financial landscape. As institutional investors flock to Bitcoin ETFs, USDC has become the preferred stablecoin for Bitcoin-related transactions. This development has not only boosted USDC’s presence in traditional finance but has also enhanced its visibility as a bridge between traditional finance and the emerging world of digital assets.

3. Final thoughts

Looking ahead, USDC is well-positioned for continued growth in 2024 and beyond. Its focus on regulatory compliance, transparency, and institutional adoption gives it a competitive edge over other stablecoins, especially Tether. As the digital asset market matures and traditional financial institutions integrate blockchain technologies, USDC’s role as a trusted stablecoin will only expand. With its global reach, growing adoption by DeFi protocols, and strategic positioning in emerging markets, USDC is a strong contender for stablecoin dominance.

In conclusion, USDC’s resurgence in 2024 highlights the increasing demand for regulated, transparent stablecoins bridging traditional and digital finance.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.