TL;DR

- Total funds raised: $22M, backed by top VCs like OKX Ventures, Binance Labs, Blockchain Capital, and CMT Digital. Notably, the final round was valued at $0.023, equating to a Fully Diluted Valuation (FDV) of $200M.

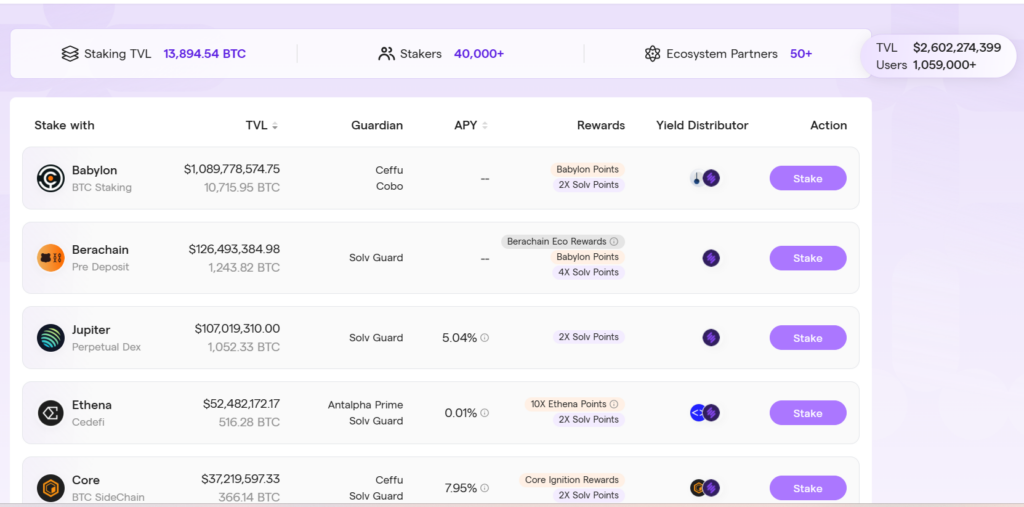

- BTCFi Trend: With the burgeoning BTCFi trend and influx of capital, Solv stands to benefit significantly, holding the number two market share in space.

- Market Position: Solv Protocol ranks second in BTCFi Restaking market share, boasting a TVL of $2.4B, trailing only Babylon, and has amassed 800k total unique users.

- Fundamentals: Solv exhibits strong fundamentals compared to its competitors.

- Valuation: The current valuation is considered low relative to its TVL, trading at an FDV of $624M (3x the fund’s valuation). However, VC token unlocks are scheduled for January 2026. The monthly unlock volume is $8M, which is negligible compared to the daily volume of $240M.

- Holder Concerns: $SOLV holders face minimal selling pressure from VCs for the next 11 months. However, careful observation is advised to secure favorable price positions, as tokenomics presents risks for retail investors.

1. Executive Summary

Token Overview

- Ticker: $SOLV

- Current Price: $0.07

- Market Cap: $123,041,300

- FDV: $697,117,848

- Sector: Restaking BTCFi.

2. Due Diligence Summary

2.1. Technology and Product

2.1.1. Overview

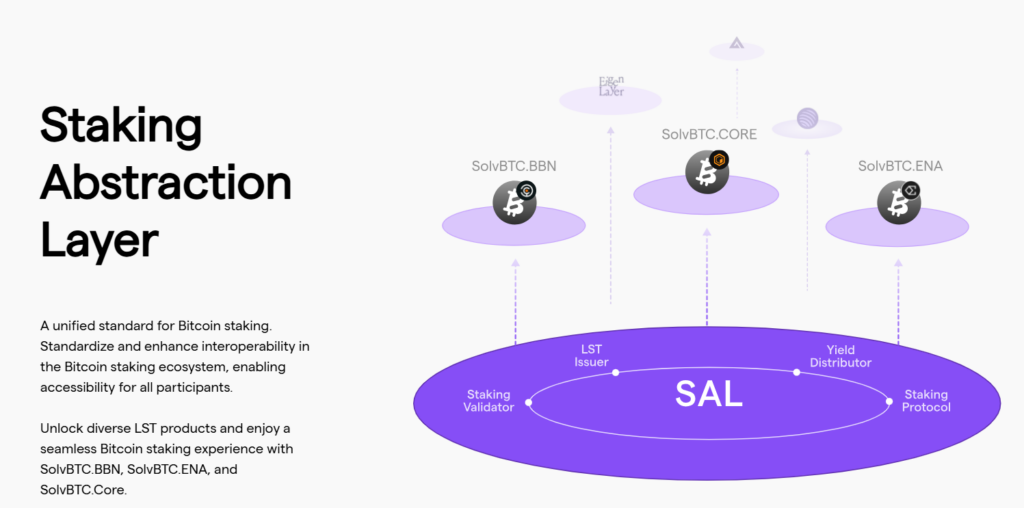

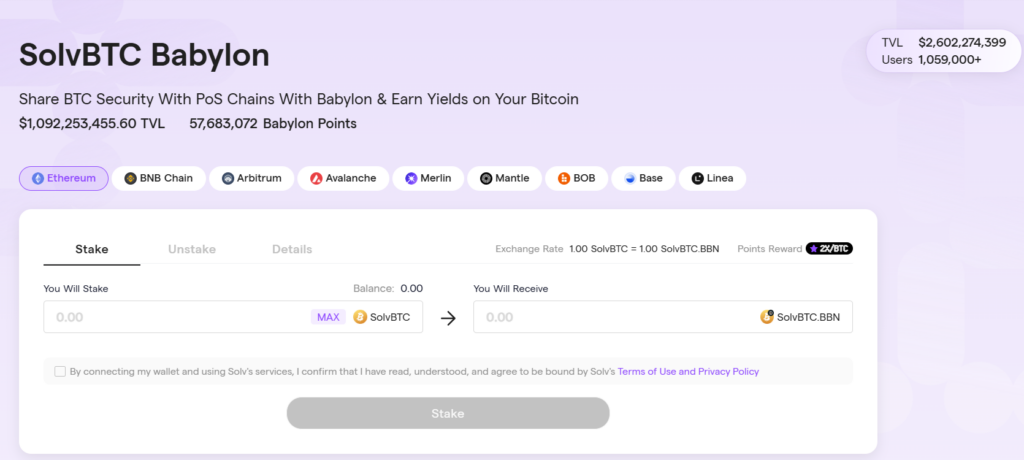

Solv Protocol is a restaking protocol for Bitcoin, currently supporting multiple chains but primarily focused on native Bitcoin. Utilizing its Staking Abstraction Layer (SAL) technology, Solv Protocol provides a seamless and transparent Bitcoin staking experience, enabling users to enhance their returns and expand their access to BTCFi.

2.1.2. Product

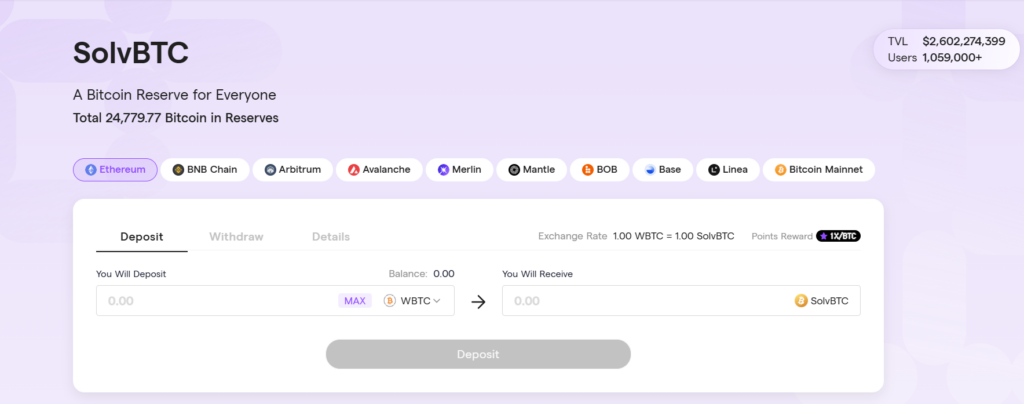

SolvBTC: This is the $SolvBTC token, designed to unlock the liquidity of idle Bitcoin and connect it to the DeFi ecosystem. Backed 1:1 by $BTC, $SolvBTC provides Bitcoin holders with the ability to seamlessly move into cross-chain DeFi opportunities and earn yields.

Note: Staking $BTC for $SOLV.BTC does not directly generate yield. Instead, users can utilize the protocol’s DeFi Vault products to seek yields through DeFi.

Additionally, to ensure liquidity and maintain the value of the SolvBTC token, the Solv Protocol team categorizes Liquid Staking Tokens (LSTs) into two groups: Core Reserves and Innovative Reserves.

- Core Reserves: This group consists of tokens with the highest liquidity and security, such as BTC, BTCB, etc.

- Innovative Reserves: This group includes tokens with higher risk, such as low liquidity, smart contract risks, etc. Tokens in the Innovative Reserves group include WBTC, FBTC, cbBTC, among others. Accordingly, the project team will limit the amount of SolvBTC issued through this group. The limit varies depending on the type of token.

Solv Protocol currently facilitates restaking across a range of blockchain networks, including:

- EVM-compatible chains: BNB, ETH, ARB, Mantle, Base, and Linea.

- Bitcoin-based chains: Native BTC, Merlin, and BOB.

SolvBTC.LSTs are liquid staking tokens that enable Bitcoin holders to participate in both staking and advanced trading strategies. These LSTs optimize the yield-earning potential of Bitcoin across various protocols through activities like lending and liquidity provision.

Supported Chains:

- EVM Chains: ETH, BNB, ARB, AVAX, Mantle, BASE, Linea.

- BTC Chains: BOB, Merlin.

- Yield-Bearing LSTs: When you stake $Solv.BTC, you receive $Solv.BTC.LST, which accumulates yield in the form of protocol points (pending future token launch) and 2x Solv points.

Bitcoin Reserve Offerings (upcoming)

Bitcoin Reserve Offerings (BROs) are capital raising events conducted by Solv Protocol to build a Bitcoin reserve owned by the protocol. In 2025, Solv plans to hold three BROs, one each in Q1, Q2, and Q3, with each offering issuing 42 million SOLV tokens in the form of convertible notes.

These notes have a one-year term, and buyers will receive $SOLV tokens upon maturity, corresponding to Q1, Q2, and Q3 of 2026. This means investors will not receive SOLV tokens immediately upon purchasing the notes but only after they mature.

Subsequent Bitcoin Reserve Offerings will be managed by the DAO, and the $SOLV token supply may increase through network governance for BROs.

Overall

- Solv Protocol’s business model, in terms of solutions, is similar to LST projects (Lido, Renzo, EtherFi) on Ethereum. Solv is capitalizing on the early stages of BTCFi staking, addressing the issue of unlocking a significant amount of Bitcoin liquidity (over $2B USD) for DeFi and enabling native $BTC holders to earn stable yield percentages.

- Solv will then begin raising capital to build BROs in the form of $SOLV token convertible notes. BROs enhance sustainability and ensure the protocol’s long-term growth. However, they also carry the risk of increasing $SOLV supply through BRO issuances, which could create selling pressure in the market.

2.2. Team & Road Map

2.2.1. Team

- Ryan C.: Founder and CEO of Solv Protocol. Previously, he worked at Singularity Financial as a financial analyst.

- Meng Yan: Co-founder of Solv Protocol. He has worked at several major financial enterprises, including IBM China, CSDN, and Ample Fintech LTD.

- Will Wang: Co-founder and CTO of Solv Protocol. He has also worked at numerous well-known technology companies in China, such as Nantian, Shang Lezhu Technology, and Beijing Unizon Technology.

Assessment: The team’s background is rooted in China, with extensive experience in the technology sector. This suggests a strong capability for product development and execution. However, a significant portion of blockchain projects within the BTCFi space originates from Chinese teams, and some of these projects have been associated with negative perceptions within the community. This presents a potential drawback.

2.2.2. Roadmap

Q1/2025

- CEX and DEX Listings. -> Completed

- SolvBTC and SolvBTC.LST Integration with More Ecosystems (BeraChain, Sonic, zkSync, Soneium, Sei, etc.). -> In Progress

- Launch of Exchange Earn Campaigns -> In Progress

- Second SOLV Points Campaign Launch -> In Progress

- Launch of the First Bitcoin Reserve Offering -> In Progress

- SolvBTC.RWA Launch -> In Progress

Q2/2025

- Launch of the Second Bitcoin Reserve Offering.

- SolvDAO Launch.

- BTC ETF Integration into SolvBTC Core Reserve.

- Issuance of More SolvBTC.LSTs.

- ETF Tokenization.

Assessment: The project is developing and completing its roadmap objectives as planned, which is a positive sign.

2.3. Competitive Landscape

2.3.1. Market Sector (using Liquid Restaking TVL as the primary metric)

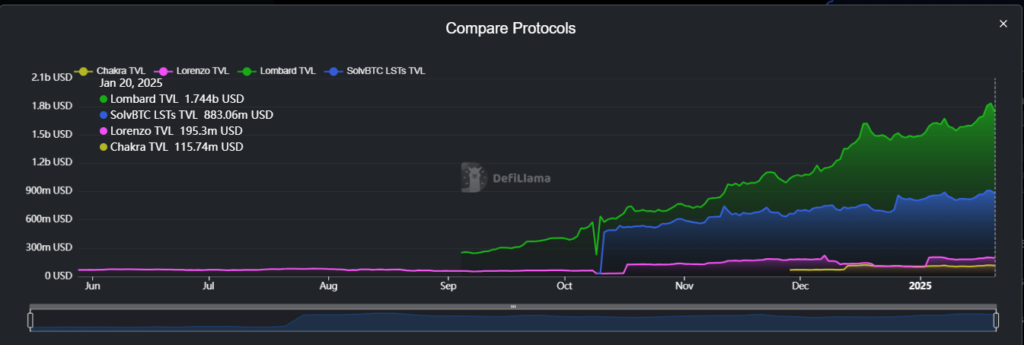

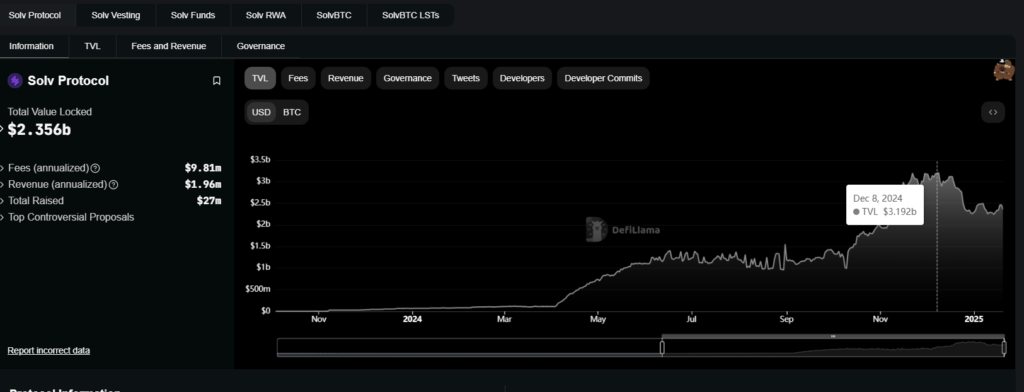

The BTC Liquid Restaking sector currently has a Total TVL of $3.14B (excluding Babylon, which falls under the Restaking sector, not Liquid Restaking). Recorded in December, the TVL was $2.7B, indicating a growth of over 24% to date. This increase has been driven by the recent surge in Bitcoin’s price.

2.3.2. Observations

- Lombard: Leads with $1.744B TVL, holding the largest market share among all protocols. This protocol has demonstrated consistent growth, surpassing competitors since October 2024, and maintaining a steady growth rate.

- Solv: Ranks second with $1.06B TVL, directly competing with Lombard (both projects offer similar yield points). However, in December 2025, Solv faced FUD regarding TVL manipulation (prior to the $SOLV TGE). Coupled with Lombard’s lack of a token launch, this led to a shift of TVL to Lombard, increasing its market share to 58%. // (Considering only BTC LST; in the overall BTC Restaking sector, Solv has $2.4B TVL, ranking second only to Babylon.)

- Overall: Despite the FUD and token launch, Solv has maintained a stable LST TVL, fluctuating between $850M and $1B. However, its 14% growth has not shown the same strong momentum as Lombard’s.

| TVL | % market share | 30D % Change | |

| Lombard | $1.85B | 58% | +24.61% |

| Solv | $2.06B | 33% | +14% |

| Lorenzo | $195M | 6.2% | +76.51% |

| Charka | $115M | 3.6% | +3.54% |

2.3.3. Key Metrics (Financial & On-chain Metrics)

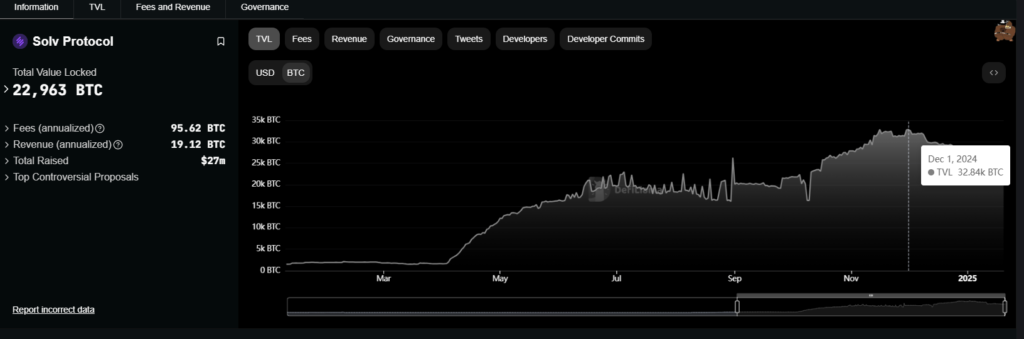

Solv’s current Total TVL (USD) is recorded at $2.3B, which corresponds closely with Total TVL (BTC). Both metrics move in sync, showing no significant discrepancy, indicating that the decrease in TVL (USD) is influenced by Bitcoin’s price fluctuations in the market.

2.3.4. Total Unique User & DAU

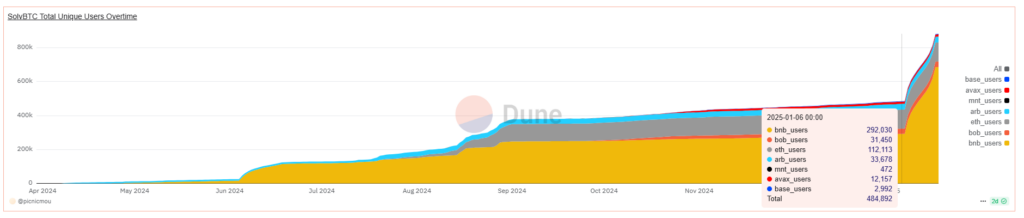

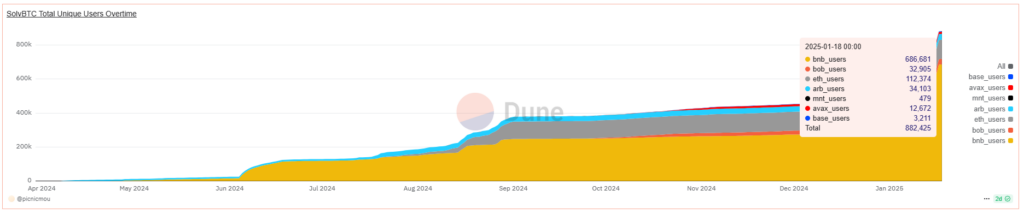

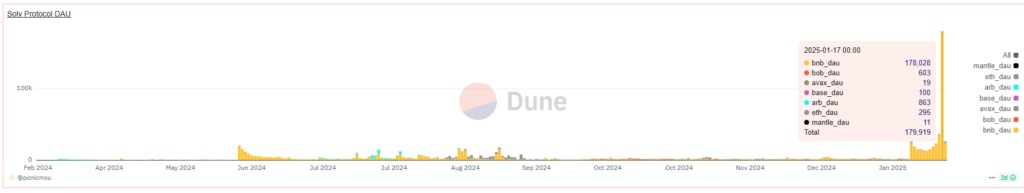

The protocol experienced a significant surge in users within a 12-day period, with total unique users increasing from 484k to 882k (a 100% increase). This spike was driven by the major Megadrop airdrop event on Binance Web3, which specifically boosted BNB Chain users from 292k to 686k. Prior to this event, the protocol’s user growth maintained a steady rate of only 2-3% per month.

2.3.5. Overall

Upon closer examination of the sector, the project’s individual metrics reveal that the overall TVL of the BTCFi space is steadily increasing by 24% month over month. This indicates that the Product-Market Fit (PMF) of BTCFi Restaking is highly viable. Solv and Lombard, the two leading projects in BTC Liquid Restaking, have been in direct TVL competition, with consistent growth from October 2024 to January 2025, essentially neck and neck.

However, Solv has launched its token, while Lombard has not. Therefore, Solv’s potential to optimize returns for investors is considered superior to Lombard’s.

2.4. Tokenomics analysis

Token Info

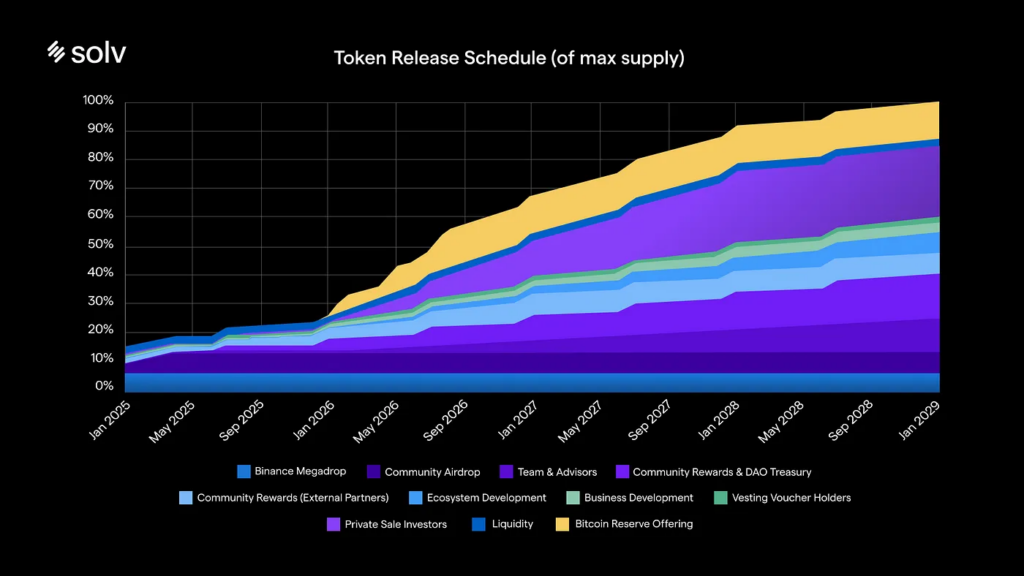

- Max Supply: 9,660,000,000 (may increase through network governance for Bitcoin Reserve Offerings)

- Total Supply: 8,400,000,000

- Circulating Supply: 1,482,600,000 (17.65%)

- Price: $0.08

- Market Cap: $123,041,300

- FDV (Fully Diluted Valuation): $697,117,848

Raised Fund

- Total Raised Fund: $22.18M

- Final Strategic Investment Round: $11M with an FDV of $200M -> fund purchase price of $0.02

- Tier 1 Investors: OKX Ventures, Binance Labs, Blockchain Capital, CMT Digital

Token Use Case

- Governance

- Voting

- Staking & Restaking

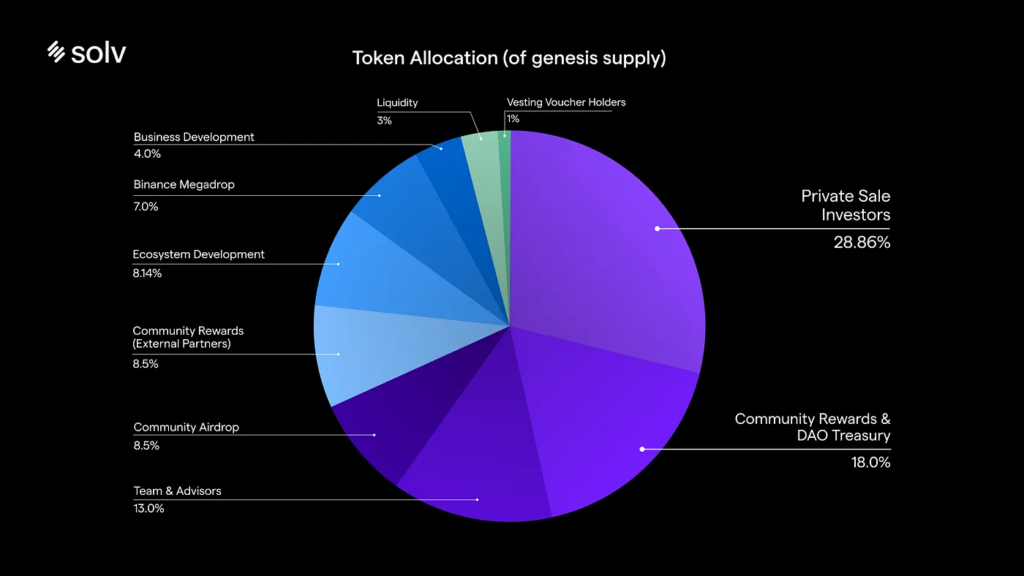

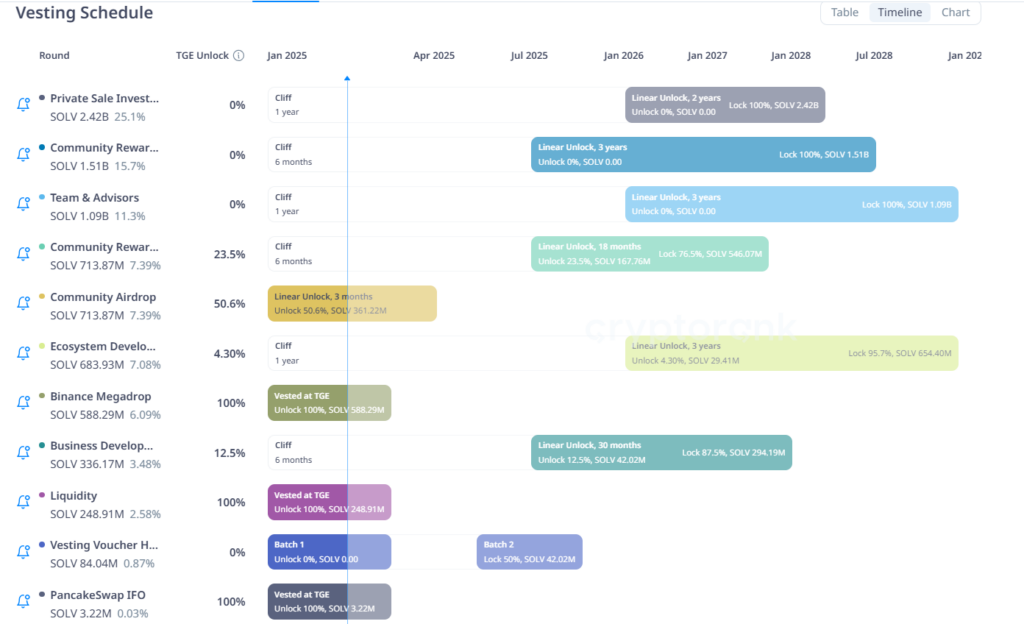

Token Allocation & Vesting

Analysis & Observations

Tokenomics at TGE

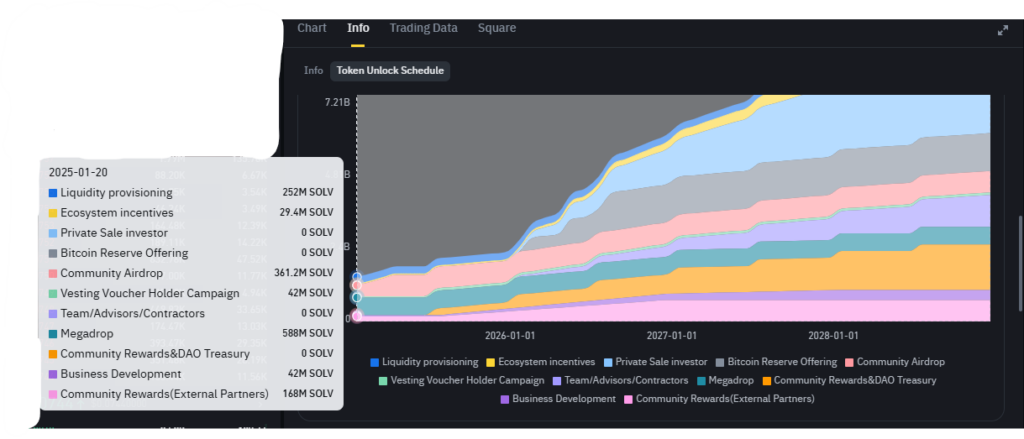

- At the Token Generation Event (TGE), 17.65% of the total supply (1.48 billion tokens) was in circulation. This came from [Liquidity, Ecosystem, Community Airdrop, Megadrop, Vesting Voucher, Community Reward, Business Dev].

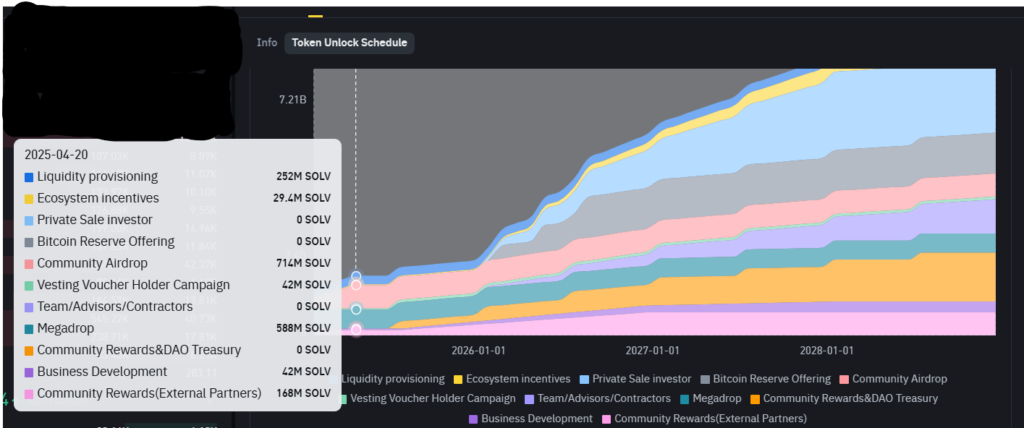

- There is no selling pressure from Investors & Team for the next 12 months; unlocks begin in January 2026.

- While there’s no investor selling pressure, the $SOLV tokenomics is not highly regarded. This is due to the diluted distribution across numerous rounds [Ecosystem, Community Airdrop, Megadrop, Vesting Voucher, Community Reward, Business Dev], all unlocked at TGE.

- This could be seen as a negative action, implying the project may intend to exit liquidity from retail investors and other investors.

Circulating Supply Increase

- From January 2025 to April 2025, the circulating supply increased to 21%, a 4% difference from the TGE’s 17.65%.

- This represents a vesting rate of over 1.4% per month, creating immediate selling pressure upon TGE.

Opportunity

- However, there’s an opportunity if the project demonstrates long-term commitment, avoids negative actions, and maintains a significant token reserve.

- This could lead to a supply squeeze, acting as a catalyst for token price appreciation.

- This will increase the %Yield that is attractive, therefore attracting users to deposit $BTC into the protocol to earn that yield.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.