1. Recommendation & Position Summary

Historical Context

Aster emerged at the end of 2024 through the merger of two projects—Astherus and APX Finance—integrating yield farming and a perpetual futures exchange into a unified platform. Operating on BNB Chain and other EVM-compatible networks, Aster distinguishes itself with dedicated reward point programs (Rh/Au) designed to attract users.

On September 17, 2025, the $ASTER token generation event (TGE) ignited a powerful FOMO rally, propelling the platform’s TVL from $172M to $545M USD (+216%). As of this report’s writing, TVL has surged over threefold to $1.7B USD.

The $ASTER price mirrored this frenzy, climbing from $0.08 to $0.79 (+875%) within 48 hours post-TGE. Momentum carried forward over the next four days, driving the price to an all-time high of $2 (+1,500% from TGE) before a pullback to the $1.3–1.5 range by September 22, 2025.

Key catalysts for this parabolic run included substantial whale inflows and relentless “shilling” from CZ, who publicly endorsed the project on X (formerly Twitter) with his signature “keep building” message immediately following the $ASTER TGE. This fueled speculative hype while drawing a surge of users to experiment and trade on Aster.

Current Status

Aster has solidified its position as the leading perpetual futures DEX on BNB Chain by TVL and trading volume. BNB Chain has pledged “maximum support” for its ongoing development—underscored by CZ’s full commitment to building out the BNB Chain ecosystem.

Following the short-term correction, from $2 to $1.3–1.5, Aster rebounded strongly on upcoming catalysts, reclaiming new all-time highs of $2–$2.21, with a market cap of ~$3.81B (fully diluted valuation ~$18.38B).

The analysis below details the investment thesis, operational model, competitive landscape, valuation, and risks to inform a data-driven decision on $ASTER exposure.

2. Investment Thesis

From both quantitative and qualitative perspectives, the investment thesis for Aster positions $ASTER for substantial growth potential, as evaluated by analysts across the four pillars outlined below.

2.1. Binance Counter-Positioning Against Hyperliquid via Ecosystem Proxy

Aster serves as the “on-chain spearhead” for BNB Chain, bypassing direct confrontation with Binance CEX. Instead, YZi Labs is betting on an on-chain proxy (Aster) that delivers CEX-level experience—featuring order books, low latency, and hidden orders—to, to challenge Hyperliquid’s (HL) monopoly in the perpetual DEX space.

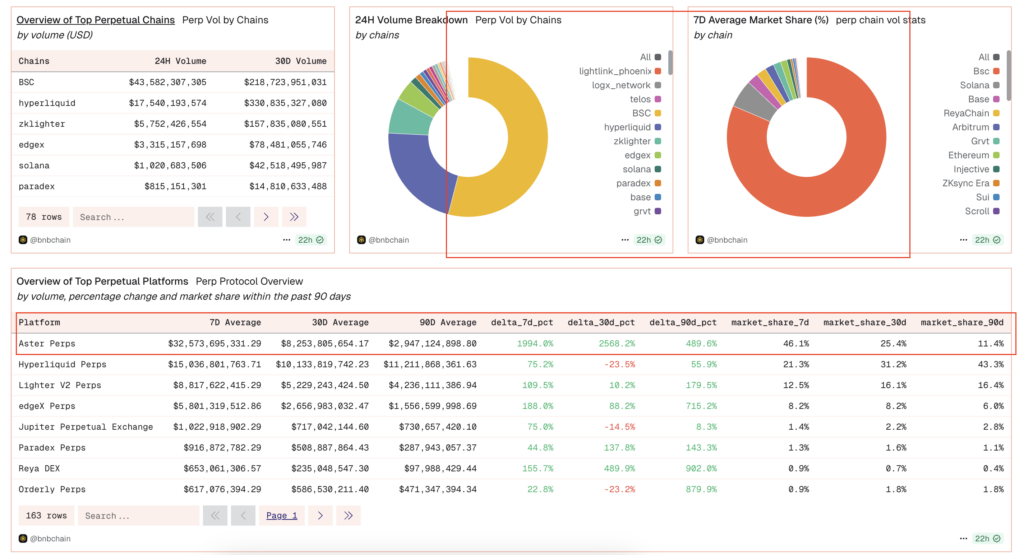

Post-TGE data shows Aster achieving over $35B in 24-hour volume consistently for two weeks, securing the top spot and driving 30-day volume to $200B—closing the gap with Hyperliquid’s $270B 30-day volume to just $70B in a single month.

Daily fees, representing Aster’s core revenue, have stabilized at $14M–$16M for nearly two weeks—a, a massive figure that creates a wide moat over Hyperliquid and positions Aster as the second-highest fee-generating protocol market-wide, trailing only Tether.

If Aster sustains a daily market share of ≥20–30% over multiple weeks, this “counter-positioning proxy” strategy could not only reclaim shares from Binance CEX but also erode Hyperliquid’s long-held dominance.

This explosive growth stems partly from a 4% supply airdrop (~$600M at $1.9 pricing) in a compressed timeframe—ongoing monitoring is essential to distinguish genuine fundamentals from potential illusory hype.

2.2. CZ’s Return and Implicit Guidance of Aster via BNB Chain Post-Legal Resolution

Following his separation from SEC oversight and no longer directly managing Binance, CZ has staged a comeback, publicly committing to advancing on-chain flows on BNB Chain. This has catalyzed surges in network fees, TVL, and DeFi activity—directly benefits BNB’s value and propelling BSC to the top spot for daily fees (~$1M/day) within two weeks of Aster’s launch.

As a fast-scaling perpetual DEX, Aster captures significant value for the broader BNB Chain ecosystem (including wallets). Backed by YZi Labs, it received immediate endorsement from CZ via a launch-day tweet, followed by repeated mentions of “$ASTER & $BNB.” Today, Aster holds the #1 spot among on-chain perpetual DEXes on BNB Chain.

2.3. VC-Free Tokenomics: Community-Driven with Centralized Supply Control

At TGE, 20% of supply entered circulation with zero allocation to VCs, emphasizing a community-centric model. However, on-chain tracking reveals the project retains control of up to 92% of total supply, engineering deliberate scarcity. This structure incentivizes aggressive growth in price, volume, fees, and user adoption to validate gradual releases of the ~90% held tokens into the market.

2.4. Attractive Valuation Structure with Ample Upside Relative to Peers

On October 5, Aster’s Season 2 airdrop (~4% of supply) will boost circulating supply to 24% (at a steady $2 price, lifting market cap to $3.8B)—aligning closely with Hyperliquid’s ~27% circulating structure.

Analysts note Aster’s P/S multiple (circulating) at 5.31x, versus Hyperliquid’s 14.88x—a 2.8x discount—while P/S (FDV) trades at a 3.5x lower premium. Should $ASTER maintain its top daily volume market share through Q4 2025, it could target $4–$5.5 pricing.

3. Business Model & Snapshot Metric

Business Model: Aster operates an integrated DeFi ecosystem centered around its decentralized derivatives exchange. The protocol’s primary revenue streams include:

- (i) Transaction Fees from Perp & Spot Trading on Aster DEX

- The core revenue driver, Aster offers highly competitive fees to rival both CEXs and DEXs: 0.01% (maker) to 0.035% (taker) and ~0.03%–0.05% for PERP 1001x mode.

- Aster not only secured the #1 spot in 7-day trading volume but also rapidly captured value for BNB Chain, commanding ~39% market share in the Perp DEX segment, leading both daily and weekly rankings.

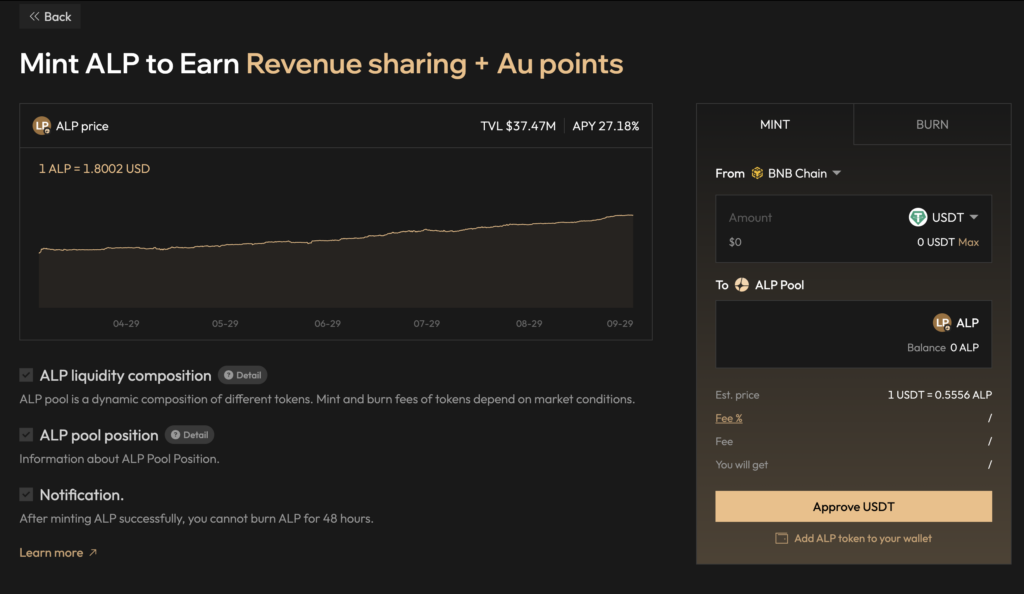

- (ii) Profits from Market-Making Mechanisms: Revenue is generated through the ALP liquidity vault, which acts as a counterparty for traders in 1001x mode.

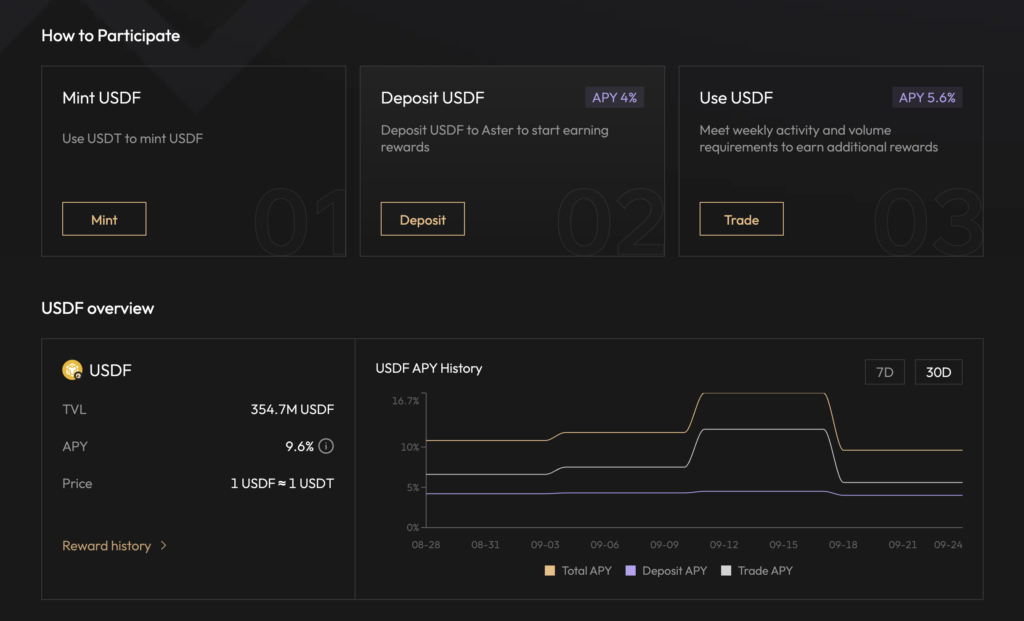

- (iii) Income from Yield Products (Earnings stem from offerings such as BNB staking rewards and interest from the USDF stablecoin). Aster’s fee distribution system currently allocates the majority of proceeds to the protocol’s treasury and token buyback fund, with a smaller portion distributed as rewards to Liquidity Providers (ALP) and asBNB/USDF stakers.

As such, increased trading volume directly benefits the $ASTER token through a buyback-and-burn mechanism or value accrual via the protocol’s treasury. This model mirrors that of centralized exchanges (e.g., BNB, OKB) but is executed on-chain.

| Metric | 09.2025 | Comment |

| Price | $1.73 | After reaching an ATH of $2.2, the price is currently correcting to the $1.73 – $1.8 range, reflecting overall market sentiment. |

| Market Cap | $2.89B | N/A |

| Circ. Supply | 1.66B | Accounts for ~20% of total supply, with over 1.3B $ASTER reserved for swap allocation between $APX/$ASTER |

| Total Supply | 8B | Fixed supply — no emission schedule |

| FDV | $18B USD | Equivalent to 32% of HyperLiquid’s FDV |

| TVL | $2.18B USD | Surged from $300M to $2.18B (+499% MoM) |

| DAU | 2M | The total number of active users on the official platform reached 2 million |

| Volume 24h | $20B – $35B | Trading volume skyrocketed from $1.4B to $20B (+1320%), pushing Aster into the top-performing DEXs by daily volume) |

| Fee | $16M – $18M | Post-TGE, trading fees spiked significantly. According to DeFiLlama, Aster now ranks #2 in daily fee generation, just behind Tether |

| Cummulative Fee | $109M USD | Total cumulative fees reached $109M after TGE, transferred to the Treasury in preparation for potential buyback activities |

| Market Share | 20% | – Explosive growth propelled Aster to become the #1 PERP DEX, with $35B in 24h volume (~40% market share) – HyperLiquid ranks second with $18B (20% share) |

| – Overall, Aster has achieved the scale of a major exchange in a remarkably short period. Revenue and market share surged from 2% → 20% within one week, underscoring the project’s rapid traction and strong fundamentals. – Note: Part of the high trading volume may stem from airdrop farming and short-term speculation — further observation is needed to assess the sustainability of this momentum. | ||

Revenue Model

- Revenue is directly tied to daily perpetual futures trading volume and the applied fee structure (taker fee ~0.01%, maker fee ~0.035%), with fees flowing directly into the project’s Treasury.

- Currently, Aster’s 24-hour trading volume averages $30B per day, driven by the $ASTER Season 2 airdrop campaign. After a 50% discount adjustment, the effective volume is ~$10B USD per day, with an average fee parameter of 0.036%.

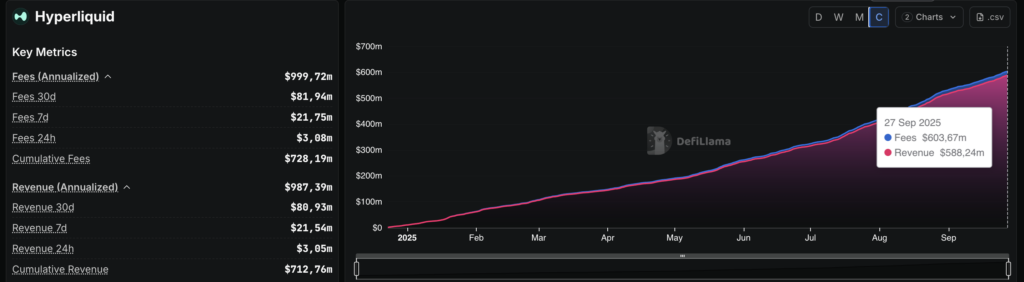

Comparison with Hyperliquid: Performance Fees from Early 2025 to Q3 2025

4. Catalyst Timeline

| Timeline | Events | Expected Impact |

| 1/10/2025 | – Completion of $APX → $ASTER swap at a 1:1 ratio – Approximately 900M $APX (estimated) converted into $ASTER, increasing circulating supply from 704M → ~1.66B $ASTER | – Positive: Strengthens brand consolidation, as Aster effectively absorbs APX Finance into one unified ecosystem. – Negative: Circulating supply expands notably; however, most APX holders have anticipated the swap, meaning this effect may already be priced in. |

| Q4 2025 | – Launch of Trading Incentives & Liquidity Mining Program Traders receive $ASTER airdrops (from the community fund) based on trading volume, LP provision in ALP pools, or staking asBNB/USDF. | – Expected to drive on-chain activity and user retention after the initial airdrop phase. – Well-designed incentives could generate buying pressure (as traders acquire $ASTER to stake and qualify for rewards) while also reducing sell pressure (users hold tokens to continue farming). – However, since campaign performance depends on $ASTER’s value, long-term success relies on core product adoption and sustainable fee models to convert users into loyal participants. |

| Q1 2026 | Launch of Aster Chain mainnet and related tech upgrades. | Potential introduction of new tokenomics, such as staking $ASTER to run validator nodes or locking tokens for liquidity partnerships — enhancing utility and network demand. |

| Looking Ahead | The Q4 trading incentive program will act as a growth catalyst, boosting user engagement and on-chain volume. Meanwhile, any rumors or moves from CZ or Binance involving Aster could further amplify market momentum. | |

5. Valuation

Observations

- Aster’s P/S (circulating) ratio stands at ~4.21×, significantly lower than Hyperliquid’s ~14.88×. This indicates that $ASTER is currently undervalued relative to its competitor based on revenue metrics.

- Even when considering FDV, Aster’s FDV/24h volume ratio (~0.46×) is notably lower than Hyperliquid’s (3.75×).

- If Aster sustains its current top position in 24-hour volume market share, the $ASTER price could target $4.5–$6 USD per token, representing a 2–3× increase from its current level.

| Metrics | Aster | Hyperliquid (HYPE) | Multiple Aster to Hyperliquid |

| Price | $2.00 | $45.40 | – |

| Market Cap | $3,840,000,000 | $15,000,000,000 | 25.60% |

| %cỉrc. supply | 24.00% | 27.00% | 88.89% |

| FDV | $16,000,000,000 | $45,000,000,000 | 35.56% |

| Volume 24h | $35,000,000,000 | $18,000,000,000 | 194.44% |

| Annualized Revenue (Thống kê từ DeFilama) | $723,096,000 | $1,008,000,000 | 71.74% |

| P/S (theo cap) | 5.31 | 14.88 | 2.80 |

| P/S (theo FDV) | 18.11 | 64.00 | 3.53 |

| FDV / Volume 24h | 0.46 | 3.75 | 8.20 |

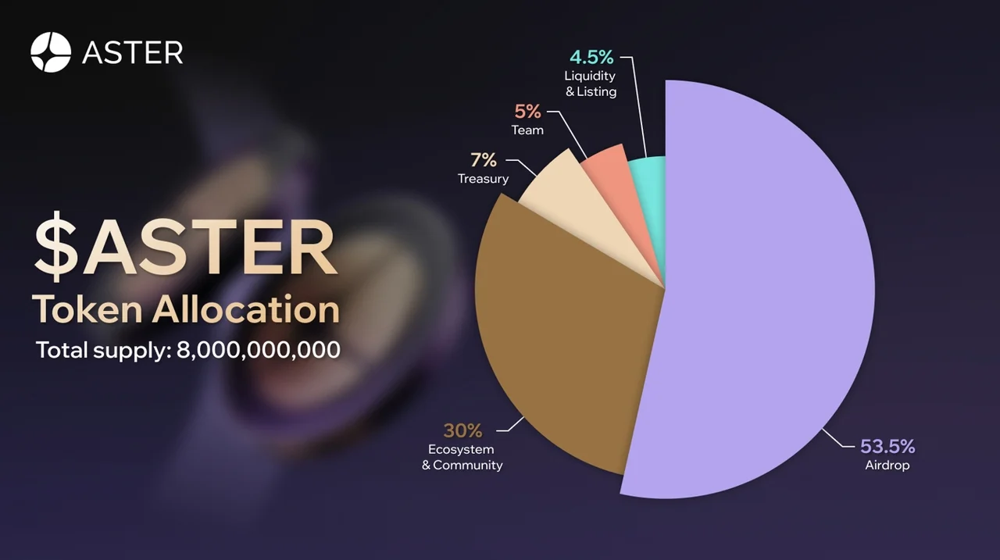

6. Tokenomics

- Total Supply: 8B $ASTER

- Circulating Supply: 1.66B $ASTER (~20% of total supply)

- Allocation:

- Airdrop (Retroactive & Community Rewards) – 53.5% (4.28B ASTER): 704M (~8.8% of supply) unlocked at TGE. The remaining 3.576B (~44.7% of supply) will be gradually distributed through trade mining, staking, and other community incentives.

- Ecosystem & Community – 30% (2.4B ASTER): Allocated for migration (APX → ASTER), grants, marketing, and liquidity. 900M (~11.25% of supply) designated for a 1:1 APX swap. The majority is reserved for ecosystem development and CEX/DEX liquidity.

- Treasury – 7% (560M ASTER): Managed by Aster DAO and the team to support long-term growth. Locked for 1–2 years, with gradual allocation thereafter.

- Team – 5% (400M ASTER): Allocated to the team with a 1-year cliff, followed by linear vesting over 40 months (~8.33M/month). Unlocking begins on September 17, 2026.

- Liquidity & Listings – 4.5% (360M ASTER): Used for initial liquidity provision and exchange listings (e.g., BingX, MEXC, with potential for Binance/OKX in the future). Considered part of the circulating supply to facilitate trading. Currently, wallets hold 238M $ASTER (~2.98% of supply).

Assessment: Aster’s tokenomics are technically designed to favor the community, with up to 83% of the total supply allocated to users and no VC involvement. However, a few key points should be noted:

- (i) The majority of these tokens will be distributed gradually to long-term users, trading campaigns, and future projects built on Aster Chain. It’s crucial to monitor how the team allocates and manages these tokens in both the short and long term.

- (ii) Despite being “community-oriented,” the project currently controls around 90% of the supply, which leaves room for potential short-term price manipulation or pump-and-dump behavior.

- (iii) On-chain tracking reveals that the AtherusVault wallet, which once held around 1.658B tokens (~20% of total supply), now holds only ~800M (~10.2%). The remaining ~10% has been distributed to CEXs (MEXC, Gate.io) and smaller wallets, each holding between 0.01% – 0.091% of supply.

A deeper dive shows these wallets have been withdrawing tokens from CEXs (interpreted as buying activity) shortly after the project announced the end of its 4% airdrop (Phase 2) on Oct 5, while CZ continued publicly “shilling” Aster — potentially contributing to renewed buying momentum.

7. Key Risk

- Regulatory Risk: The legal framework for perpetual futures DEXs remains unclear. Products like decentralized leverage or tokenized stocks may be deemed non-compliant by regulatory bodies (e.g., SEC) and banned in certain jurisdictions. Legal uncertainty could significantly impact Aster’s future operations.

- Technical & Security Risks: Complex mechanisms (e.g., cross-chain bridges, hidden orders) carry inherent risks of smart contract errors or security vulnerabilities.

- Token Allocation Risk: Token Allocation Risk: A significant portion of the $ASTER supply remains locked and will be gradually unlocked. These unlock events could create substantial selling pressure if demand does not match supply (e.g., the upcoming 4% supply airdrop on October 5). Additionally, post the initial high-profile airdrop phase, a lack of sustained incentives may lead users to sell tokens rather than hold long-term.

- Market Volatility Risk: $ASTER’s price is heavily influenced by broader market trends. A decline in market euphoria or speculative capital outflows could adversely affect emerging projects like Aster.

- Dependence on Binance/CZ Endorsement: While CZ’s shilling and Binance’s support are advantages, they also pose risks if CZ’s stance shifts or if he faces renewed legal pressures.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.