We are thrilled to present our latest in-depth research on Bitcoin’s current state. This report explores where we are in the market cycle, the impact of macroeconomic dynamics, ETF flows, and key market indicators. We aim to help you navigate Bitcoin’s cycle more confidently by breaking down the most critical charts and trends. Stay ahead of the curve by diving into this week’s macro updates and our crypto insights.

1. Major Developments This Week

The U.S. election remains a key catalyst for Bitcoin and the broader crypto market. We believe November’s election presents a “win-win” scenario for crypto. While Trump’s policies are seen as more favorable due to his clear strategy and promise to make America the “crypto capital of the planet,” regardless of who wins, the outcome is expected to be an improvement over the current administration.

On the China front, Reuters reported plans for issuing special sovereign bonds worth approximately 2 trillion yuan this year as part of fresh fiscal stimulus. Bloomberg also reported that China is considering injecting up to 1 trillion yuan of capital into its largest state banks.

China’s stimulus is the next major catalyst for a crypto bull run. Historically, crypto has benefited from China’s liquidity expansions. With growing risk-on sentiment, this could push risk assets higher and reinforce the “Uptober” narrative

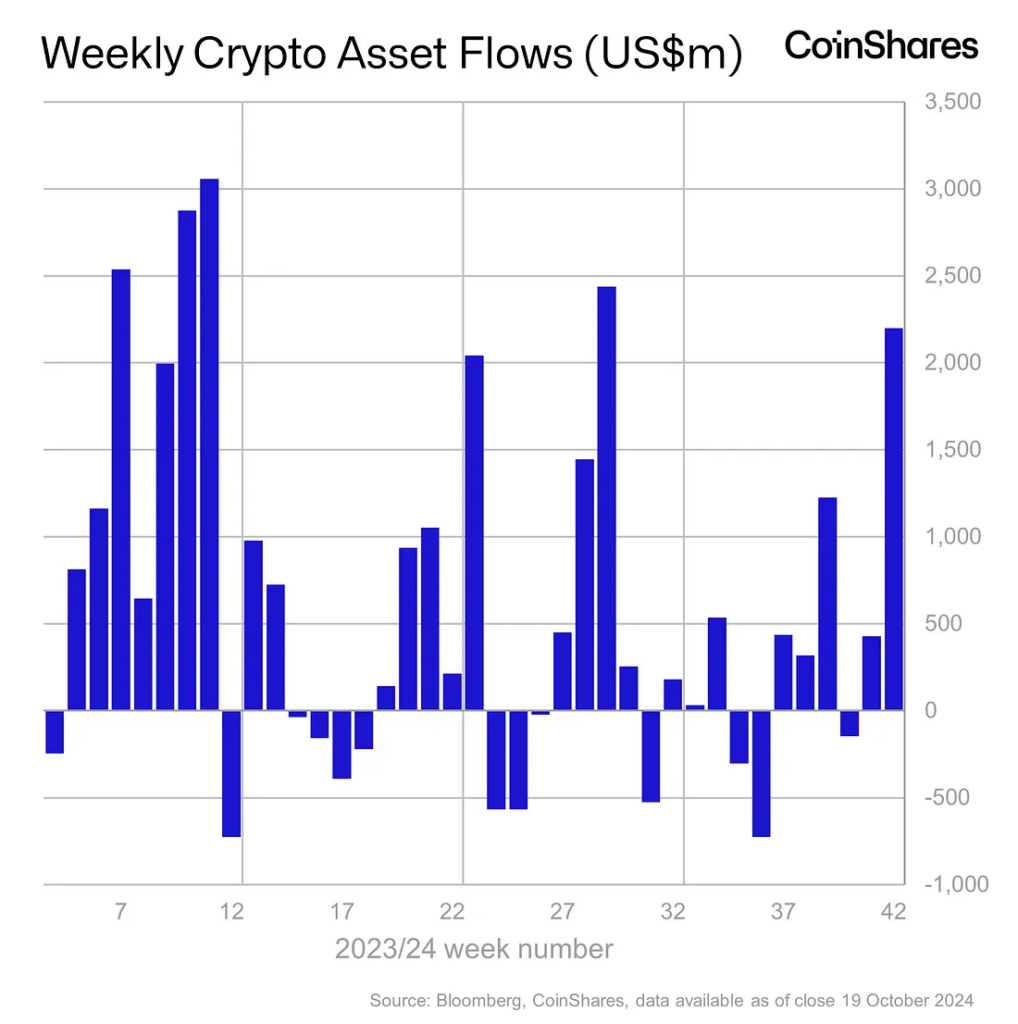

Fund Flows: Last week, digital asset funds saw inflows of $2.2 billion. Notably, on October 17, inflows reached $470 million when Bitcoin (BTC) was priced at $65k, more than double the $200 million inflows from August 8, when BTC was $59k. This indicates that ETF investors are increasingly willing to deploy more capital at higher prices, signaling strong confidence in Bitcoin’s future growth potential.

Q4 Outlook: Ample liquidity from the Fed’s rate cuts and China’s aggressive fiscal stimulus will continue to fuel ETF inflows, driving the next phase of the bull market. These strong and growing inflows serve as a leading indicator of further rallies for BTC.

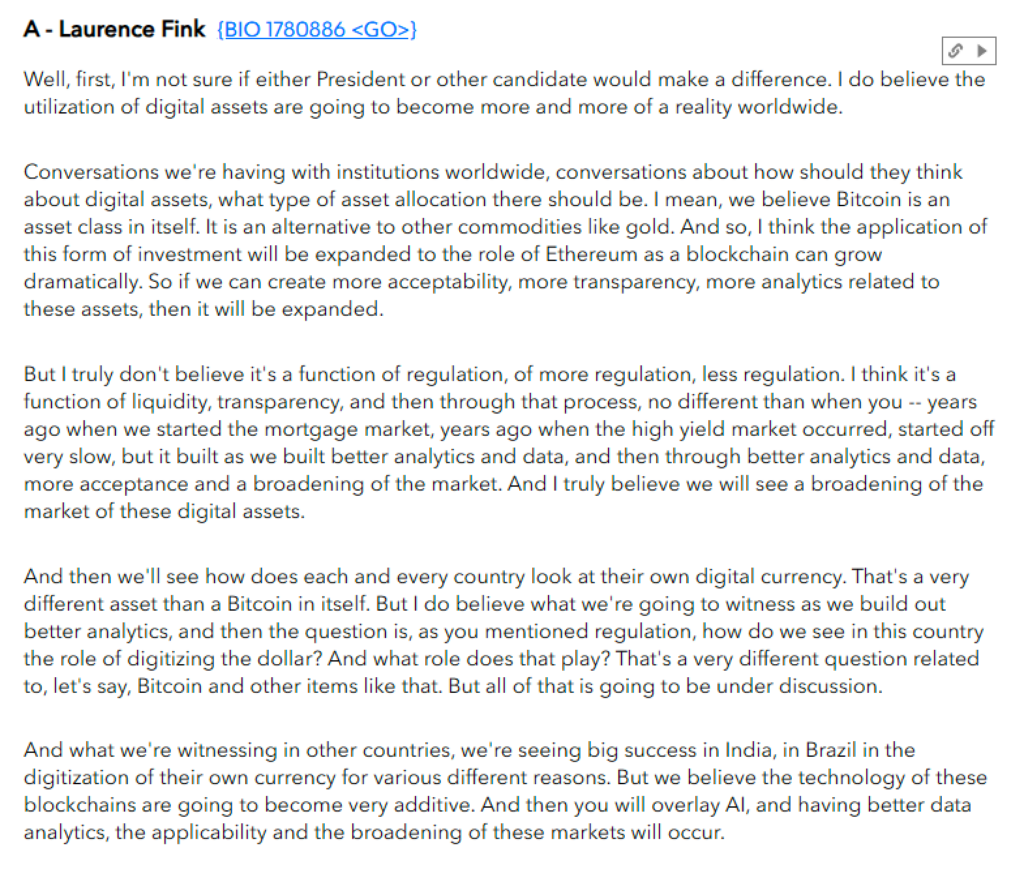

Broadening Institutional Adoption: In BlackRock’s Q3 earnings call, CEO Larry Fink (overseeing $10 trillion in assets) emphasized that digital assets, particularly Bitcoin, are becoming increasingly important in institutional portfolios globally, regardless of political shifts.

Fink’s remarks underscore the evolution of digital assets from speculative instruments to mainstream financial products, driven by enhanced liquidity, transparency, and analytics. His outlook is bullish on the long-term potential of digital assets and blockchain.

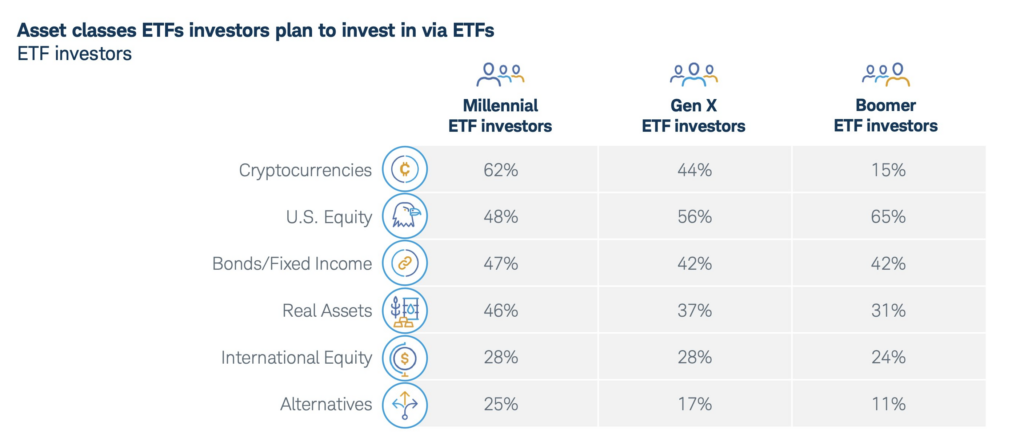

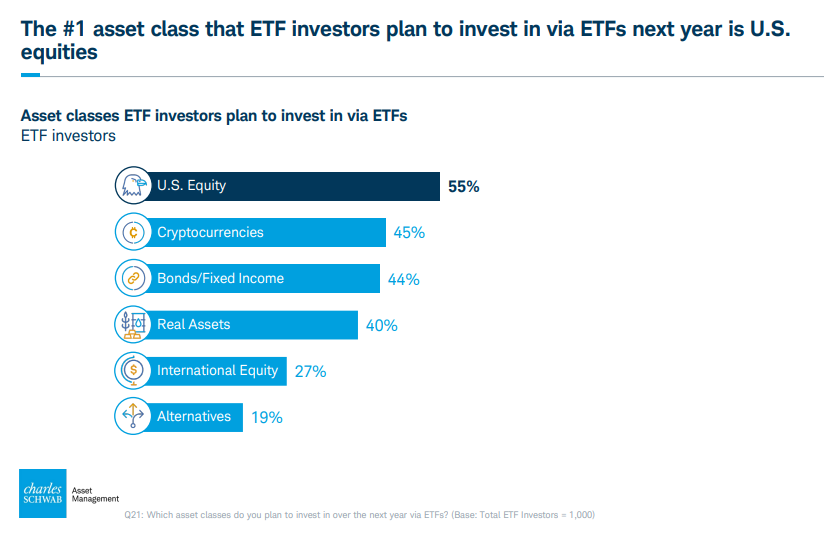

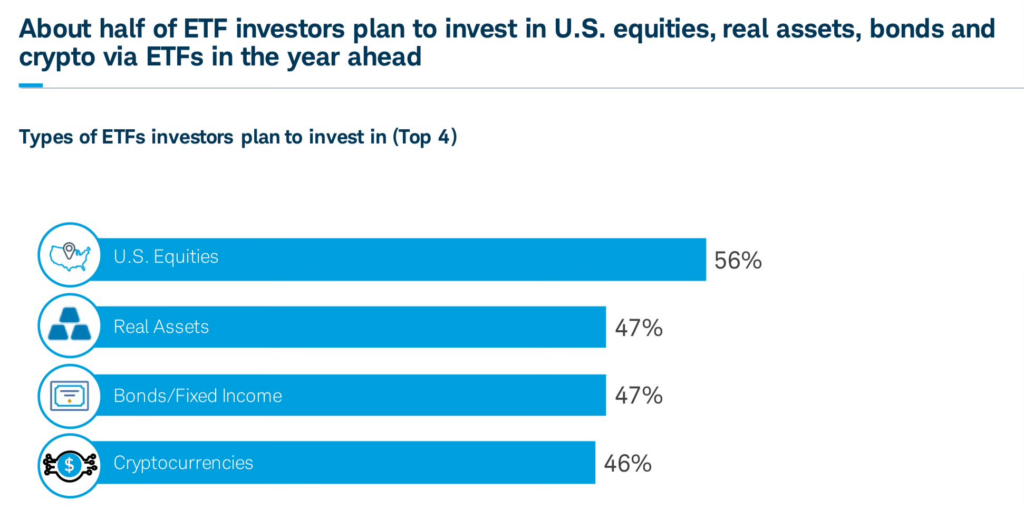

Retail Insights: According to a survey by Charles Schwab of 2,200 investors:

- 62% of Millennials plan to allocate to a crypto ETF next year, compared to 44% of Gen X and only 15% of Boomers.

- Boomers are largely uninterested in crypto, while Millennials show stronger enthusiasm for crypto than equities. Gen X ranks crypto as their second choice, ahead of bonds.

Nearly half of those surveyed plan to invest in crypto ETFs rather than bonds, international equities, or alternatives over the next 12 months.

The same survey conducted two years ago, before crypto ETFs existed, had Bitcoin priced at $30k. The 2024 survey highlights strong, unmet demand for crypto investment products, signaling further growth potential for the asset class.

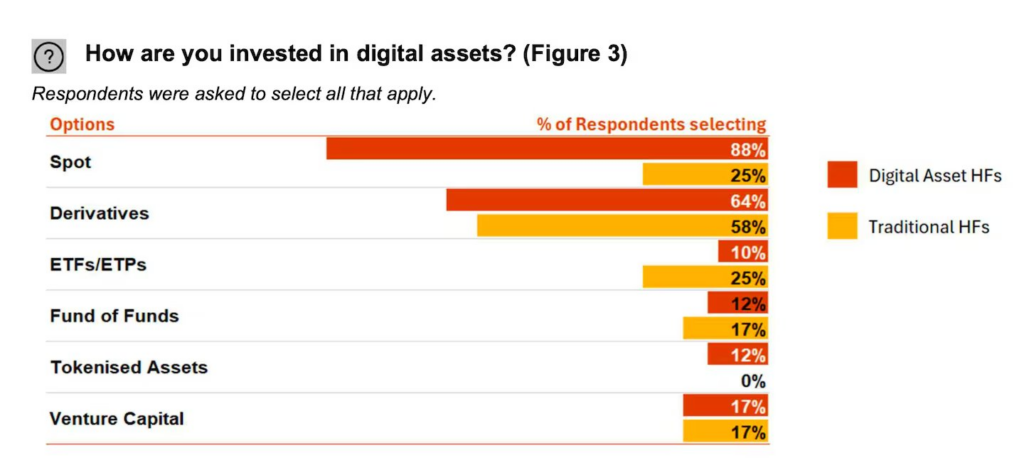

Institutional Insights: According to PwC’s Global Crypto Hedge Fund Report:

- 47% of hedge funds trading in traditional markets now have exposure to digital assets, up from 29% in 2023 and 37% in 2022.

- 67% of hedge funds plan to maintain their current crypto allocations, with the remainder planning to increase their investments by the end of 2024.

- 58% of traditional hedge funds are active in crypto derivatives, up from 38% last year, while those trading in spot markets dropped to 25% from a peak of 69% in 2023.

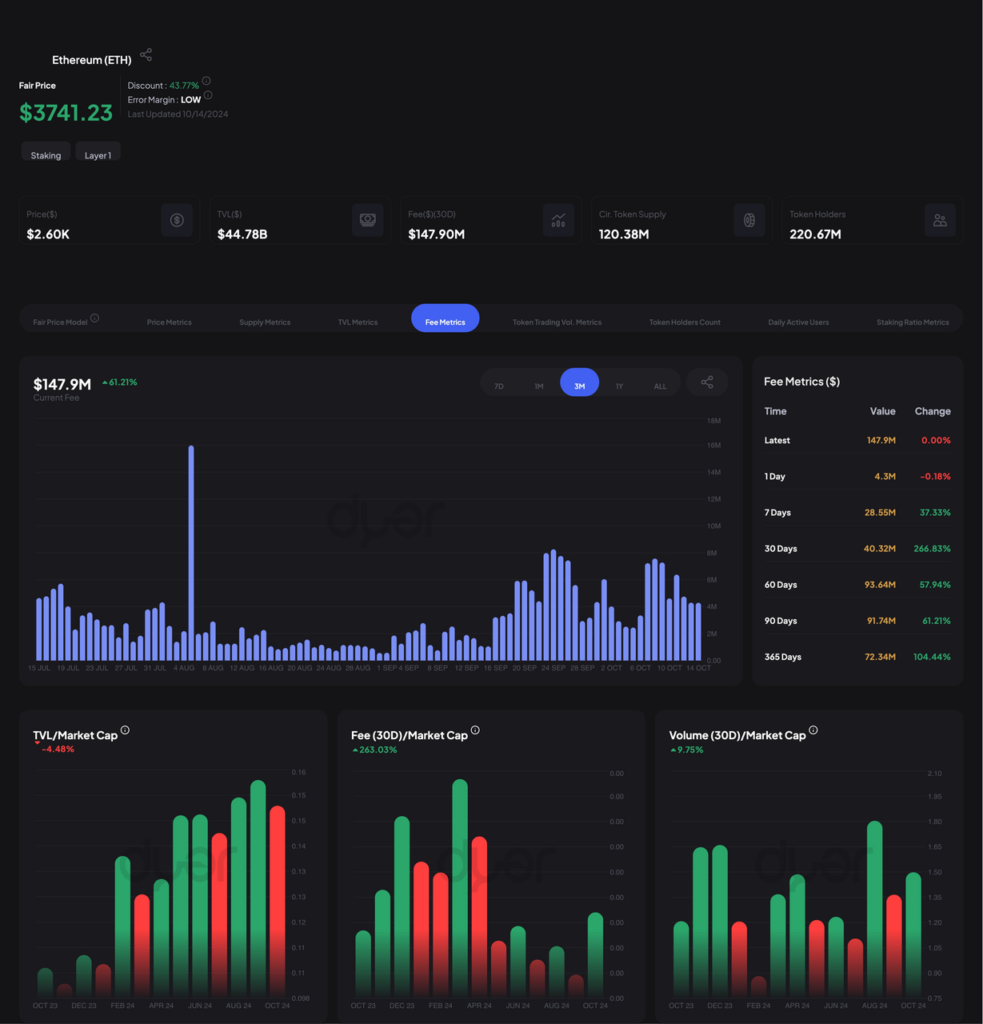

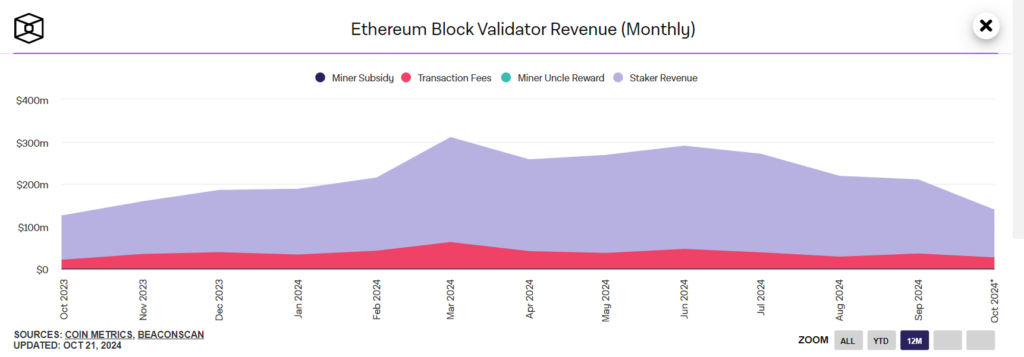

Ethereum Transaction Fees: Last week saw notable growth in Ethereum’s network performance, with transaction fees increasing 2.6x over the past 30 days, highlighting strong network activity.

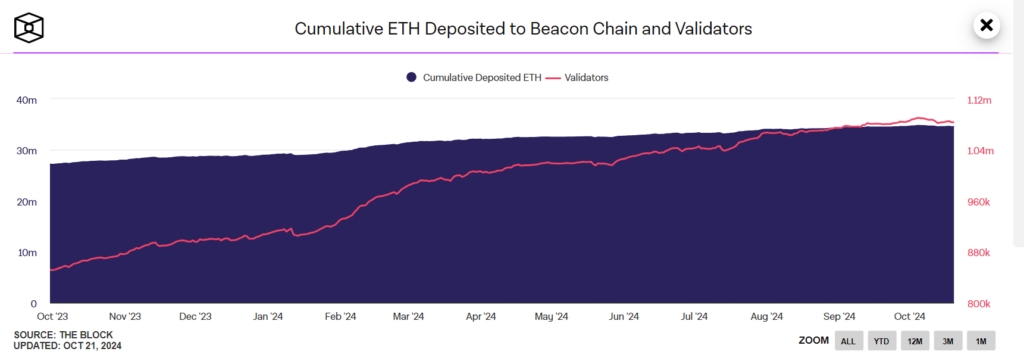

Staking Revenue & Validator Growth: While staking revenue for ETH has declined from peak levels, the consistent increase in the number of validators reflects sustained long-term confidence in Ethereum’s future.

2. Closing Thoughts

No significant macro headwinds are expected for Bitcoin in Q4. Regulatory clarity is emerging globally, boosting confidence in digital assets among both retail and institutional investors, as evidenced by recent surveys and reports from major players.

Bull Market Continuation Signals: Factors like the rate-cut cycle, global liquidity recovery (U.S. rate cuts + China stimulus), ETF flows, and seasonal trends support the bullish outlook. Another potential catalyst: a pivot towards governments’ pro-crypto policies.

Trade Ideas: Focus on Layer 1 blockchains (SOL, ETH, APT) and DeFi projects (AAVE, UNI).

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.