1. Quick Take:

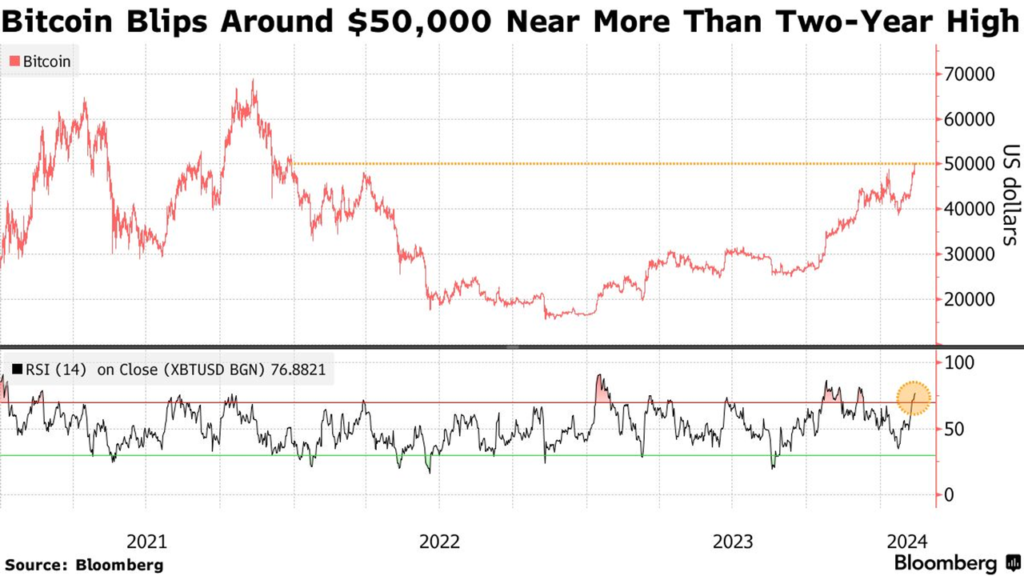

The approval of Bitcoin Spot ETFs has garnered increasing interest from both institutional and retail investor groups, propelling the BTC price to $52,580 – the highest mark since December 2021, and bringing Bitcoin’s market capitalization back to $1 trillion.

2. Catalysts for Bitcoin Surge:

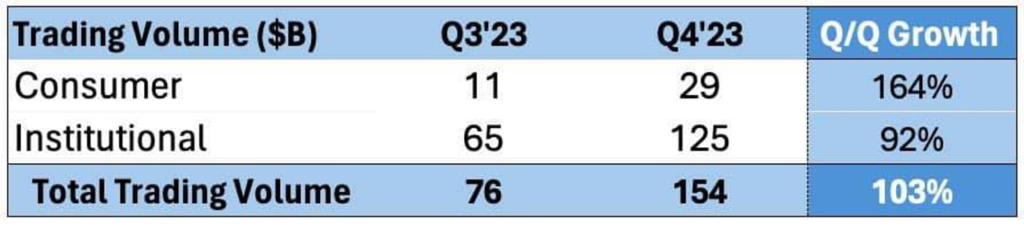

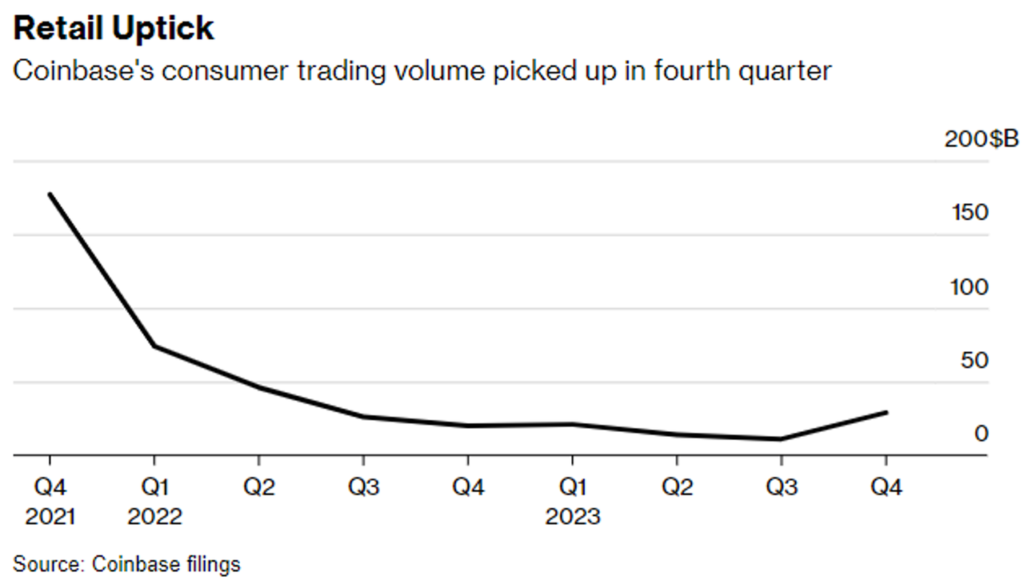

- Firstly, Coinbase’s Q4 report indicates that trading volumes from both institutional groups and retail investors have risen, with the percentage growth of retail investors being stronger (164% compared to 92%).

Sourecs: Coinbase Fourth Quarter and Full-Year 2023 Earnings Call

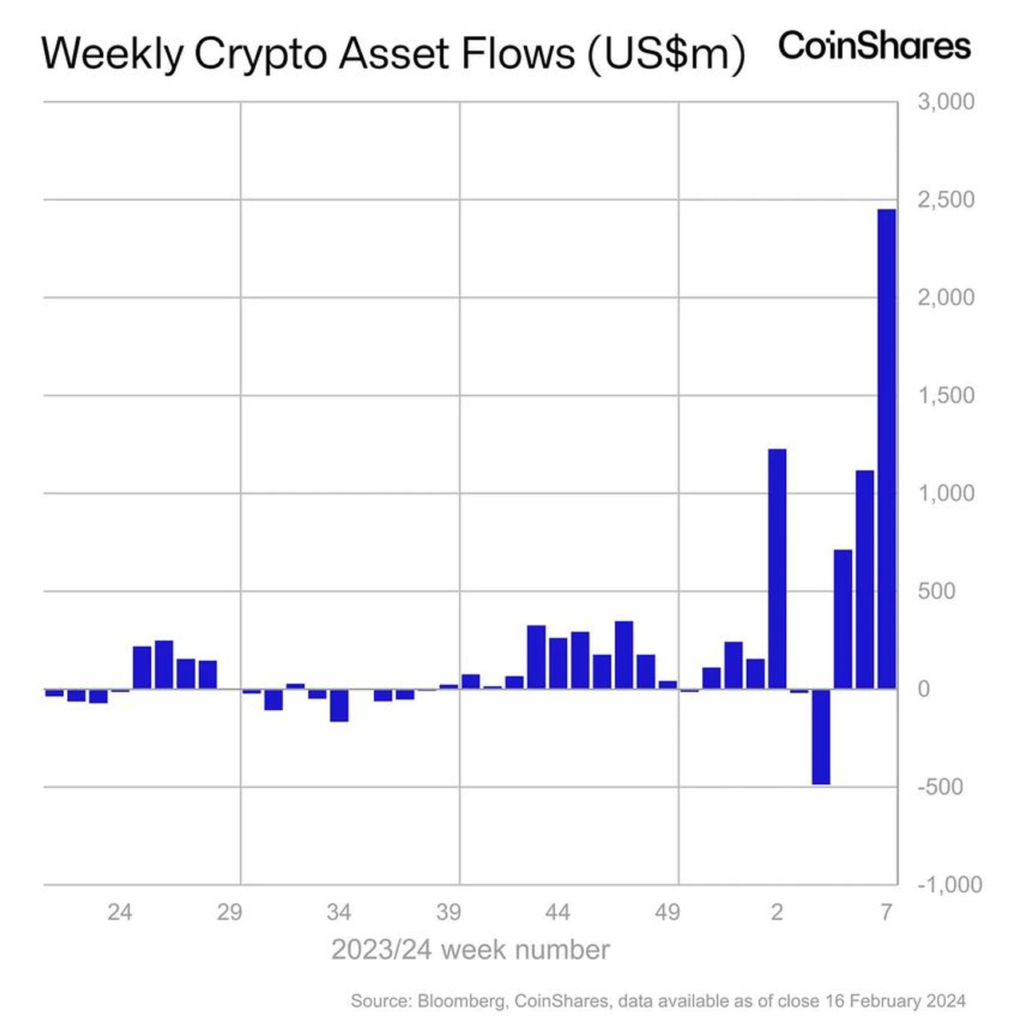

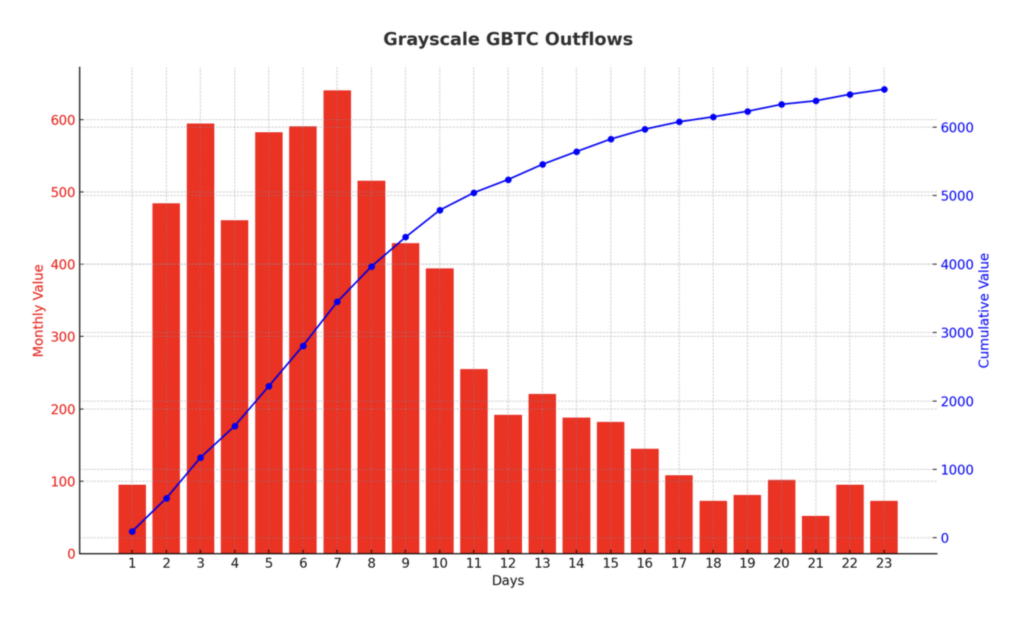

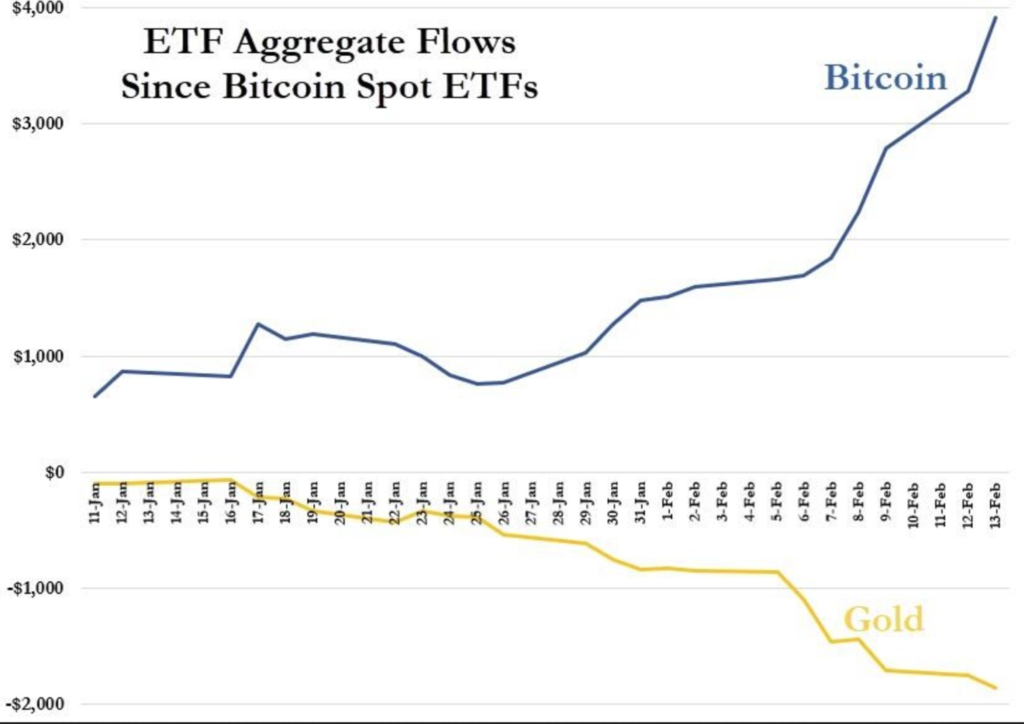

- Secondly, a significant increase in capital inflows into ETFs, overshadowing the capital outflows from GrayScale’s GBTC fund. From January 26 to February 15, Bitcoin Spot ETFs consistently witnessed positive cash flows. Specifically, last week saw the largest inflow into Bitcoin Spot ETF, reaching $2.45B.

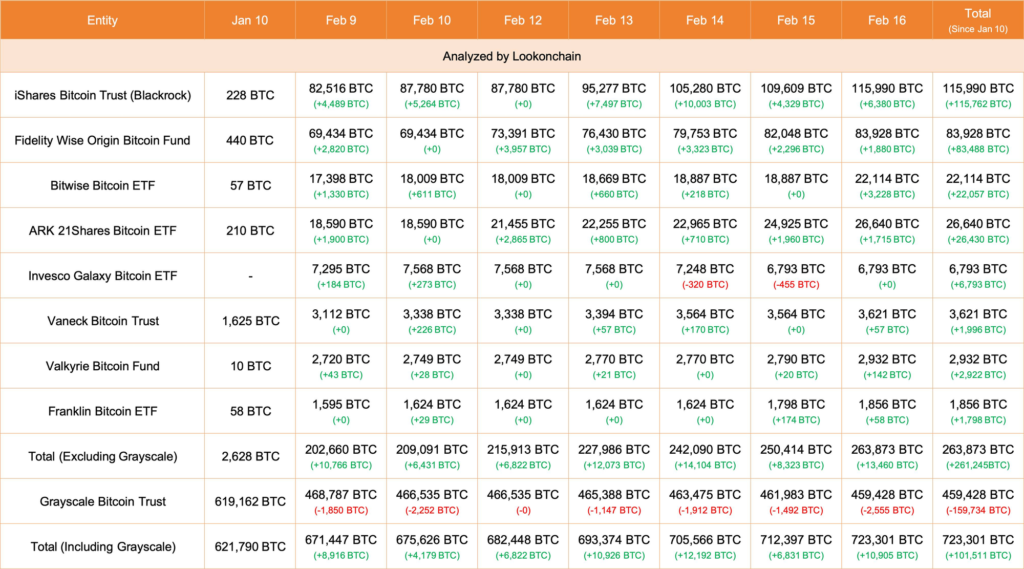

- Thirdly, Wall Street’s funds continuous accumulation of Bitcoin. As of February 16, 9 Bitcoin ETFs Funds are holding a total of 263,873 BTC, buying an average of ~10,000 BTC a day. This is about 11x the daily issuance from the block reward, indicating a supply-demand imbalance.

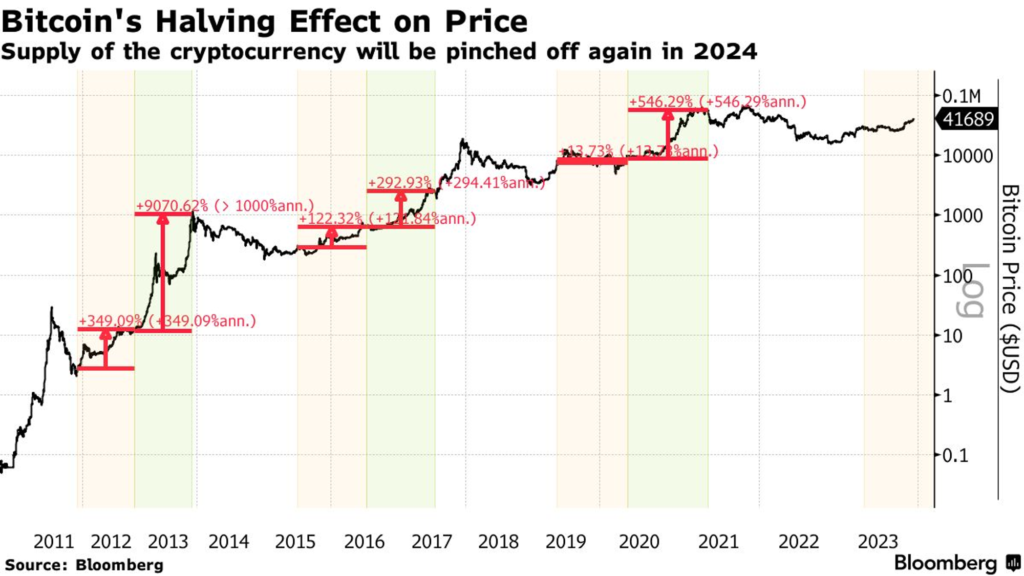

- Finally, the outlook of the BTC halving (in two months) has reinforced investor optimism, as BTC prices have historically increased following the halving events in 2012, 2016, and 2020.

The Future Prospects and Price Forecast:

The trading of Bitcoin Spot ETFs on US stock exchanges has increased Bitcoin’s popularity with mainstream investors, expanding its accessibility to the majority of investors. Estimation models from various research entities anticipate that US Spot BTC ETFs will attract inflows of $10 billion to $20 billion in the first year (having already drawn more than $5 billion in total net flow → room for growth remains). The fixed supply and strong demand are expected to lead to significant price increases in the medium and long term. In the short term, investors should prepare mentally and plan their trading strategies for any potential adjustments.

Concluding Thoughts:

BTC has now become an integral part of a well-diversified portfolio. Investing in Bitcoin contributes to portfolio diversification due to its low correlation with other assets. According to the principles of portfolio management, the overall risk of the portfolio decreases when investors hold a variety of assets with low correlations. Consequently, with many investment funds currently allocating 5-10% of their portfolio value to gold, they will probably increase their Bitcoin allocation to 1-2% (depending on the future performance of Bitcoin and gold, investment funds will adjust their allocation ratios accordingly).

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.