Since Donald Trump’s reelection, Bitcoin has skyrocketed, hitting record highs above $99k! But is this meteoric rise simply market hype—or is there a solid foundation behind it? Our latest research breaks down the key drivers behind this surge and the potential regulatory shifts under Trump’s leadership. Dive into the full analysis here!

1. Overview

Bitcoin hit a record high of $99,692, marking a 135% surge in 2024, outpacing stocks, gold, and other assets. Since Trump’s election win, the crypto market has gained approximately $1 trillion.

2. Unpacking the Surge: A Data-Driven Insight

Trump’s Crypto-Backed Agenda:

- Launch a strategic reserve of Bitcoin.

- Halt government sales of its $19.2 billion Bitcoin stash.

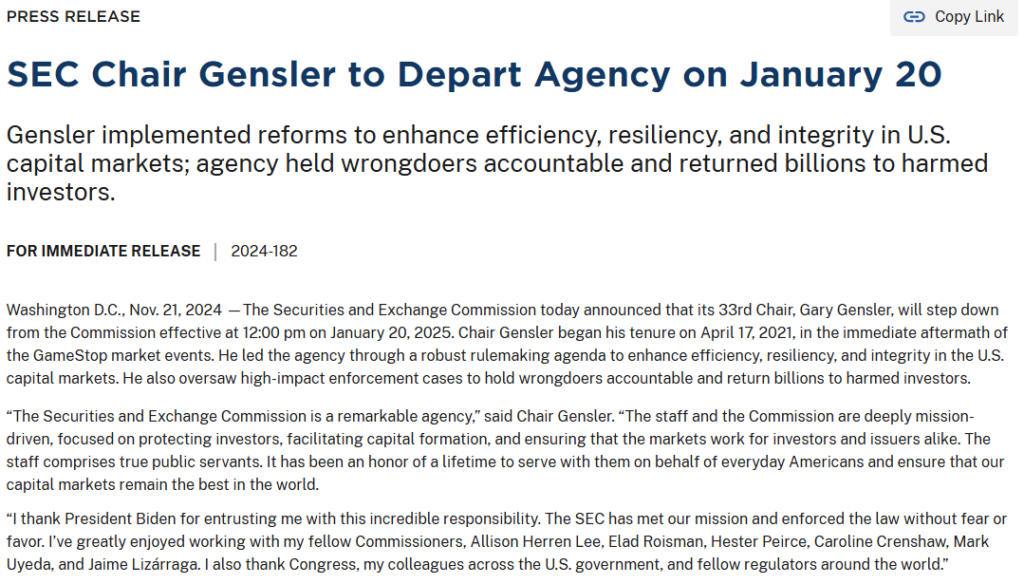

- Replace SEC Chair Gary Gensler with a crypto-friendly appointee by January 20, 2025.

- Establish a Bitcoin-focused advisory council within Trump’s first 100 days to create a crypto-friendly regulatory framework.

- Promote domestic Bitcoin mining, aiming for U.S.-produced Bitcoin only.

- Crypto advocates like Elon Musk and Vivek Ramaswamy will lead efforts to streamline crypto policies.

With Trump’s pro-crypto administration taking shape and the “red wave” in Congress, regulatory optimism is on the rise, signaling a new era of crypto-friendly policies and potential market-transforming changes.

2.1. Increased TradFi Demand

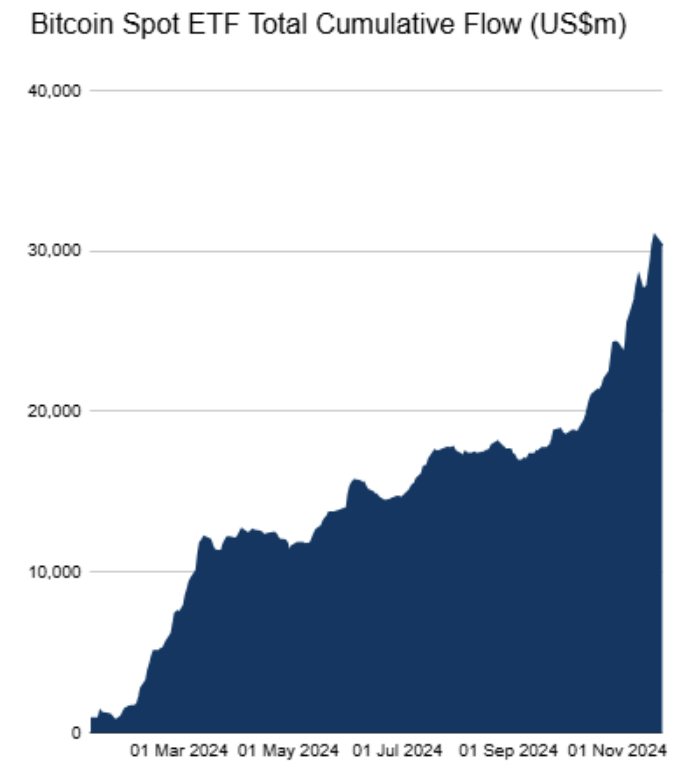

Since the U.S. election, Bitcoin spot ETFs have seen $8 billion in inflows, bringing total net inflows to $30 billion since their January launch. BlackRock’s IBIT ETF recorded a daily net inflow of nearly $1.1 billion on November 7, highlighting the growing institutional interest reshaped by Trump’s victory.

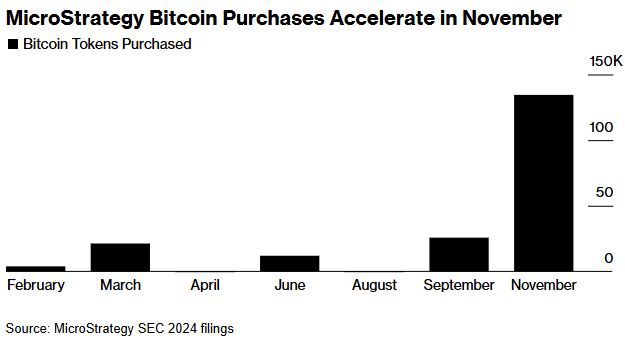

2.2. MicroStrategy’s Accelerated Bitcoin Purchases

MicroStrategy, now a prominent Bitcoin Treasury company, has invested a record $5.4 billion in Bitcoin, marking its third major purchase this month alone.

2.2.1. Macro tailwinds

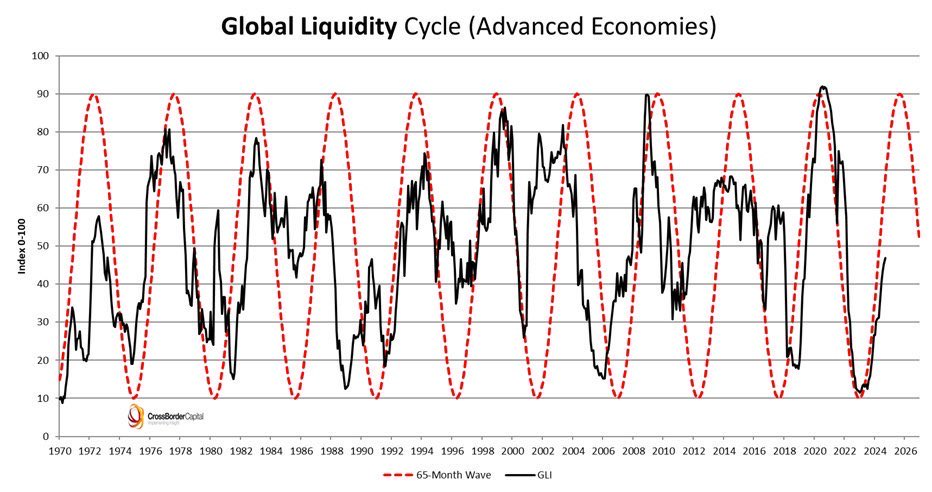

Global liquidity reached its cycle low in October 2022 and is now on the rise as most central banks reduce interest rates. In particular, the Fed has already cut rates by 75bps this year and is expected to reduce rates by another 25bps in 2024. This expanding liquidity is a key driver of market strength.

2.2.2. SEC Chair Gary Gensler stepped down

In another positive signal for crypto, SEC Chair Gary Gensler announced plans to step down on January 20, coinciding with Trump’s inauguration. Gensler’s tenure was marked by a series of enforcement actions, which the industry expects will diminish under a pro-crypto administration.

3. Closing Thoughts

- Under the Trump administration, crypto legislation could soon be approved, marking a shift from regulation by enforcement to a more collaborative approach. Regulatory clarity would act as a tailwind for venture capital investments.

- We remain confident that the current bullish market sentiment will persist into 2025, fueled by ongoing inflows into Spot Bitcoin ETFs, Trump’s pro-crypto stance, a supportive U.S. Congress, and Fed rate cuts.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.