1. Executive Summary

Token Overview

- Ticker: $PARTI

- Sector: Layer 1 – Account Abstraction

TLDR;

Pioneering Chain Abstraction solution featuring Universal Accounts, enabling users to utilize a single account and balance across all chains (EVM & non-EVM). Addresses user and liquidity fragmentation, delivering a seamless experience without the complexities of manual bridging.

Total Raised Fund: $25M from Tier 1 funds, with Binance Labs leading the Series B round in 2024. L1 project listed on Binance with a reasonable valuation (MC $80M – FDV $300M).

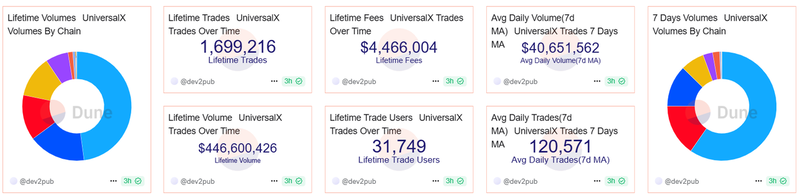

Impressive Growth with UniversalX and Partner Ecosystem: Universal Accounts integrated into UniversalX, the first cross-chain trading dapp, achieving over $440M in trading volume and generating over $4.4M in fees within one month. The dapp also partners with notable emerging chains like Bera and Sonic.

Tokenomics with Potential for Short-Term Price Catalysts: In the short term, the circulating supply will remain at 23.3% for the first 6 months post-TGE, with no major unlocks scheduled. Strong fundamentals provide a rationale for holding the token; however, it’s important to note that the continuous token airdrop strategy to attract users may create selling pressure on $PARTI’s price.

$PARTI’s Price will be Driven by Key Catalysts in 2025, such as:

- Launch of Mainnet V2 with features like Dual Staking and Aggregated DA -> Q3/2024.

- Expansion of Universal Accounts into AI, BTCFi, and stablecoin applications -> Q3/2024.

- B2B integrations with major projects and potential listings on Tier 1 exchanges like Coinbase or Upbit.

2. Overview

Particle Network is a layer-1 blockchain project leveraging the Account Abstraction mechanism through its Universal Accounts. This enables users to seamlessly interact with dApps across multiple chains without the need to manage numerous wallets or possess complex blockchain knowledge.

Furthermore, Particle Network provides infrastructure in the form of SDK tools, empowering developers to easily build projects, protocols, and dApps within the blockchain ecosystem.

2.1. Team

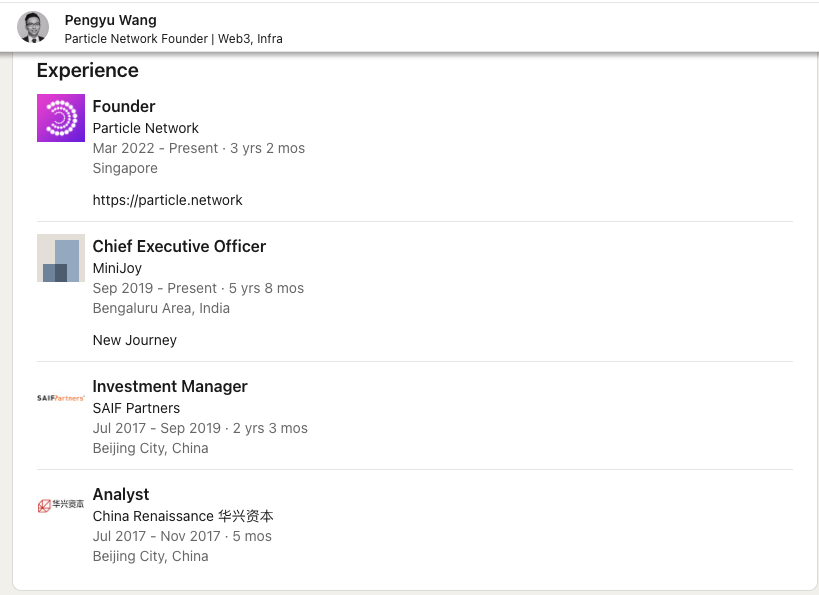

Pengyu Wang – Founder

- Previously served as an Investment Director at SAIF Partners and CEO at MiniJoy. He founded and has been building a Particle Network since March 2022.

- CEO – MiniJoy (2019): An India-based gaming platform with a focus on integrating Web3 into the entertainment experience

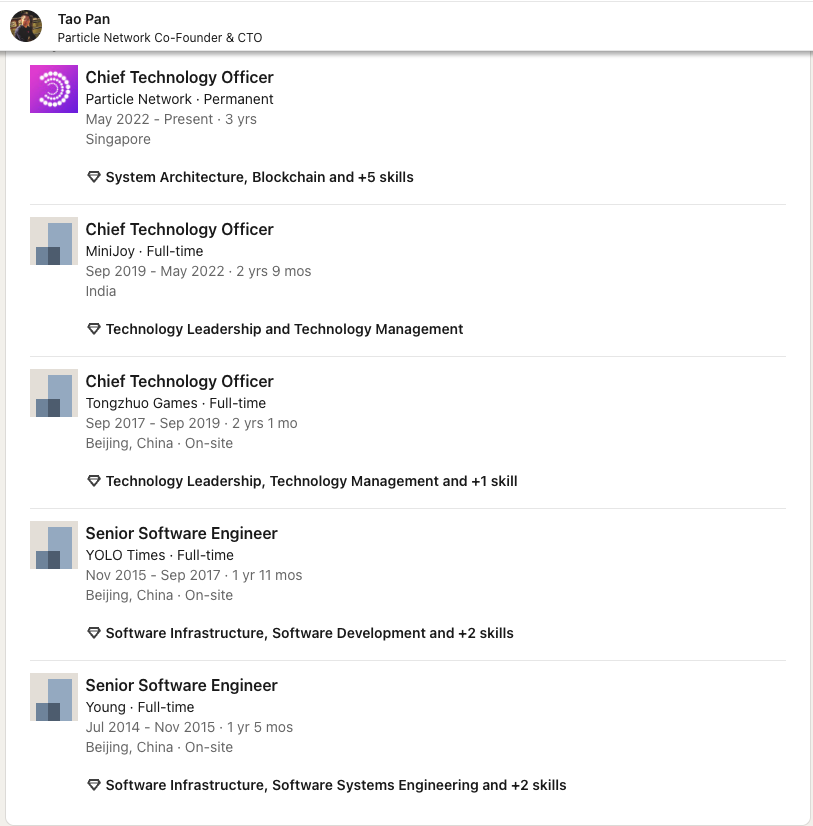

Peter Pan – CTO

- With over 10 years of experience since 2017, Tao Pan has consistently held the position of Chief Technology Officer (CTO) at various technology companies. He has a track record of building social gaming platforms and successfully raised $15M in funding from Alibaba.

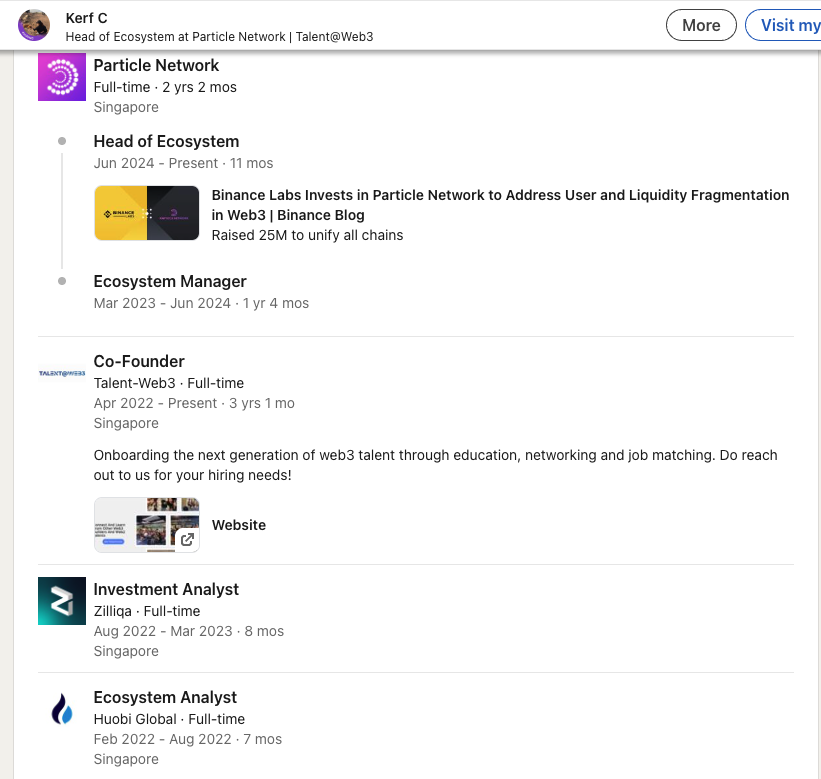

Kerf Chang – Head of Ecosystem

- Brings experience working as an Analyst, specializing in Strategy & Investment at PwC, Zilliqa, and Huobi.

- Kerf has been with Particle Network since March 2023, initially as an Ecosystem Manager, and currently holds the position of Head of Ecosystem since June 2024.

- Kerf Chang played a crucial role in securing $25 million in funding across the pre-seed, Series A, and Series B rounds – a significant milestone for Particle Network

Observations

The background of the team showcases outstanding academic foundations and practical experience: The Founder and CTO are graduates of Tsinghua University, China’s top-ranked institution. Their extensive experience in Finance & Investment provides a significant advantage in product strategy, strategic fundraising, and international market expansion.

CTO Peter Pan assumes a leadership role in technology: His strong expertise in blockchain infrastructure architecture is crucial for building and bringing the product to market.

Overall: The tight collaboration between the three core areas of Finance, Technology, and Marketing/Ecosystem creates a rare and “well-balanced” team within the blockchain infrastructure space. This synergy positions them well to achieve product-market fit on a global scale.

2.2. Product & Business Model

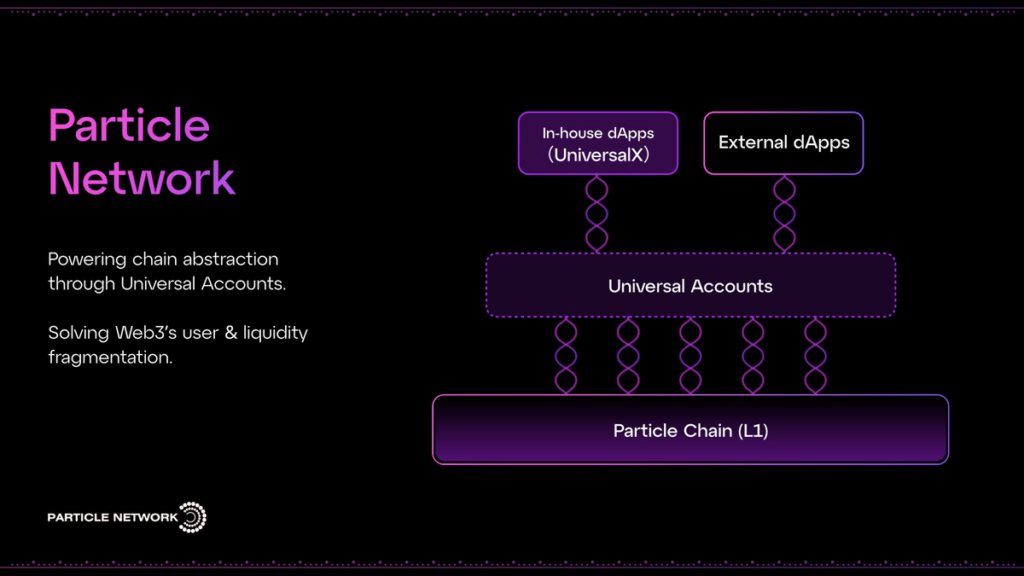

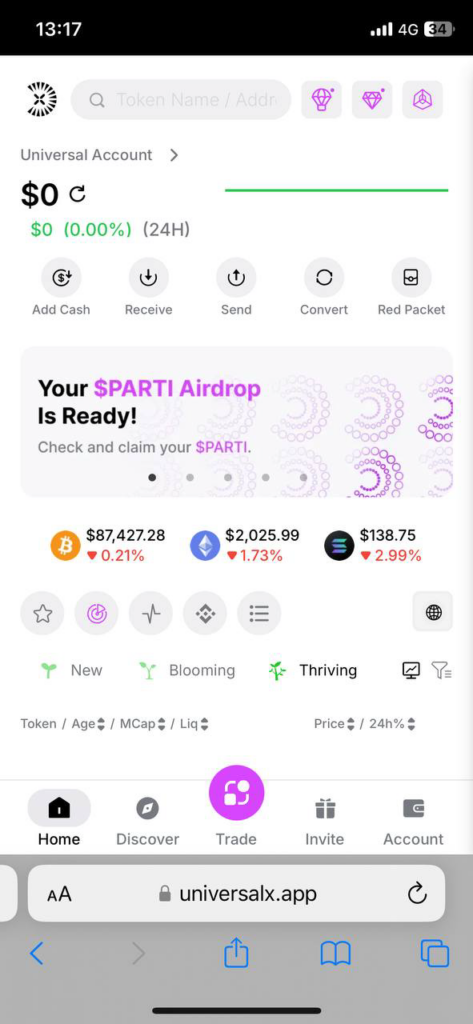

Particle Network’s business model revolves around providing the market with two primary services: UniversalX and Universal Accounts.

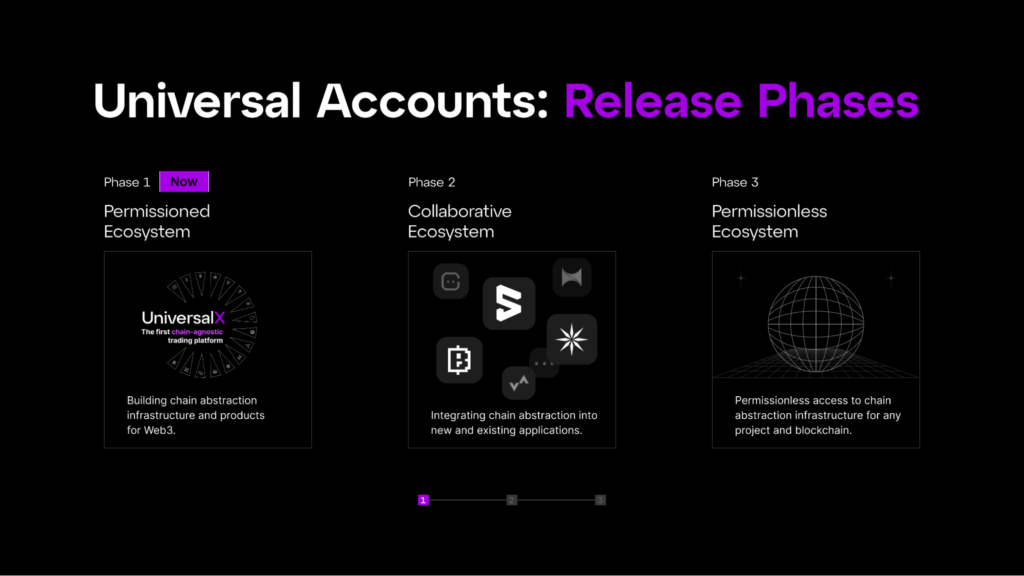

Universal Account

An infrastructure SDK toolkit for Account Abstraction: One account, one balance, any chain. Developed, packaged, and distributed by the project for integration across applications (dApps) on all chains.

- Phase 1: Exclusive on UniversalX (Ongoing).

- Phase 2: Permissioned Expansion (Pending). Broadening the reach of UA through collaborations with selected partner applications.

- Phase 3: Permissionless Deployment (Pending). Any dApp can integrate Universal Accounts without restrictions, and any chain can deploy Universal Accounts for seamless connectivity with the rest of the Web3 ecosystem.

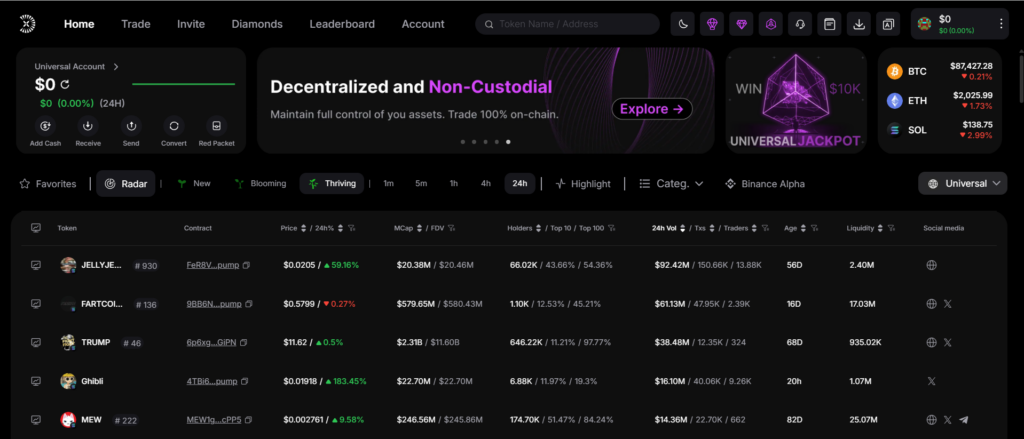

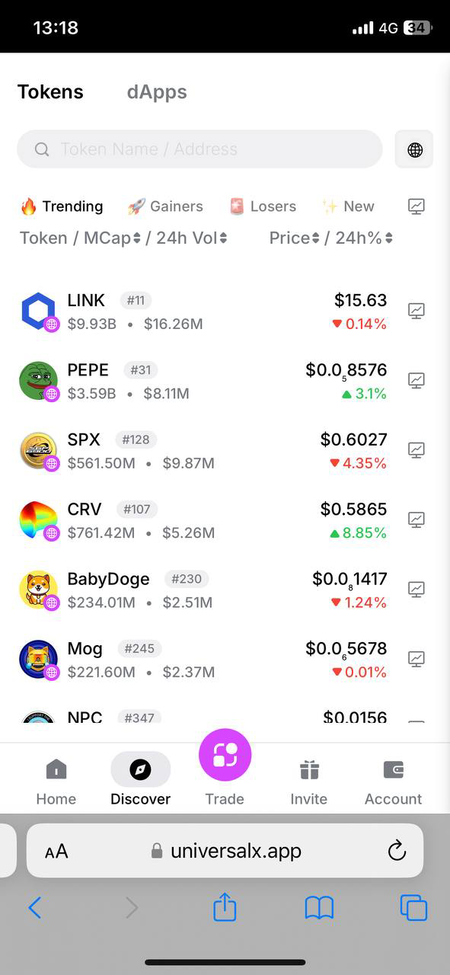

Universal X

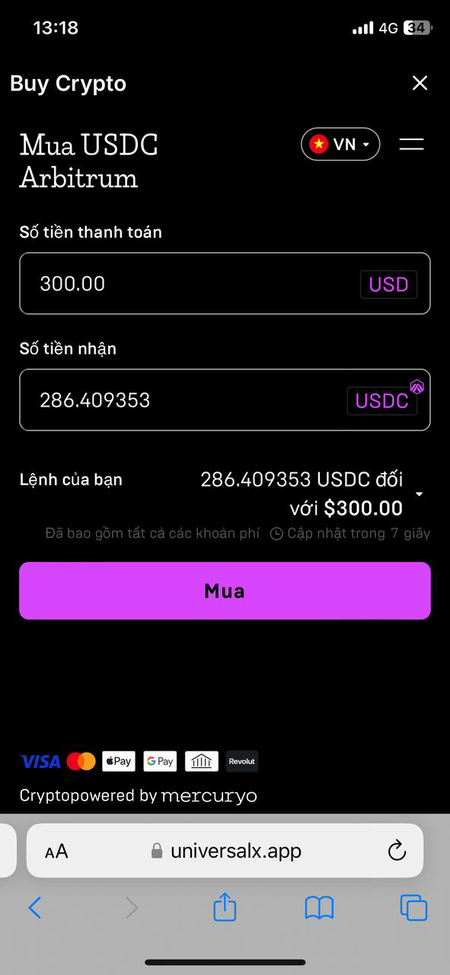

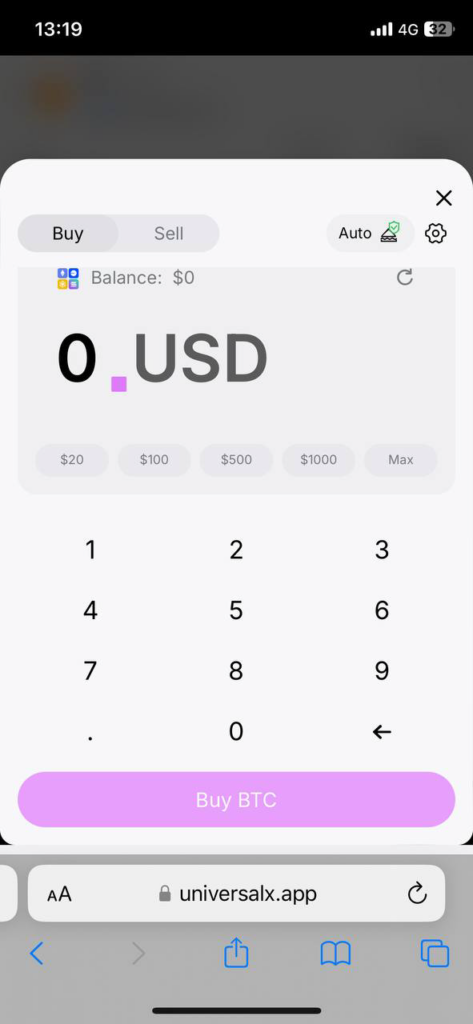

A trading platform leveraging Universal Accounts (AA), built independently and not reliant on any specific Layer 1 blockchain.

- The platform is completely non-custodial.

- Provides MEV (Miner Extractable Value) protection for users.

- Enables trading of any token on any chain without the need for bridging.

- For users wanting to buy tokens, it doesn’t matter if their assets are scattered across multiple chains or which chain the desired token resides on. The user simply clicks “Buy”, and UniversalX handles the rest.

Revenue stream

Particle Network’s main revenue comes from fees collected through:

- Transactions on the UniversalX platform.

- The integration of its Universal Account SDK on various blockchains and decentralized applications

Business Model Observations

The project addresses a significant pain point in the current market: “liquidity fragmentation and complex, difficult operations.” The integration of Universal Accounts into UniversalX (the exchange) allows users to easily access Web3 and trade Tokens and NFTs across all chains with just one click, a functionality not yet offered by other projects.

UniversalX has achieved a cumulative trading volume of $440M USD and generated $4M USD in fees for Particle within its first month. Annualized, this figure is estimated at $48 million USD in fees with a trading volume of approximately $5.29 billion USD – an extremely impressive figure with the potential for continued growth as more dApps integrate this new technology.

Challenges:

- Increasing brand awareness of UniversalX among new users.

- Acceleration of Account Abstraction implementation by other Layer 1 chains, potentially attracting new users.

- Legal restrictions in certain countries.

Milestone

| Time | Events | Detail |

| Q2/2024 | Reached 1 million Universal Accounts on testnet | A key user milestone |

| Q3/2024 | Mainnet V1 Launch | Featuring Universal Accounts, Universal Liquidity, and Universal Gas |

| Q4/2024 | Launch of UniversalXReached 17 million WA users | A bridge-less trading platform supporting 20+ chains. |

| Q1/2025 | UniversalX reached $440M in trading volumeGenerated $4M in fees | Achieved impressive monthly trading volumeBrought in $4M in revenue for Particle |

RoadMap 2025

- Q1/2025: Launch of UniversalX & 2 other Account Abstraction applications within a controlled ecosystem.

- Q3/2025: Partnerships and expansion of Universal Accounts into AI, trading, and stablecoins.

- Q1/2026: Full opening, allowing any chain and dApp to integrate Universal Accounts.

2.3. Competitive Landscape

Particle Network distinguishes itself with its Universal Accounts feature, offering a unified balance across multiple chains, a capability that NEAR Protocol and Polkadot do not achieve.

While NEAR focuses on signing transactions across multiple chains from a single account, and Polkadot provides unified addresses without merging balances, Particle Network gains an advantage in enhancing user experience, particularly by reducing complexity and increasing seamlessness.

Currently, Particle stands out as the only project providing a unified balance, which could create a significant competitive edge in attracting both users and developers.

| Criteria | Particle Network | NEAR Protocol | Polkadot |

| Unified Accounts & Balances | Yes, via Universal Accounts | No, NEAR accounts only sign transactions on other chains, balances are separate | No, unified addresses but separate balances on each parachain |

| Cross-Chain Transactions | Uses Universal Liquidity for atomic transactions | Uses Chain Signatures to sign transactions on other blockchains | Uses XCM (Cross-Consensus Messaging) for cross-chain communication |

| Supported Chains | Designed for any chain (modular L1) | Supports Bitcoin, Ethereum, etc. via Chain Signatures | Supports parachains within the Polkadot ecosystem |

| Underlying Technology | Modular L1 blockchain with Universal Accounts | Chain Signatures using MPC (Multi-Party Computation) | Relay chain with parachains and XCM protocol |

| User Experience | Provides unified UX across all chains | Manages multichain interactions from a single NEAR account | Framework for building parachains and cross-chain apps |

| Security | Uses MPC for secure transactions | Decentralized MPC for reliable signature creation | Secured by Polkadot’s relay chain |

| Fee & Gas Management | Manages internal gas fees across chains | Each chain has its own gas mechanism | Each parachain has its own fee mechanism |

2.4. Tokenomics

Token Info

- Total Supply: 1B

- Circulating Supply: 233M ~ 23%

- Giá: $0.25

- Market Cap: $58M

- FDV: $250M

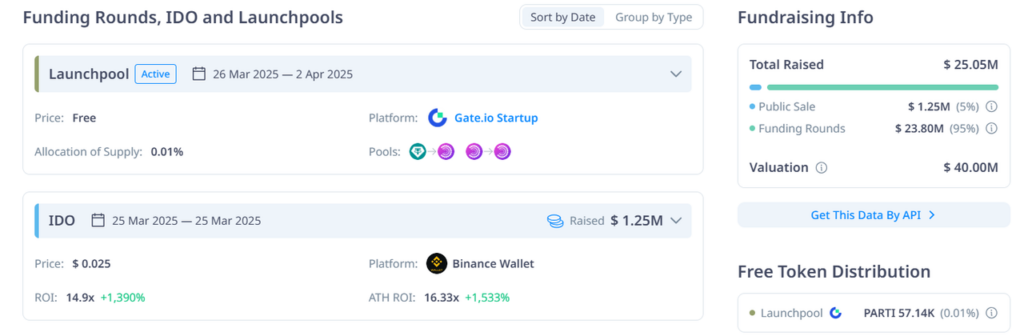

Raised Fund

- Total Raised Fund: > $25 triệu USD

- Investors Tier 1 & 2: Binance Labs, Hashkey Capital, The Spartan Group, Alibaba Group…

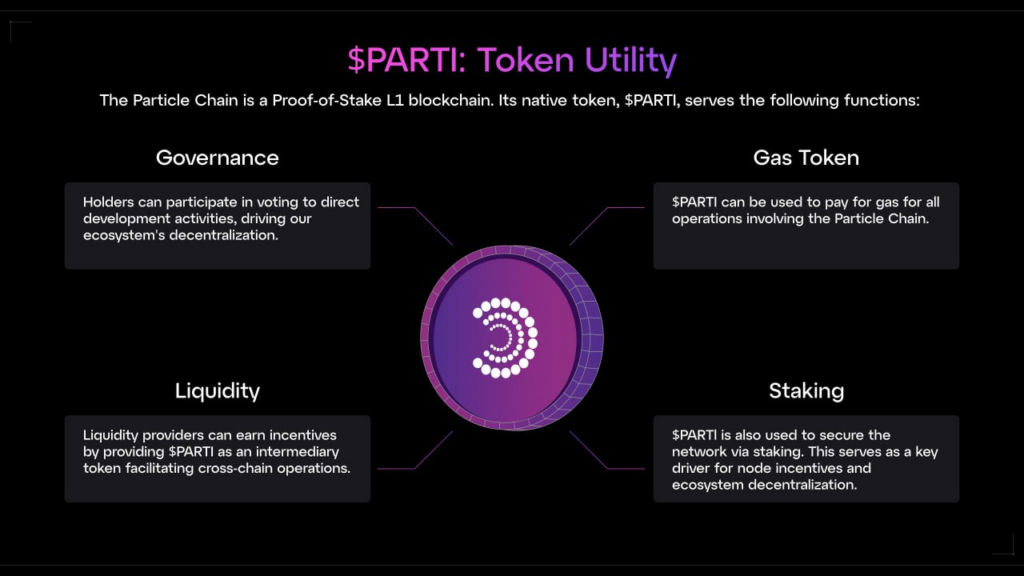

Token Use Case

- Staking & Governance

- Universal Gas Token

- Universal Liquidity Token

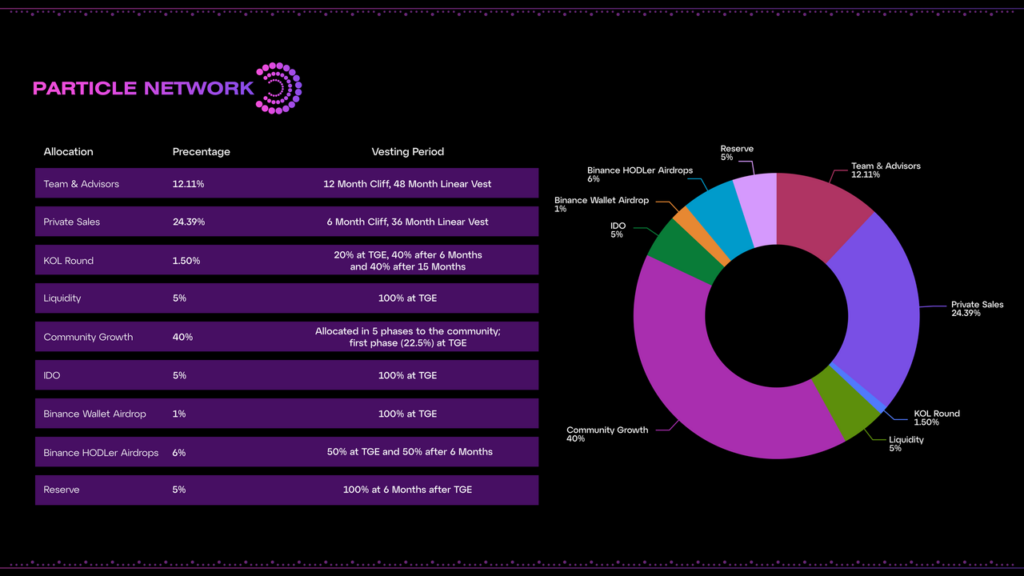

Token Allocation & Vesting

| 1,000,000,000 | Allocated | Percentage | TGE Unlock | Locked up (Months) | Vesting | Initial TGE Supply | USD Amount at TGE | Unlock Time (Months) | 6 months TGE |

| Team & Advisor | 121,100,000 | 12.11% | 0% | 12 | Scheduled for release within 48 hours | 0 | $0 | 48 | 2,522,917 |

| Private Sales | 243,900,000 | 24.39% | 0% | 6 | Scheduled for release within 36 hours | 0 | $0 | 36 | 6,775,000 |

| KOL Round | 15,000,000 | 1.50% | 20% | 6 | 40% after 6 months, 40% after 15 months | 3,000,000 | $1,110,000 | 15 | 9,000,000 |

| Liquidity | 50,000,000 | 5.00% | 100% | 0 | 100% TGE | 50,000,000 | $18,500,000 | — | 50,000,000 |

| Community | 400,000,000 | 40.00% | 23% | 0 | 22.5% at TGE, released in 5 tranches | 90,000,000 | $33,300,000 | — | 180,000,000 |

| IDO | 50,000,000 | 5.00% | 100% | 6 | 100% TGE | 50,000,000 | $18,500,000 | — | 50,000,000 |

| Binance Wallet Airdrop | 10,000,000 | 1.00% | 100% | 0 | 100% TGE | 10,000,000 | $3,700,000 | — | 10,000,000 |

| Binance Holder Airdrop | 60,000,000 | 6.00% | 50% | 9 | 50% TGE, 50% after 6 months | 30,000,000 | $11,100,000 | — | 60,000,000 |

| Reserve | 50,000,000 | 5.00% | 0% | 0 | 100% after 6 months | 0 | $0 | — | 50,000,000 |

| Total | 1,000,000,000 | 100.00% | 233,000,000 | $86,210,000 | 418,297,917 |

Analysis & Comments

At TGE, 23.3% of the total supply was listed and in circulation, including allocations from the KOL Round, Liquidity, Community, IDO, Binance Wallet Airdrop, and Binance Holder Airdrop. This is sufficient to support initial trading activity and early community building.

Short-term: During the first 6 months after TGE, aside from potential early sell pressure from the airdrop event, the circulating supply remains stable at 23.3% with no scheduled token unlocks. This creates a relatively safe environment for short-term market performance.

Long-term: Starting from month 7, two major allocations—Team and Private Sales—begin unlocking at a rate of 0.9% of total supply per month. Additionally, 13.8% of the total supply (~$51M) will be unlocked, raising the circulating supply to 41.8%. Notably, the Community allocation has no fixed unlock schedule, adding unpredictability. These factors could introduce significant sell pressure on the market over time.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.