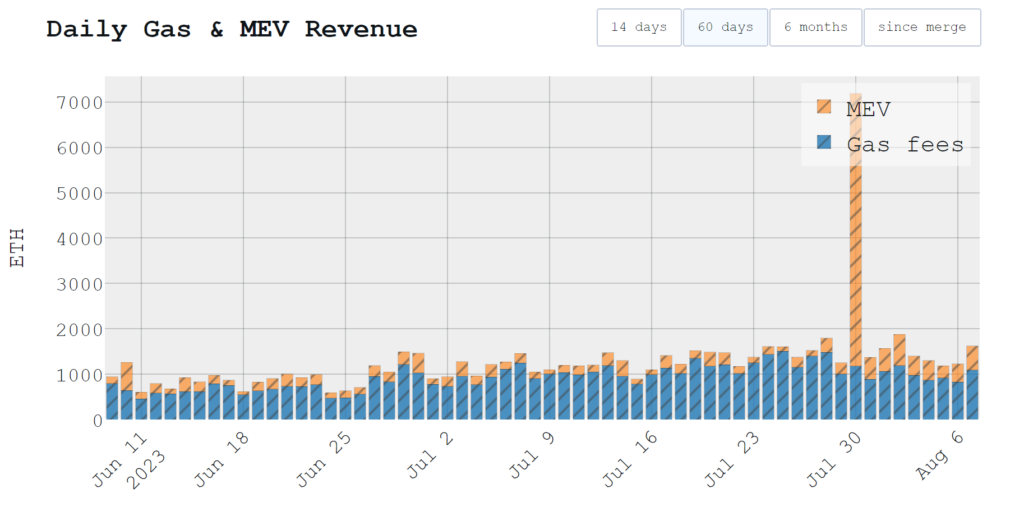

Last week, Ethereum experienced the most profitable day for MEV block rewards since the Merge, with 6,006 ETH ($11.1 million) paid out. The exploitation of several Curve pools facilitated MEV bots front-run the transactions, resulting in significant rewards. Specifically, block 6,992,273 received a block reward of 584 ETH (approximately $1.08 million), while blocks 6,993,342 and 6,992,050 received rewards of 345 ETH ($641,000) and 247 ETH ($459,000) respectively. This is notable because the average daily MEV block reward typically amounts to only 0,060671 ETH ($111) per block.

The term MEV steadily grows in popularity in this space. So, what is MEV, and how can we reduce its impact on the network?

Introducing MEV

Maximal extractable value (MEV) refers to the maximal value that can be extracted from block production (excluding block rewards and gas fees) by eliminating and rearranging the order of transactions within a block.

Since The Merge, Ethereum has transitioned to a proof-of-stake mechanism, where validators are responsible for block production instead of miners. The block production process involves validators bundling transactions into a block, which is then validated by the entire network of nodes. If the block passes validation, it is added to the ledger. The network ensures that all transactions are added to the block, but in reality, there is no guarantee that the transactions will be arranged exactly as they were sent to the network.

Each block has a limited number of transactions that it can contain, which facilitates validators the complete freedom to select transactions from the mempool and include them in their block. They can take advantage of this opportunity to rearrange the order of transactions and extract the value. In simpler terms, MEV refers to the value extracted by manipulating the order of transactions.

MEV-Boost

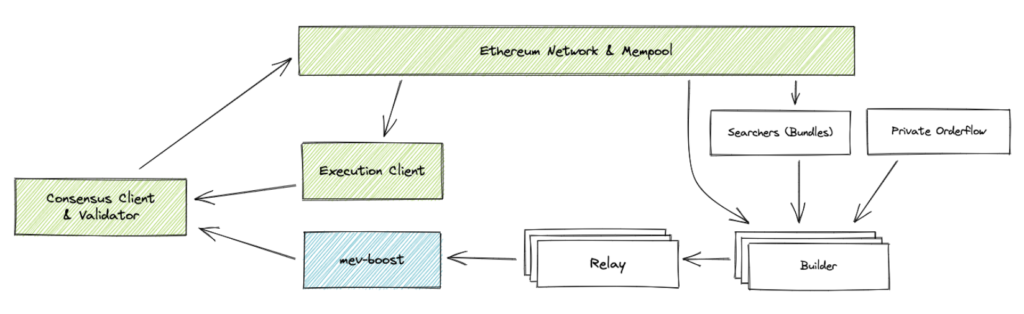

Proposer Builder Separation (PBS) is anticipated to enhance Ethereum’s infrastructure post The Merge, splitting the role of validators into block proposers and block builders. In this setup, block builders are responsible for including transactions into the block and forwarding them to block proposers, who then propose the block to the network for validation.

While this function would have promoted decentralization on Ethereum, it was not deployed due to its complexity. However, after The Merge, the developers of Flashbot implemented Proto-PBS using an open-source protocol called MEV-Boost, enabling validators to outsource block building according to their demand.

MEV-Boost mechanism

- POS node operators run three software components: validator clients, consensus clients, and execution clients. MEV-Boost is a tool that supports the consensus client, allowing for the outsourcing of block building by a network of block builders.

- Block builders set up the blocks that are optimized aim to deploy MEV, and then send these blocks along with their bids to the Relay, which aggregates blocks from multiple block proposers. The consensus client of the proposing validator forwards this block to the network for validation and creates the valid block.

- Relay has the ability to review all of the blocks are sent by block builders to validate their validity and the bid price paid to validators. Only the block with the highest bid price is forwarded to the validators. At present, there are over twelve relay providers in the market, with four of them accounting for 70% of the market share. The top relay providers include Flashbot, Ultra Sound, Bloxroute and Agnostic Gnosis. Relays do not generate profits, so they lack the incentive to encourage the involvement of counterparties.

- Searchers play a crucial role in the network of block builders. They are individuals who identify opportunities to extract value during block production. There are various strategies they can employ, such as arbitrage, sandwich attacks, and frontrunning… Currently, the vast majority of searchers are MEV bots. These bots scan the mempool to identify worth-value transactions and execute the mentioned strategies by adding new transactions, rearranging the order of transactions, bundling them together, and sending them to the block builder. Typically, searchers are entities that offer the highest fees (which can account for up to 90% of their profit) to ensure their transactions are included in the block.

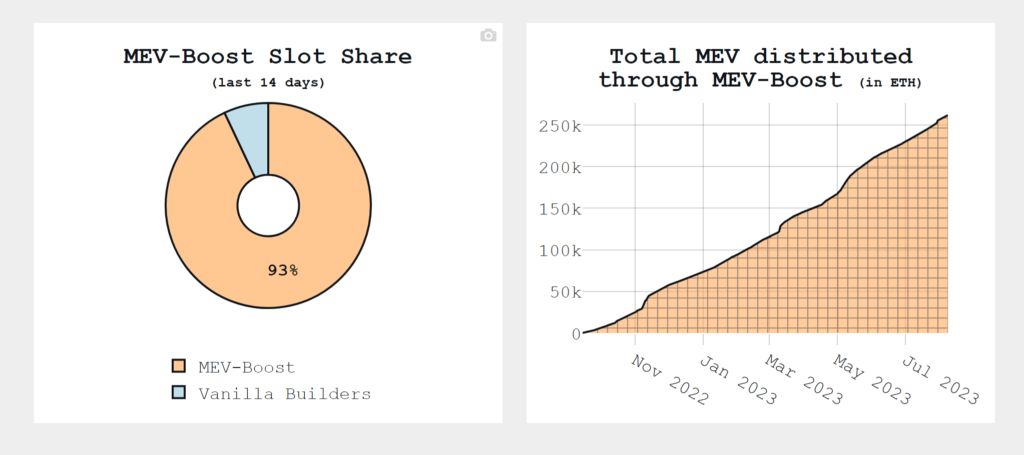

Currently, 93% of blocks on Ethereum are produced by MEV-boost, with a total revenue of approximately 261,826 ETH ($470 million) since The Merge. In reality, the vast majority of transactions that take place on the blockchain are conducted by MEV bots, which automatically program detect opportunities to generate profit from the transactions, such as arbitrage bots and sandwich bots. According to Glassnode, approximately 70% of the trading volume on Uniswap (Ethereum) is attributed to arbitrage bots and sandwich bots, while the remaining 30% represents human trading activity.

Does ERC-4337 reduce the impact of MEV-Boost on Ethereum?

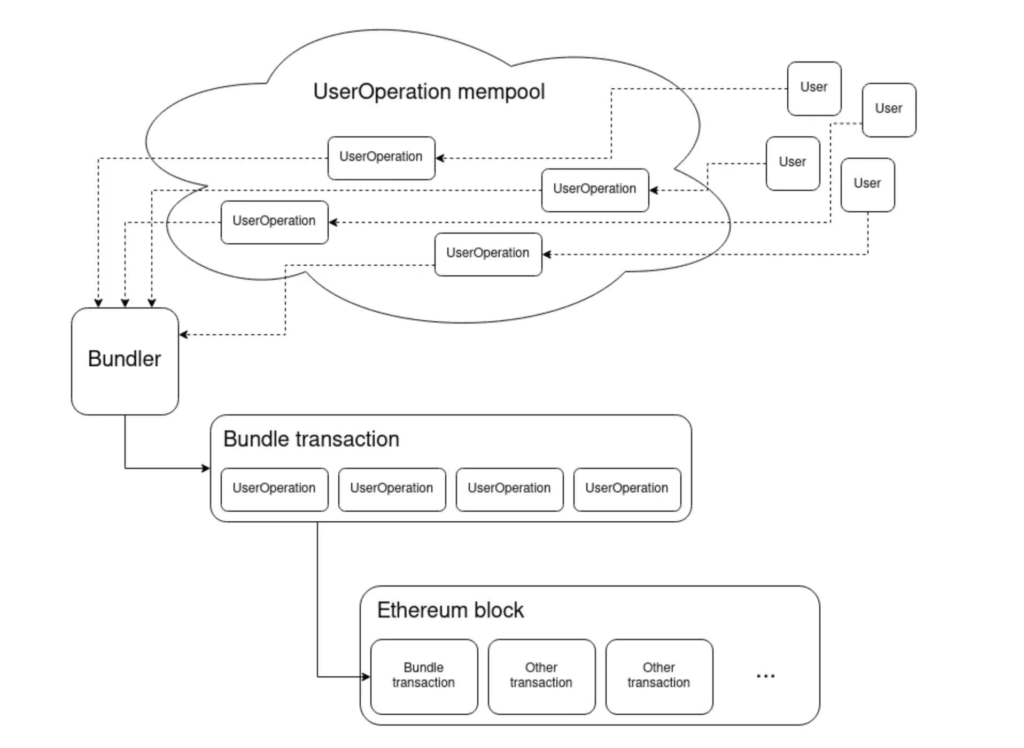

ERC-4337 aims to use an EntryPoint contract to achieve account abstraction without changing the consensus layer protocol of Ethereum. ERC-4337 allows users to use a smart contract wallet containing custom logic instead of their EOA wallet.

This standard introduces several new components for Ethereum architecture such as:

- UserOperations is designed to execute actions through a smart contract account. Unlike the Ethereum mechanism, UserOperation allows users to deploy a series of actions/transactions into one single operation, sign it, and send it to the network. UserOperations utilize a separate mempool called Alt-mempool.

- Bundlers bundle multiple UserOperations into a single transaction and submit that transaction to the EntryPoint contract.

- EntryPoint receives transactions from Bundlers, unpacking the bundle and executing all the operations.

- Paymaster acts as payers who settle the transaction fees for users. Paymaster has an important role in ERC-4337, which helps users enable paying for gas with stablecoins, ERC-20 tokens, or even free gas (if protocols sponsor it).

This mechanism sounds like MEV searcher cannot access the mempool and rearrange the order of transactions because all transactions are included in the separate mempool. Right?

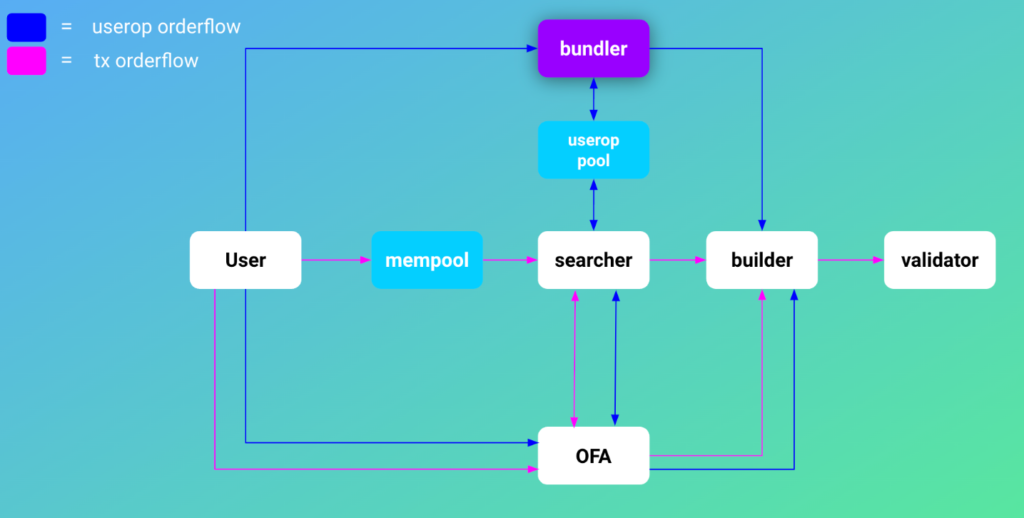

Yup! But we have another problem. Bundlers enable them to be operated by searchers, builders, and Order Flow Auctions (OFA), who can extract MEV from users. The key difference that ERC-4337 will create for MEV-Boost is that it will split the mempool into two types: “old mempool” contain single transactions (like as usual) and “new mempool” contain UserOperation with more complexity than usual. However, there are multiple duplicate functions between bundlers, searchers, and builders, such as collecting the transactions, bundling and sending them. In the future, as ERC-4337 wallets become more popular in this space, Alt-mempool will likely contain a huge number of transactions enough to “carry out profit”, leading to a shift in focus for searchers and builders. Thus it seems very likely that searchers will run bundlers to extract MEV from user operations, and builders will run bundlers to build the most competitive blocks possible.

On the flip side, ERC-4337 enables the creation of multiple Alt-mempools with different rulesets and their unique mempool IDs. This allows dApps to run their own mempool, which shares only limited information about transactions, thereby reducing the impact of MEV. This is the way ERC-4337 could be used to change the MEV landscape and make it fairer to users.

MEVs have become an integral part of the Ethereum economy. On one hand, they benefit the ecosystem by swiftly addressing imbalances through arbitrage bots. On the other hand, they result in a negative user experience, particularly with sandwich bots, causing disruptions during transactions. Furthermore, the “gas race” among searchers contributes to higher gas prices and network congestion. Therefore, familiarizing oneself with MEV when engaging on Ethereum is unavoidable.

Multiple organizations have introduced anti-MEV measures, such as MEV Blocker and MEV-share. However, the introduction of ERC-4337 could potentially be a turning point for the overall MEV landscape. The key factor lies in the replacement and optimization of the mempool by different types of mempools, dispersing public transactions and avoiding centralized accumulation, which could make it more challenging for MEV operators to execute their strategies. Nevertheless, it’s important to note that ERC-4337 has not yet been fully implemented. Thus, in the near future, users will still have to coexist with MEV and its effects on their experience.

The information provided in this article is for reference purposes only and should not be considered as investment advice. All investment decisions should be based on thorough research and personal evaluation.

[…] Blockbase,ERC-4337 是否会降低 MEV-Boost 对以太坊的影响? […]

Comments are closed.