The recent widespread cryptocurrency sell-off completely contrasts with the record highs in global stock markets. Our comprehensive report delves deeper into the key factors that have contributed to this sell-off, analyzes the impact of these factors, and outlines appropriate action plans based on the current market outlook.

Let’s explore the details through the in-depth study below.

1. Overview

On Friday, Bitcoin’s price fell to $53,000, marking a 25% drop from its all-time high and reaching its lowest since February 2024.

Key factors behind the cryptocurrency’s intense sell-off:

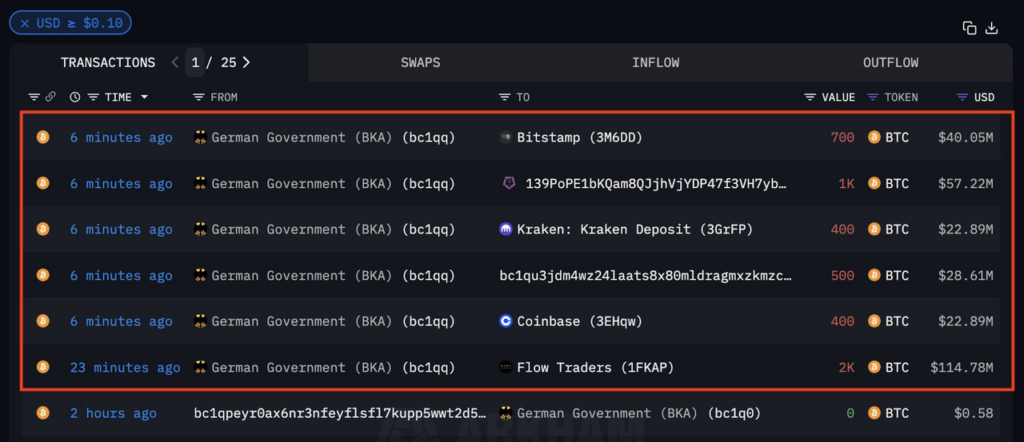

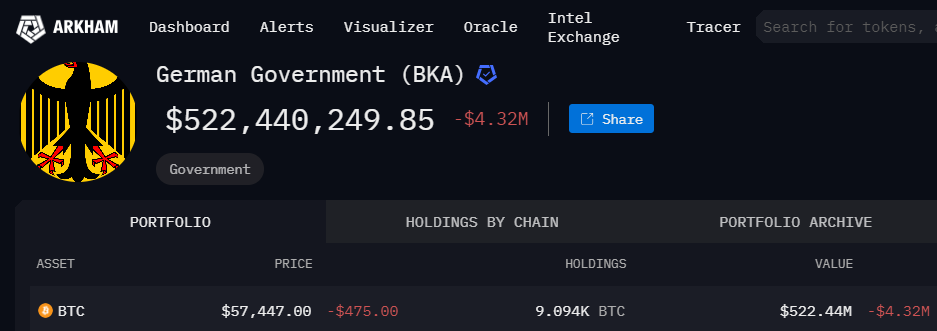

- The German government sold a significant amount of their confiscated Bitcoin, amounting to billions of dollars. According to Arkham Intelligence, Bitcoin wallets identified as belonging to the German government transferred in several batches to external addresses, including crypto exchanges Bitstamp, Kraken, Coinbase, and market makers Flow Traders and Cumberland DRW.

- The crypto exchange Mt. Gox, which went bankrupt in 2014, has begun repaying creditors with billions of dollars worth of digital currency. Specifically, Mt. Gox moved 47,229 BTC (approximately $2.71 billion) from its cold wallet. The exchange’s wallets still hold 138,985 BTC (around $8 billion).

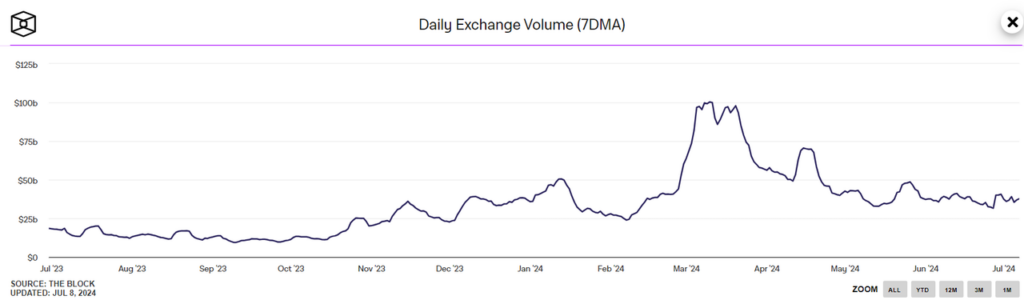

- The influx of a massive supply of Bitcoin into the market during the typically low-volume summer season has negatively impacted market sentiment.

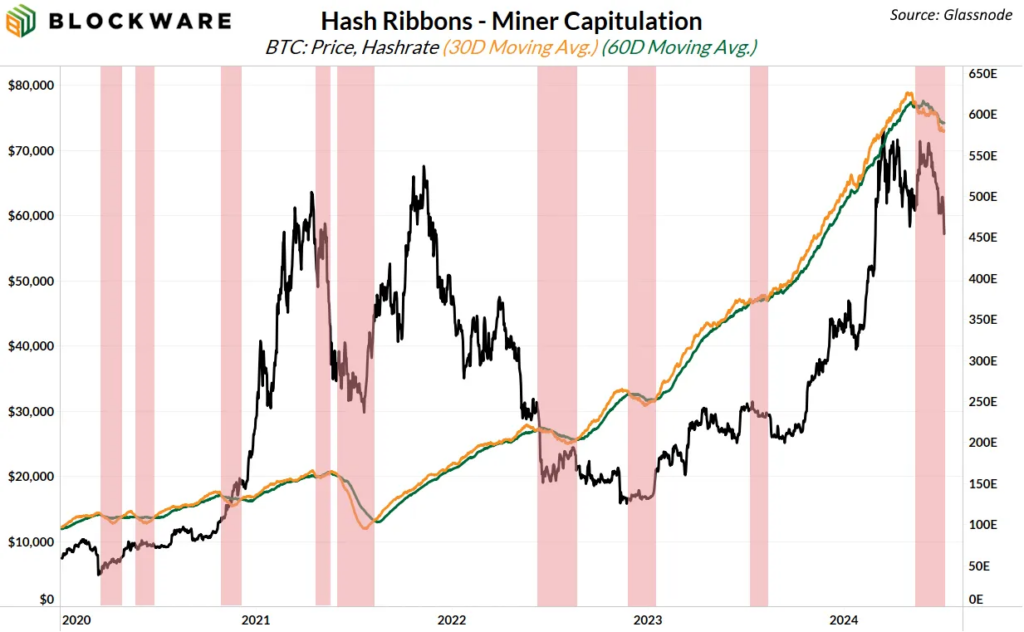

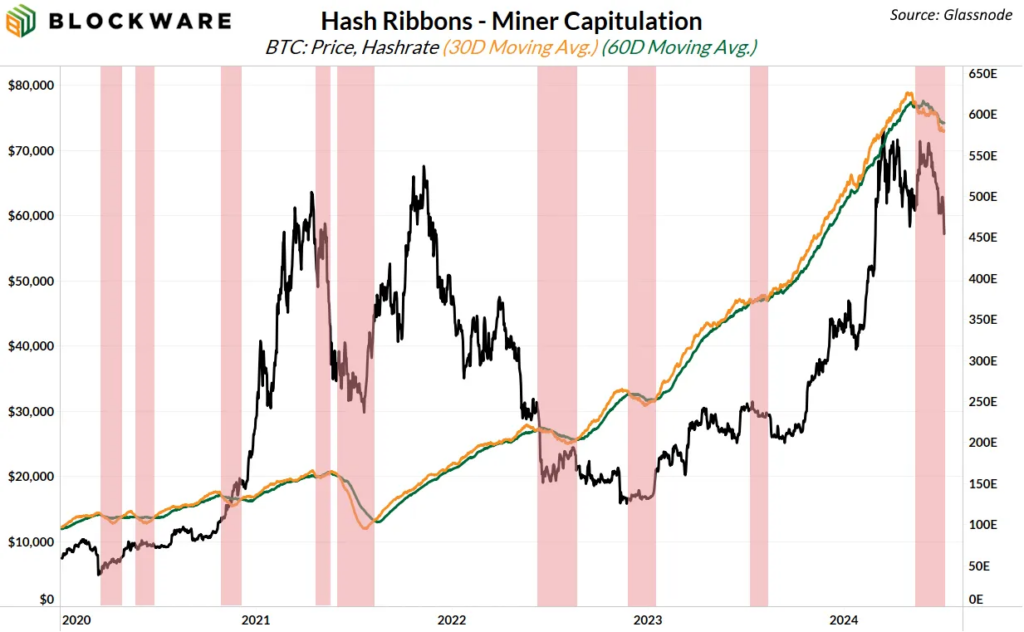

Miners, facing high electricity costs and inefficient hardware, are selling BTC to cover expenses. This has led to the most prolonged period of miner capitulation in nearly two years, as indicated by hash ribbons.

2. Why We Shouldn’t Panic?

Despite the recent Bitcoin sales impacting market sentiment, the long-term outlooks remain positive:

- Mt. Gox Issue: The crucial question is how many creditors will sell their reclaimed coins. They might sell Bitcoin and Bitcoin Cash to invest in Ethereum and promising altcoins, anticipating the approval of ETH ETFs, rather than cashing out completely.

- Fear and Greed Index: The index has reached its lowest point in 2024 (28 points), indicating high fear and skepticism. However, sentiment can swiftly change, especially with weaker U.S. economic data prompting the Fed to ease monetary policy and potential ETH ETF approval lifting the market mood.

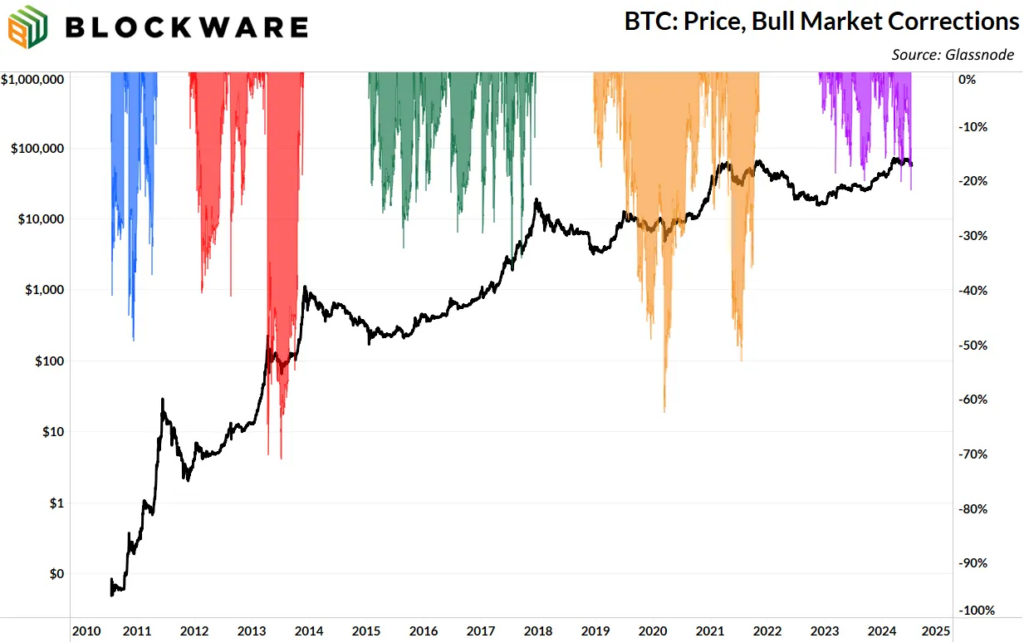

- Historical Bull Markets: In the 2021 bull market Bitcoin had three 20%+ drawdowns. During the 2017 cycle, BTC had 10 drawdowns of 20% or more. We’ve had two so far this year, so we see that as a normal, healthy, bull market correction.

- German Government Sales: Germany is selling BTC aggressively, but 90% of the 50k BTC has already been sold, leaving only 4.925 BTC ($522.44M), a relatively minor amount.

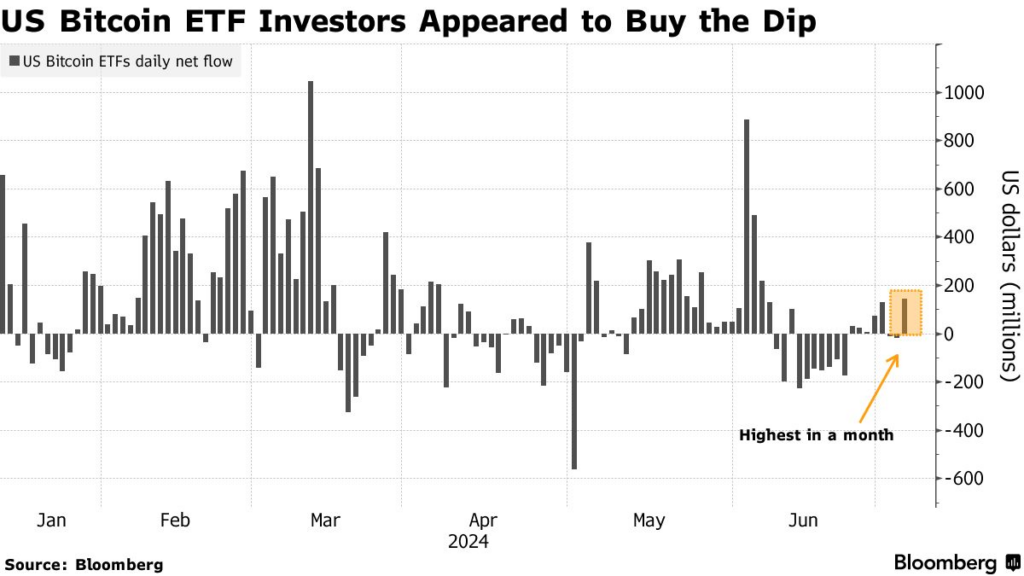

- The most important purchasing group: U.S. Bitcoin ETF investors are buying the dip and can absorb the remaining selling pressure from the German government.

- Miners’ Selling Pressure: Miners often sell after halvings, as seen in 2020 when there was a two-month capitulation. Once weaker miners exit, BTC prices typically rise due to reduced selling pressure.

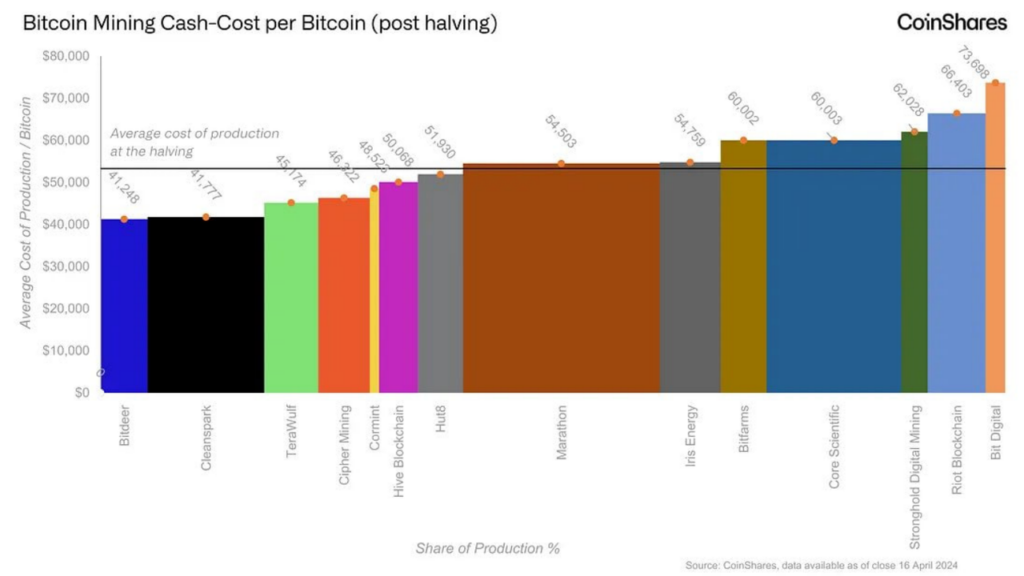

- Miners’ Break-Even Point: Bitcoin miners reach their break-even point at around $53k. Miners, which are seen as the OG market maker team, need to maintain current price levels and push BTC higher to ensure profitability.

- Political Shifts: Donald Trump, running against Democratic President Joe Biden, has announced support for the American Bitcoin industry. The Trump campaign discusses crypto frequently at rallies, signaling potential policy shifts favoring the industry.

3. Conclusion and Action Plan

- There are many reasons to stay bullish: regulatory pivots, interest rate reductions, institutional adoption, ETH ETF launch soon, and more. In short, Bitcoin’s price volatility provides opportunities for strategic capital deployment to those with a longer time horizon.

- For Existing Investors: Avoid panic selling or cutting losses. Instead, adopt a Dollar-Cost Averaging (DCA) strategy and hold.

- For New Investors or Cash Holders: Consider allocating a portion of funds into Ethereum and its ecosystem, anticipating ETF approval within weeks, and expecting ETH, ETH-betas, and Real-World Assets (RWA) to lead the next market surge.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.

[…] Bearish Bitcoin Headwinds? Can the market recover? […]

Comments are closed.