The intersection of gaming and finance, called GameFi, has sparked considerable interest and investment, promising to revolutionize how players interact with virtual worlds. However, a fundamental tension exists between a game’s financial or spectacular elements and gameplay. While games are designed to offer an enjoyable experience, focusing on financial aspects can undermine the core gaming experience. Players may find it challenging to simultaneously enjoy the entertainment value of the game and the thrill of asset value fluctuations, leading to a potential dilemma.

1. The GameFi dilemma

Consider an online strategy game where players initially enjoy the thrill of building and managing their virtual kingdoms. The core gameplay involved strategic planning, resource management, and battle competition. This offered a deep sense of satisfaction and accomplishment from overcoming challenges and achieving goals within the game.

Over time, the developers introduced features that allowed players to buy and sell rare in-game items for real money. These items could significantly enhance a player’s kingdom or give them competitive advantages. A virtual marketplace was also added, where players could trade these items, creating a dynamic financial ecosystem within the game.

As these financial elements became more prominent, players faced a dilemma. The time and effort required to excel in the marketplace, such as monitoring item values, making trades, and managing investments, distracted from the original gameplay. Players found themselves spending more time on financial activities, like trading or optimizing their virtual assets, rather than engaging in strategic planning and battles that initially attracted them to the game.

For some players, the excitement of profiting from trades and watching the value of their assets fluctuate became the primary focus, overshadowing the enjoyment of the original gameplay. They invested significant time and money into mastering the marketplace rather than the game’s core mechanics.

Conversely, players who wished to focus solely on the original gameplay often felt at a disadvantage. They missed out on valuable items and enhancements available through the marketplace, potentially feeling less competitive and less engaged with the game.

Thus, the introduction of financial elements created a conflict between enjoying the game’s original strategic experience and participating in the virtual economy, leading to a trade-off between the pleasure of gameplay and the allure of financial gain.

When a game’s asset value rises, it attracts more players. However, if asset values drop, players may lose interest, forgetting the game’s primary enjoyment. This situation requires game developers to balance the gaming experience with financial transactions skillfully.

2. Challenges Facing Crypto GameFi Projects: Sustainability and Gaming Community Backlash

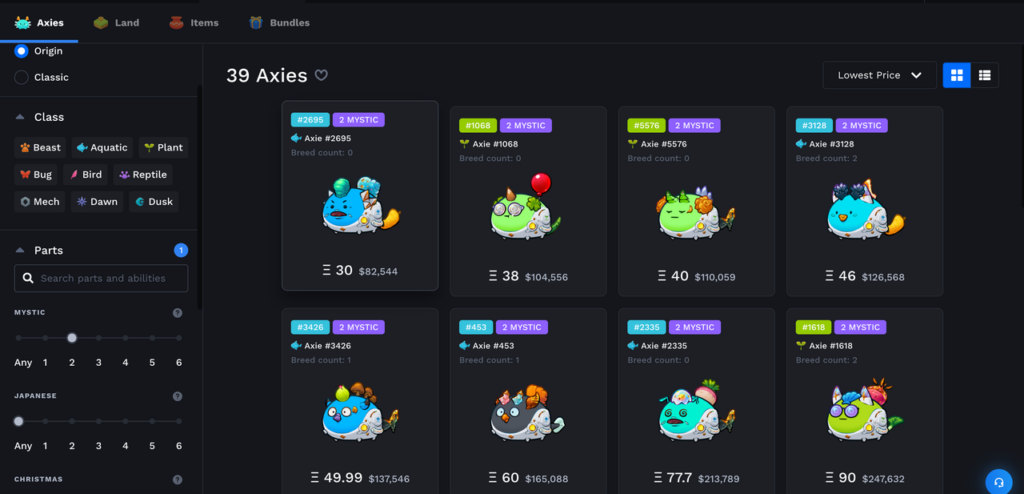

2.1. Lack of sustainable crypto gaming projects

There are 2 primary factors contributing to the lack of viable crypto-gaming projects. Firstly, the crypto market prioritizes simple financial products and speculation over complex games for profitability, thus limiting the incentive for developing intricate gaming experiences. Secondly, experts from the traditional gaming industry, who possess crucial skills in game development are not actively involved in crypto game development. Without recognizing the capital potential of the market, these professionals are reluctant to explore crypto gaming, leading to a shortage of top talent in addressing critical development and operational challenges. Gaming professionals need to recognize the crypto market as a valuable opportunity for progress.

2.2. Backlash from the gamer community

Some argue that GameFi is intended solely for cryptocurrency investors rather than for gamers.

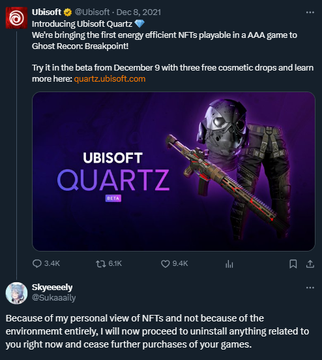

Major studios encountered numerous obstacles that failed in their NFT integration efforts. The principal challenge was a backlash from the community, with many players perceiving NFTs as a method for companies to financially exploit them, which led to significant opposition and negative sentiment. Furthermore, concerns about speculation interfered with the gaming experience and affected community dynamics.

For games like “Minecraft,” integrating NFTs contradicted the game’s principles of creativity and inclusivity. Companies often fail to effectively communicate the benefits of NFTs, resulting in misunderstandings and mistrust among players. These factors combined to create a hostile environment for NFT integration in gaming, prompting companies to reconsider or abandon their plans.

Ubisoft launched Ubisoft Quartz, a platform for in-game NFTs called “Digits.” These NFTs were introduced in “Tom Clancy’s Ghost Recon Breakpoint.” However, the initiative was met with harsh criticism from players who were concerned about environmental impact and the speculative nature of NFTs, causing Ubisoft to reconsider its broader NFT strategy.

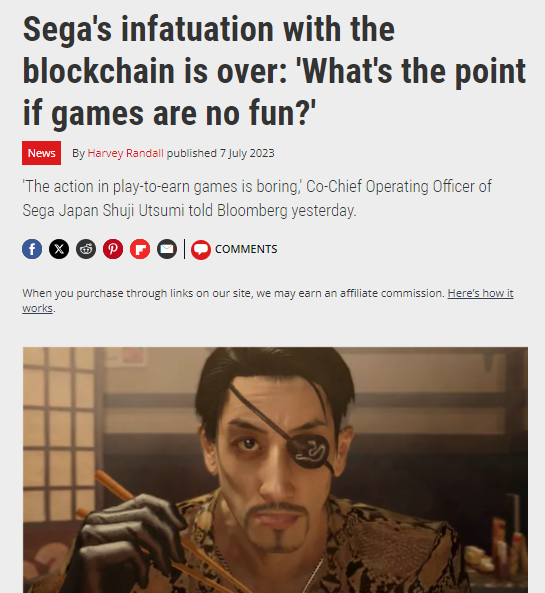

Sega considered adding NFTs to their games, exploring ways to incorporate blockchain technology into their gaming ecosystem. However, following the intense negative reaction from gamers towards other studios’ NFT initiatives, Sega decided to halt its NFT plans to avoid alienating its core audience and maintain its brand reputation.

In summary, comprehending the intricacies of financial models and refraining from hasty categorization is essential when assessing GameFi projects. Achieving a balance between financial attributes and gameplay remains a fundamental challenge, necessitating adept game development. For Web3 ventures to succeed, large companies must undertake targeted and authentic innovation efforts.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.