1. Executive Summary

Token Overview

- Ticker: $RED

- Current Price: $0.5

- Market Cap: $142M

- FDV: $508M

- Sector: Oracle

TLDR;

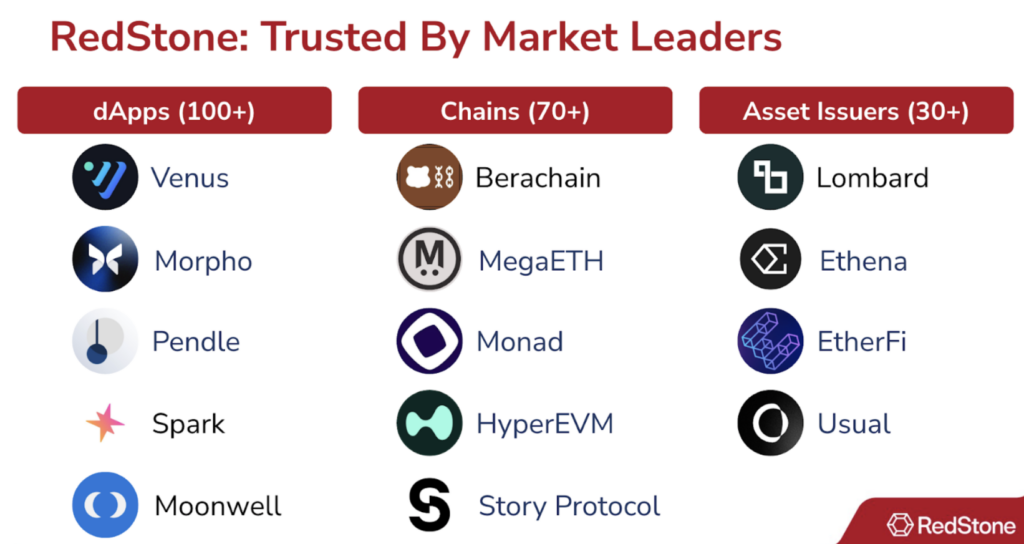

RedStone, an Oracle project utilizing a Pull & Push model, offers verified, tamper-proof, secure, and highly accurate price data for both EVM and Non-EVM chains with low gas costs. RedStone has the potential to become the leading choice for projects seeking flexible and cost-effective Oracle solutions, especially on emerging blockchains.

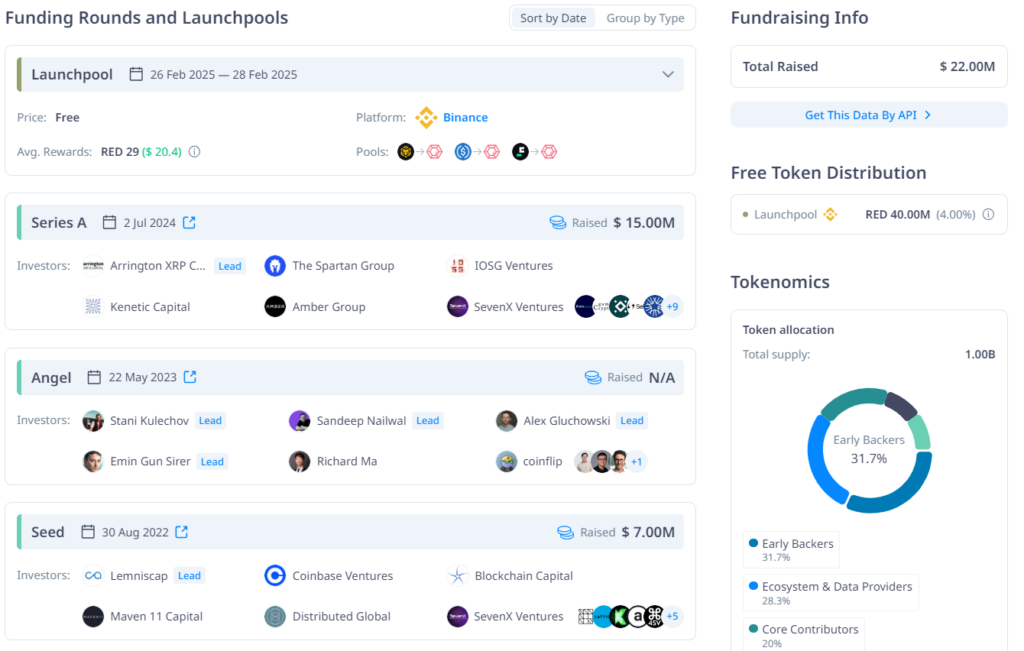

Total Raised Fund

RedStone has raised $22M USD from Tier 1, 2, and Angel investors, including Coinbase Ventures, Blockchain Capital, and Spartan Group. Beyond support from Tier 1 backers, RedStone also received significant backing through a dedicated Angel investment round from long-standing industry OGs such as the Ethereum Foundation and Polygon.

Strong Growth in TVS & Major Integrations

RedStone’s TVS reached an ATH of $6.6 billion USD in December 2024, a 1,400% increase year-over-year, driven by the LST, LRT, and RWA narratives. RedStone is experiencing the fastest TVS growth in the Oracle sector, demonstrating widespread adoption by major projects.

Undervalued Tokenomics

With 28% of the token supply in circulation within the first 12 months and no investor or contributor unlock pressure for a year (until February 2026), $RED’s Market Cap/TVS ratio of 0.04 is lower than Chainlink’s (0.3) and Pyth’s (0.09), indicating that the token is currently undervalued. This presents a 2-3x growth opportunity as the ecosystem continues to expand.

Key Catalysts for $RED Price Growth in 2025

Notable catalysts to watch in 2025 that could drive $RED’s price growth include the launch of RWA x AI products, enhanced Oracle solutions for BTCFi & Restaking, B2B Oracle solutions, and the potential for listings on Upbit and Coinbase.

2. Overview

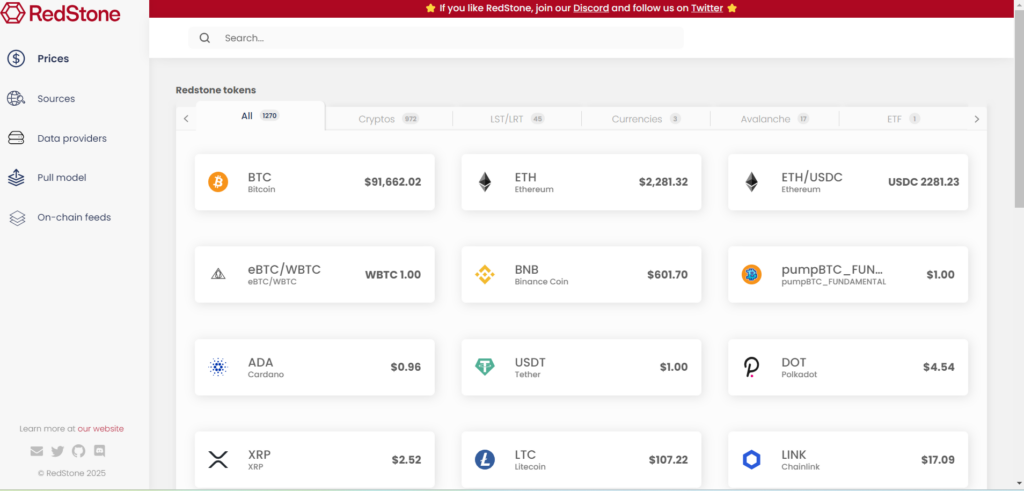

RedStone is a blockchain oracle platform that facilitates the rapid, cost-effective (gas-efficient), and tamper-proof integration of real-world data onto blockchains.

RedStone delivers the most secure, accurate, and reliable data feeds on the market through Push, Pull, and custom models. RedStone enables support for any asset, on any chain, for any use case.

2.1. Team

Jakub Wojciechowski – Co-Founder/CEO

- Studied at the University of Warsaw, earning degrees in two majors: Economic Psychology and a Master of Science in Computational Science (2002 – 2010).

- Developed internet technologies at various companies including Gemius, Infovide-Matrix, Dataspace Ltd., and Efinity Sp z o.o.

- Served as CTO & Co-Founder of Alice in the UK for 4 years and 3 months.

- Currently an advisor for DeltaPrime since 2021.

- Founder & CEO of RedStone.

Alex Suvorov – Co-Founder/Senior Software Engineer

- Worked as a Full Stack Engineer at Alice.

- Founder of codenplay.io.

- Freelance Full Stack Engineer at Toptal.

- Co-Founder & Tech Lead of RedStone.

Marcin Kazmierczak – Co-Founder/COO

- Previously a Co-Founder of Igrzyska Blockchain and Blockchain4Everyone.

- CEO & Co-Founder of AppreMe.

- Worked at Google as a Learning Program Manager for over a year.

- Worked at Gitcoin.

- Co-Founder of ETHWarsaw.

- Co-Founder & COO of RedStone.

Observations

The team exhibits a blend of technical expertise (Alex), leadership (Jakub), and community engagement (Marcin), which is well-suited for developing a blockchain oracle project. Their experience at established companies and within communities like ETHWarsaw positions RedStone for potential partnerships and expansion.

Overall, while the leadership team’s background may not be exceptionally prominent within the market, this presents significant challenges in a highly competitive landscape. Success will heavily depend on their execution capabilities, particularly within the volatile DeFi market as they seek product-market fit (PMF).

2.2. Business Model

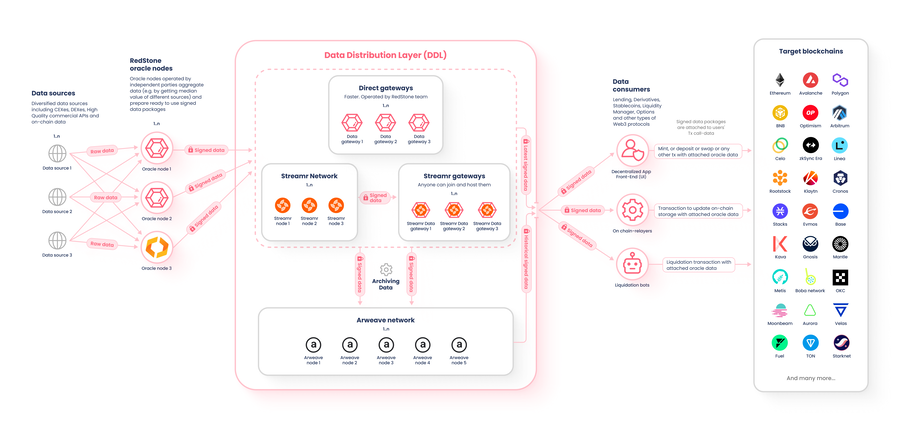

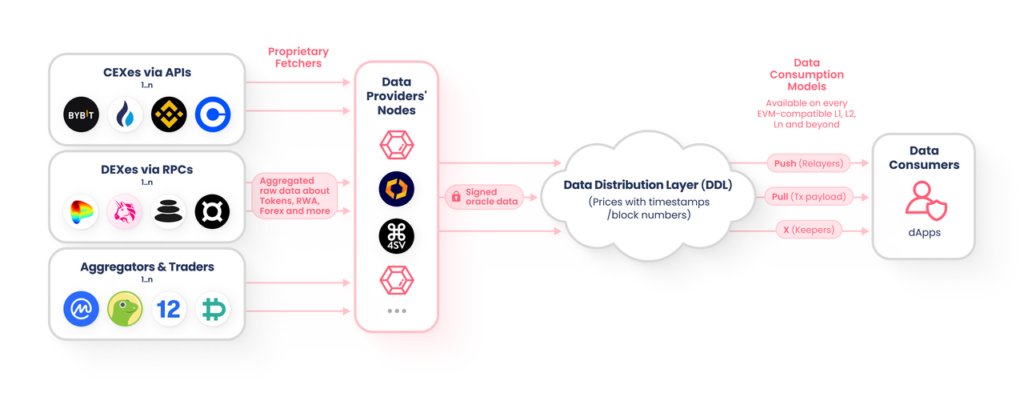

RedStone’s system is built upon four key modules, each playing a specific role in the data processing pipeline:

- Data-sourcing: Supports diverse valuation methods, including proof of reserves, liquid staking tokens (LSTs, LRTs), staked BTC, and on-chain liquidity-based data.

- Data-distribution: Supports multiple oracle gateways, encompassing community-operated decentralized gateways and high-performance, low-latency gateways.

- Data-relaying: Enables support for any data usage model, such as push models for lending protocols, pull models for perpetual (perp) trading protocols, and future models like ultra-fast price data for new chains.

- Data-consumption: Easily deployable on any chain, supporting all use cases with low scaling costs.

Revenue Streams

RedStone Oracle’s primary revenue source comes from fees: dApp users and protocols pay to utilize oracle data.

Milestone

- 2024

RoadMap 2025

Q1/2025: Restaking & DeFi Research and Enhancements

- Research and improve data models for Bitcoin restaking on the Babylon chain to optimize profitability and security.

- Enhance capital efficiency through Oracle Extractable Value (OEV) and adjust collateral factors based on RedStone’s performance, reducing risk and increasing liquidity.

Q2/2025: New Products & AI Technology

- Develop customizable Real-World Asset (RWA) & Proof of Reserves (PoR) products, utilizing Zero-Knowledge technology to ensure transparency and security.

- Explore novel AI applications, expanding the CLARA framework to increase oracle efficiency.

- Launch an updated oracle price feed product with near-zero latency, the fastest available for DeFi.

Q3/2025: Solutions for Institutions

- Introduce solutions to simplify and scale on-chain participation for enterprises and institutions.

Business Model Observations

RedStone Oracle is building a next-generation Oracle system that not only focuses on providing data but also expands its value proposition into AI, DeFi, and modular blockchains.

Offering oracle data with low gas fees ensures easy accessibility and aligns with a strong expansion strategy. Integrating with high-performing projects in the industry, such as Morpho, Pendle, Berachain, and Ethena, is a significant advantage in the current competitive Oracle landscape.

2.3. Competitive Landscape

- Market Sector

| Criteria | ChainLink | Pyth | RedStone |

| Oracle Model | Push | Pull | Push & Pull |

| Mispricing Events | – Lost $11.2M in the Terra incident (article later removed due to PR strategy, according to forum post). – 25% wstETH pricing deviation. | – 87% BTC price deviation. – Pricing error on Drift Protocol (RBL). – Price manipulation on Mango Markets. | No major incidents reported. |

| Number of Supported Blockchains | Push model = 18 | Pull model = 70+ | Push model = 38 Pull model = 70+ |

| Support for non-EVM Chains | No (currently under development) | Solana, Aptos, Sui, Fuel, Injective, v.v. | TON, Starknet, Fuel, Radix, Movement, Sui, v.v. |

| Data Sources | Aggregators | Data publishers (Market Makers) | CEX, DEX, Custom sources |

| Team Size | 650 | 55 | 30 |

| Oracle Extractable Value (OEV) | Smart Value Recapture (Ethereum only) | Express Relay (Cross-chain supported) | RedStone OEV (Cross-chain supported) |

| Proof of Reserve (PoR) Product | Yes | No | Yes |

| Bitcoin Liquid Staking PoR Oracle Supported | Yes | No | Yes |

| RaaS và L2s Stack Supported (ex: OP, Arbitrum) | No | Yes | Yes |

| Oracle Restaking Module (ex: AVS) | No | No | Yes (EigenLayer & Symbiotic Testnets) |

| Enterprise Clients | SWIFT, ANZ Bank, Soneium, v.v. | Soneium | CoinFund & CoinDesk Indices CESR, Soneium |

| VRF (Verifiable Random Function) | Chainlink VRF | Pyth VRF | Verifiable randomness (testnet) |

| Token | LINK | PYTH | RED |

| FDV | $21B | $3.4B | — |

| TVS % share | $31.78B USD ~ 53.87% | $7.11B ~ 12.05% | $4.5B ~ 7.66% |

Observations

RedStone’s biggest advantage lies in its combination of both Push & Pull models, offering greater flexibility compared to Chainlink’s Push model and Pyth’s Pull model. It also boasts broader blockchain support, including numerous non-EVM networks like TON, Starknet, Fuel, etc.

RedStone holds a strong competitive edge with its Restaking technology, multi-chain support, and more flexible model. If it continues to expand partnerships and successfully implement the $RED token, RedStone has the potential to become a formidable competitor to Chainlink & Pyth in Oracle space.

Chainlink currently maintains the top market share with $31B in TVS, accounting for 53.78%, while RedStone records $4.5B, approximately 7.66%.

- Total Value Secured

In March 2024, RED recorded a TVS of $6 billion USD, a significant 1,400% increase compared to the same period last year (March 2023). This notable rapid growth was fueled by the LRT and LST surge, with RED quickly integrating across both EVM and non-EVM chains to capture market share.

By December 2024, RED reached an All-Time High (ATH) of $6.6 billion USD, a 10% increase from March 2024. This subsequent growth was primarily driven by the overall market uptrend, predominantly within the RWA, Yield, and Lending sectors.

2.4. Tokenomics

Token Info

- Total Supply: 1B

- Circulating Supply: 280M ~ 28%

- Price: $0.5

- Market Cap: $142M

- FDV: $508M

Raised Fund

- Total Raised Fund: > $22M

- Investors Tier 1 & 2: Spartan Group, Amber Group, IOSG Ventures & several Angel Investors.

Token Use Case

- Staking AVS

- Reward

- Governance

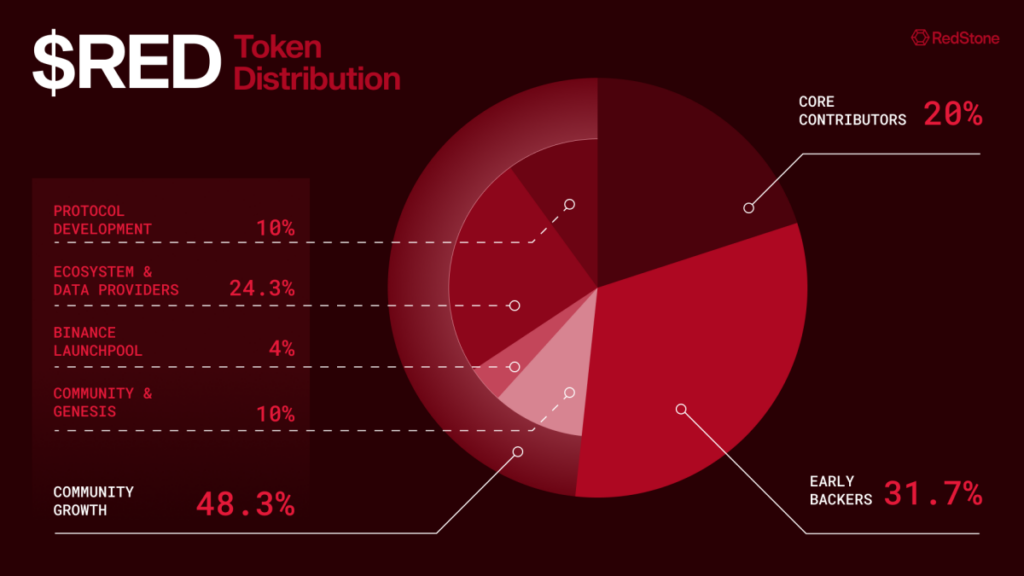

Token Allocation & Vesting

| Category | % Allocation | Vesting | TGE |

| Community & Genesis | 10.00% | Unlock 10% at TGE. | 10% |

| Binance Launchpool | 4.00% | Unlock 4% at TGE. | 4% |

| Protocol Development | 10.00% | Unlock 3% at TGE (Token Generation Event), with the remaining 7% vesting linearly starting from September 2025 at a rate of approximately 0.19% per month. | 3% |

| Ecosystem & Data providers | 24.30% | Unlock 11% at TGE, with the remaining 13.3% vesting linearly starting from September 2025 at a rate of approximately 0.36% per month. | 11% |

| Core Contributors | 20.00% | Unlock in 02.2026. | 0% |

| Early Backers | 31.70% | Unlock in 02.2026. | 0% |

| Total | 100% | — | 28% |

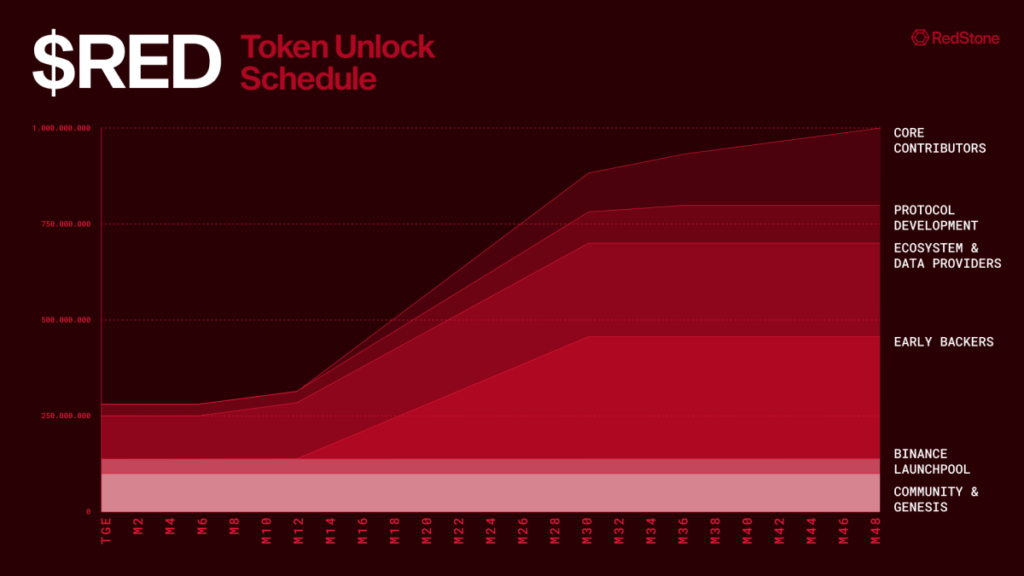

Analysis & Observations

$RED’s TGE (Token Generation Event) and listing will introduce a circulating supply of 280M tokens, representing approximately 28% of the total supply. A significant portion of this is allocated to the community [Binance Launchpool, Community Genesis & Data Providers], which suggests substantial selling pressure and potential price decrease in the short term.

For the first year post-TGE, there will be no selling pressure from Investors or Contributors. The circulating supply is expected to remain at 28% for the initial six months. Starting in September 2025, a gradual unlock of approximately 0.55% per month will commence for [Protocol, Ecosystem]. This indicates significant initial sell pressure at TGE, followed by a more gradual increase in supply later.

$RED currently has a Market Cap/TVS ratio of 0.04, which is undervalued compared to the current median. Projections suggest this multiple could reach 0.06 – 0.09, driven by upcoming catalysts in 2025:

- Advancements in Oracle Restaking & BTCFi.

- Oracle services catering to AI and RWA.

- Oracle solutions for enterprises.

- Potential listings on regional exchanges like Upbit and Coinbase.

| RED | LINK | PYTH | Median | |

| Price | $0.7 | $17.18 | $0.18 | — |

| Circulating | 280M ~ 28% | 638M ~ 63.8% | 3.6B ~ 36% | — |

| Market Cap | $196M | $10.9B | $690M | $690M |

| TVS | $4.4B | $31.78B | $7.1B | $7.1B |

| Cap/TVS | 0.04 | 0.3 | 0.09 | 0.09 |

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.

[…] compared to ~0.09 for Pyth and ~0.04 for RedStone—both smaller oracle networks 6. In dollar terms, with LINK’s market cap in the high‑teens of billions […]

Comments are closed.