1. Executive Summary

Token Overview

- Ticker: $XTER

- Current Price: $0.3

- Market Cap: $35M

- FDV: $315M

- Sector: Gaming Platform

2. Due Diligence Summary

2.1. Project Overview

Xterio is a Web3 gaming platform focused on funding, developing, publishing, and distributing games. It pioneers the integration of AI into in-game experiences and tools, enhancing creativity and gameplay for users within the ecosystem surrounding the $XTER token.

Xterio is backed by a highly experienced and visionary leadership team with diverse backgrounds in gaming, technology, and business:

- Michael Tong (CEO): Former Chief Strategy Officer at FunPlus and COO of NetEase.

- Jeremy Horn (COO): Previously Vice President of Business & Strategy at Jam City, specializing in strategic growth and operations.

- Ryan Cheung (CFO): Former Chief Financial Officer of Youku Tudou, with a proven track record in managing large-scale financial operations.

- Derrick Boo (Legal Counsel): Former Deputy Legal Counsel at OKX, an expert in legal and compliance within the technology industry.

- Brett Krause (Xterio Foundation): Current Investment Director at FunPlus and former Chairman of J.P. Morgan China.

- Yitao Guan (Xterio Foundation): Co-founder of FunPlus and former CTO of Xterio, Yitao has been pivotal in shaping the platform’s technical foundation.

The Xterio team boasts a robust track record of game development and extensive experience, originating from FunPlus, a company with globally recognized esports and numerous gaming studios across China. Furthermore, the connection of several Foundation members to the financial sector, particularly in M&A, is a significant advantage. This aligns well with the current trend in GameFi, which emphasizes expansion and M&A of game studios rather than focusing on singular game projects.

2.2. Key products

Xterio is actively developing five core product lines: Games, Launchpad, Marketplace, Xter.AI, and Staking.

2.2.1. Games

With a thriving ecosystem of more than 72 games, Xterio features four exclusive titles under its own publishing banner. Demonstrating strong market confidence, half of these exclusive games have successfully raised between $8 million and $12.5 million from leading tier-1 venture capital investors.

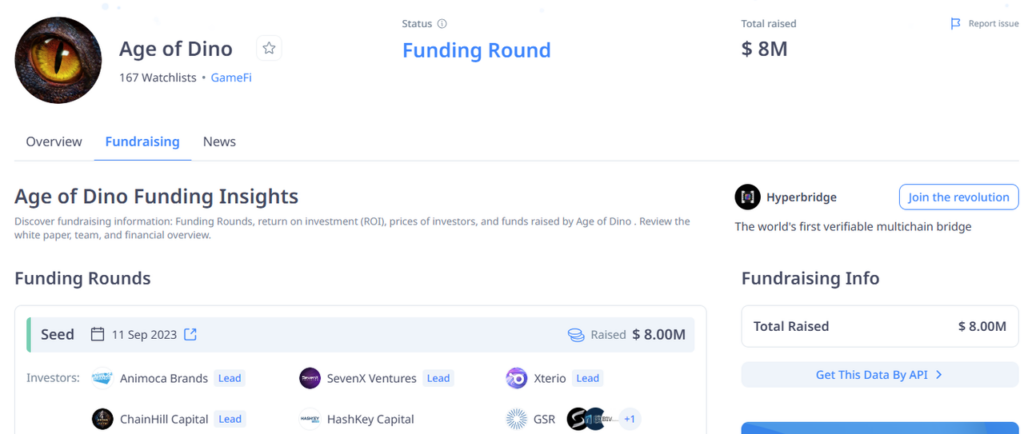

Age of Dino

Immerses players in a thrilling prehistoric world where dinosaurs and humans clash in a strategic war for dominance. Players take on the role of commanders, building and leading armies of both humans and dinosaurs to conquer territories and gather vital resources. The game’s mechanics draw inspiration from the widely popular mobile strategy game, Clash of Clans.

Notably, Age of Dino has achieved remarkable traction, with over 600,000 Unique Active Wallets (UAW). This impressive figure represents a 200% lead over other top GameFi projects, such as Pixels, which currently records over 360,000 UAW on the Ronin blockchain.

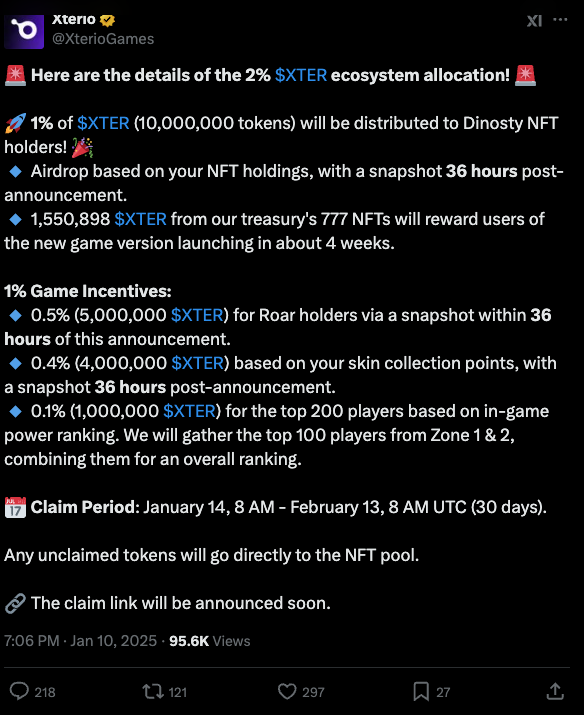

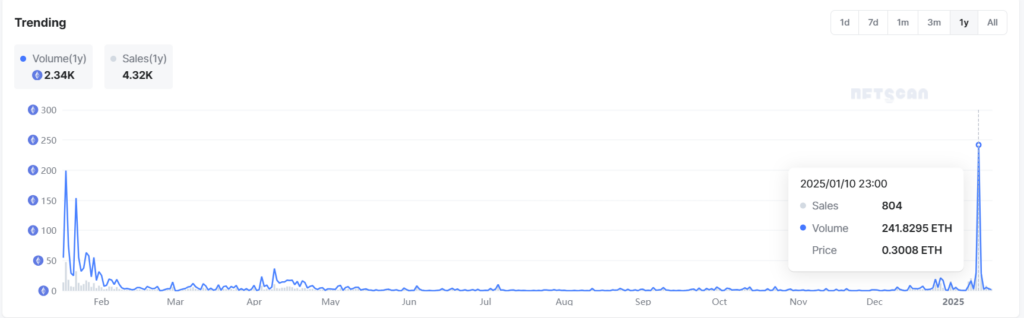

NFT Collection Release: Age of Dino – Dinosty

The Age of Dino – Dinosty NFT collection boasts 837 distinct holders, with a total trading volume of 4,431 ETH and a current floor price of 0.14 ETH. A significant sales surge occurred between January 6th and 10th, 2025, during which roughly 1,200 of the 1,767 NFTs were sold at an average price of 0.27 ETH, resulting in a total sales value of close to $1.7 million.

This surge in sales highlights the project’s popularity and strong community engagement, likely fueled by the $XTERIO airdrop for NFT holders, which distributed 2,000 $XTERIO tokens (worth $600) per NFT.

Before this surge, throughout 2024, NFT sales remained low, with fewer than 100 units sold (representing only 2% of the total supply).

Game Mechanics

Base: Each player establishes their own base and focuses on maximizing its level. Diverse buildings offer functionalities like tech advancements, troop production, and resource cultivation. Players strategically manage upgrades and army composition to engage in successful PvP base raids and PvE campaign missions.

Open world map: The game allows players to send their armies and dinosaur companions to attack other players’ bases, as well as to collect resources from the world map. Also, players are able to form or join alliances, and wage war against other alliances.

Player Campaign: Players can choose to follow the storyline and lead their army through various missions within the game to earn experience and rewards

2.2.2. In-Game Economic Factors: Relationship to Platform Token Value?

The game’s design does not incorporate a straightforward play-to-earn model. Analysts have determined that the primary revenue stream comes from fiat currency deposits via standard payment methods, used to acquire in-game items, mirroring traditional gaming economics.

The game features two in-game currencies, Diamond and $DB, which are currently pegged at a 1:1 ratio. In-game accomplishments provide players with additional Diamond and $DB, which are used for item and resource enhancements. However, there is no direct connection between these currencies and the platform’s Xter token.

Game Rewards for Players: The current in-game economy mirrors a traditional mobile game model, featuring free-to-play access and the option for users to purchase enhanced items and upgrade in-game troops through fiat currency transactions.

Compared to Pixels on the Ronin platform, which uses the $Pixel token in all aspects of the game, including buying, selling, and creating items, as well as earning $Pixel through quests, and all $Pixel to Fiat transactions going through the Ronin chain. Also, high value Pixel NFT’s are bought and sold with the Ronin token. (As we will see later in the NFT section, the Xterio NFT collections are not bought or sold with the $Xterio token).

The platform does not employ a “flywheel” economic mechanism to link in-game activity to the platform’s token. To add more use cases and increase the value of the XTER token, the project team should change their strategy and focus on capturing more value for $XTER.

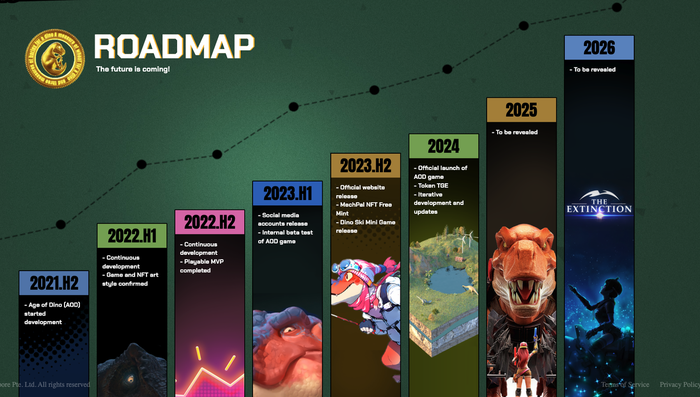

Roadmap

Age of Dino saw its official release across web, iOS, and Android platforms in 2024. Despite this launch, the project’s roadmap indicated a 2024 target for the token’s TGE, which has yet to be realized.

The following three games are in the process of development:

City Shadow: A first-person shooter set in a city overrun by crime

- Gameplay Mechanics: N/A

- Roadmap: There have been no recent updates regarding game details, visual representation of gameplay, or the commencement of NFT collection sales. The initial announcement was made in August 2024, thus continued observation is warranted.

With appropriate investment and development, the first-person shooter genre maintains considerable appeal among gamers, as evidenced by the success of SHRAPNEL on the Avalanche network.

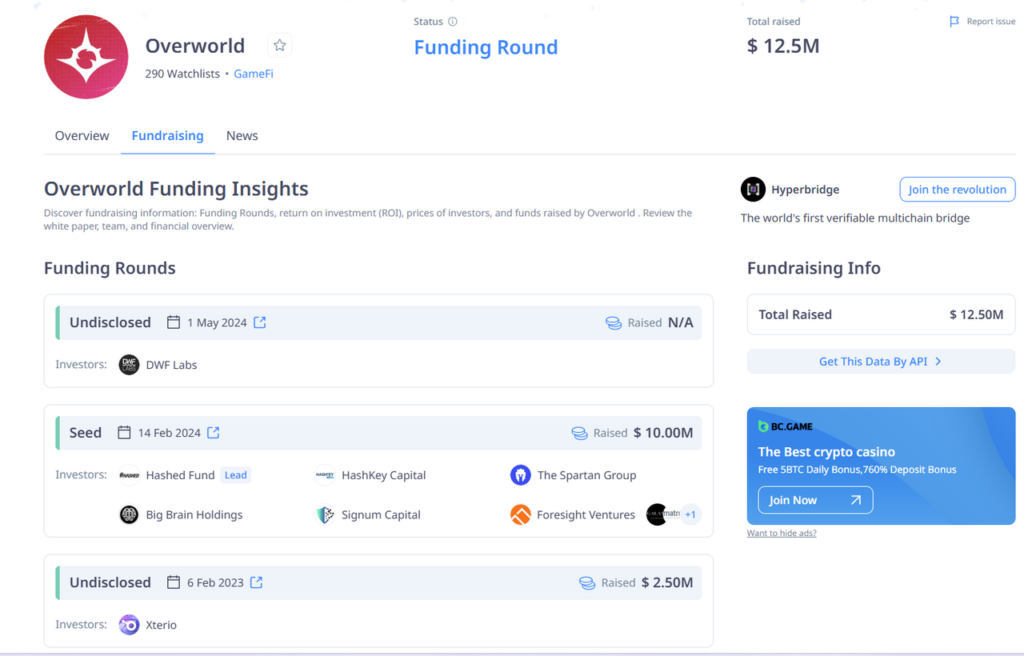

Overworld

A multi-platform, free-to-access, 3D sandbox RPG emphasizing social interaction, collaborative narratives, valuable collectible items, and immersive multiplayer mechanics. It has released NFTs, currently with a floor price of 0.12 ETH, though these NFTs exhibit low trading activity.

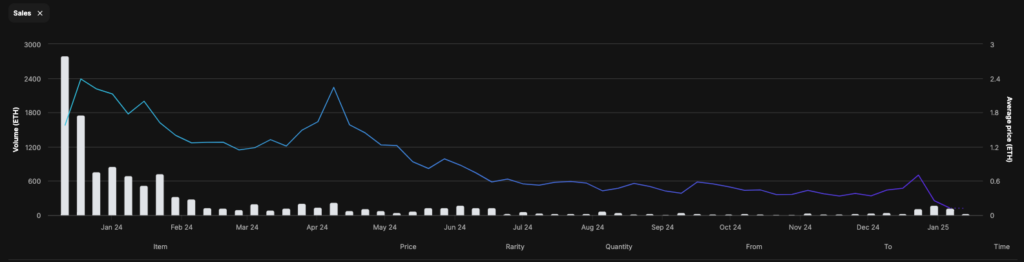

NFT Collection Launch: OVERWORLD INCARNA

Overworld has introduced an NFT collection on the Ethereum network. The collection currently has 1,500 holders, with a total trading volume of 12,183 ETH and a floor price of 0.12 ETH.

- Gameplay Mechanics: N/A

- Roadmap: N/A

The project has just finalized its latest funding phase at the beginning of 2024. For an AAA-level GameFi project such as Overworld, it will likely require further development and more information to allow for a full review. Nonetheless, the successful acquisition of $12.5 million in investment is a considerable accomplishment, and speaks to the development abilities and industry relationships of the team.

Palio

The first game to integrate AI into its development on the Xterio platform, in collaboration with AI research and development company RekaAIlabs.

- Product status: The project has released some initial gameplay images, and the team has indicated that the game is expected to launch in “Q5”, which likely refers to Q1 of 2025.

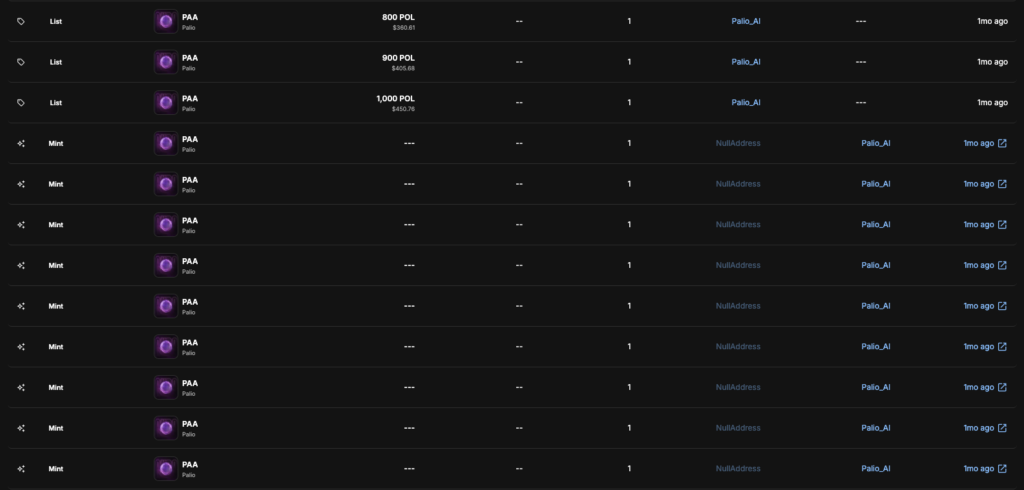

NFT Collection Launch: PAA

The game has also released an NFT collection, PAA, on the Polygon blockchain. The collection has seen minimal interest, with only approximately 9 NFTs minted. The collection currently has only one owner, a near-zero trading volume, and a floor price of 0.1 ETH.

- Gameplay Mechanics: Players will play as a shop keeper on a flying island, and will craft items to sell to AI characters. These characters will randomly visit the shop, and each have their own shopping needs, and spending budgets. To craft the items, players must complete levels to get blueprints, and find the needed materials to create new items.

- Roadmap: N/A

- Fundraising: N/A

The project has very appealing graphics, and interesting game mechanics for a casual game. But the reality is that the NFT collection that has been released only has one owner.

Overall, the ecosystem of the platform, with 4 main game projects, shows the diversity, and game development capabilities of the team. The successful funding rounds for 2 of the 4 games also shows that the team has strong industry connections, and high potential. This can provide many tools and resources to support and develop the project in the future.

2.2.3. Launchpad

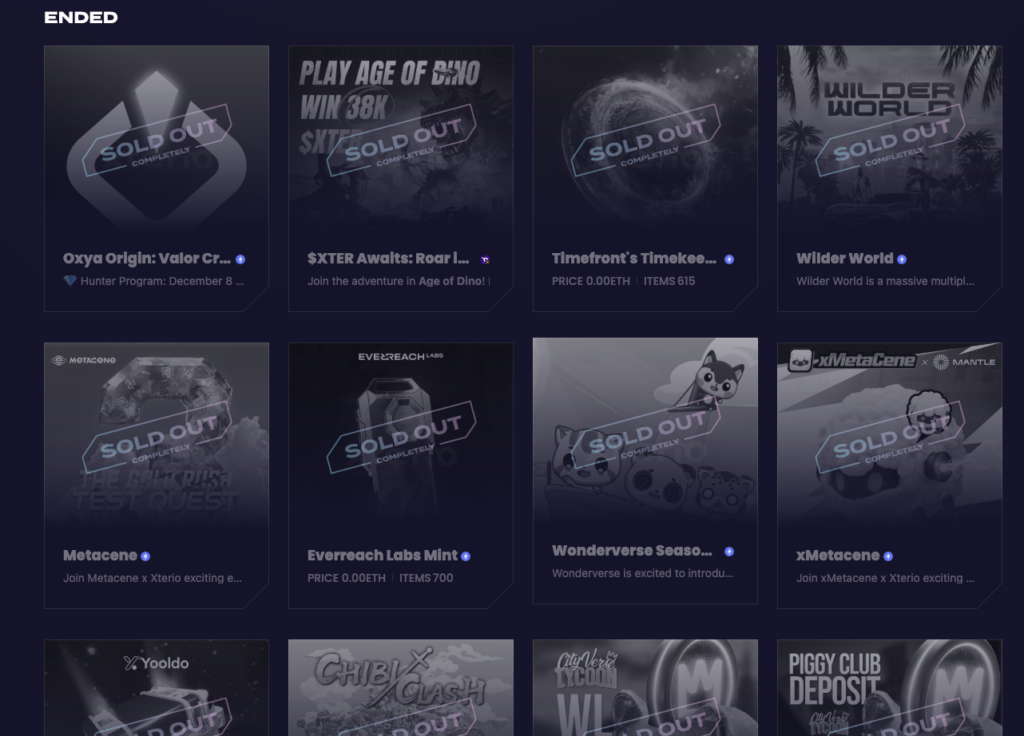

Xterio’s gaming ecosystem projects secure funding from the community through NFT collection sales, providing early-stage investment opportunities for retail investors. While the launchpad has hosted around 38 NFT sales and whitelist events, transactions predominantly occur in ETH or BNB, with only approximately 2 instances involving the Xterio token.

All projects supported are marked as “sold out” despite limited publicly available information about these sales, raising the possibility of Xterio platform buybacks rather than organic community purchases. The launchpad has featured item sales from various projects, predominantly within the Xterio ecosystem, such as MetaCene, Medieval Empires, Fortune Founder, Skytopia, Persona, Oxya Origin, Nyan Heroes, Palio, Wilder World.

Future utility for the $XTER token may involve requiring token holdings for launchpad participation, or projects wanting to launch on the ecosystem, creating future economic drivers for token value.

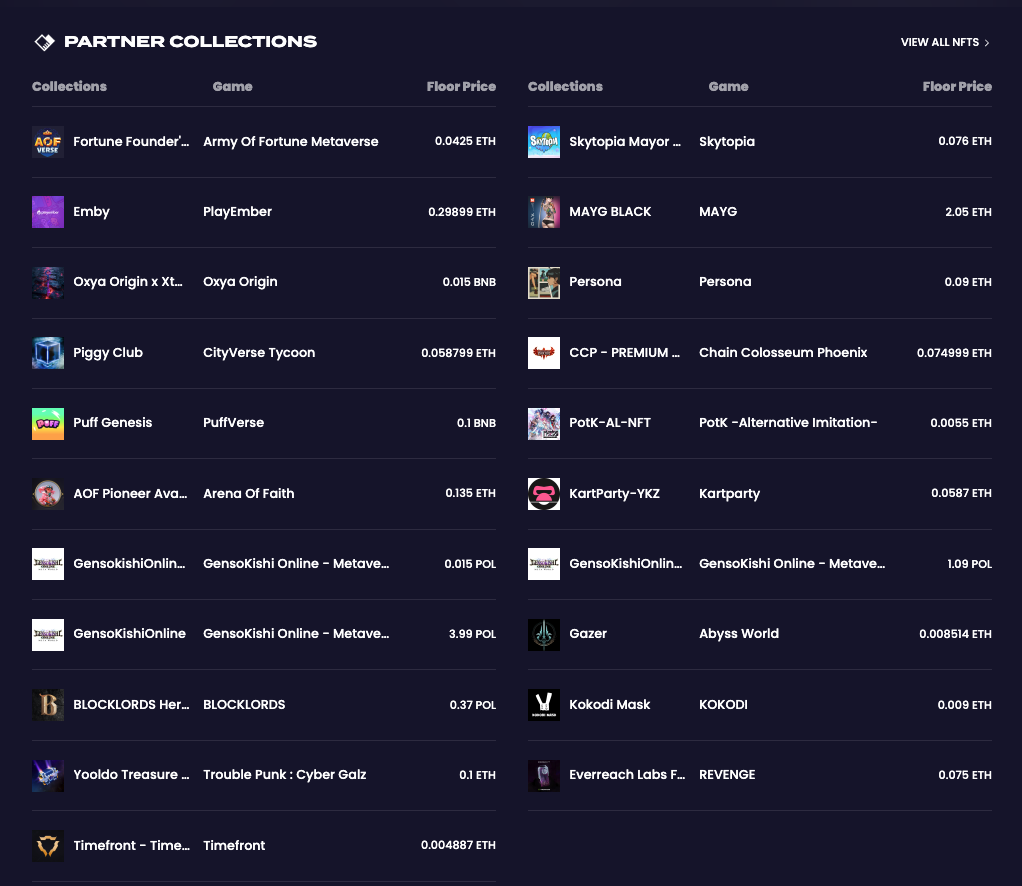

2.2.4. Market Place

The platform facilitates the buying and selling of in-game items across two blockchains: Ethereum and BNB Chain. Currently, around 21 NFT collections are available for trade.

While comprehensive metrics for each collection are not readily available, individual inspections reveal relatively low listing volumes and trading activity. Some collections exhibit transaction intervals of several weeks, signifying limited engagement. Notably, none of the collections utilize the Xterio token as a trading currency.

2.2.5. Staking

Xterio has introduced a community staking program, featuring an early bird daily yield of up to 69% for those who commit to a one-year staking lock.

2.3. Competitive Landscape

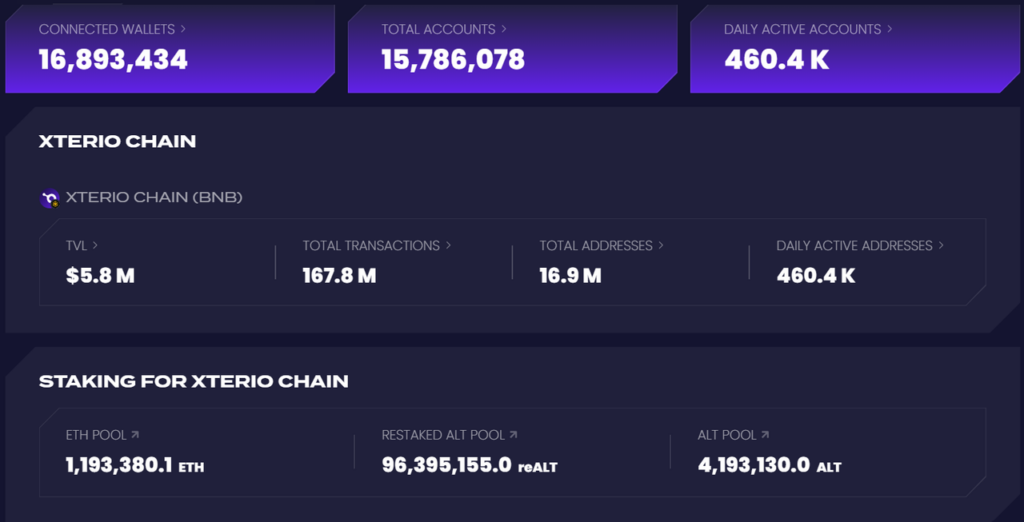

Xterio distinguishes itself with a vast game library of 72 titles and 16.5 million total addresses, second only to Portal in ecosystem game count. RONIN, while boasting a $1.5 billion valuation and $159 million in funding, features only 24 games. Xterio’s strategy emphasizes a broad portfolio of on-chain and off-chain games to attract a wide user base and establish its PMF.

However, Xterio trails XAI and Ronin in user engagement, as evidenced by their respective new transaction volumes of approximately 1 million, despite disparities in valuation and game numbers. This may stem from Age of Dino’s off-chain nature, limiting new transactions to Xter.AI’s NFT image generation.

XAI (1.6 million) and Ronin (1.1 million) demonstrate superior average active user counts, reflecting active ecosystem usage and strong community engagement. Xterio’s 170,000 average active users, while stable, are lower than those of major projects, indicating a need for user base expansion.

Excluding Ronin, the projects exhibit similar FDVs, ranging from $300 million to $400 million. Ronin’s $1.8 billion FDV aligns with its Series B funding valuation.

| Criteria | Xterio | XAI | RONIN | PORTAL | Ancient8 |

| Project definition | Gaming platform, blockchain gaming layer 2 | Gaming platform, blockchain gaming layer 2 | Gaming platform, blockchain gaming layer 1 | Gaming platform | Gaming platform, blockchain gaming layer 2 |

| Raised Fund | $55M | — | $159M | $29M | $11.7M |

| Fund Valuation | $150M | $87M | $1.5B | $290M | $100M |

| FDV now | $331M | $300M | $1.8B | $254M | $402M |

| Investor | Binance Labs, Animoca, Hashkey | Binance launchpool | a16z, Binance, Paradigm, Animoca | Binance launchpool | Pantera, Morning star |

| Number Games Launching on Platform | 72 | 11 | 24 | 150+ | 12 |

| Game Types | Diverse genres | Focus on story-driven RPGs – AAA games | Focus on casual games | Diverse genres | Focus on casual games |

| Lead Game | Age of Dino | The lost Glitches | Pixel | N/A | N/A |

| Lead Game Metrics | UAW: 404KRevenue:Trx: 695K | UAW: 101KRevenue:Trx: 438K | WAU: 256KRevenue: Trx: 269K | UAW:Revenue:Trx: | UAW:Revenue:Trx: |

| Partner network (now & future) | Funplus studio, Rekkai AI BNB collab | Ronin Chain focuses on Virtual Protocol for AI Agent integration in ecosystem games | |||

| Avg Active Users (2024) | 170k | 1,6M | 1,1M | — | 12k |

| Total Addresses | 16.5M | *5.6M | *29M | 1M wallet created | *2.034M |

| New Transactions | 179k | *1M | *1.1M | 49k | |

| Team & Advisor Background | Team with 10+ years of experience in Asian game studios. Backed by FunPlus, a major Chinese game developer with an esports team and investments in other studios. | Anonymous team | OG of GameFi crypto, with Axie Infinity’s success | Anonymous team. Advisors are top figures in traditional gaming (Rockstar Games, Team Secret, EA Games, etc.) | Team from Coin68, an OG crypto organization in Vietnam. |

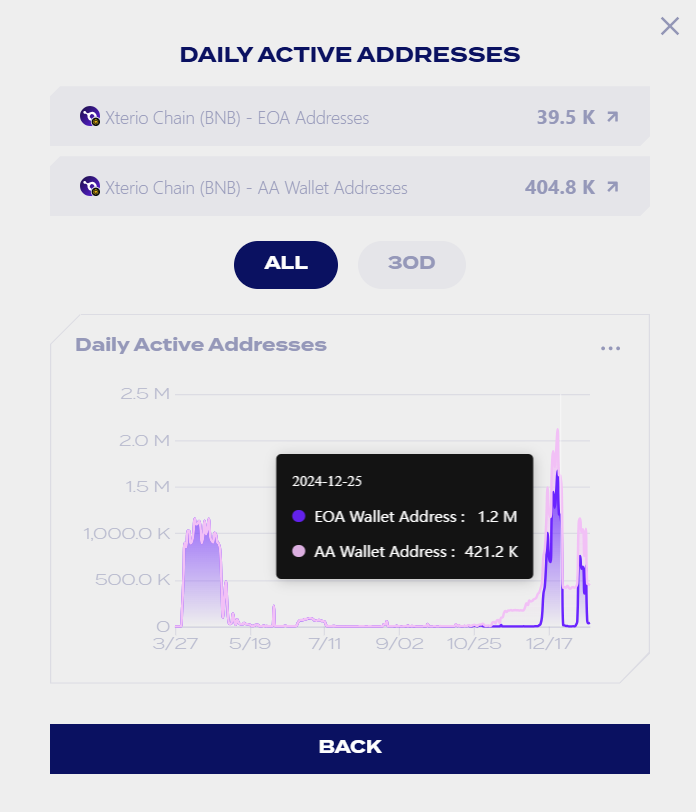

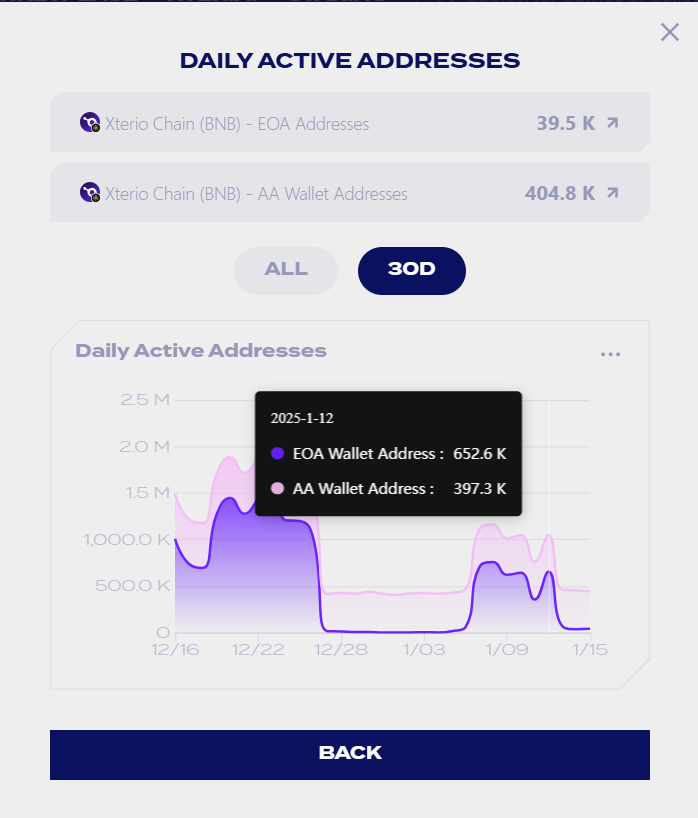

Key Metric to Xterio

Within a 30-day period, the Daily Active Addresses hit a record high of 1.6M in December of 2024. This is a 45% increase when compared to the 1.1M in March of 2024. This increase was driven by the BeFriend AI game that was released on Xter.AI, that included a play to airdrop campaign for the $XTER token, before the TGE.

Xterio leverages AVS services from EigenLayer and AltLayer, resulting in a substantial contribution of 1.19 million ETH, representing 28% of the combined TVL of these platforms.

Project data reveals that accumulated revenue for 2024 totaled $25 million USD, with contributions from in-game transactions, NFT sales, and launchpad activities at 29%, 44%, and 24%, respectively. This demonstrates a consistent revenue stream, validating the project’s business model and its potential for long-term growth, while mitigating reliance on invested capital. This is a positive indicator and a significant catalyst for Xterio’s development.

Xterio has introduced a community staking program, featuring an early bird daily yield of up to 69% for those who commit to a one-year staking lock.

2.4. Road to market strategy

Xterio

- B2C Marketing and User Incentives

Xterio has recently unveiled a reward program for its ecosystem games, specifically distributing Xterio tokens to players of its flagship title, Age of Dino – Dinosty. This represents a shift towards utilizing the platform’s native token for user incentives, moving away from the previous reliance on in-game item rewards. This could signal a broader adoption of the Xterio token upon the release of the remaining three games.

Xterio’s marketing efforts are largely focused on engaging users through in-game task completion.

- Business-to-Business Partnerships

The project actively promotes collaborative partnerships among its Xterio ecosystem projects, fostering horizontal value creation across different games and external gaming ecosystems. These collaborations primarily center on utilizing the Xterio platform for in-game NFT listings and implementing a cross-game points system. Players accumulate points by completing various tasks across different games within the ecosystem, thereby incentivizing engagement and increasing overall ecosystem activity. The reward mechanism involves the future conversion of earned points into tokens upon the respective games’ TGEs.

The collaboration and marketing initiatives have not yet made a substantial impact on the Web2 community through media coverage. Participation is largely limited to individual airdrop participants and select Web3 gaming communities. Additionally, the platform does not utilize established marketing platforms like Galxe.

Ronin

- B2C: Ronin’s ecosystem has seen rapid expansion by integrating many popular game titles. It has established itself as the leading blockchain gaming platform in terms of daily active users and demonstrates strong performance in NFT sales and releases.

- B2B: The Ronin team is dedicated to ecosystem growth and is highly adaptable to emerging trends. They’ve gained attention by actively interacting with the popular virtual agent, aixbt, for marketing purposes. Furthermore, the founder of Ronin recently launched an AI agent on the Virtual platform, which sparked significant interest and achieved a $15 million market cap.

XAI

- B2C: The XAI platform does not participate directly in marketing or game development initiatives. Furthermore, the XAI token is not integrated into the games listed on the platform.

- B2B: The project’s main focus is on the distribution of nodes, which appears to be its primary source of income. In comparison to other platforms in the same tier, XAI’s game selection and collaborative development approach are notably modest. The project appears to prioritize node sales as its primary revenue generation strategy.

Portal

- B2C: The Portal platform does not directly participate in marketing or game development. The Portal token is not integrated into games listed on the platform.

- B2B: The project has developed the Portal hub, which functions like the Steam gaming platform. Some projects can opt to use the Portal token for in-game item transactions or collaborations as a form of marketing rewards. The Portal wallet also benefits from in-game item transactions and custody.

Compared to other platforms of similar tier, the number of games and collaborative development strategy are quite limited. The project appears to focus primarily on node sales for team revenue generation.

2.5. Tokenomics analysis

Token info

- Total Supply: 1,000,000,000

- Circulating Supply: 112,500,000 (11.2%)

- Price: $0.32

- Market Cap: $36.7M

- FDV: $326,713,064

Total Raised Funds

- Total Capital Raised: $55.3M

- Investors: Binance Labs, Animoca Brands, Makers Fund, FTX Ventures, Hashkey Capital.

- Valuation: $150M FDV ~ $0.15/$XTER

Token Use Case

- Staking

- Reward Ecosystem

- Fee Platform

- Utilized in Xterio’s exclusive game titles

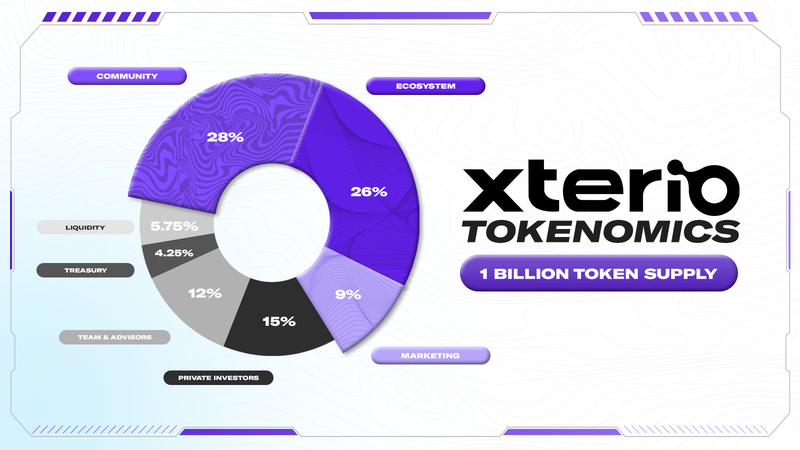

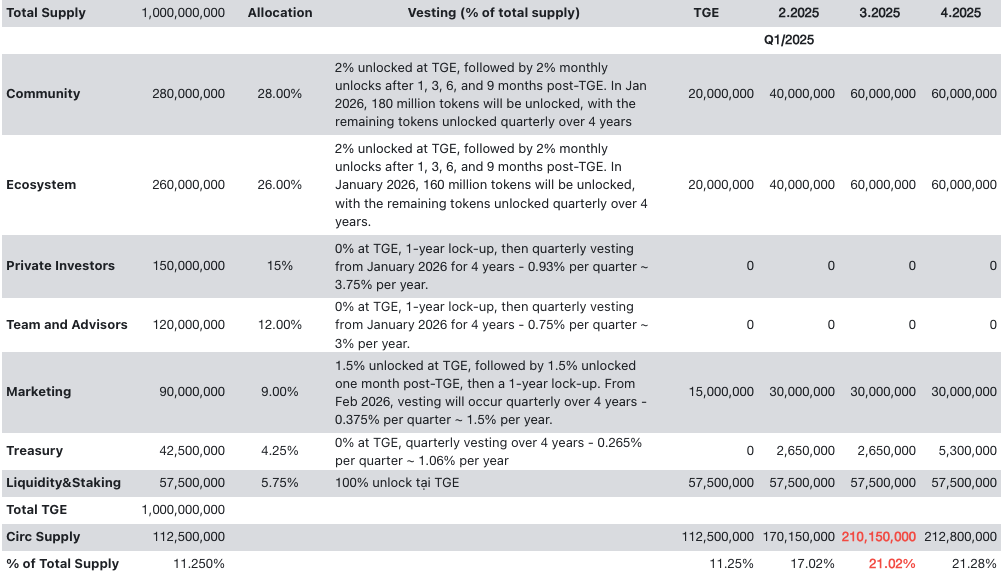

Token Allocation & Vesting

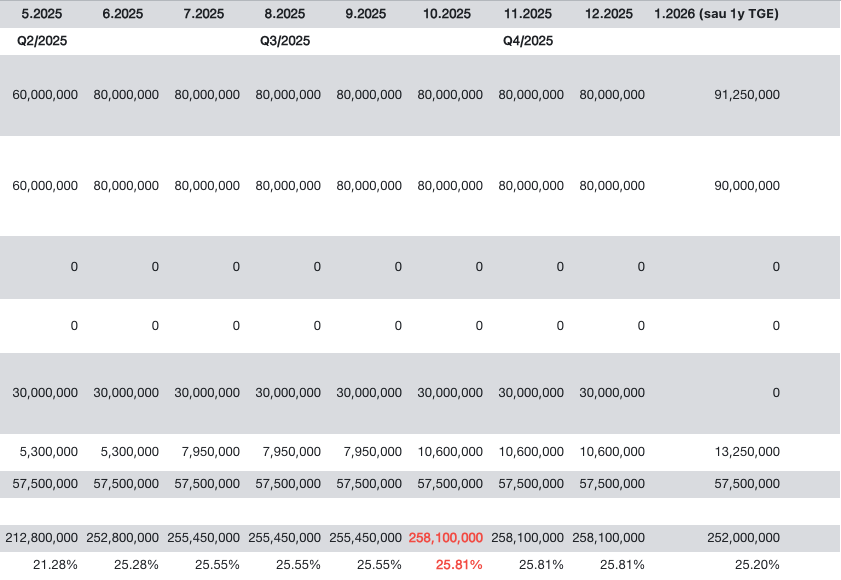

At the Token Generation Event (TGE) in January 2025, Xterio will have a circulating supply of 11.25%. However, in four rounds—Community, Ecosystem, Marketing, and Treasury—will, will unlock a combined 9.75%, approximately $29 million USD, raising the total circulating supply to 21.02% by the end of Q1 2024.

Currently, investors have a 2x return on investment, but tokens are locked for one year from January 2025 to January 2026, meaning there will be no selling pressure during this period.

Insight: The project’s tokenomics do not pose immediate selling pressure from initial investors, but there is a potential risk for holders of liquid $XTER tokens. If a substantial number of tokens unlocked from the four rounds (held by the project) are sold, it will create significant selling pressure, potentially causing a sharp decline in token prices.

Conversely, if the project does not sell these tokens, it could act as a catalyst for price appreciation by reducing supply pressure. A price projection table for Q1 and Q3 based on this scenario is provided below.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.