1. Executive Summary

Token Overview

- Ticker: $INIT

- Sector: Layer 1

TLDR;

Initia: A Modular L1 Blockchain Paving the Way for Native Rollups

Initia is a pioneering modular Layer 1 blockchain that natively integrates rollups with a multi-layered incentive mechanism. This innovative approach incentivizes both users and app-chains, aiming to comprehensively address the fragmentation of liquidity and users commonly seen on traditional L1s. Initia strives to deliver a seamless on-chain experience, fostering a genuine growth flywheel within its ecosystem.

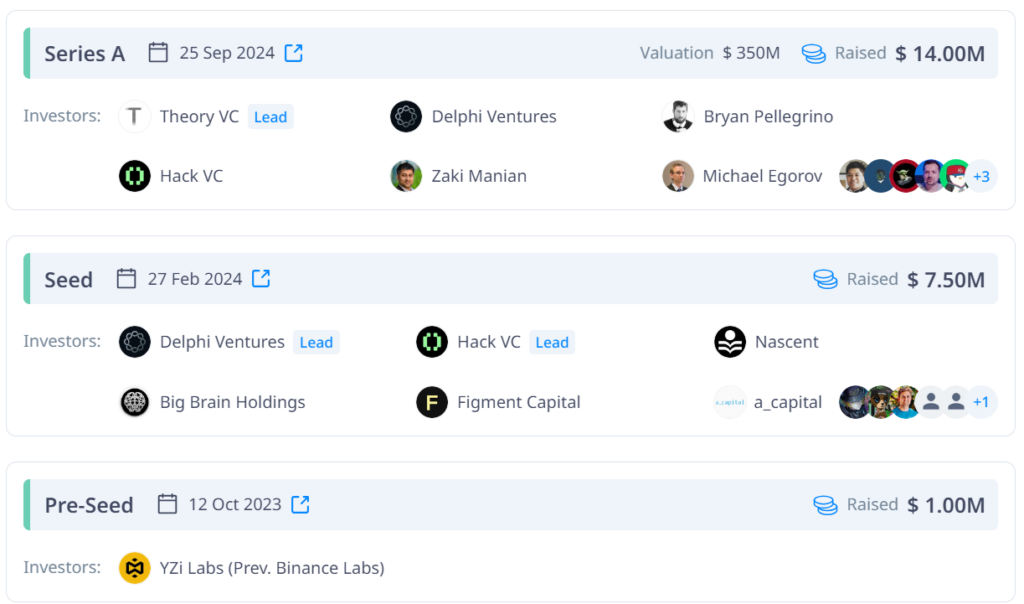

Strong Funding and Market Positioning

Initia has successfully raised $25 million in funding from Tier 1 venture capital firms, with Binance Labs leading the round and notable participation from Hack VC and Delphi Ventures. Its final Series A funding round valued the project at a $350 million FDV (Fully Diluted Valuation). Following its listing on Binance, Initia’s reasonable market capitalization of approximately $120 million was positively received by the community. This positions Initia for significant upside potential, particularly as its ecosystem successfully bootstraps.

Tokenomics Designed for Short-Term Growth

Initia’s tokenomics show strong potential for short-term price appreciation. At TGE (Token Generation Event), only 14.8% of the total supply will be in circulation, with 11% allocated to the community (via airdrops and launchpools). Crucially, there will be no unlocks by VC or Echo Sale participants for the first 12 months, significantly reducing selling pressure during the initial phase. This solid fundamental, combined with a potential growth flywheel, could support the price of INIT in the short term.

Catalysts for Future Growth

Initia has the potential to reach a market capitalization of $300 million to $600 million, driven by several key catalysts:

- New VM Deployment on Rollups: The implementation of a new Virtual Machine (VM) on its rollups will support a wider range of smart contract types, attracting a more diverse developer base.

- Tier 1 Exchange Listings: Beyond Binance and Kraken, there’s significant potential for Initia to be listed on other major Tier 1 exchanges, including Coinbase and, notably, Upbit.

1.1. Overview

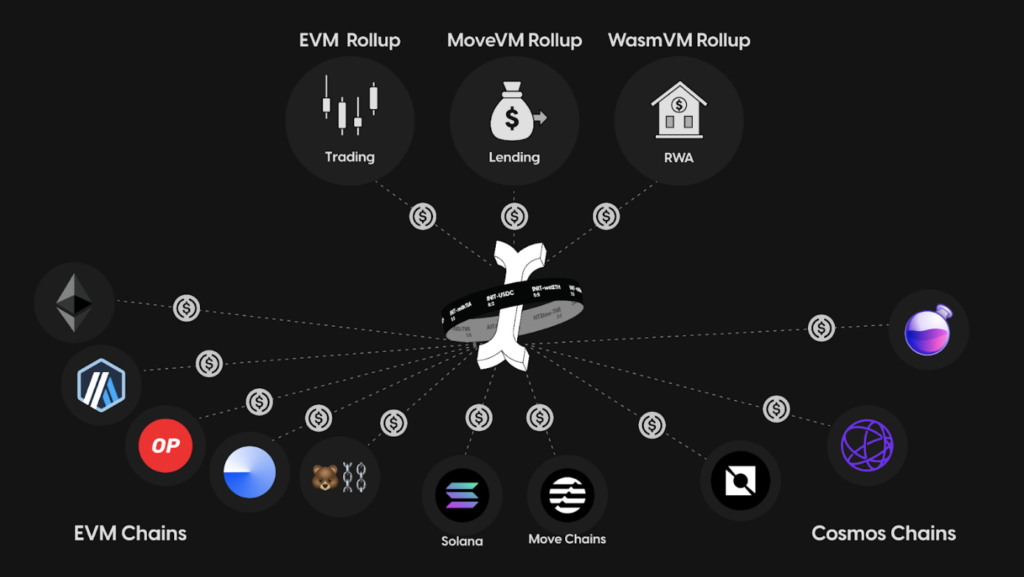

Initia is a Layer 1 blockchain built on the Cosmos SDK, designed to simplify the development of application-specific chains, also known as app-chains. It achieves this by seamlessly integrating Layer 1 and Layer 2 functionalities.

Initia’s core focus is on scalability and interoperability, aiming to reduce fragmentation within the multi-chain ecosystem. Its architecture comprises a foundational Initia Layer 1 that supports the creation of numerous Layer 2 rollups built upon it.

Furthermore, Initia offers support for various virtual machines, including EVM, MoveVM, and WasmVM. This broad compatibility makes it significantly easier for developers to build and deploy their applications within the Initia ecosystem.

1.3. Team

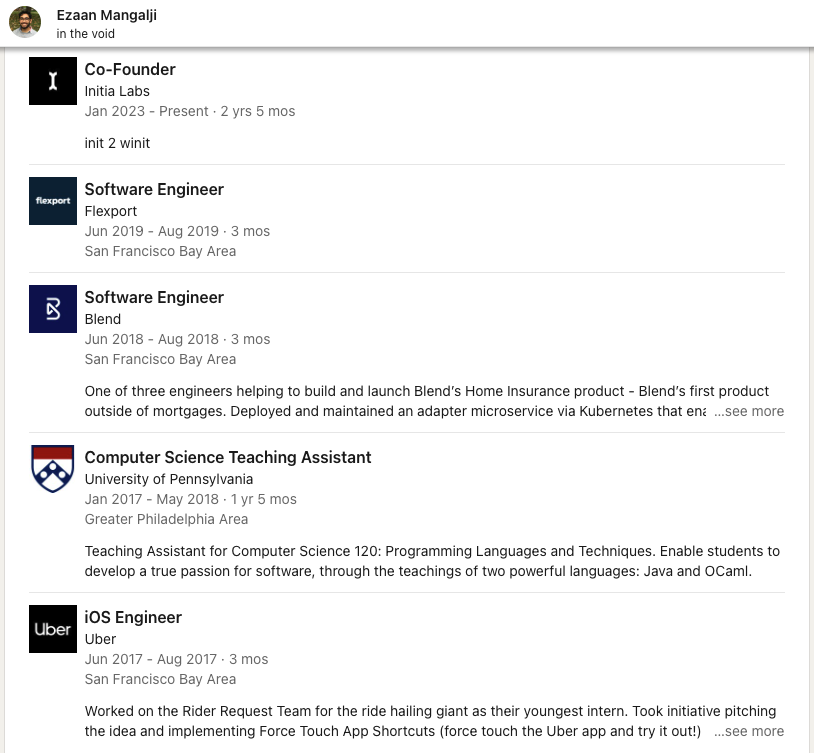

Ezaan Mangalji | Co-Founder

- Currently serves as the CTO of Initia

- Formerly contributed to smart contract development at Terraform Labs

- Prior to entering blockchain space, he worked in quantitative trading and analytics at financial firms

Stan Liu | Co-Founder

- CEO of Initia

- Holds a degree in Mathematics from Princeton University

- Former Head of Research at Terraform Labs, where he focused on MEV (Maximum Extractable Value) research

Initia is led by a team of “builder natives” with extensive hands-on experience from long-standing, large-scale projects like Cosmos Hub and Terra Station. Notably, their past experience with Terraform Labs provided invaluable lessons.

The team has chosen a distinct path, recognizing the shortcomings observed in traditional L1 models such as Solana (SoL) and Ethereum, where “Proof of Stake” mechanisms often revolve primarily around staking with limited real value creation for end-users.

Instead of following conventional approaches, Initia has opted for a different and more sustainable direction, featuring an economic model re-designed from the ground up. This model aims to give more back to users through a flexible incentive system directly tied to liquidity and genuine interaction.

2. Due Diligence

2.1. Technology

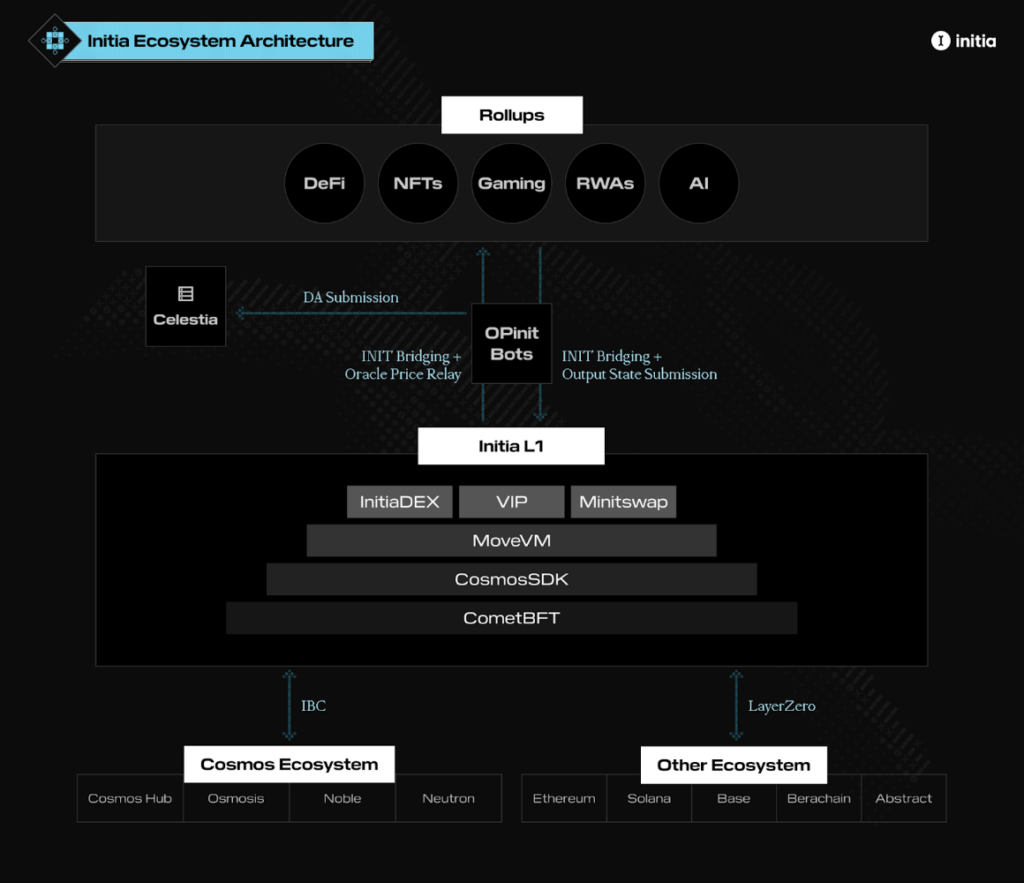

Initia’s technological architecture is comprised of three main components:

- Initia L1: This serves as the foundational infrastructure layer and the central liquidity hub for all Interwoven Rollups.

- Interwoven Rollups (Appchains – L2): These are the ecosystem of blockchain rollups built on top of the Initia L1.

- Interwoven Stack: This is Initia’s suite of developer tools designed to help developers easily build applications and rollups.

2.2. Product/Service

Initia provides a suite of network services, similar to other L1 blockchains. These include:

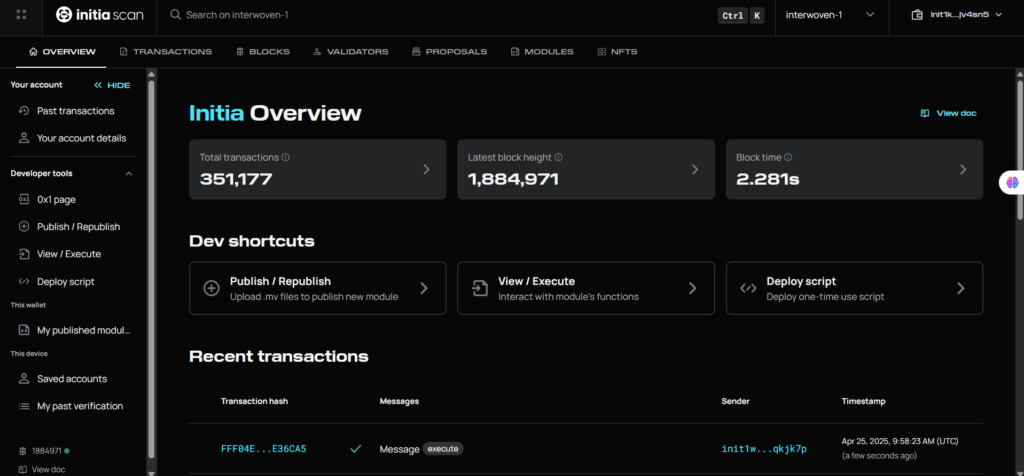

- Initia Scan: An explorer for both the Initia L1 and all L2s. This tool is best suited for experienced users and on-chain analysts/developers.

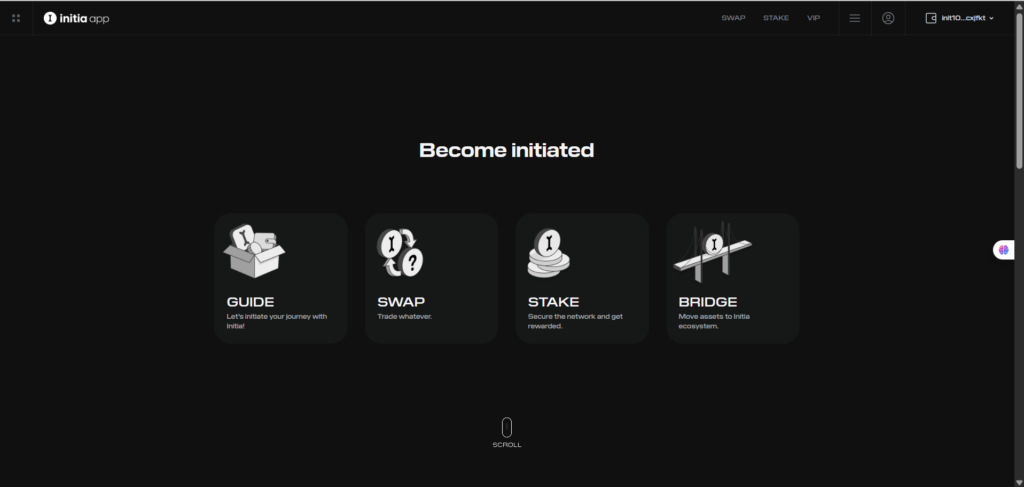

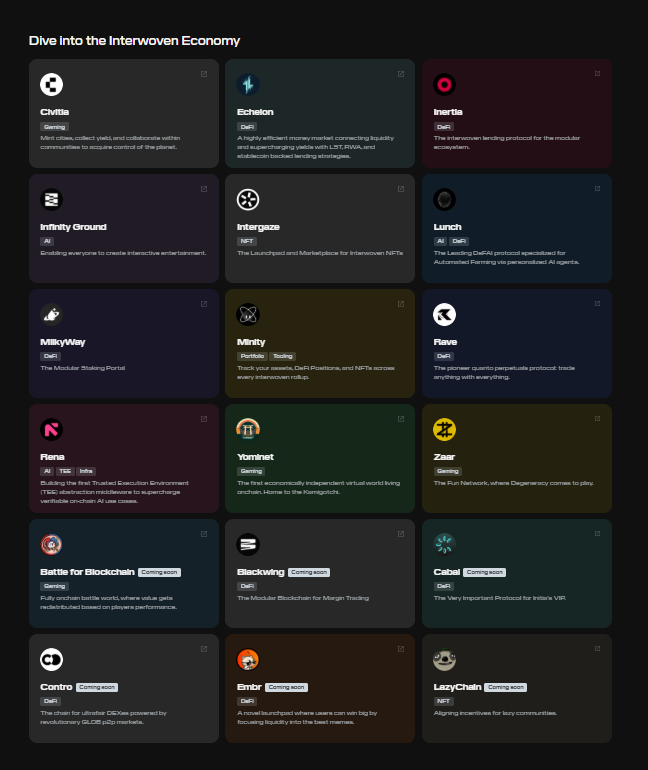

- Initia App: serves as a comprehensive hub for everything related to the Initia blockchain. It integrates core features such as swapping, staking, and bridging, along with various decentralized applications (dApps) within the ecosystem. The entire user experience and interface (UX/UI) have been meticulously simplified and optimized, allowing new users to easily access and interact with the platform, often with just a single tap.

- Initia name service: A multi-chain naming service.

- Initia Wallet: A simplified wallet interface designed to connect your wallet to accounts across any VM (Virtual Machine) and manage multi-chain balances.

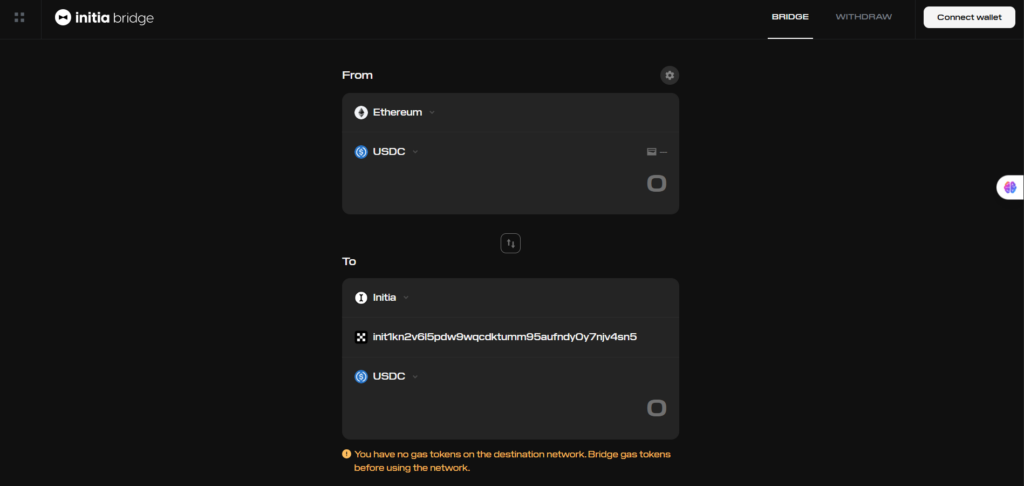

- Initia Bridge: Simplifies the process of connecting and moving assets between any Layer 1 or Layer 2, regardless of whether they are EVM, non-EVM, or MoveVM chains, leveraging both IBC and LayerZero.

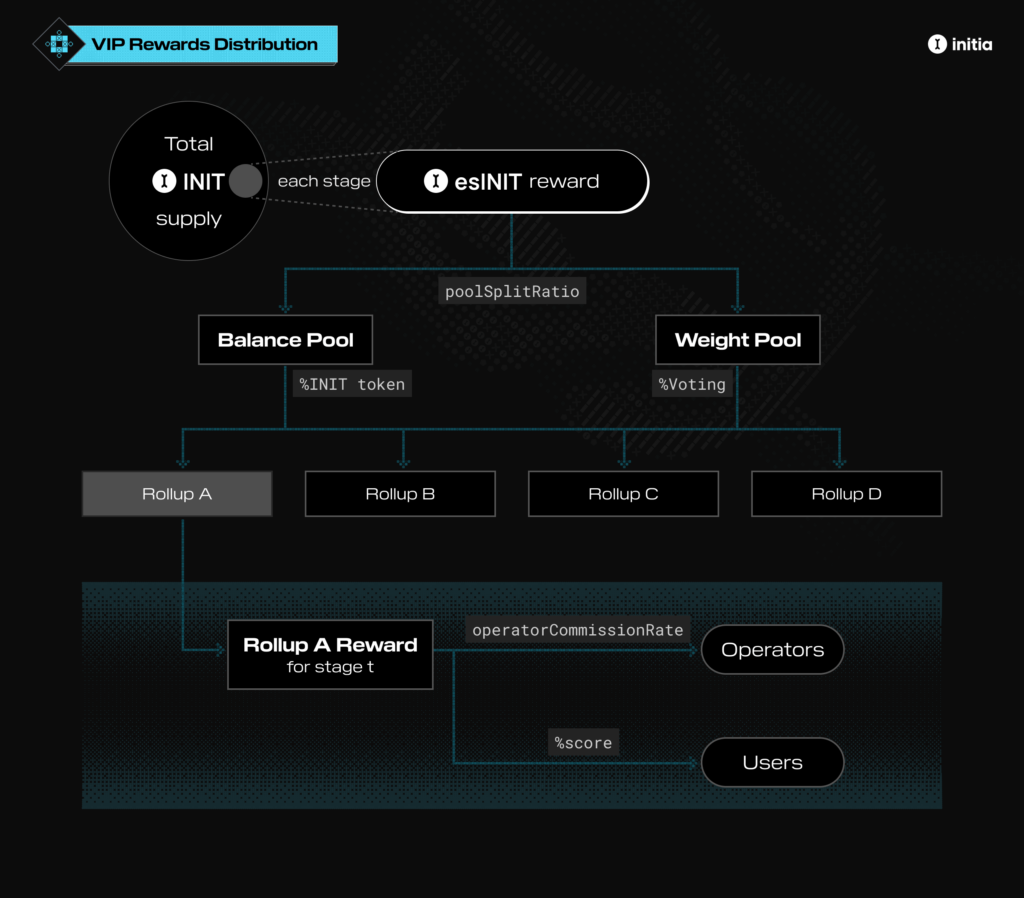

Model L1 Economics

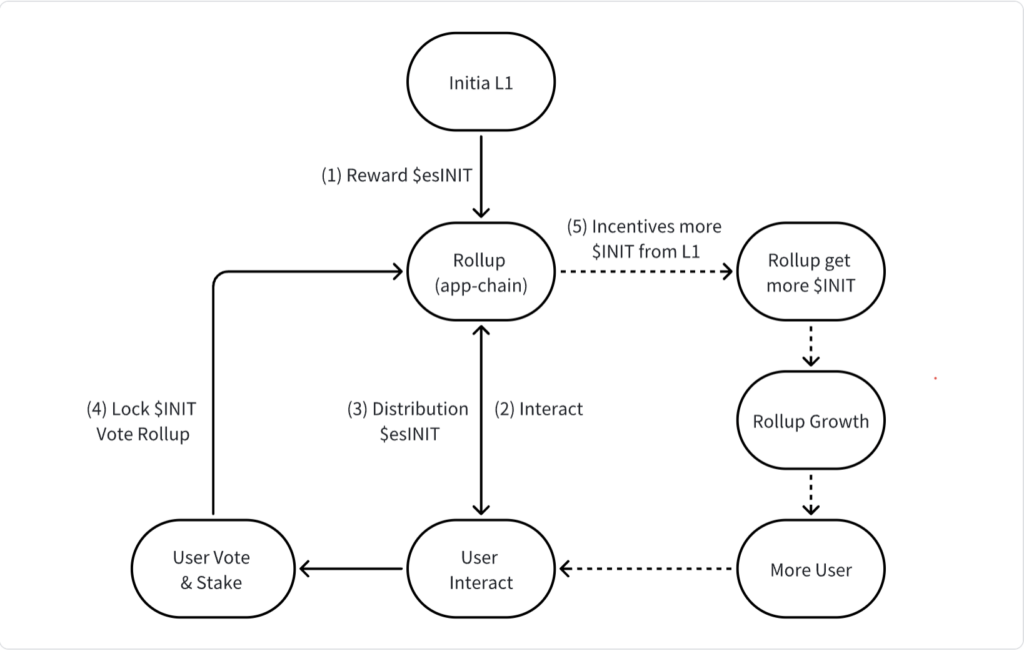

- Initia is pioneering a modular Layer 1 economic model with native rollups. In this design, app-chains don’t just operate independently; they are actively incentivized and directly rewarded by the broader ecosystem.

- This mechanism delivers real value directly to end-users, encouraging their deep engagement within specific app-chains. This, in turn, ignites a powerful value flywheel for the entire ecosystem.

- This approach marks a significant departure from other Layer 1s, where value is often primarily distributed to validators, neglecting the burgeoning Layer 2 rollups developing on top of them—a, a common characteristic seen in networks like Ethereum and Solana.

Revenue stream

Initia is a Layer 1 blockchain with a Business-as-a-Service (BaaS) model, where its primary revenue streams come from:

- Transaction fees within the Layer 1 ecosystem

- Cross-rollup messaging fees

- Slashing economy fees

Business Model Assessment

From a theoretical standpoint, Initia’s L1 economic model is both innovative and creative, focusing on distributing value to all parties with genuine “skin in the game.” This approach aims to activate a flywheel that expands both real users and app-chains, thereby laying the groundwork for Initia to build sustainable long-term revenue.

However, the major real-world challenge during the mainnet phase will be for Initia to successfully bootstrap liquidity and maintain a price trajectory that generates attractive APY (Annual Percentage Yield) for both users and dApp builders. This is crucial for ensuring competitiveness and accelerating the ecosystem’s bootstrapping process.

Milestone

| Time | Milestone | Details |

| Q4/2023 | Binance Labs Pre-Seed. | No detailed valuation disclosed |

| Q1/2024 | Seed Round – raised fund $7.5M USD. | Preparing for testnet launch, ecosystem development, and L2 support |

| Q3/2024 | Series A – raised fund $14M USD. | Token valuation at $350M USD |

| Q3/2024 | Community Token Sale on Echo – $2.5M | Token valuation at $250M USD |

| Q2/2025 | Initia Mainnet Launch | Listed at $0.61, later increased to $0.98 (+60%) as of April 26, 2025 |

RoadMap 2025

- Q2/2025

- Initia Mainnet Launch

- Airdrop.

- Q3/2025

- More appchains (rollups) launching on Initia

- Upgrades and enhancements to the Initia product suite

- Improved Layer 1 performance

- Q4/2025

- New VM on Interwoven Rollup

- Overlapping enhancements

2.3. Competitive Landscape

Both Initia and Berachain are innovating their Layer 1 economic models by integrating direct incentives, but their approaches differ significantly. Initia focuses on native rollups with multi-layered incentives (for Rollups, Users, and Operators). In contrast, Berachain combines security and liquidity through its Proof-of-Liquidity (PoL) mechanism and a Curve/Convex-style flywheel.

Compared to traditional Layer 1s like Ethereum, Solana, BNB, and Sui, both Initia and Berachain proactively incentivize ecosystem development from within their economic models. This contrasts with reliance solely on transaction fees or basic staking rewards.

| Criteria | Initia | Bera | Ethereum | Sol | Bnb | Sui |

| Consensus Mechanism | PoS + Native Rollup | PoL | PoS | PoH + PoS | PoSA | dPoS |

| Layer 2 Architecture | Modular L1 with native rollups running in parallel | No native rollups, but extended via appchain contracts | Independent L2s (Arbitrum, Optimism…) | Non-modular, monolithic mainchain | No support for native modular L2 | Non-modular, standalone chain |

| Incentive Layer | VIP Program: esINIT reward cho Rollup + Users + Operators | Incentives via HONEY + BGT – bribe gauge voting, LP stakers control rewards | Incentives only for validators | Incentives only for validators | Incentives only for validators | Incentives only for validators |

| Primary Revenue Source | L1 transaction fees + Cross-rollup messaging + Optional appchain fee sharing | Transaction fee L1, Bridge fee. | Transaction fee + MEV | Transaction fee | Transaction fee + Bridge fee | Transaction fee + MEV |

| Flywheel Value | Rollup growth → Users earn rewards → Voting → More rollup growth | LP provides liquidity → gets BGT → Vote gauges → Earn HONEY → More LP | L2 growth → Ethereum earns L1 fees | Mainnet volume increases → Hold SOL | More use cases on mainnet → Hold BNB | Mainnet volume increases → Hold SUI |

| Key Advantages | Direct value transfer to users + rollups; modular and native incentives | Liquid staking → Strong incentive alignment + Curve/Convex-like flywheel for L1 | Strong security, diverse ecosystem | High speed, low fees | Extremely low fees, strong Asia-based ecosystem | Secure Move VM, object-centric design |

| Challenges | Must maintain attractive APY incentives early on, needs active rollups | Relies on real liquidity to sustain PoL + complex tokenomics risks | MEV pressure, intense L2 competition | Risk of downtime, spam transactions | High validator centralization | Faces modular competition from Aptos & others |

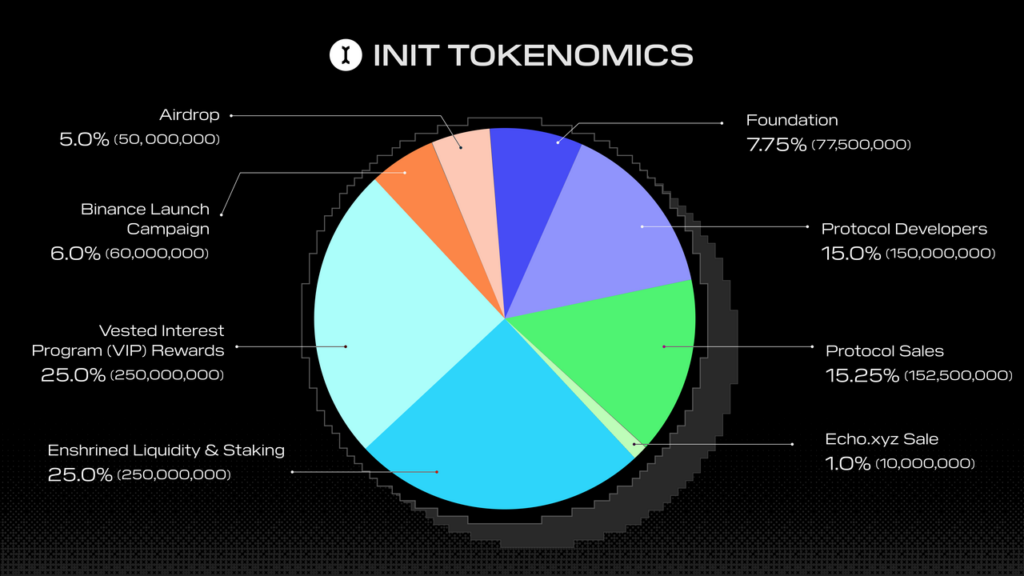

2.4. Tokenomics

Token Info

- Total Supply: 1B

- Circulating Supply: 148M

- Price: $0.66

- Market Cap: $99M

- FDV: $667M

Raised Fund

- Total Raised Fund: $25M

- Valuation: $350M – Series A

- Investors Tier 1 & 2: Binance Labs, Delphi Ventures, Hack VC, Theory VC

Token Use Case

- Staking & Vote

- Govermance

- Payment Network

Token Allocation & Vesting

| 1,000,000,000 | Allocated | Percentage | TGE Unlock | Locked up (Months) | Vesting | Initial TGE Supply | USD at TGE | Unlock Time (Months) | 6 months TGE |

| Foundation | 77,500,000 | 7.75% | 50% | 6 | The remaining 50% will be released every 6 months over a period of 48 months. | 38,750,000 | $0 | 48 | 43,593,750 |

| Protocol Developers | 150,000,000 | 15.00% | 0% | 12 | 25% after 12 months, 75% after 36 months | 0 | $0 | 36 | 0 |

| Investors | 152,500,000 | 15.25% | 0% | 12 | 25% after 12 months, 75% after 36 months | 0 | $0 | 36 | 0 |

| Enshrined Liquidity & Staking | 250,000,000 | 25.00% | 0% | 0 | 5%/year | 0 | $0 | — | 6,250,000 |

| VIP Rewards | 250,000,000 | 25.00% | 0% | 0 | 7% per year, distributed linearly over 12 months. | 0 | $0 | — | 8,750,000 |

| Binance Launch | 60,000,000 | 6.00% | 100% | 0 | 100% TGE | 60,000,000 | $36,600,000 | — | 60,000,000 |

| Airdrop | 50,000,000 | 5.00% | 100% | 0 | 100% TGE | 50,000,000 | $30,500,000 | — | 50,000,000 |

| Echo sale | 10,000,000 | 1.00% | 0 | 12 | 25% at month 12, 15, 18, and 24 after TGE. | 0 | $0 | — | 0 |

| Total | 1,000,000,000 | 100.00% | 148,750,000 | $67,100,000 | 168,593,750 |

Tokenomics Analysis: TGE & Short-Term Outlook

At TGE (Token Generation Event) and subsequent listing, Initia had 148.75 million INIT tokens in circulation, representing approximately 14.8% of the total supply. Of this, 11% was allocated to the community through programs like Airdrops and the Binance Launchpool. An additional 2.5% was designated for liquidity on CEX exchanges (excluding Binance), with the remaining 1.38% held by the foundation.

It’s highly probable that there will be selling pressure from the foundation, especially as INIT has garnered community FOMO and seen its token price increase over 60% from $0.61, reaching a market cap of around $120 million.

Crucially, for the first 12 months following TGE, INIT will not face any token unlock pressure from VCs or Echo Sale participants. This favorable condition allows Initia’s economic model to operate effectively, potentially activating its growth flywheel and significantly reducing the risk of token dumps from unlocks. This can contribute to the stability of INIT’s value during the foundational phase of the ecosystem.

Here’s a projected price scenario for the next six months, considering a circulating supply of 16.8%:

- Bull Case: With a strong growth flywheel and low circulating supply, the projected market cap could reach $556 million (+100%) to $667 million (+500%) compared to the current market cap.

- Base Case: If the flywheel is activated and circulating supply remains low, the projected market cap could be $222 million (+128%) to $333 million (242%) compared to the current market cap.

- Worse Case: If the flywheel fails to activate, the projected market cap could drop to $67 million, a decrease of -391% from the current market cap.

| Time | TGE 24/4 | Currently (at this point) | Worse Case | Base Case | Bull Case | ||

| Price | $0.61 | $0.66 | $0.40 | $1.32 | $1.98 | $3.30 | $3.96 |

| Growth | 0% | 8% | -39% | 100% | 200% | 400% | 500% |

| Total Supply | 1,000,000,000 | 1,000,000,000 | 1,000,000,000 | 1,000,000,000 | 1,000,000,000 | 1,000,000,000 | 1,000,000,000 |

| Circ Supply | 148,000,000 | 148,000,000 | 168,593,750 | 168,593,750 | 168,593,750 | 168,593,750 | 168,593,750 |

| Growth | 0% | 13.91% | |||||

| Market Cap | $90,280,000 | $97,680,000 | $67,437,500 | $222,543,750 | $333,815,625 | $556,359,375 | $667,631,250 |

| Growth | 0% | 8% | -31% | 128% | 242% | 470% | 583% |

| FDV | $610,000,000 | $660,000,000 | $400,000,000 | $1,320,000,000 | $1,980,000,000 | $3,300,000,000 | $3,960,000,000 |

3. Conclusion

Initia represents an innovative trend in Layer 1 blockchain design. Its modular L1 model, combined with native rollups and a multi-layered incentive mechanism, focuses on real users and genuine app-chain activity. This approach stands in stark contrast to traditional L1s, which primarily reward validators.

If the Initia team continues to execute on its development roadmap and successfully penetrates key markets in DeFi, SocialFi, and AI/Fi, we believe Initia has the potential to reach a market capitalization of $300 million to $600 million in upcoming favorable market cycles.

Initia is certainly worth adding to a medium-to-long-term investment watchlist, particularly for those prioritizing assets within the new-generation blockchain infrastructure segment.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.