1. Binance to delist several altcoins at the start of June

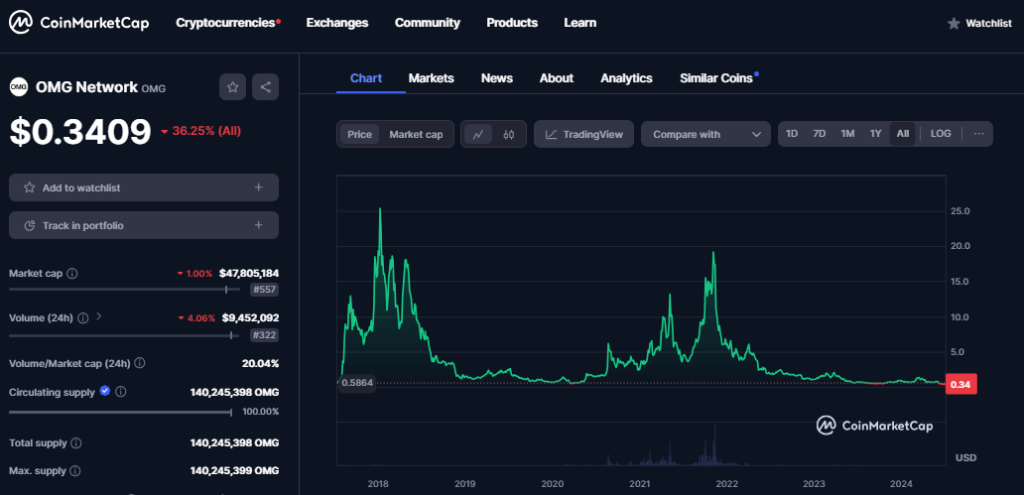

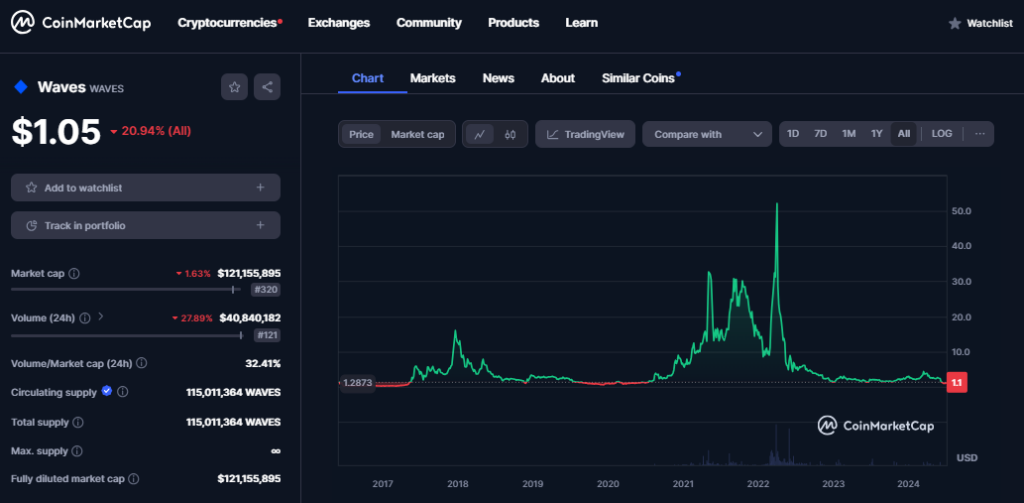

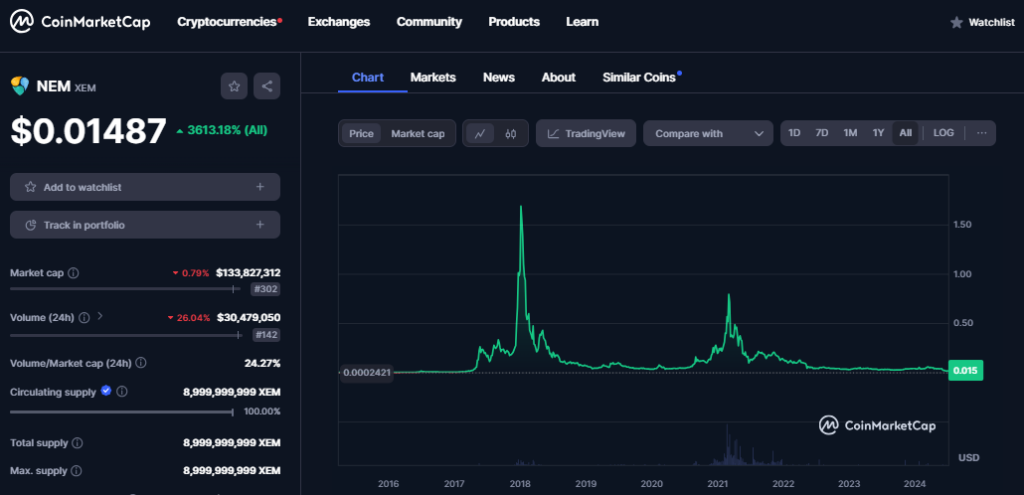

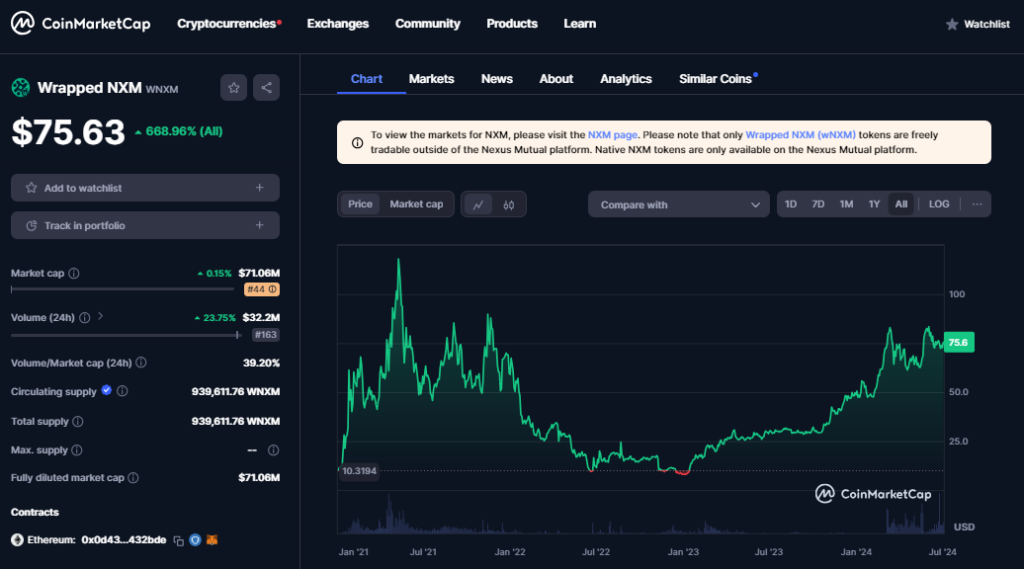

On June 3rd, Binance announced the delisting of several altcoins, including OMG Network ($OMG), Waves ($WAVE), Wrapped NXM ($WNXM), and Nem ($XEM). Notably, some of these altcoins, such as $OMG, $WAVE, and $XEM, had been closely associated with the early growth stages of the cryptocurrency market.

In its announcement, Binance cited a few key criteria that led to the decision to delist these altcoins, including:

- The level of commitment and quality of operations by the project’s development team

- The trading volume and liquidity of altcoin

- The development and engagement of the project’s community

- Altcoin’s overall contribution to the broader cryptocurrency ecosystem

It appears the aforementioned projects were unable to sufficiently demonstrate adherence to the standards set by Binance for continued listing on the exchange.

One of the potentially most important factors seems to be the trading volume of altcoin. Robust trading volume, even for newly launched projects, can signify a large and engaged community of investors, as exemplified by recent examples like Notcoin ($NOT) and Memecoin ($MEME), which were quickly listed on Binance due to their sizable user bases and high trading activity.

2. A few characteristics that investors should be aware of from this delisting

In May, $OMG recorded a 24-hour trading volume of only $10 million – $15 million, $WAVE had $20 million – $50 million, $XEM had only $3 million – $6 million, and $WNXM had $2 million – $8 million. These are relatively low daily trading volumes. Traders have seemingly lost enthusiasm for these projects.

2.1. $OMG altcoins (OmiseGO)

The official X account of OMG has not been updated since November 2023, and the main website is even inaccessible. This indicates the project has not been actively engaging with the community. If OMG does not make substantial improvement efforts, it risks becoming a “dead coin”.

2.2. $WAVE altcoins (Waves)

Waves was launched and listed in 2016, as a global open-source platform for building decentralized applications. After 8 years, the Waves ecosystem has not expanded significantly, and there are not many prominent projects built on the Waves codebase. The project also lacks integration with other initiatives and has yet to adopt trending market features like staking and restaking.

2.3. $XEM (Nem)

NEM ($XEM) was launched in 2015, and after the 2021 uptrend, the project has become quite obscure. The project’s Discord channel has not been updated since 2022, and the official website stopped posting updates in September 2023. The project has poor community engagement and has not rolled out any initiatives to attract new users.

2.4. $WNXM (Wrapped NXM)

WNXM is a wrapped token supported 1:1 with Nexus Mutual (NXM), a platform providing smart contract insurance services. Binance’s delisting of this wrapped token may be due to diminishing trading demand.

Following this news, the prices of OMG, WNXM, WAVE, and XEM have all been affected. Specifically, OMG, WAVE and XEM have dropped close to their 2023 lows and may set new bottoms, as there are no signs of strong buying pressure returning. Investors may need to review their portfolios and consider restructuring positions in projects with poor community engagement, failure to keep up with market narratives, and low trading volumes, to mitigate risks.

Visit the official announcement at: https://www.binance.com/en/support/announcement/binance-will-delist-omg-waves-wnxm-xem-on-2024-06-17-f65faeeefe07417a8b6dd2900ba8da7e

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.