1. Recommendation & Position Summary

Pendle has successfully leveraged its business model by packaging crypto assets (including stablecoins) into a “zero-coupon” market that provides a fixed yield. This has created a leading product with a strong Unique Selling Point in the yield market sector, boasting approximately $8 billion USD in TVL and ranking among the top 7 DeFi projects.

On August 7, 2025, Pendle further expanded its offerings by packaging “yield from funding rates” into a hedging product. This addresses a significant issue for the perpetual futures (PERP) market and for institutional and retail investors.

Action: The analyst recommends opening a position

- Spot: Long 1x the $PENDLE token at a price of $5.45

- Allocation: 1.5% of NAV, with 20% of that 1.5% allocated weekly

| Token | Price Recommend | Price | Weekly | Monthly |

| $PENDLE | $5.45 | $5.45 | 40% | 47% |

- Price Spot: $5.45

- Price target: $15

- Stop Loss: -25% from the final DCA (Dollar-Cost Averaging) price

- Time position spot: 3 months

- Leverage: 1x

- ROI: 175.2%

- Reward/Risk: 2.33: 1

2. Investment Thesis

2.1. Breakout Performance in Q4 2024 & H2 2025

Exceptional Growth in TVL & DEX Volume

Pendle’s TVL has seen a nearly 20x increase, with daily DEX volume reaching $300M on its AMM. By mid-2025, TVL continued its record-breaking ascent to approximately $8.57B (a +100% quarter-over-quarter increase).

Pendle has secured its position as the top player in the yield market, directly benefiting from the “era of interest-bearing stablecoins”. The protocol has generated over $6B in TVL for Ethena, accounting for 80% of Pendle’s total TVL. This fixed-yield market is set for further explosive growth as stablecoins continue to flourish.

2.2. Second Product Market Fit: Hedging Funding Rates

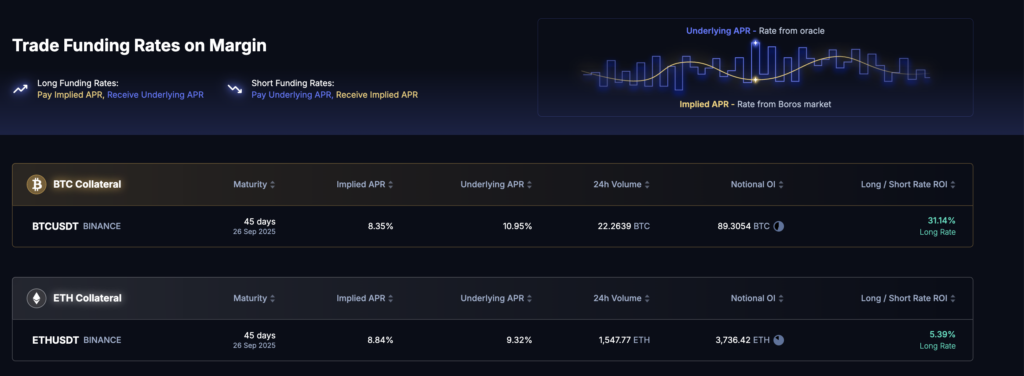

The launch of the new product, Boros on Arbitrum (August 2025), is a key driver. This product, which offers “hedging funding rates,” taps into the massive perpetual futures (PERP) market with an Open Interest (OI) of $198B. It creates a completely new, significant yield source (10-15% per year) for investors, particularly institutions, by allowing them to directly trade BTC/ETH perpetual funding rates.

This product meets a critical need for high-frequency trading institutions (like Ethena and Hedge Funds) for hedging, solidifying Pendle’s lead in “decentralized financial yield.

2.3. Sustainable Revenue Model & Token Value Accrual

Pendle generates revenue from two main sources: its AMM and total yield, collecting a 5% fee. The protocol’s revenue is distributed to vePENDLE holders, with only 0.15% going to the treasury. This structure strongly incentivizes token locking and drives positive feedback for the token.

Over the last 30 days, Pendle’s DEX trading volume reached approximately $5.43 billion, generating around $2.14 million in net earnings. Annualized, this translates to $25–30 million, demonstrating the high efficiency of the model.

2.4. Sustainable Tokenomics & Future Valuation

The veToken model and 100% token unlock status mean there is no longer selling pressure from investors. The effective circulating supply is only 60%, with the remaining 40% locked as vePENDLE for voting rights. As Pendle’s business model strengthens, the value of the $PENDLE token is expected to continue rising.

It is projected that the MC/TVL ratio for Pendle will increase from 0.11 to 0.3, leading to a potential market cap of $2 billion USD and an FDV of $2.3 billion.

2.5. Expanding Ecosystem

Pendle has already integrated with a wide range of blockchains including Ethereum, Arbitrum, BSC, Mantle, Optimism, Base, Sonic, and Berachain. The platform is now expanding to include Solana, Hyperliquid, and TON—three chains currently seeing significant stablecoin volume and high-performance retail trading. This strategic expansion is designed to reach new users and broaden its market.

A key long-term catalyst is the plan to offer “KYC yield” products in partnership with traditional institutions like Citadel. This initiative will open up the market to institutional investors, paving the way for future growth.

3. Business Model & Snapshot Metric

Pendle Finance is addressing significant challenges in the “interest rate/yield” market with two main products:

3.1. Yield Trading/ Zero Coupon

Users deposit yield-bearing assets (e.g., stETH, wETH, or interest-bearing stablecoins) to mint Principal Tokens (PT) and Yield Tokens (YT). Pendle’s AMM facilitates the trading of these PTs and YTs, allowing users to:

- Lock at a fixed rate by holding PTs.

- Speculate on the yield by trading YTs.

This product has been a massive success, driving impressive metrics for Pendle:

- TVL: $8.5 billion (+214% Year-over-Year)

- Cumulative DEX Volume: $33 billion

- Total Revenue: $58 million since 2024

- Net Income for Token Holders: $42 million since 2024

3.2. Boros Hedging Funding Rate

Boros is Pendle’s platform that allows users to trade and profit from fluctuations in funding rates within the perpetual futures market. It functions as a decentralized marketplace for buying and selling interest rates, both fixed and floating, directly on the blockchain.

- The Total Addressable Market (TAM) for perpetual futures has an Open Interest (OI) of approximately $200 billion, with an annual interest rate yield of around 10%. This significant market has motivated Pendle to target a substantial share, aiming for over 20% of the TAM, or $40 billion.

- Pendle’s first-mover advantage, deep understanding of market needs, and strong institutional backing position Boros with immense potential to become protocol’s second major Product Market Fit (PMF).

| Metric | 07.2025 | 08.2025 (MTD) | Comment |

| Price | $4.5 | $5.89 | 20% m/m |

| Market Cap | $756M | $992M | 17% m/m |

| Circ. Supply | 168M | 168M | Approximately 60% of the total supply is in circulation, while the remaining 40% is locked as veTokens for voting |

| Staking | 58M | 58M | +5% QoQ |

| Total Supply | 281,527,448 | 281,527,448 | Any subsequent increases will come from incentives |

| FDV | $1,27,764,165 | $1,667,764,165 | 35% m/m |

| TVL | $6.8B | $8.5B | 25% m/m |

| Revenue | $3.16M | $1.6M | Pendle’s all-time revenue is $58M |

| Dex Vol | $4.2B | $1.8B | Median Dex Vol: $1.8B – $3B monthly. With a 0.15% fee on median volume, Pendle maintains a consistent positive cash flow. |

| Raised Fund | Total Raised: $17.14 million USDTier VCs: Binance, Spartan, Hashkey Capital… | ||

| Competitive | Within the yield sector, protocols like Royco Protocol and Convex Finance were competitors. However, their TVLs have now decreased by as much as 90%, and other “Pendle-clone” projects on different chains have also ceased development.Pendle has maintained its top position due to its pioneering and distinctive business model. | ||

4. Catalyst Timeline

| Timeline | Events | Expected Impact |

| H2-2025 | End of July 2025, Pendle launches Boros on Arbitrum.Enables trading of BTC/ETH funding rate spreads.Product debut with an OI limit of $10M per pair, 1.2x leverage, and a vault mechanism for LPs. | Major milestone, expanding Pendle’s business scope from staking yield to margin yield.Access to the PERP market with $196B OI, highly promising for Pendle.Boros product enables institutions, hedge funds, and trading firms to access “Hedge Yield”. |

| Q3-Q4 2025 | In the coming months, Pendle will add more pairs (SOL, BNB, SUI…) and integrate it with more exchanges/platforms (Hyperliquid, OKX & Bybit…).Gradual rollout of Boros Vaults, allowing LPs to provide liquidity (earning swap fees and PENDLE rewards). | Expanding into popular asset pairs and across multiple exchanges will amplify the user base, especially on Hyperliquid.Pendle token holders benefit most as Boros LP Vaults share swap fees, indirectly pushing $PENDLE price upward. |

| Q4 2025 | Pendle announces roadmap to support additional non-EVM platforms such as Solana, Hyperliquid L1, and TON. | This strategy reduces the emergence of “Pendle clones” on other chains and enables broad coverage following a blue ocean strategy. |

| End of 2025 | Project to launch a “KYC yield” variant for traditional funds and institutions. | Expands market reach to regulated investors, tapping into the traditional finance segment. Collaboration with Ethena (launching Conver chain) to focus on TradFi organizations. |

5. Valuation

Compared to competitors with similar market caps (but different business models), Pendle’s MC/TVL multiple is relatively close to the median.

For example, Lido manages a massive amount of staked ETH (with TVL tens of times larger), yet its market cap is only slightly higher than Pendle’s. However, Pendle benefits from a new niche market and its multi-chain potential. This positions Pendle for significant growth, with its MC/TVL ratio projected to increase from 0.11 to 0.3.

| Projects | FDV ($B USD) | FDV vs Median | Market Cap (B) | MC vs Median | MC/TVL |

| Pendle | $1.60 | 1.07 | $0.93 | 0.7464 | 0.11 |

| LDO | $1.40 | 0.93 | $1.30 | 1.04 | 0.04 |

| Ethefi | $0.54 | 0.36 | $1.20 | 0.96 | 0.05 |

| Sky | $2.01 | 1.34 | $1.80 | 1.44 | 0.32 |

| Median | 1.5 | 1.25 | 0.08 | ||

6. Tokenomics

- Total Supply: 281,527,448 tokens, with a 2% annual inflation rate beginning in May 2026

- Circulating Supply: 164,744,520 tokens, which is approximately 63% of the total supply

Pendle’s tokenomics model is similar to CRV and Aerodrome (Base), focusing on value accrual for all participants. Liquidity Providers (LPs) are rewarded with $PENDLE tokens, while $vePENDLE holders receive a share of the protocol’s swap fees. This structure ensures a positive feedback loop by providing deep liquidity and minimal slippage for traders.

A key factor is that there’s no longer any selling pressure from investors or the team, as the token vesting schedule for both groups was fully completed in September 2024.

All tokens currently entering circulation are from incentives. The protocol is in its 83rd week of emissions, releasing 600,000 $PENDLE per week (2.4M $PENDLE or ~$8.4M USD per month). This emission rate will decrease by 1.1% each week until April 2026. After that, a new inflation schedule of 2% per year will begin in May 2026, which translates to roughly 5M $PENDLE based on a circulating supply of $251M.

Currently, 55M $PENDLE tokens are staked, representing 19.5% of the total supply. This leaves the actual circulating supply on the open market at approximately 167M $PENDLE.

7. Key Risk

- Legal and Regulatory Risk: New products, such as interest-bearing stablecoins and yield trading, could face increased regulatory scrutiny. A crackdown on cryptocurrency operations, particularly on stablecoins or derivatives, or the introduction of strict digital asset management requirements, could negatively impact DeFi yield.

- Competition: Pendle cũng chịu cạnh tranh gián tiếp từ Lido/EigenLayer (đối thủ restaking) và các nền tảng yield aggregator khác. Sự thành công của những giao thức này có thể chia sẻ dòng tiền của nhà đầu tư.

- Technical Risk: The complexity of Pendle’s design, particularly its yield tokenization and AMM mechanisms, exposes it to smart contract vulnerabilities and potential bugs. A discovered exploit could lead to the loss of user assets. Additionally, oracles or complex yield calculations could malfunction or become inaccurate during periods of high market volatility.

- General Market Risk: Overall market sentiment and macroeconomic developments (e.g., global interest rates, financial crises) can significantly impact the project’s performance, regardless of its underlying fundamentals.

8. Position Sizing & Implementation Plan

- Target position size: We recommend allocating 2-4% of NAV for this long-term PENDLE position

- Buy zone: $5 – $5.45

- TP1: $10

- TP2: $15

- Stop loss: -22% from the total DCA (Dollar-Cost Averaging) price

- Time: 3-4 months

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.