TL;DR

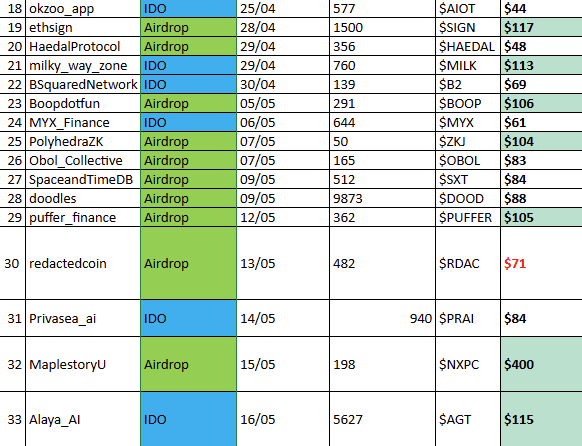

The Binance Alpha program has launched 11 projects in the last 3 weeks – almost double the number of IDOs (6 projects) during the same period.

The typical timeframe for these Alpha project announcements is between 2 PM and 6 PM (UTC+7).

The average profit per project from Binance Alpha is $80-$100, resulting in a total PNL of $1100-$1600 across 11 projects. This significantly outperforms the IDO PNL (6 projects yielding $500-$600) based on real case study data.

NXPC stands out as the most lucrative airdrop (averaging $400-$700). Additionally, users received extra NXPC tokens for locking BNB on Binance Simple Earn for 3 days.

As user FOMO increases, the point requirements for receiving Airdrops/Alpha allocations will likely continue to rise (evidenced by the initial requirement of only 45 points compared to the current average of 180-190 points).

Currently, users can only participate in a maximum of 4 Alpha deals within a 15-day period (4 deals cost 60 points, while the minimum entry point is now around 185 points). This translates to an average of 245 points needed every 15 days, requiring users to earn approximately 16-17 points daily to reach that threshold.

Common Characteristics of Listed Binance Alpha Projects:

- For Fundamental Analysis (FA) Projects: Hot narrative, public team, Tier-1 VC backers (or a strong native community), a working product with good traction, clear and audited tokenomics.

- For Meme Projects: They only require meeting two criteria: strong social appeal and a large community.

Binance Alpha Token Performance Post-Listing:

- 9 out of 11 tokens did not reach a new all-time high (ATH) after day 3.

- Only 2 out of 11 tokens (SIGN & HAEDAL) established their ATH after day 1.

- The median 3-day change from the day-1 close was -30%, with only Haedal (+13%) & SXT (+10%) showing positive gains.

- The median 7-day change was -37% (SIGN, BOOP, OBOL, DOOD experienced losses between -35% and -70%).

- The optimal selling window for maximizing profits is post-listing (between 15 and 75 minutes).

Effective Selling Strategy: Close over 80% of your token holdings, and for the remaining portion, set a trailing stop-loss of -10% from the peak. If the stop-loss isn’t triggered, sell the remaining tokens before the end of day 3.

1. Overview

Here’s a list of criteria Binance applies when evaluating non-circulating airdrops:

- Alignment with Current Trends (Narrative Fit): The project aligns with popular narratives such as AI agents, ETH liquid restaking, ZK-narratives, or NFTs.

- Good Traction & Large Community: For example, achieving ≥ $10 million in Total Value Locked (TVL) or ≥ 50,000 engaged followers.

- Backed by Top-Tier Venture Capital (VC): 60% of projects have Tier-1 fund backing (e.g., YZi Labs, Pantera, Coinbase…). If not, a large community presence is a necessary substitute.

- Public Team: 80% of projects have a publicly known team. Meme projects may have anonymous teams.

- Clear Tokenomics: Includes a vesting schedule with ≤ 30% released at Token Generation Event (TGE) and specific token utility.

- Audited by a Third Party Before TGE: The project has undergone and passed an audit conducted by an independent third-party auditor prior to the Token Generation Event.

| Project | Sector | Airdrop date | Quick Summary | Backer | Team | Quality social traction |

| EthSign (SIGN) | Infra – credential | 28-Apr | EthSign is an omni-chain authentication protocol that enables creation, storage, and verification across all EVM/L2 chains. | Sequoia, YZi Labs, Animoca | Public | • CZ tweet/shill. • 288k X followers |

Haedal Protocol (HAEDAL) | Defi – LSDfi | 29-Apr | A liquid staking protocol on Sui. Stake SUI to receive haSUI, which can be used in DeFi farming to earn additional yield. | OKX Ventures, Hashed Fund, Animoca | Public | • 205M TVL – • 205M TVL • 11k staker • 249k X followers 11k staker • 249k X followers |

| Boop.fun (BOOP) | Meme-launchpad | 5-May | Meme token launchpad on Solana, allows users to create “cult” tokens with built-in verification and social promotion tools. | Angel Investor Group | Public | • Huge social hype. • 48,3k X followers • >180k tokens minted first 24 h |

| Polyhedra (ZKJ) | Infra | 7-May | Polyhedra/EXPchain combines zkML and Proof-of-Intelligence to turn AI outputs into verifiable data. | Polychain, YZi Labs, Animoca | Public | • $1B valuation (Series B) • zkBridge $420m vol • 1M X followers. |

| Obol Collective (OBOL) | Defi – LSDfi | 7-May | Utilizes Distributed Validator Technology (DVT) to split ETH nodes across multiple machines, reducing single-point failure. | Pantera, Coinbase, Spartan | Public | • 1500 DV clusters live • Main-net operators 3k+ • 48K X follower |

| Space and Time (SXT) | Blockchain Service | 9-May | ZK data warehouse with Proof-of-SQL, enabling tamper-proof queries for smart contracts and LLMs. | OKX Ventures, GSR | Public | • 30+ dApps • Partnerships: Microsoft M12, Chainlink • 479k X followers |

| Doodles (DOOD) | NFT | 9-May | NFT collection 9998 trên Ethereum, mở rộng token DOOD cho game & IP bán lẻ. | FTX Ventures | Public | • Floor ≈ 5 ETH • 581k X followers • 45k NFT holders |

| Puffer Finance (PUFFER) | Defi – LSDfi | 12-May | Ethereum-based NFT collection (9,998 pieces), expanding with DOOD token for gaming and retail IP. | Coinbase, YZi labs | Public | • Peak TVL $850m • Ethereum foundation grant 120k |

Redacted-coin (RDAC) | Infra – AI | 13-May | “Datasphere” combines AI entertainment with blockchain; users earn RDAC for play-trade-watch activities. | Spartan, Animoca | Fully anon | • 258k X followers |

| MapleStory Universe (NXPC) | Gamefi | 15-May | Tokenizing Nexon’s 23-year MMORPG IP on Avalanche; integrates NFTs, UGC, and DeFi. | ___ | Public | • 274k X followers |

| REVOX (REX) | Blockchain Service | 17-May | Permissionless ML infrastructure including Web3 GPT Lens, Smart Wallet; ReadON DAO has reached 21M global users. | YZi Labs | Public | • 21m app installs • BNB-Chain AMA highlight |

2. Binance Alpha Token Performance

Key takeaways:

- 9 out of 11 tokens closed their first trading day below their opening price.

- Only 2 out of 11 tokens (SIGN & HAEDAL) reached their all-time high (ATH) after the first day of trading.

- The median price change after 3 days was -30% from the day-1 closing price, with only Haedal (+13%) and SXT (+10%) showing positive returns.

- The median price change after 7 days was -37% (SIGN, BOOP, OBOL, and DOOD experienced losses ranging from -35% to -70%).

| Token | Airdrop Date | Qty token received | Day-1 close (USD) | Implied price¹ | ATH (USD) | Implied Price | % run-up (ATH vs D-1) | Performance after Lising |

| SIGN | 28-Apr | 1500 | $120 | $0.08 | $200 | $0,133 | 67% | • 1D: +70% (ATH sau 20h) -• 3D:- 38% • 7D: -48% |

| Haedal | 29-Apr | 356 | $44 | $0,124 | $74 | $0,208 | 68% | • 1D: +79% (ATH) • 3D: +13% • 7D: +23% |

| BOOP | 5-May | 291 | $88 | $0.30 | $132 | $0.45 | 50% | • 1D: -30% • 3D: -30% • 7D: -65% |

| OBOL | 7-May | 165 | $45 | $0.27 | $78 | $0.47 | 73% | • 1D: -39% • 3D: -30% •-7D: -50% |

| ZKJ | 7-May | 50 | $106 | $2.12 | $110 | $2.20 | 3% | • 1D: +1% • 3D: +3% (ATH) • 7D: -3,6% |

| SXT | 8-May | 512 | $74 | $0.15 | $84 | $0.16 | 14% | • 1D: -8% • 3D: +10% • 7D: -11% |

| DOOD | 9-May | 9 873 | $84 | $0.01 | $104 | $0.01 | 24% | • 1D: -5% • 3D: -29% • 7D: -37% |

| PUFFER | 12-May | 362 | $97 | $0.27 | $134 | $0.37 | 38% | • 1D: -1% • 3D: -15% |

| RDAC | 13-May | 482 | $24 | $0.05 | $64 | $0.13 | 167% | • 1D: -50% • 3D: -70% |

| NXPC | 15-May | 198 | $520 | $2.63 | $788 | $3.98 | 52% | • 1D: -13% |

| REX | 17-May | 3935 | $79 | $0.02 | $81 | $0.02 | 3% | • 1D: -5% |

| Total | $1,319 | $1,883 |

The total rewards earned from participating in all IDOs and Alpha program deals from April 25th amount to $1,692 (based on real case study data shared by user Solo Top on platform X).

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.