1. TLDR;

The core essentials of the market are Decentralized Exchanges (DEXs) and Lending platforms. These two sectors consistently attract significant capital inflows into various chains, which then circulate down to different Decentralized Applications (DApps).

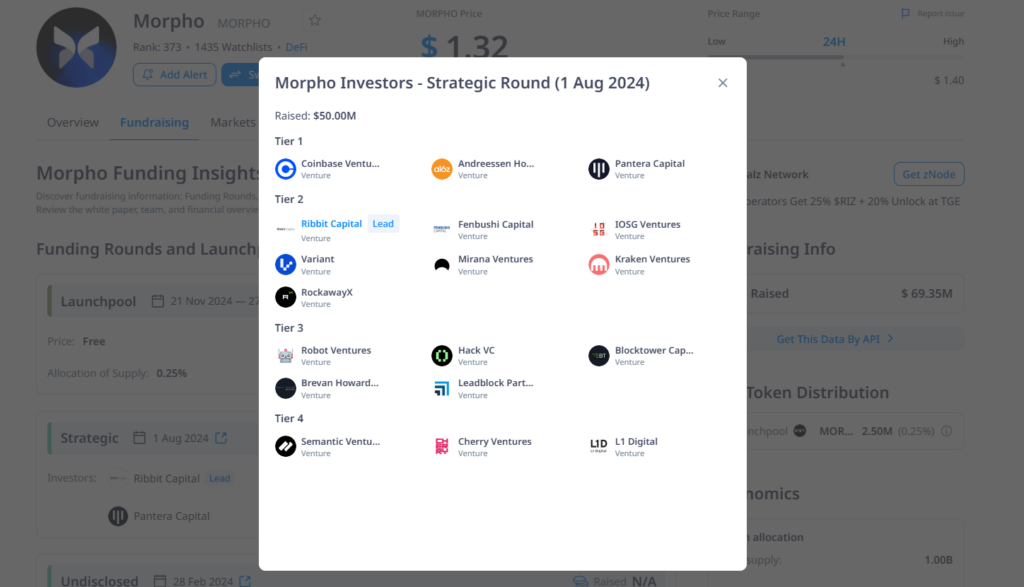

Morpho is a DeFi project that successfully raised $70 million from top-tier Venture Capital (VC) firms following the DeFi Summer of 2020. It competes head-to-head with first movers and, at times, has surpassed Compound in Total Value Locked (TVL), reaching over $3 billion.

The strategic round purchase price for funds was $0.74, meaning the current price of $1.3 offers a relatively safe entry point, as it’s not even a 2x increase. Morpho’s Unique Selling Propositions (USPs) are its Morpho Market and Morpho Vault.

Analysts predict that Morpho will become a top 2 DeFi lending platform (with a 20% market share) within the next 12 months. This growth is expected to be driven by the adoption of BASE and Morpho’s inherent strengths, leading to a significant boost in on-chain network efficiency and potentially securing a top 3 position in the Lending Sector’s market share.

The tokenomics of Morpho do not present significant selling pressure. The project raised $50 million from tier 1 investors (such as A16z), and tokenomics have been innovated with a commitment from these investors to begin unlocking only in April 2025 for team and investor allocations.

2. Due Diligence Summary

2.1. Technology and Product

Core Technology & Product

Morpho is an over-collateralized lending protocol developed by Morpho Labs in 2022, operating on the Ethereum and Base blockchains. The Morpho Protocol currently focuses on two primary areas: Morpho Optimizer and Morpho

Technology Overview

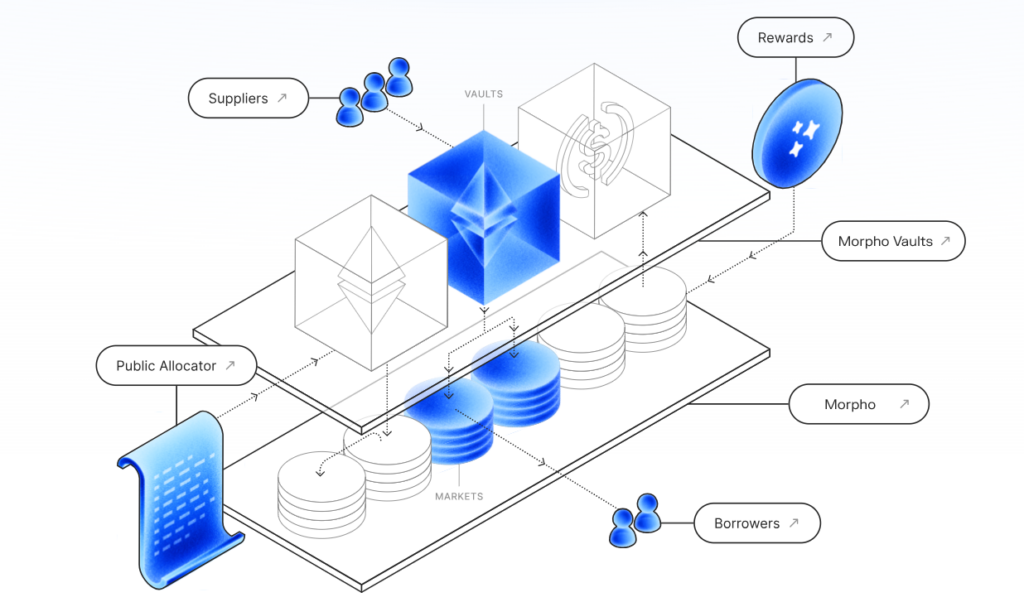

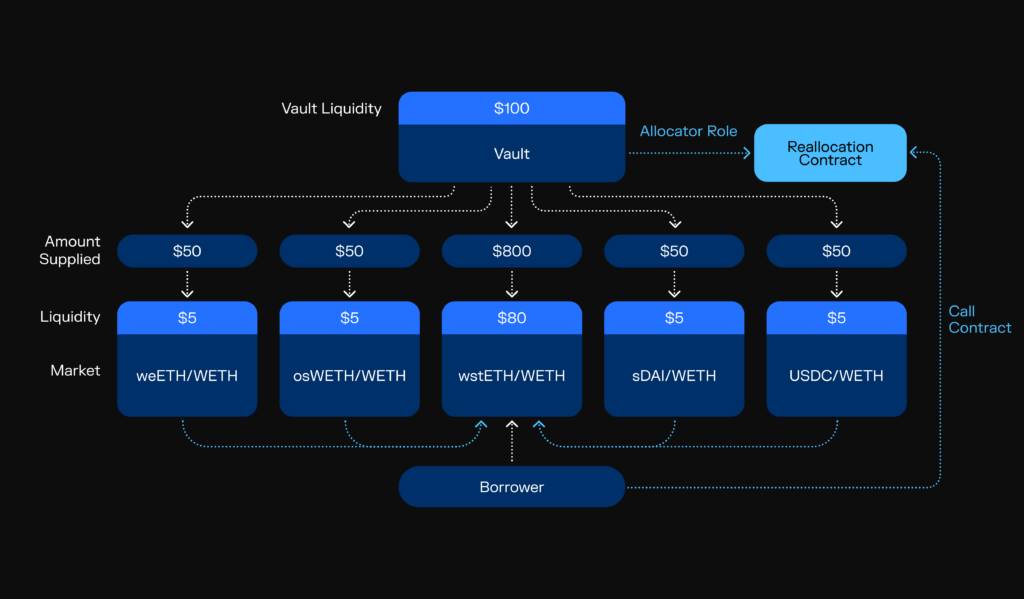

Morpho’s architecture comprises two primary layers: the Morpho Market (liquidity layer) and the Morpho Vault (execution layer), alongside the Public Allocator.

Innovation Level

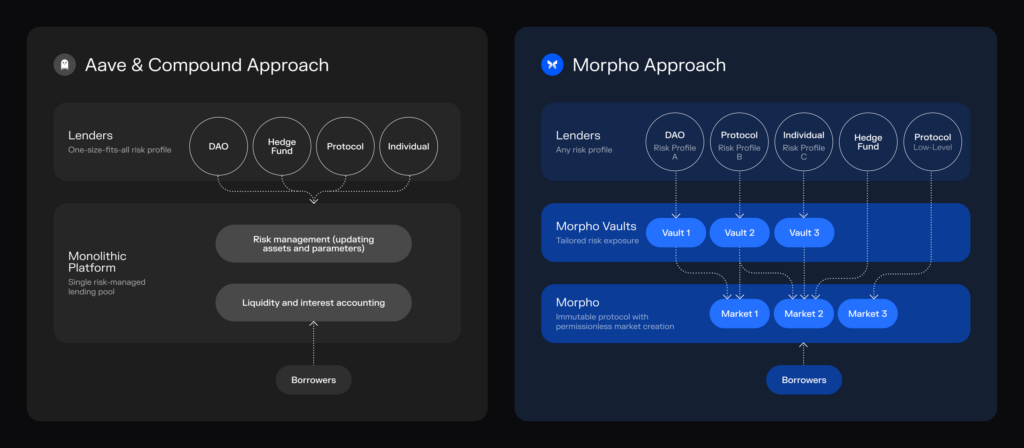

Morpho’s innovative model, featuring the Morpho Market and Morpho Vault, enables anyone to participate and create their own lending markets. This represents a significant departure from previous lending models like Aave or Compound, where market creation required governance approval. Currently, there are 196 markets on Morpho, with notable examples including sUSDe/DAI, USDe/DAI, WBTC/DAI, and wstETH/USDC

2.2. Competitive Landscape

- Market Sector – Lending/Borrowing

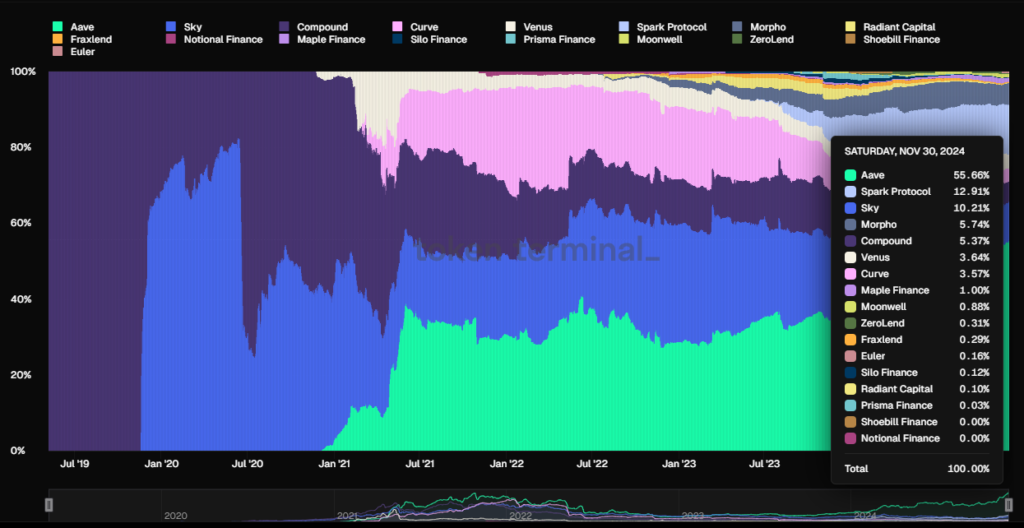

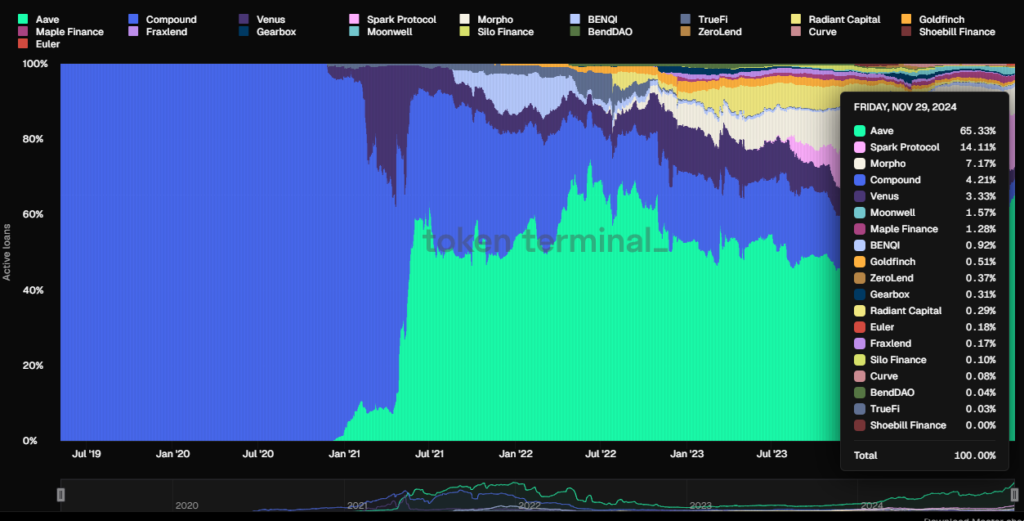

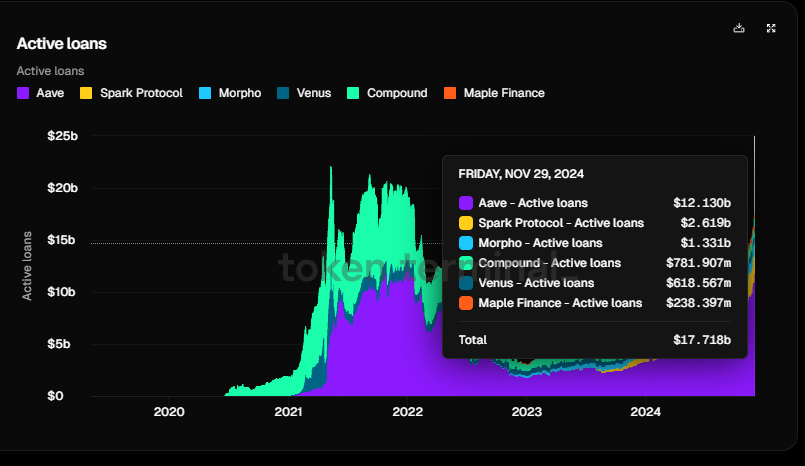

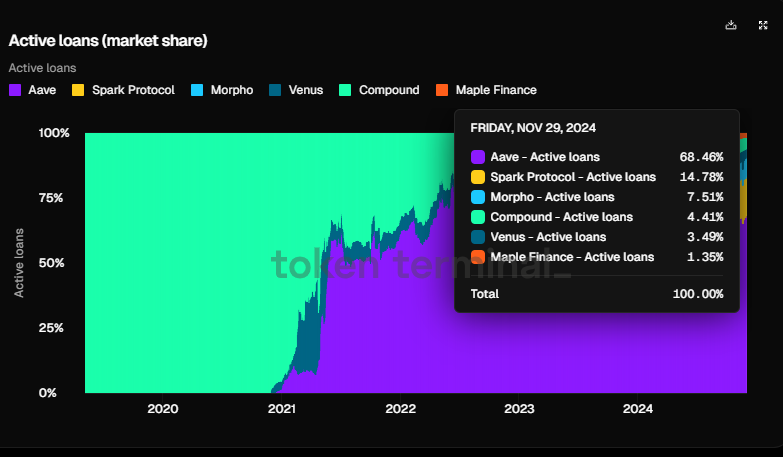

An overview of the Lending Market Sector, utilizing three key metrics: Total Net Deposits, Active Loans, and Total Value Locked (TVL), with data sourced from DeFi Llama and Token Terminal.

| Market Sector | Total Deposit | Active Loan | TVL |

| Top 20 projects | $54B USD | $18.56B | $49B |

| Morpho % share | $3.22B (5.9%) | $1.37B(7.39%) | $2.57B(5.2)% |

| Top Market | Top 4 | Top 3 | Top 4 |

Launched in July 2022, Morpho initially entered a market dominated by four major players: Aave, Compound, Curve, and Sky. However, in January 2024, the project underwent a complete business model overhaul, receiving highly positive feedback from users. This, combined with the explosive growth of the Base Layer 2, propelled Morpho’s position, enabling it to recapture market share and break into the Top 4 of the Lending Sector.

- Key Metrics (Financial & On-chain Metrics)

| Metrics | August | September | October | December | MoM |

| Monthly active user | 24.6k Base (21.4k) ETH (3.2k) | 23.5k Base (20.1k) ETH (3.4k) | 18.5k Base (15.5k) ETH (3k) | 23.8k Base (20.7k) ETH (3.1k) | 28% |

| Net Deposit | $2.32B | $2.09B | $2.08B | $2.56B | 23% |

| Active Loan | $880M ETH ($838M) Base ($41M) | $782M ETH ($742M) Base ($39M) | $797M ETH ($740M) Base ($57M) | $1.3B ETH ($1.19B) Base ($134M) | 63% |

| Loan/Dep | 37% | 37% | 38% | 50% | 31% |

Since its expansion to Base in June 2024, Morpho has experienced a significant surge in Monthly Active Users (MAU), reaching 24.6k in August 2024. Notably, the MAU on Base accounted for 21.4k, while Ethereum contributed only 3.2k. Although Deposit and Loan metrics saw a 9-10% decrease in September and October compared to August, the recent market rally in November has propelled MAU, Deposits, and Loans to increase by 28%, 23%, and 63% respectively, compared to the previous month.

The explosive growth and network effect from Base have propelled Morpho to achieve the top lending position on Base, elevating its standing to the top 3 in the Lending Market Sector.

- Competitive Landscape

| Daily | Morpho | Aave | Spark | Compound |

| Deposit | $3.22B | $31.2B | $7.5B | $3.01B |

| Active Loan | $1.35B | $12.45B | $2.62B | $769M |

| Loan/Dep | 41% | 39% | 34% | 25% |

| Flash loan fee | No Fee | 0.09% | — | — |

| Morpho | Aave | Chênh lệch | |

| Cap | $180M | $3B | 16x |

| Circ Supply | 13% (133M) | 93% (15M) | 7.5x |

| FDV | $1.3B | $3.2B | 2.4x |

Compared to key competitors in the sector, such as Aave, Spark, and Compound, Morpho currently holds the top 3 positions in the market, evidenced by key metrics like Deposits and Active Loans.

A significant factor is the Morpho Market mechanism, which enables institutions, protocols, and individuals to create their own lending and borrowing markets. Notably, Spark (distinct from Aave) has directly leveraged this feature, contributing to Morpho’s top 2 market share.

Morpho’s Loan-to-Deposit ratio leads the sector at 41%, demonstrating superior capital efficiency compared to other protocols. This is largely attributed to the unique technology of Morpho Vault, which sets it apart from its competitors.

2.3. Tokenomics analysis

- Total Supply: 1,000,000,000

- Circulating Supply: 132,045,549

- Price: $1.3

- FDV: $1,382,887,247

- Total Raised Fund: $70M – Tier 1:A16z, Coinbase, Pantera Capital…

Token Use Case

Holding $MORPHO grants voting rights on changes or improvements to the protocol, including:

- Future initiatives aimed at developing the Morpho protocol;

- Deployment and ownership of Morpho smart contracts;

- Enabling or disabling fee switches integrated into Morpho smart contracts;

- Management of the DAO Treasury

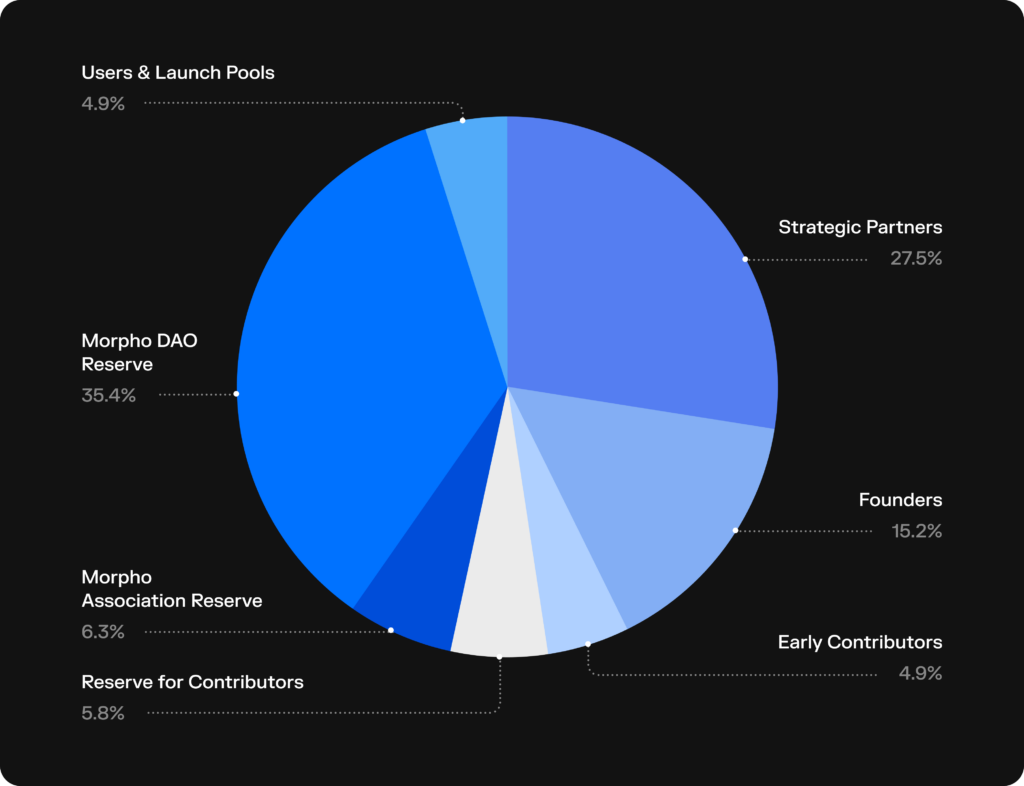

Token Allocation

| Allocation | Lock | Vesting | |

| Morpho DAO | 35.4% | No lock (decided by DAO) | — |

| Morpho Association | 6.3% | No lock – Ecosystem funding | — |

| Reserve for Contributors | 5.8% | No lock – for employee,… | — |

| Users & Launch Pools | 4.9% | User airdrop at TGE – 21/11/2024 | — |

| Early Contributors | 4,9% | Unlock starts on 24/12/2022 | 3 years (64.4% vested) |

| Strategic Partners Cohort 1 | 4.0% | Unlock starts on 24/12/2022 | 3 years (64.4% vested) |

| Strategic Partners Cohort 2 | 16,8% | Unlock starts on 04/2025 | 6 months |

| Strategic Partners Cohort 3 | 6,7% | Unlock starts on 17/05/2026 | 2 years |

| Founders | 15,2% | Unlock starts on 17/05/2026 | 2 years |

The project’s tokenomics were redesigned after a new funding round in August 2024, where $50 million was raised from top-tier funds such as A16z, Pantera, and Coinbase Ventures. Consequently, there were changes to the token release schedule for investors.

At the re-listing on November 21, 2024, 58.13% of the total token supply was unlocked, allocated to the [DAO, Association, Reserve, Launch Pool, Early Contributors, and Cohort 1]. However, only 10.6% was released into circulation, belonging to the [Launch Pool, Early Contributors, and Cohort 1]. The remaining 47.5% of the unlocked tokens, held by the [DAO, Association, and Reserve], are not yet in circulation, pending decisions by the DAO and future protocol development.

Currently, selling pressure primarily originates from Early Contributors and Cohort 1. Based on records, Cohort 1 (Seed round) investors purchased tokens at $0.48 per Morpho, representing a 2.8x ROI at the current price.

However, tokens vested since 2022 are now contributing to selling pressure, with subsequent unlocks at 0.24% of the total supply per month, equivalent to approximately 2.2% of the circulating supply per month.

Comparing Market Cap (MC) & Fully Diluted Valuation (FDV) with competitors during the 2021 uptrend cycle – Price Prediction

| 2021 | Aave | Compound |

| Price | $631 | $854 |

| Market Cap | $7.953B | $4.3B |

| Circ Supply | 78% | 50% |

| FDV | $10B | $8.5B |

| MorphoPresent | 04/2025Forecast | 04/2025Bull | |

| Price | $1.3 | $2.6 | $6.9 |

| Market Cap | $174M | $372M | $1B |

| Circ Supply | 13.2% | 14.32% | 14.32% |

| FDV | $1.296B | $2B | $6.9B |

Risks associated with holding $MORPHO include:

- Protocol hack: This could trigger a market sell-off (low probability).

- Adverse market correction scenario: A 6-month sideways trend in the first half of 2025 could demotivate Early Contributors and Investor Cohort 1, leading them to exit their positions with a 2.8x ROI.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.