1. Executive Summary

According to the monthly report, analysts identified a “bull trap” in the market based on two core factors: low capital inflow into the ecosystem and geopolitical uncertainties in the Middle East (Iran vs. Israel). This led to a sharp market decline by the end of last week, with Total Value Locked (TVL) dropping from $116B to $106B (-4.6%) on a weekly basis and a Month-to-Date (MTD) TVL decline of -7.6%.

Top-performing coins in May 2025, such as ETH (+84%), SOL (+87%), BNB (+31.55%), Sui (+140%), ARB (+95%), and notably $HYPE (+309%), saw strong price gains that persisted only until the end of May. In June, however, these asset classes reversed, triggering a short-term bearish trend.

- TVL and Market Share breakdown shows no clear differentiation among asset classes. Comparing June vs. May market share data, BNB and ETH recorded gains of 3%–7%, outperforming other assets.

- Top coins and altcoins have retreated to price levels seen in early April 2025. Analysts recommend monitoring market reactions and capital flows over the next 2–3 weeks, noting that historical data from June to August 2024 showed significant market underperformance.

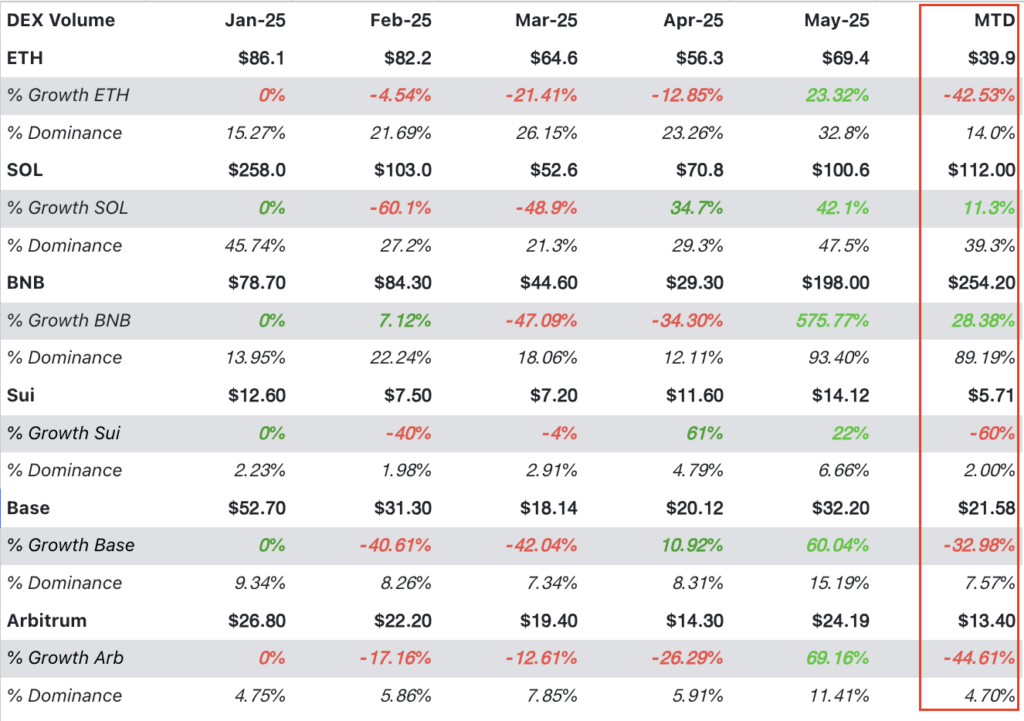

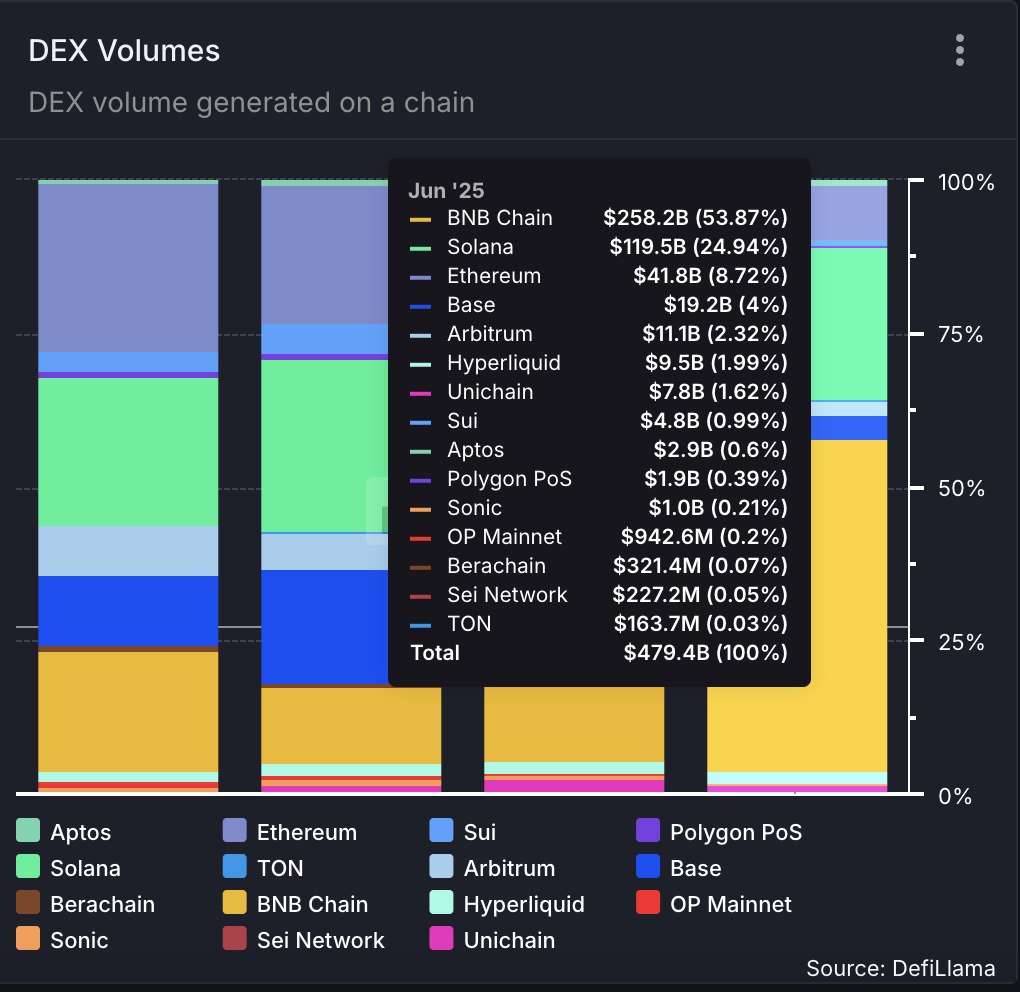

Decentralized Exchange (DEX) Weekly Volume increased from $96.8B to $106.88B (+10.4%), with MTD volume rising from $212B to $285B (+34.4%). In DEX volume breakdown, Binance Smart Chain (BSC) maintained its top position with an 89% market share, while Solana (SOL) secured the second spot with an 11.3% share, driven by integrations with centralized exchanges (CEX) like Bybit and OKX, boosting DEX activity.

Circle (USDC) listed its IPO under the ticker $CRCL, with a current share price of $240 and a market cap of $54.4B USD. Circle’s 2024 revenue reached $1.6B USD, with 60% distributed to Coinbase and third-party USDC listing partners, resulting in low profit margins. However, Circle’s annualized EV/Revenue multiple stands at 3.1x, below the industry average of 5.1x (e.g., Coinbase, Robinhood).

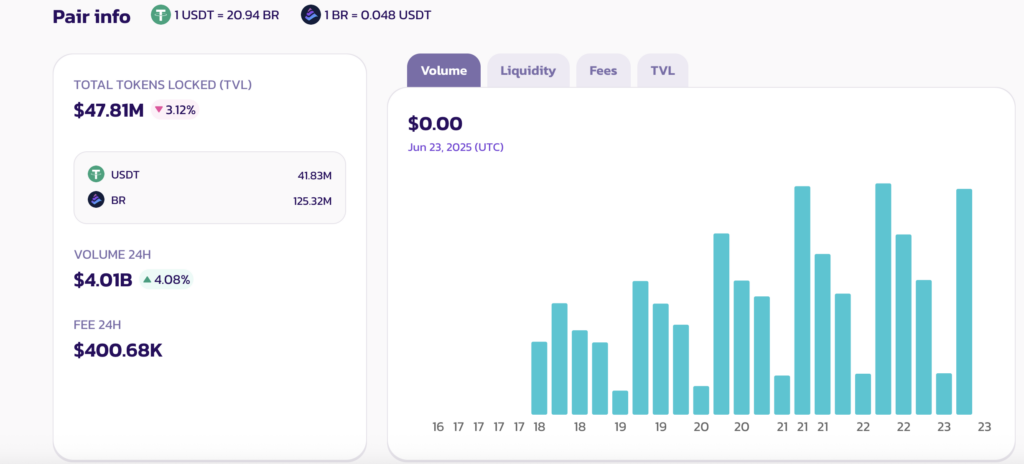

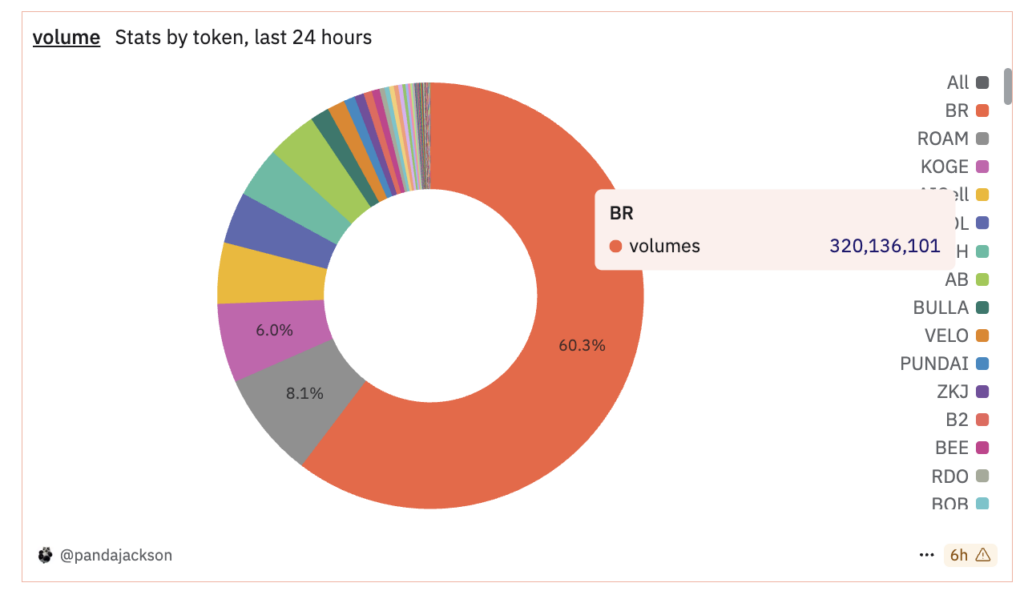

Binance Alpha remains a hotspot for users following the price collapse of ZKJ and KOGE. The Bedrock (BR) project officially launched liquidity provision for the BR/USDT pair, offering farm points with $45M USD in liquidity. This drove a trading volume of 15x daily, with 80,000 unique addresses trading per day.

2. DeFi Market

BlockBase DeFi Market Monthly Analysis Report from last week (June 9, 2025): Analysts identified a “Bull Trap” in the market, driven by two key factors:

- Layer 1 assets surged strongly in mid-May, then moved sideways until the end of the month. However, this did not translate into capital flow driving price increases for tokens within their ecosystems.

| Asset | Eth | Sol | BnB | Sui | Sonic | Arb | HYPE |

| Price (01.04.2025) | $1408 | $95.33 | $515 | $1.72 | $0.379 | $0.25 | $11.29 |

| Price (01.05.2025) | $2779.19 | $184.70 | $707.23 | $4.14 | $0.65 | $0.49 | $45.18 |

| % change | +84% | +87.03% | +31.55% | +140% | +62% | +95% | +309% |

| Price (23/06/2025) | $2238.50 | $132.89 | $619.84 | $0.248 | $0.2745 | $0.272 | $35.9 |

| % change | -24.2% | -26.68% | -9.65% | -40% | -54.47% | -43.2% | -19.28% |

- Geopolitical tensions in the Middle East and the Federal Reserve’s decision to maintain unchanged interest rates continue to influence market dynamics.

DeFi Weekly Total Value Locked (TVL) decreased from $111.6B USD to $106.50B USD (-4.6%), driven by macroeconomic factors, particularly escalating war-related news between Iran and Israel. This contributed to a Month-to-Date (MTD) TVL decline of -7.6% compared to May 2025, establishing a bearish trend since the start of the month.

Decentralized Exchange (DEX) Weekly Volume maintained growth, rising from $96.82B to $106.88B (+10.4%), with MTD volume reaching $285B USD, a 34.4% increase from May. This surge, driven by ‘Binance Alpha,’ ended the short-term downward trend observed since March.

| DeFi Market Weekly | ||||||

| Weekly | 1/6 – 8/6 | 8/6 – 15/6 | 15/6 – 22/6 | |||

| TVL | $111.59 | $111.60 | $106.50 | |||

| % change | – | 0.0% | -4.6% | |||

| Dex Volume | $96.05 | $96.82 | $106.88 | |||

| % change | – | 0.8% | 10.4% | |||

| Stablecoin | $250.40 | $251.74 | $251.52 | |||

| % change | – | 0.5% | -0.1% | |||

| DeFi Market Monthly | ||||||

| Monthly | 01/2025 | 02/2025 | 03/2025 | 04/2025 | 05/2025 | MTD |

| TVL | $115.00 | $109.00 | $93.00 | $88.00 | $115.21 | $106.50 |

| % change | 0% | -5.2% | -14.7% | -5.4% | 30.9% | -7.6% |

| Dex Volume | 564 | 379 | 247 | 242 | 212 | 285.00 |

| % change | 0% | -32.8% | -34.8% | -2.0% | -12.4% | 34.4% |

| Stablecoin | $205.0 | $218.0 | $228.0 | $233.0 | $243.3 | $251.7 |

| % change | 0% | 6.3% | 4.6% | 2.2% | 4.4% | 3.4% |

TVL, Dex VL & Stable Breakdown

Last week’s TVL breakdown showed shifts in % dominance and unclear differentiation as the market declined (with capital being swapped into safe-haven assets). Month-to-Date (MTD) data recorded ETH as the top performer with 55% dominance (~$58.9B TVL), followed by SOL at #2 (7.4%, ~$7.95B TVL), BNB at #3 (5.45%, ~$5.82B TVL), and Base at #4 (3.36%, ~$3.59B TVL).

Compared to May 2025, ETH and BNB were the two assets with higher MTD dominance performance than other asset classes.

- In May, ETH had a dominance of 53% compared to an MTD dominance of 55% (up +3.6%), BNB had a dominance of 5.29% compared to an MTD dominance of 5.45% (up +2.9%). SOL had a dominance of 8% compared to an MTD dominance of 7.4% (down -7.5%).

DEX Volume: BNB and SOL exhibited the strongest trade volume performance in the market. BNB maintained robust transaction flow within its ecosystem, reaching $254B, a 28.38% increase compared to May. Following closely, SOL recorded $112B, up 11.3% from May, driven by CEXs (Bybit and OKX) boosting value directly from their DEXs for SOL.

Conclusion

In June 2025, Total Value Locked (TVL) showed signs of decline, influenced by macroeconomic events. Top coins and altcoins are trending downward, approaching price levels seen in early April 2025. Analysts recommend monitoring market reactions and capital flows over the next 2–3 weeks, noting that historical data from June to August 2024 indicates short-term bearish market performance.

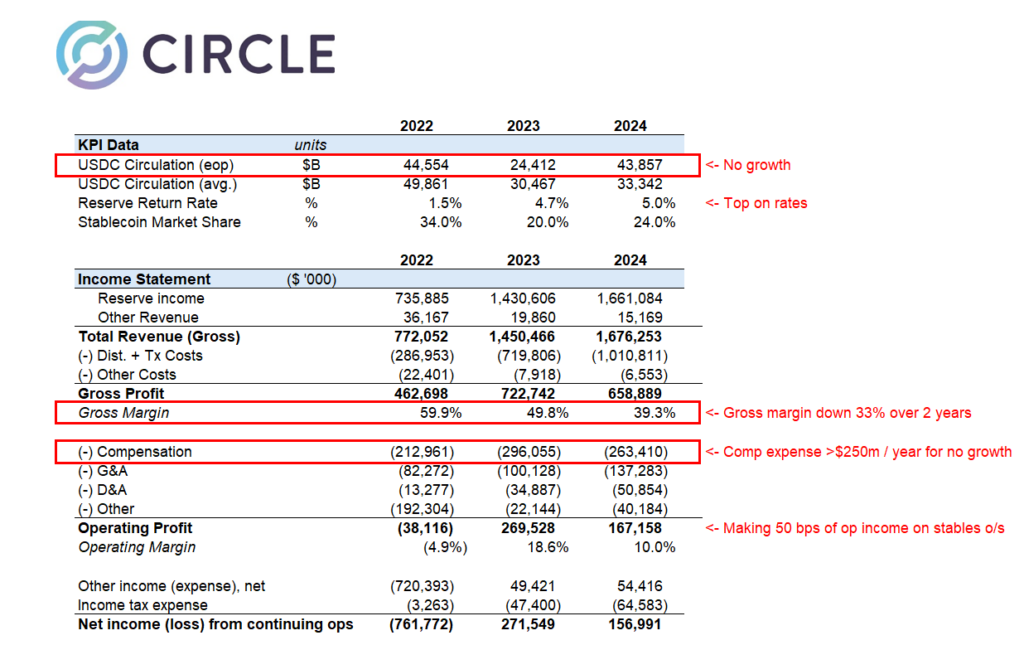

3. Circle – USDC IPO & CoinBase

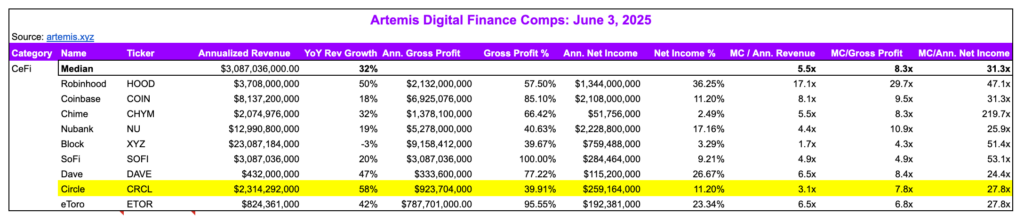

The Senate passed the GENIUS Act (stablecoin approval) with a 68-30 vote late Tuesday. Circle successfully listed its IPO under the ticker $CRCL at a current price of $240, with a market capitalization of $54.4B.

In the latest strategic agreement between USDC and Coinbase:

- Revenue will be shared based on the amount of $USDC held on each platform.

- Interest income will now be equally divided from any $USDC held off-platform, such as in DeFi wallets.

This structure resulted in USDC generating $1.6B–$1.7B in revenue for 2024, with 60% of the revenue value distributed to Coinbase and third parties.

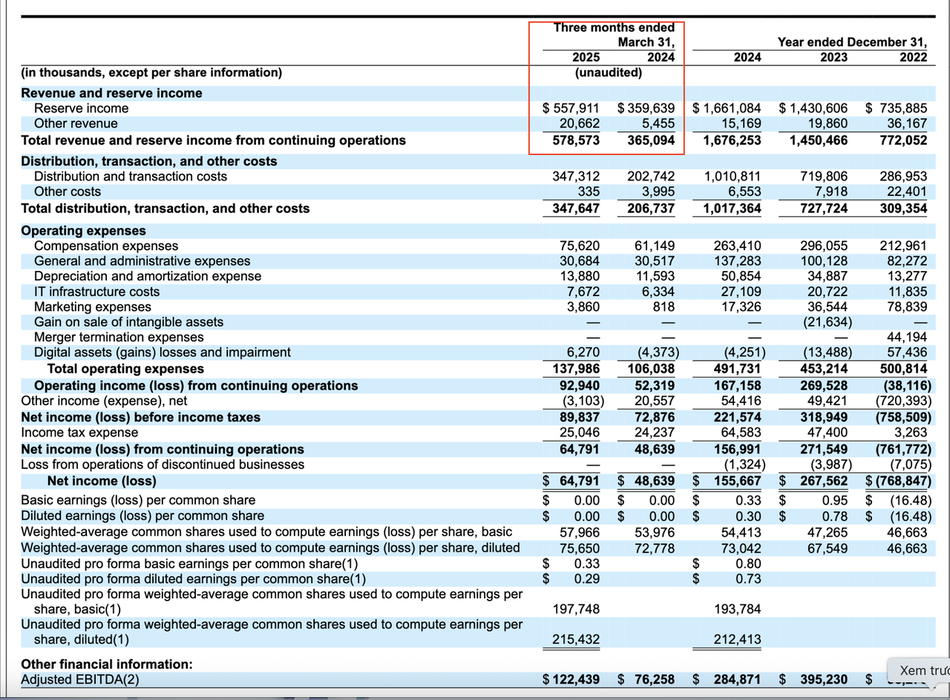

Following the official listing of USDC’s $CRCL IPO, the Q1/2025 report revealed revenue growth from $365M in Q1/2024 to $578M in Q1/2025, a 68% increase year-over-year.

Consequently, annualized revenue reached $2.3B, up 59% year-over-year (YoY), and annualized net income hit $259M, up 32% YoY. This growth trajectory suggests Circle could surpass fintech peers like Robinhood, Coinbase, and SoFi.

- EV/Revenue = 3.1x (compared to fintech average of 5.5x)

- EV/Gross Profit = 6.7x (compared to fintech average of 8.3x)

- EV/Net Income = 12.6x (compared to fintech average of 31.3x)

CRCL’s valuation remains low compared to fintech competitors, with key risks including:

- A sharp decline in bond yields, directly impacting CRCL’s revenue.

- Rising distribution costs as USDC scales beyond its platform.

- Increasing competition from new stablecoin entrants, including major players like Amazon and Walmart.

- Tether’s continued dominance as the top stablecoin, with USDT scaling rapidly in the U.S. market.

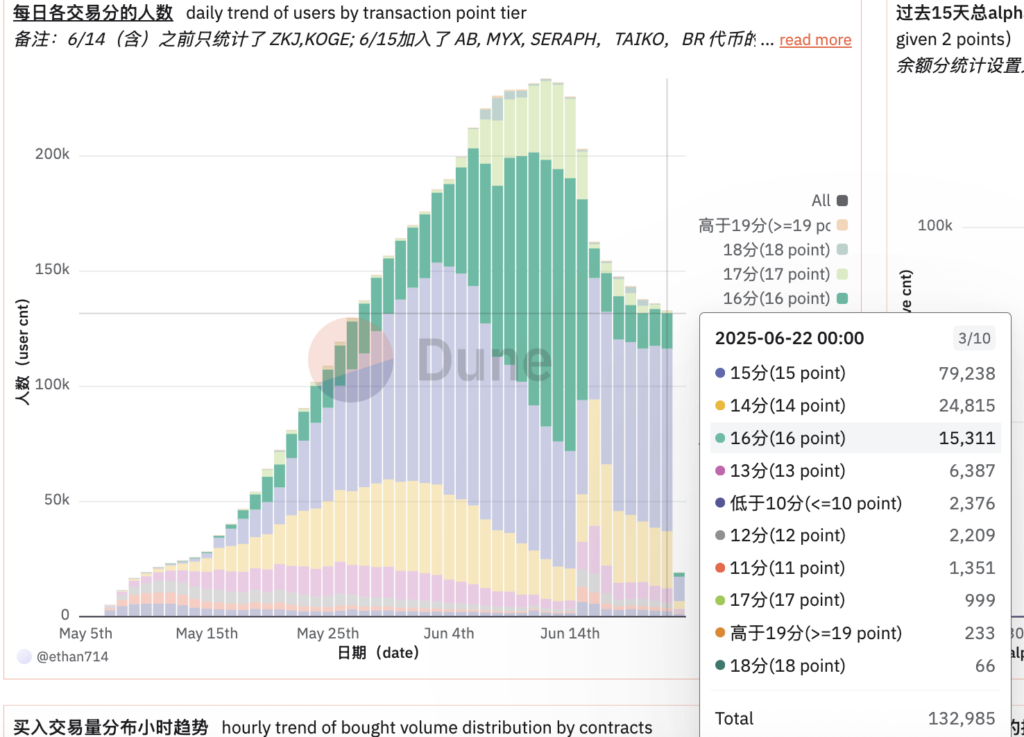

4. Binance Alpha Update

On-chain data following the sharp decline of ZKJ and KOGE shows users returning to trading, with over 79,000 addresses recording a daily trading milestone of 15x after the Bedrock project officially supported liquidity for the BR/USDT pair on PancakeSwap, with liquidity exceeding $45M USD.

The BR/USDT pair achieved a stable 24-hour trading volume of $320M/day, supporting users in farming points and adding liquidity.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.