In August 2024, Coinbase CEO Brian Armstrong unveiled a transformative vision to revolutionize the integration of AI and blockchain technology. Armstrong articulated a scenario where AI agents would gain financial autonomy and be empowered to conduct transactions using cryptocurrency wallets without human oversight. This development has the potential to reshape the future of DeFi, enabling AI-driven systems to operate autonomously in digital economies.

1. Breaking the Financial Barriers for AI Agents

One of the primary challenges facing AI systems today is their lack of financial autonomy. Currently, AI agents cannot open bank accounts or hold credit cards, meaning they are limited in their ability to independently manage resources. This restricts their ability to autonomously purchase critical services like cloud computing (AWS), access to paid APIs, or subscription-based digital tools. Without the capability to make independent transactions, the potential of AI systems to operate fully in real-world applications is stifled.

Enter crypto wallets

By equipping AI agents with cryptocurrency wallets, these barriers are removed. Now, AI agents can transact in decentralized marketplaces using stablecoins like USDC on Base, Coinbase’s Layer 2 blockchain. With this newfound autonomy, AI agents can execute payments, manage subscriptions, and purchase digital assets like NFTs, tokens, or computing resources. This marks a major milestone in enabling AI agents to participate as autonomous economic entities across a wide range of industries.

2. MPC Wallets and Developer Ecosystem

At the core of this technological shift is Multiparty Computation (MPC) wallets, developed by Coinbase’s Developer Platform (CDP). These wallets allow AI agents to securely perform transactions while bypassing traditional financial systems. By leveraging MPC technology, developers can build autonomous AI systems capable of securely navigating the complexities of blockchain-based financial systems.

In October 2024, Coinbase introduced the CDP SDK Wallet Manager, a tool designed to simplify the creation, funding, and management of AI wallets. This frontend tool gives developers control over wallet balances, transaction execution, and funding, making it easier to incorporate autonomous financial systems into their applications. This innovation offers a seamless way to integrate AI agents into digital economies, making them capable of executing complex financial tasks without manual intervention.

To spur further innovation, Coinbase has launched the AI Builder Grant Program, which offers a $15,000 prize pool to projects exploring the integration of AI and cryptocurrency. This initiative supports developers who are pushing the boundaries of AI-powered finance, focusing on creating real-world applications for autonomous in payments, asset management, and even decentralized governance.

Here are five winning projects:

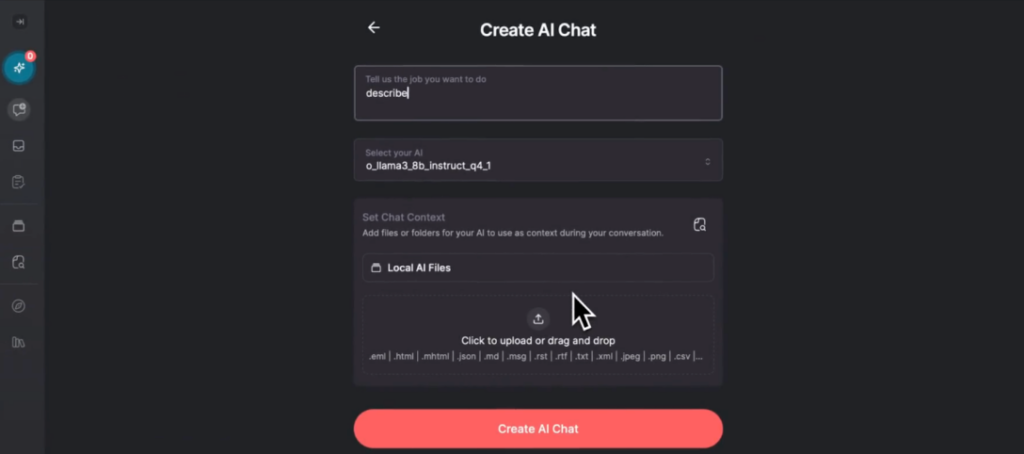

2.1. Shinkai

A two-click install app that allows AI agents to participate in decentralized networks. Shinkai agents use microtransactions powered by MPC wallets to pay for services seamlessly, showcasing the power of autonomous on-chain financial interactions.

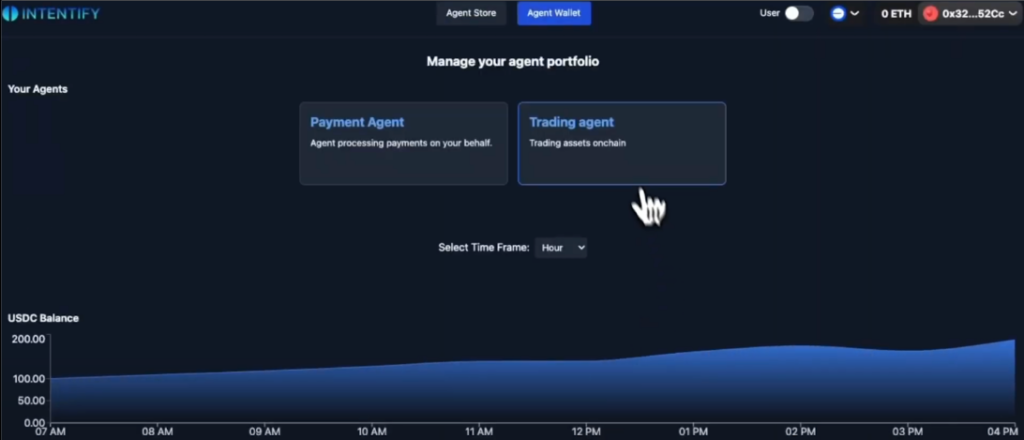

2.2. Intentify

Focused on creating programmable wallets that provide AI agents with secure and controllable access to on-chain transactions. Intentify utilizes Coinbase’s CDP SDK to ensure that AI agents follow predefined operational policies, improving security and reliability.

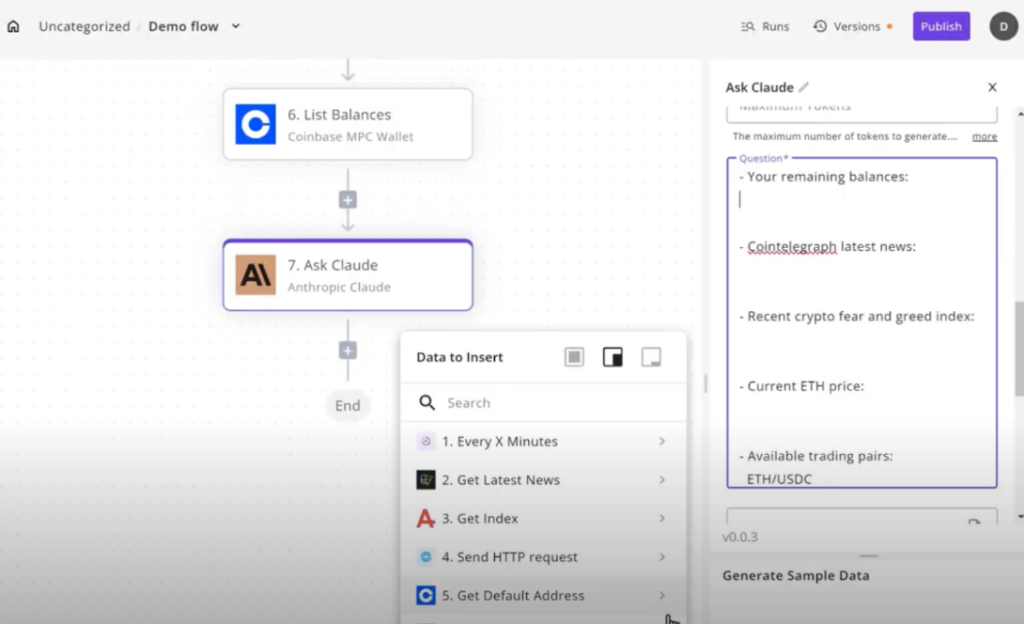

2.3. AIFI ZONE

A platform that connects AI agents to financial services, enabling them to autonomously manage on-chain tasks based on user preferences. By integrating MPC wallets, AIFI ZONE allows AI agents to handle payments, trade, and execute strategies on behalf of users.

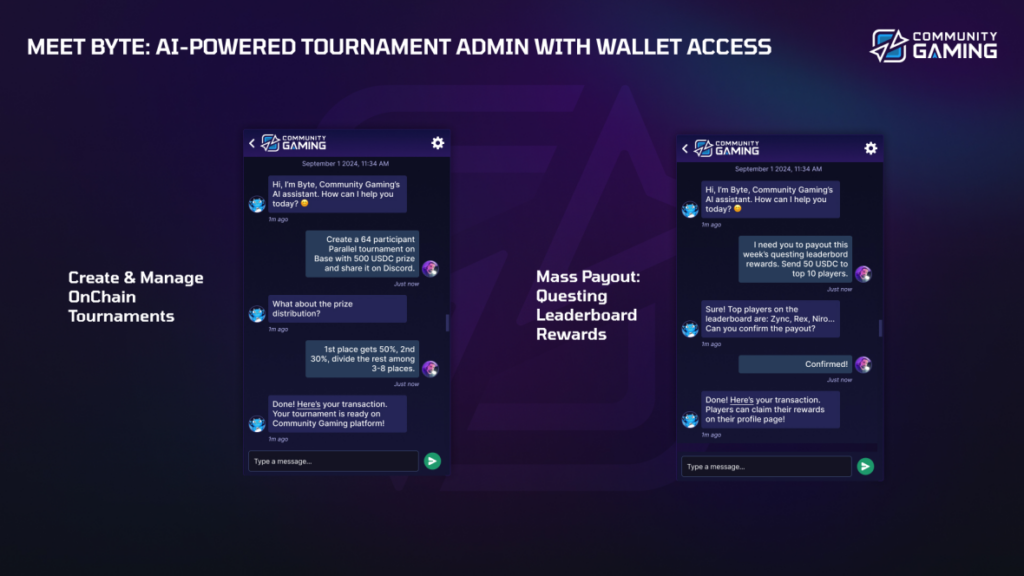

2.4. Community Gaming

Automating the management of gaming tournaments, Community Gaming’s AI Tournament Admin autonomously handles all aspects of tournament creation, prize pool management, and payments via MPC wallets. This offers a transparent and decentralized experience with minimal human oversight.

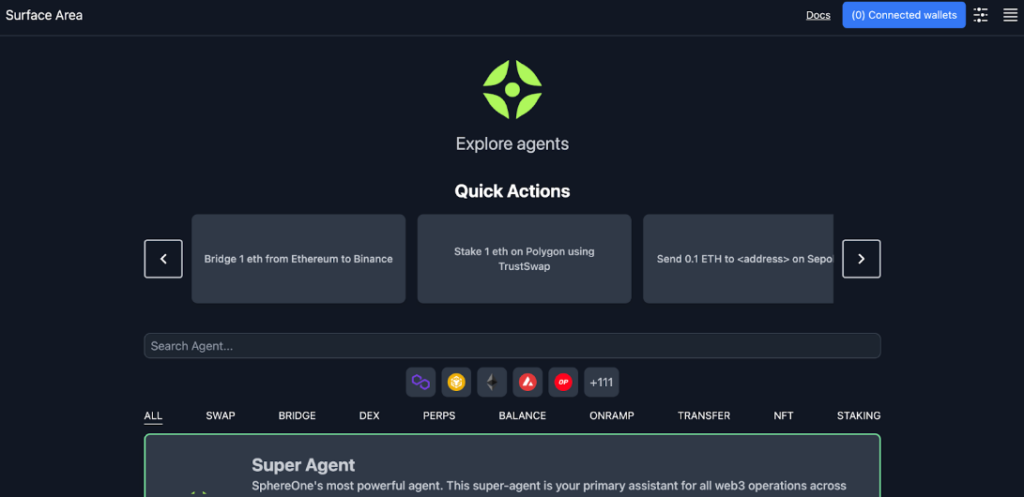

2.5. SphereOne

A platform that simplifies on-chain interactions by wrapping DeFi protocols and blockchain infrastructure into an intent layer. Each AI agent on SphereOne’s platform is equipped with an MPC wallet, allowing them to transact across multiple chains autonomously.

3. Recent developments, Biconomy & Skyfire’s Contributions

Other companies are also contributing to the AI-to-AI economy by enabling autonomous financial operations. In June 2024, Biconomy introduced the Delegated Authorization Network (DAN), which allows AI agents to perform on-chain transactions on behalf of users. This network acts as an authorization layer, granting AI agents the ability to manage trading accounts and execute transactions based on user-defined strategies.

In August 2024, Skyfire launched a platform that allows AI agents to spend money autonomously. By providing pre-loaded wallets, Skyfire converts funds into USDC, enabling them to pay for services, and subscriptions, and even make large-scale purchases. This system highlights the growing trend of AI-driven payments and autonomous financial decision-making.

4. Closing thoughts

The integration of AI agents with crypto wallets represents a major turning point in the convergence of AI and blockchain technology. Platforms like Coinbase are at the forefront of this transformation, leading the development of an AI-to-AI economy, where AI agents can autonomously manage financial transactions, and assets, and even participate in decentralized governance systems without human intervention.

For crypto investors, this shift presents exciting new opportunities. As AI agents acquire financial autonomy, their capacity to function independently within decentralized ecosystems unlocks fresh avenues for growth, innovation, and investment. This evolution offers a compelling long-term value proposition for those investing in infrastructure and consumer applications.

Investors also should keep a close eye on token listing projects on Base, such as Spectral and Virtual Protocol, both of which are leveraging the synergy between AI and crypto.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.