1. Executive Summary

Xitadel is a next-generation DeFi protocol that introduces a novel fixed-income instrument the Liquid Treasury Token (LTT) — designed to unlock productive capital from Web3 treasuries without diluting ownership or crashing token prices. The protocol allows Web3 projects, DAOs, and VCs to raise stablecoin capital through overcollateralized debt issuance, where repayment is enforced by smart contract logic and safeguarded by real-time collateral monitoring.

This model fills a critical post-TGE funding gap in the market by enabling projects to raise working capital against locked or illiquid tokens, while offering investors predictable yield with downside protection. By combining the trust-minimized guarantees of DeFi with fixed-income-style structure, Xitadel offers a credible fixed-term lending marketplace that is both compliant and scalable.

By seamlessly blending the trust-minimized assurances of DeFi with a structured fixed-income approach, Xitadel delivers a credible, compliant, and scalable fixed-term lending marketplace. This positions Xitadel as a category-defining protocol at the nexus of fixed-income finance, DAO tooling, and DeFi infrastructure, poised to resolve a systemic inefficiency within on-chain capital markets.

2. Project analysis

2.1. The Post-TGE Capital Dilemma

After a Token Generation Event (TGE), Web3 projects frequently find themselves in a peculiar bind: while they often possess substantial holdings of their native tokens, securing operational capital without diluting their ownership or destabilizing token markets becomes a significant challenge.

This dilemma presents several key pain points:

- Market Pressure: Selling tokens post-TGE invariably depresses their price due to increased supply, creating unwanted market pressure.

- Permanent Dilution: Efforts to diversify treasury assets often result in a permanent dilution of the project’s core holdings.

- Inefficient Debt Solutions: Traditional over-the-counter (OTC) debt arrangements are plagued by a lack of transparency, slow execution, and often fail to meet compliance standards.

- Fragmented DAO Funding: Decentralized Autonomous Organizations (DAOs) struggle with fragmented funding mechanisms and a notable absence of structured financial tools.

Simultaneously, the broader crypto capital market remains heavily skewed towards short-term speculation. It conspicuously lacks a structured debt layer, an equivalent to the bonds or notes that are fundamental to traditional finance (TradFi).

2.2. Solution what Xitadel do?

Xitadel introduces Liquid Treasury Tokens (LTTs) overcollateralized, fixed-term crypto instruments that provide working capital to token-rich entities without token liquidation.

Here’s how it works at a high level:

- Projects deposit native tokens as collateral. This secures the loan with existing assets

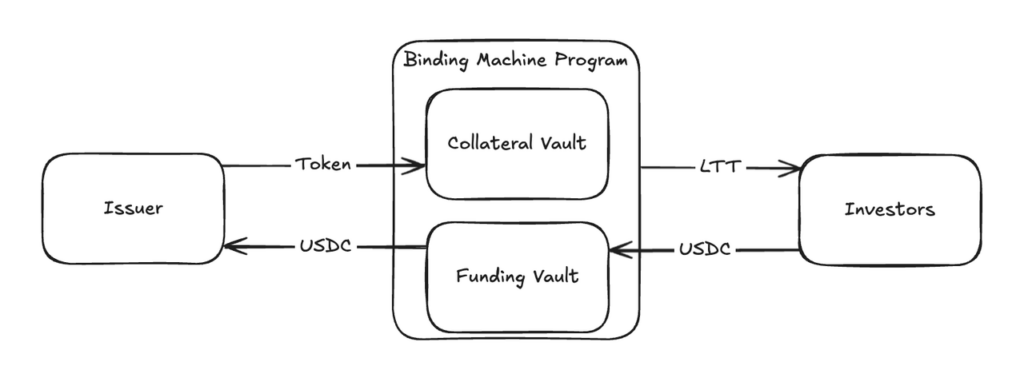

- Xitadel mints LTTs and sells them to investors in exchange for stablecoins

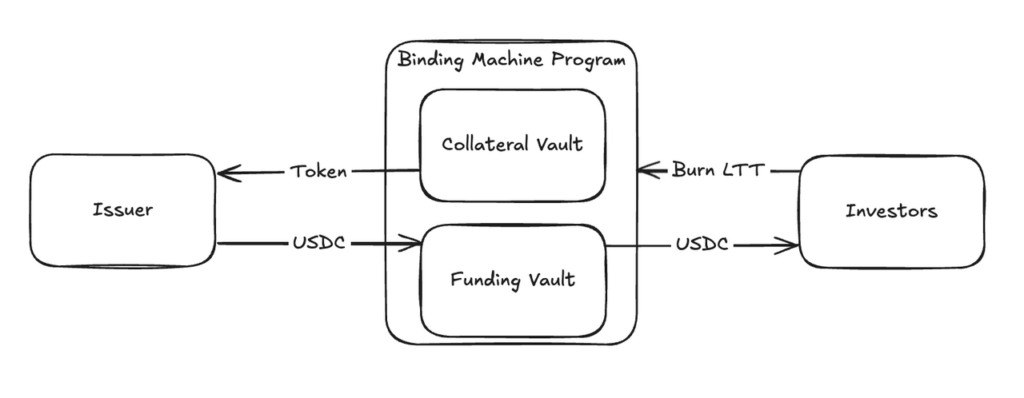

- LTTs mature at a defined future date, returning principal plus fixed interest to investors

- The deposited collateral is locked and continuously monitored on-chain. This crucial step ensures security. If the collateral’s price drops significantly or the issuer defaults, LTT holders can directly claim the collateral

This entire process is robustly enforced by smart contract programs, notably the Binding Machine Program, which meticulously governs the lifecycle transitions and repayment mechanisms.

- Stablecoins (USD-LTT) – predictable fixed yield. The USD Type is a zero-coupon structure offered on Xitadel platform, where investors receive a fixed amount of stablecoin as interest at maturity. This format is designed to provide stable and predictable returns for investors who prefer to avoid the volatility of native tokens.

- Native tokens (COIN-LTT) – bullish, variable-yield structure. The Coin Type is a also zero-coupon structure offered on Xitadel platform, where investors receive a fixed amount of native token as interest at maturity. This format provides a new way to earn benefit from potential token price appreciation while avoiding loss of principal.

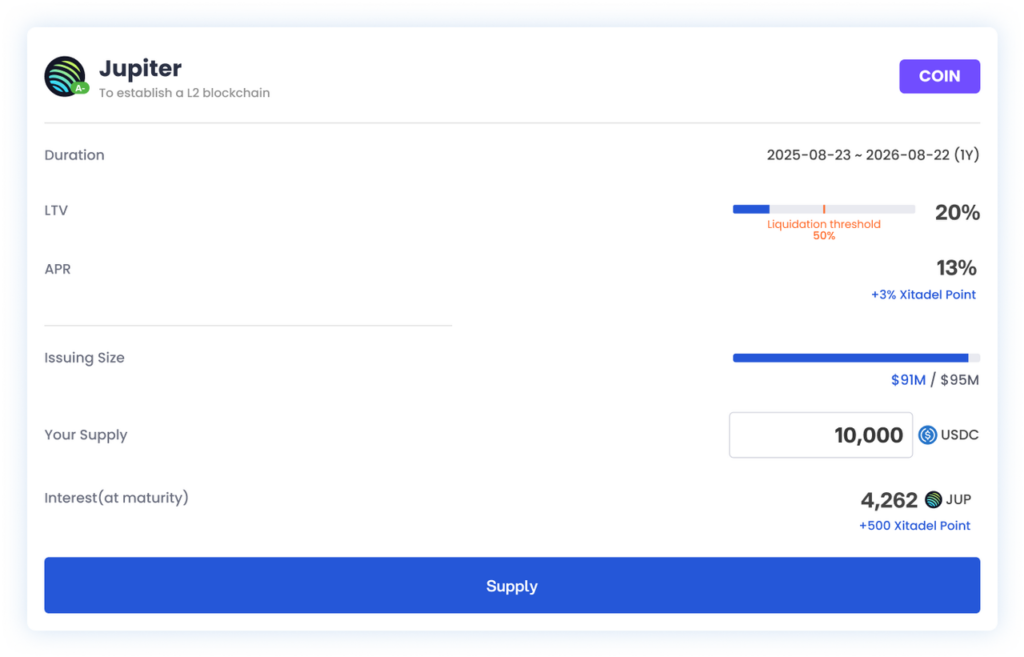

For example, Jupiter may issue a Coin Type LTT to raise $100M with a 13% interest rate (with 5% LP Allocation). Upon maturity, investors receive their principal and interest in $JUP tokens, based on a fixed quantity determined at the time of issuance. Let’s assume the price of $JUP is 0.305 USDC when the LTT is issued. An investor who supplies 10,000 USDC would receive 4,262 JUP as interest at maturity, along with their principal.The key characteristic of the Coin Type is that the amount of tokens to be distributed as interest is predetermined. This means the actual return for investors will fluctuate based on the token price at maturity.If the price of $JUP increases by the time the LTT matures, the effective interest rate rises. Conversely, if the token price decreases, the realized interest rate falls. This dynamic makes the Coin Type a high-reward potential product for those bullish on the issuer’s token.

Xitadel is more than just a DeFi protocol it builds core capital markets infrastructure for the on-chain economy. Fixed-income layers are missing in Web3, and Xitadel enables:

- Sustainable DAO treasury management

- On-chain non-dilutive capital formation

- DeFi-native yield instruments for stablecoins

- Institutional-style debt with protocol-level enforcement

The fixed-term, collateral-backed structure of LTTs could be a foundational primitive akin to bonds in TradFi, with composability across DeFi money markets, derivatives, and treasuries.

3. Mechanics and Product Design

3.1. Lifecycle Overview

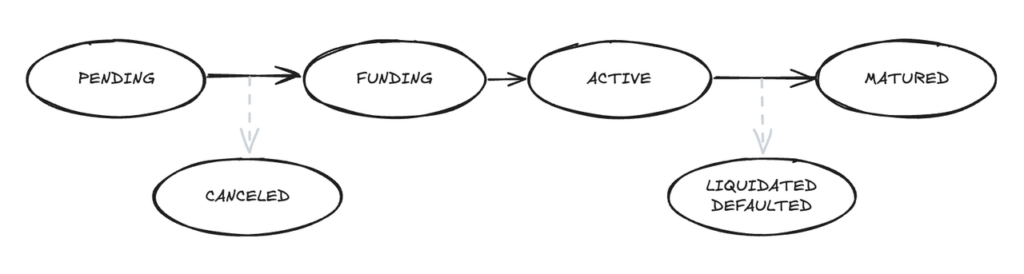

Each LTT follows a strict sequence of on-chain lifecycle states:

- Pending – parameters set, collateral locked.

- Funding – investors contribute capital.

- Active – raise success, interest accrues.

- Matured – issuer repays, investors redeem.

- Liquidated / Defaulted / Canceled – failure paths with collateral fallback.

All transitions are governed by smart contract logic, enforced by the Keeper Bot and monitored by decentralized Watchtower nodes.

3.2. Collateral and Safety Mechanics

- Overcollateralized: LTV thresholds are enforced based on volatility, liquidity, and market depth of the native token.

- Liquidation Triggers: Real-time price feeds via oracles initiate liquidation processes if thresholds are breached.

- Investor Protection: In default scenarios, LTT holders can burn their tokens to claim a share of the locked collateral.

3.3. Secondary Market

Each LTT issuance includes an embedded AMM liquidity pool, seeded with a 5% slice of the issuance. This provides price discovery, trading flexibility, and exit optionality before maturity.

4. Market and Use Cases

4.1. Target Customers

A. Web3 Protocol Foundations

- Need stable coins for grants, development, liquidity incentives.

- Don’t want to dump native tokens on the open market.

- LTTs offer a non-dilutive, compliant funding path.

B. DAOs

- Often hold governance tokens but lack stable working capital.

- DAO governance can approve LTT issuance transparently.

- Keeps funding on-chain, community-led, and traceable.

C. Venture Capital Funds

- Hold large token allocations but want liquidity to reinvest.

- Can issue LTTs against illiquid positions.

- Can also act as lenders seeking yield on idle stablecoins.

D. DeFi Investors

- Desire structured, fixed-yield products with downside protection.

- Choose between stablecoin-based (safe) or token-based (growth) returns.

4.2. Competitors

| Project | Model | Fixed Terms | Collateralization | Risk Protection | Liquidity |

| Xitadel | Overcollateralized LTTs | ✅ | ✅ | ✅ Smart Contracts + Bots | ✅ AMM-based |

| Goldfinch | Real-world loans | ❌ | ❌ | ❌ | ❌ OTC |

| Maple Finance | Under-collateralized DeFi credit | ✅ | ❌ | ❌ | Limited |

| TrueFi | Unsecured institutional lending | ✅ | ❌ | ❌ | Medium |

| Ribbon / Pendle | Yield instruments on DeFi tokens | ✅ | Market-based | Partial | Medium |

Key Differentiators

- Xitadel is on-chain, overcollateralized, and programmable.

- Unlike others, it’s not reliant on off-chain legal agreements.

- LTTs resemble fixed-term notes with DeFi-native risk controls.

5. Token Economics and Revenue Model

Protocol Revenue

- LP residuals after settlement (if value > liability).

- Fee capture on LTT issuance or AMM trades.

- Potential future revenue: LTT rating services, insurance integration.

Xitadel is not dependent on token incentives or inflation-based rewards. Yield is generated from borrower obligation, aligning incentives more closely with TradFi models.

6. Key Risks

| Risk Category | Description | Mitigants |

| Collateral Volatility | Sharp drop in token value may trigger default or poor recovery | Overcollateralization, real-time monitoring |

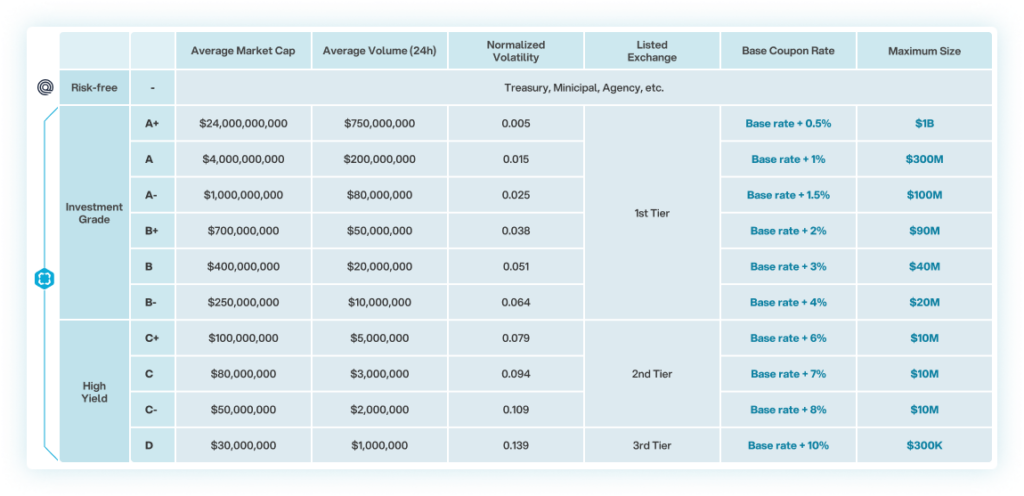

| Fraudulent Issuers | Issuers could collateralize with illiquid or junk tokens | LTT rating model, due diligence, whitelisting |

| Smart Contract Risk | Protocol exploits or bugs | Formal audits (e.g., Halborn), on-chain logic |

| Oracle Manipulation | Incorrect prices triggering false liquidations | Decentralized oracles, Watchtower validation |

| Market Liquidity | Lack of secondary market liquidity on long-dated LTTs | Built-in AMMs seeded from issuance |

Xitadel does not issue instruments resembling equity or revenue-sharing contracts:

- LTTs are debt obligations, not securities.

- Issuers must pre-fund redemptions.

- Investors have no governance rights. This limits classification risk, while being compatible with evolving stablecoin and debt security regulations.

6.1. Investment Thesis

We believe Xitadel represents a high-conviction, asymmetric opportunity at the convergence of structured finance and decentralized trust.

6.2. Why We Are Bullish

- Solves a real and growing problem: post-TGE capital gaps.

- Highly composable: usable by DAOs, VCs, DeFi protocols.

- No token emissions required to sustain yields.

- The market pulls from both capital-seeking projects and yield-hunting investors.

- Thoughtful engineering: overcollateralized design, lifecycle FSM, embedded liquidity.

6.3. Strategic Upside

- Xitadel could become the bond desk of Web3.

- It enables native debt markets, complementing token equity models.

- Long-term potential for structured products, CDOs, tranches, and more.

Xitadel is pioneering a missing financial primitive in the decentralized economy: structured, secure, on-chain debt issuance. Its LTT framework bridges the stability of fixed-income instruments with the openness of DeFi. With post-TGE treasuries swelling across the ecosystem, expect demand for non-dilutive, compliant capital to explode and Xitadel is one of the only protocols positioned to meet it at scale.

Recommend pursuing further due diligence and initiating an early-stage investment conversation, particularly if the team can demonstrate strong early adoption, responsible credit assessment frameworks, and successful LTT repayments across reputable Web3 issuers.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.