1. Market Context

During the peak period of NFTs from the beginning of 2021 to mid-2022, the renowned NFT exchange OpenSea was always regarded as the kingpin of the industry. At that time, whenever anyone mentioned buying, selling, or exchanging NFTs in the secondary market, they would undoubtedly have to reference OpenSea. This exchange consistently maintained its position as the market leader over the years, even though various competitors like LooksRare, X2Y2, and others successively emerged. This dominance continued until the onset of 2023 when a new dynasty named Blur emerged—a secondary NFT exchange tailored for professional traders. In less than a year since its launch, Blur has:

- Officially surpassed OpenSea in daily NFT transaction volume for several months.

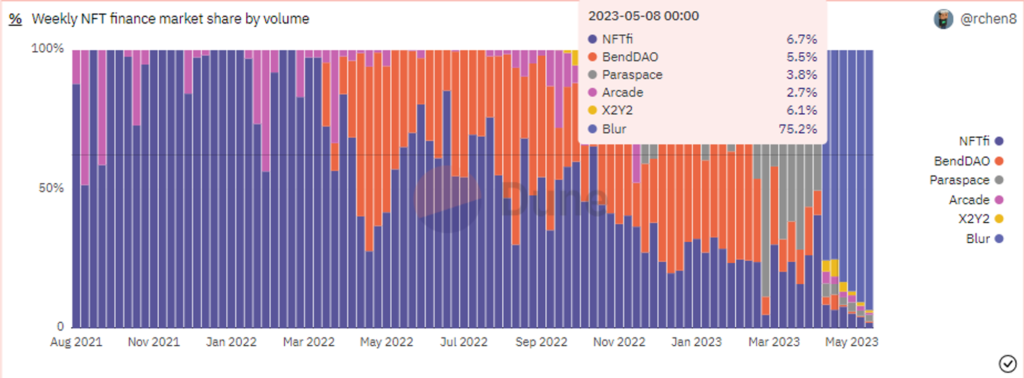

- Accounted for over 70% of the NFT transaction volume on the Ethereum ecosystem and held 80% market share for NFT lending concerning NFTFi protocols (the NFTFi concept will be analyzed in the following chapter).

- For the first time, OpenSea had to consistently implement new incentive policies to retain its market share.

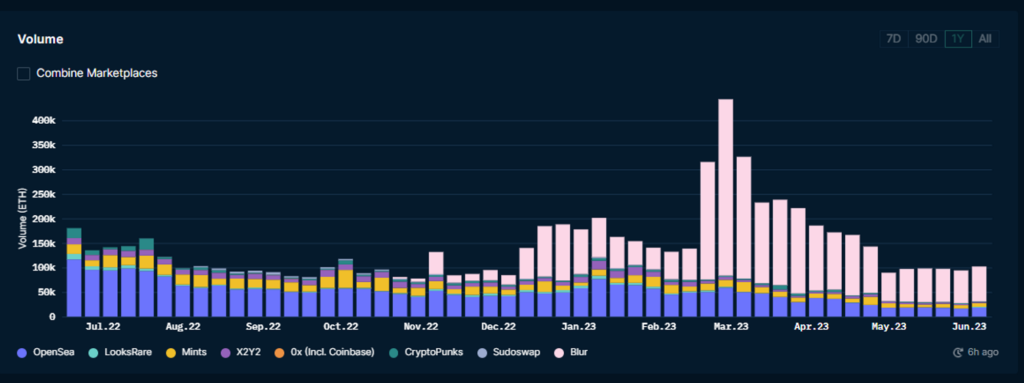

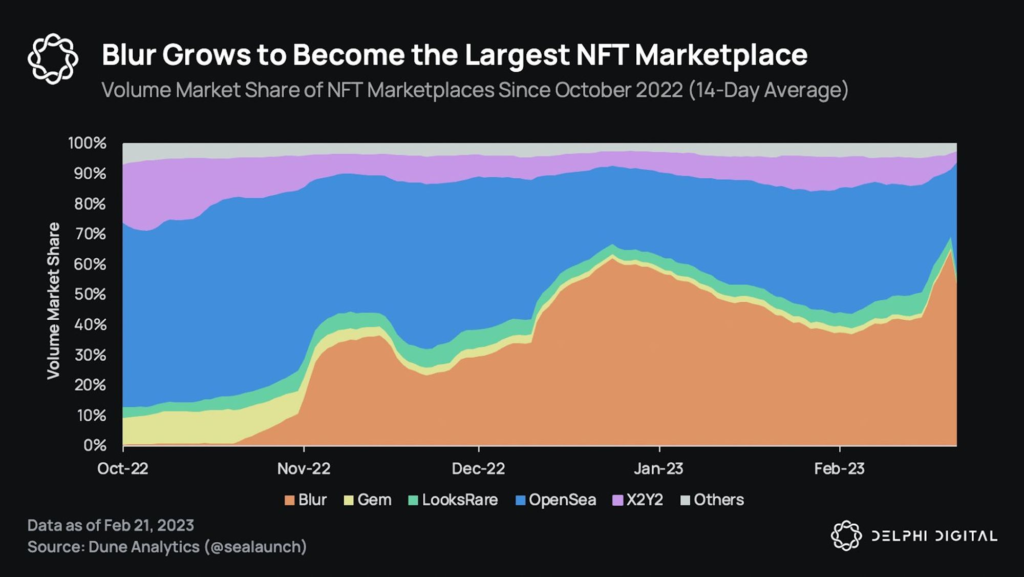

The transaction volume of Blur (in light pink) has held a dominant advantage since its launch compared to other exchanges, including OpenSea (in dark blue).

How? How did Blur manage to go “from Zero to Hero” when countless other exchanges that have risen over the past years have failed? What distinguishes Blur’s marketing campaign from the rest? Let’s delve deeper.

Blur is an NFT Marketplace and NFT Aggregator developed on the Ethereum ecosystem. On March 28, 2022, Blur completed its seed round of funding, raising a total of 11 million USD, led by Paradigm – one of the leading investment funds in the crypto market.

List of seed investors for Blur.

Launched for the first time on October 19, 2022, Blur is currently the leading NFT Marketplace in the market, with a total daily trading volume at times reaching over 60,000 ETH, accounting for more than 80% of the total market volume.

A notable difference between Blur and OpenSea is the Aggregator feature. Why is the Aggregator so crucial?

In the late 2021-2022 period, we witnessed a blossoming NFT spring, leading to the emergence of various NFT Marketplaces. However, this resulted in fragmentation in terms of user numbers and trading volumes across these exchanges. Moreover, sometimes NFTs listed on one platform might not be listed on another, which, to some extent, diminishes the liquidity of the NFTs.

An Aggregator is a solution that consolidates NFT prices from various Marketplaces with the purpose of making it more convenient for users to buy or sell NFTs. Instead of browsing through multiple exchanges to find the best price, investors only need to engage with a single NFT Aggregator platform.

2. Go-to-Market (GTM) Strategy

To achieve its current accomplishments, Blur truly employed highly effective marketing strategies, and it can be viewed as a quintessential case study in the Crypto industry. Similar to previous NFT exchanges like X2Y2, LooksRare, etc., from its initial launch days, Blur executed a Vampire Attack campaign, primarily targeting OpenSea, which was the dominating NFT trading platform at the time.

However, if they were to simply follow in the footsteps of previous projects, they knew they couldn’t overcome the colossal shadow of OpenSea. The market needed a breakthrough for change. Specifically, Blur split the total number of tokens airdropped to platform users in 2022 and 2023 into 2 Seasons.

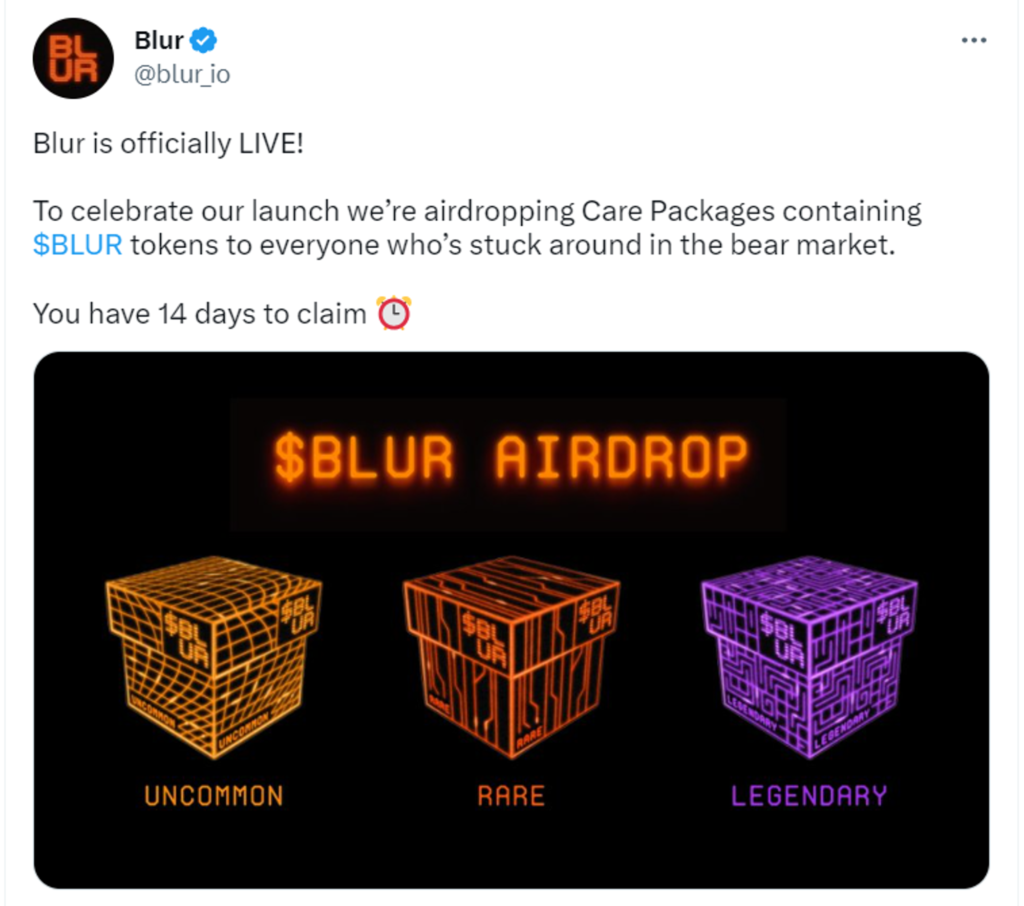

In Season 1, they announced an airdrop of $BLUR tokens to users in 3 phases as follows:

- Phase 1: Users who engaged in NFT transactions on platforms within the Ethereum ecosystem in the 6 months before Blur’s launch.

This move was designed to attract a massive customer base from OpenSea, which was the home to 90% of NFT transactions in the market. The event reward was designed in the form of an NFT Box categorized by rarity, further amplifying curiosity with the aim of drawing the attention of the entire market.

Concurrently with the Vampire Attack campaign, at this juncture, Blur also announced a non-revenue Marketplace model with a complete transaction fee-free policy. In addition, they introduced a voluntary Royalties mechanism, wherein all traders selling NFTs on Blur have the prerogative to adjust the Royalties fee as per their wishes. Blur believes that to balance the interests of traders, collectors, and creators, they should not impose a mandatory Royalties policy. Instead, they encourage traders to execute full Royalties by enhancing the reward mechanism.

- Phase 2: Users who listed NFTs on Blur before December 6, 2022.

After successfully creating a significant buzz in the NFT market, Blur embarked on its second airdrop campaign for anyone who listed their NFTs on Blur with the slogan “the more you list, the more you earn.” Aiming to retain the customers introduced to Blur during the first airdrop phase, while also encouraging users to explore more features on Blur, this campaign achieved astonishing success. Data showed that within just two weeks from its launch, Blur’s daily trading volume on November 2, 2022, had surpassed that of OpenSea.

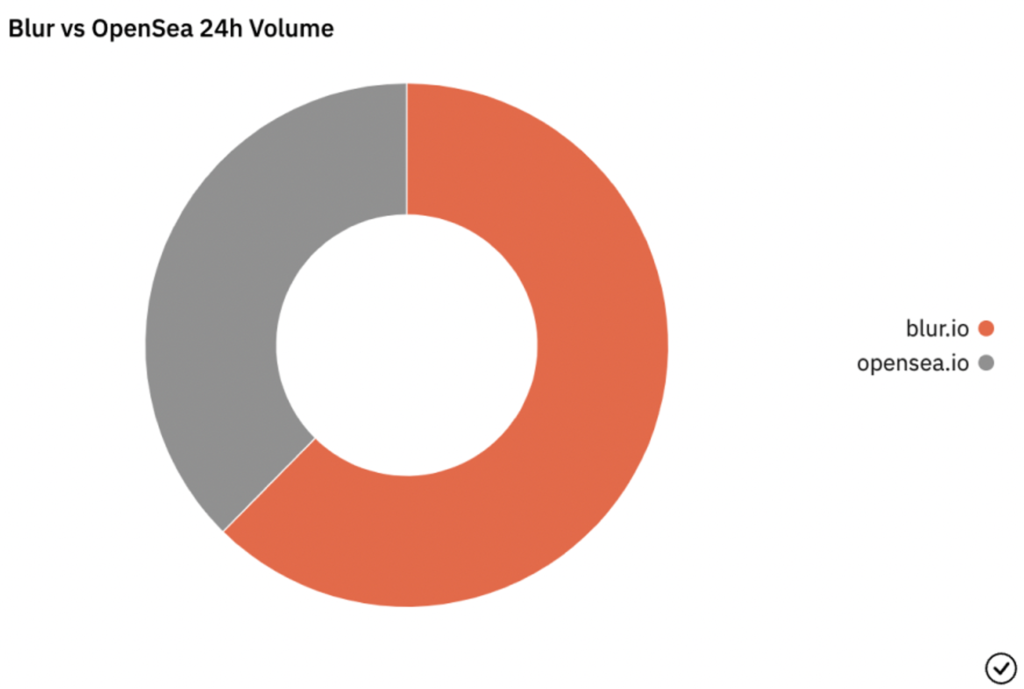

Total trading volume on Blur (in orange) compared to OpenSea (in gray).

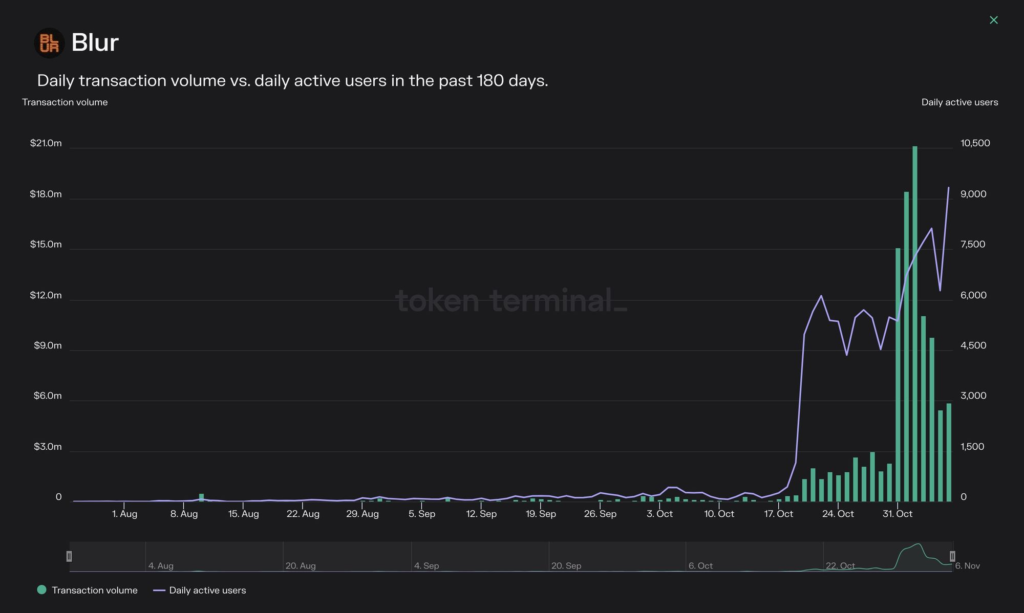

Simultaneously, the Daily Active Users count also reached a milestone of more than 9,000 people. The graph below depicts a pronounced shift since Blur implemented the two airdrop campaigns.

The daily transaction volume and daily active users on Blur saw a significant surge post their marketing initiatives.

- Phase 3: Users place a Bid order (pending purchase) at a price close to the floor price on Blur (before 14/2/2023).

For this mechanism, Blur encourages users to execute Bid orders on their platform. The closer users bid to the floor price and the longer the bid duration, the more points they earn. These points will serve as a basis to receive more rewards in the third airdrop as well as the largest airdrop of the first season. Encouraging users to place Bids on Blur also aims to increase the liquidity of the platform. The more people bid on the same collection at a price close to the floor, the more choices sellers have for quick liquidity by accepting the bid. The result is that the buyer gets both the NFT and points, the seller gets immediate liquidity, and Blur increases its transaction volume.

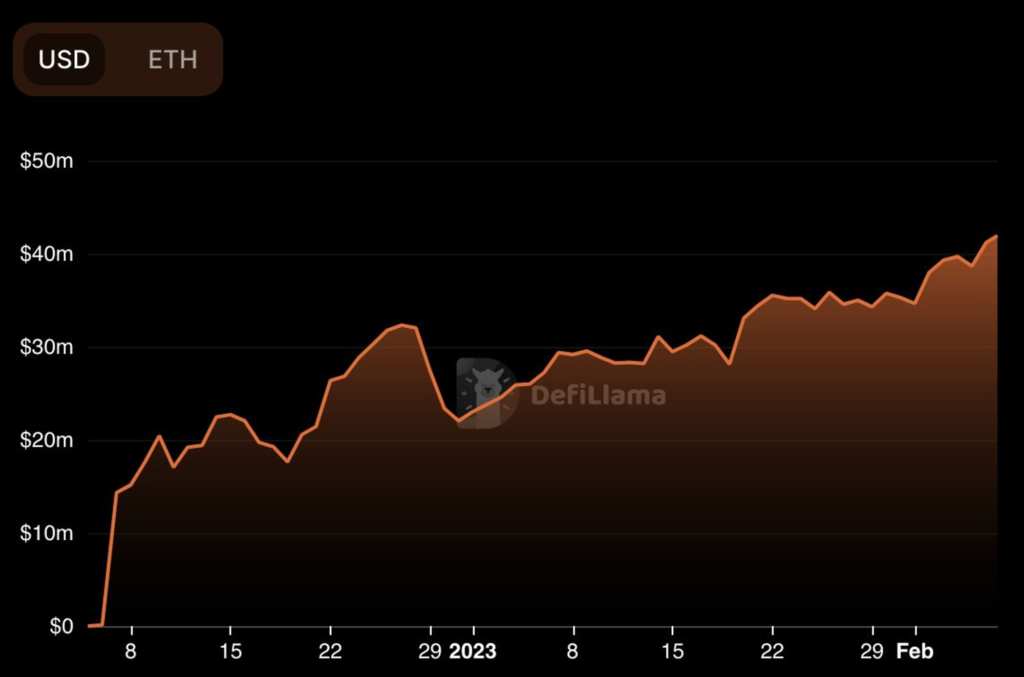

By the beginning of February 2023, the total bidding pool on Blur reached $42 million, equivalent to two-thirds of the Total Value Locked of Aptos, a Layer 1 blockchain at that time. A number that doesn’t lie.

The total bidding pool on Blur in February.

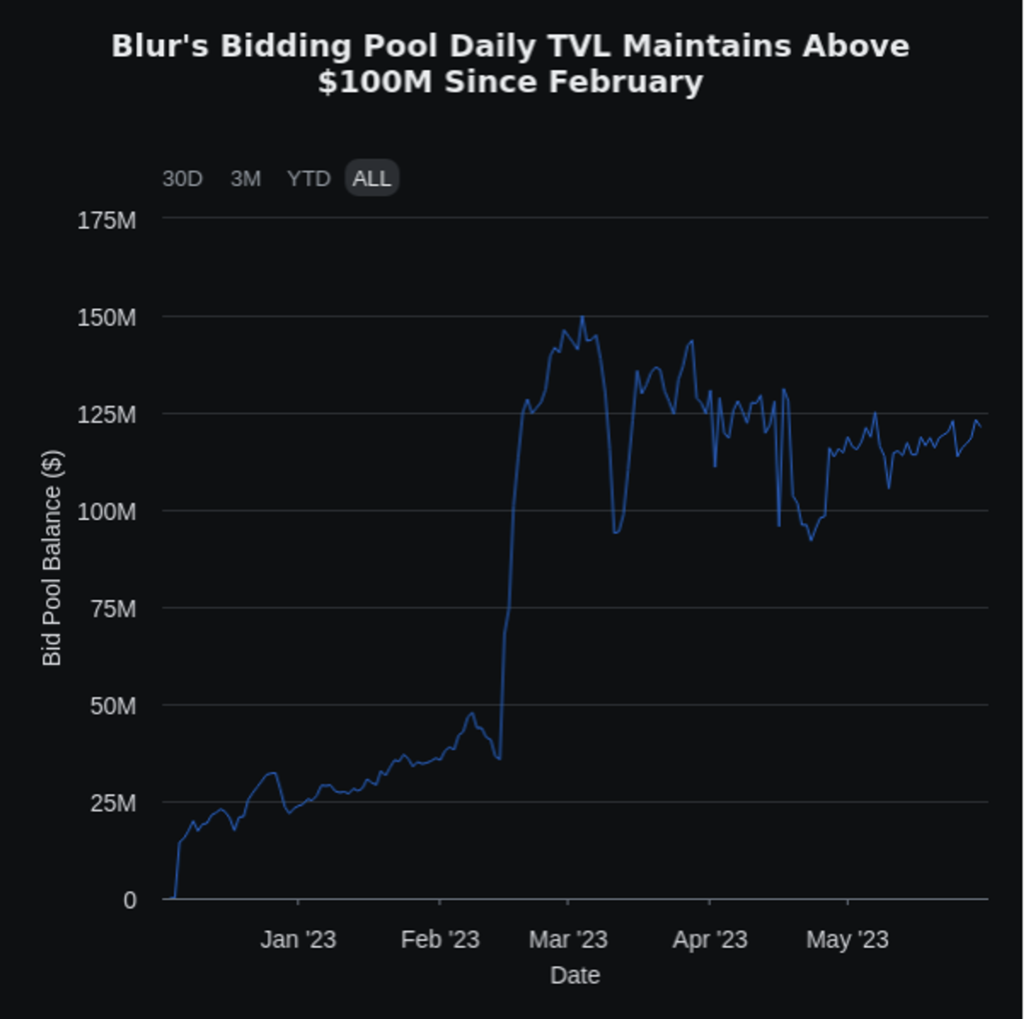

At the peak on March 4th, the total bidding pool reached an all-time high (ATH) of $150M converted to ETH. This is the record liquidity ever observed in the NFT space up to that point.

The total bidding pool on Blur since the beginning of the year.

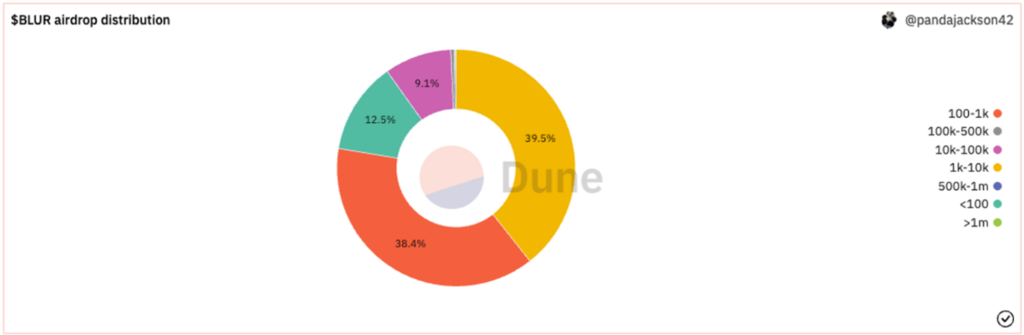

The conclusion of Season 1 with the launch of the $BLUR token on February 14th once again shook the entire NFT market, with a total of 360 million $BLUR (accounting for 12% of the total supply) distributed over 3 airdrop phases. Some traders received amounts up to several million $BLUR, with the highest recorded being 3.2 million $BLUR for a total trading volume of 5.84 million USD.

Distribution of the $BLUR token amount across wallets that have participated in NFT trading on the platform.

💡 After Season 1, we can observe that both the Trader and Blur won big in this battle. The biggest losers were OpenSea and other NFT trading platforms.

- Traders, regardless of the volume of their activities, received rewards for their transactions on Blur.

- Blur, while perhaps not yet profitable, has temporarily dominated the market share over OpenSea. This is the first time we’ve seen OpenSea constantly updating their policies to retain customers, further proving that they are becoming increasingly concerned about the throne they’ve held for many years.

A report from Delphi Digital indicates that Blur is becoming the largest NFT trading platform.

If in Season 1 Blur aimed to maximize user engagement with their product, Season 2 begins with Blur focusing on retaining more loyal customers. By using the Loyalty Score mechanism, users will achieve the maximum Loyalty points if they exclusively conduct transactions on Blur without using any other platforms. Accordingly, the total points will be calculated according to the formula:

💡 Maximum Points = Number of NFTs listed (based on value and quantity) x Loyalty Score.

The higher the Loyalty Score, the bigger the airdrop reward for Season 2, naturally. Thanks in part to this factor, users tend to want to perfect their experience. A study once showed that people prefer the absolute number of 100% over any form of incompleteness.

Additionally, Blur recently launched an NFTFi protocol named Blend. The points awarded to users utilizing this protocol also contributed to making Blend the largest NFT lending platform compared to its competitors in the industry.

The image above shows the market share of Blur one month after the launch of the Blend protocol, accounting for nearly 80%.

3. Feature and Metrics Comparison between Blur and OpenSea Pro

OpenSea Pro (formerly known as Gem) is an NFT aggregator platform acquired and renamed by OpenSea in April 2022. It is viewed as a trading platform geared towards pro traders and is currently Blur’s biggest competitor.

OpenSea Pro’s bidding mechanism is somewhat different from Blur’s. This platform allows users to bid using any ERC-20 token, rather than exclusively using ETH as Blur does. This offers added convenience, giving users a broader range of options when initiating NFT transactions. Additionally, OpenSea Pro’s Aggregator mechanism integrates data from 172 NFT exchanges (Blur currently only supports the three most popular exchanges: OpenSea, X2Y2, and LooksRare). Therefore, it can be asserted that OpenSea Pro remains the most accurate NFT pricing platform available today.

A Brief Comparison of Features between OpenSea Pro and Blur

- Blur

- A trading platform offering optimized tools tailored for pro traders.

- Aggregator platform integrating data from OpenSea, X2Y2, and LooksRare, ensuring optimal gas fee savings.

- Blend: An NFT lending protocol providing liquidity to the entire market, while also lowering the barriers to acquiring high-value NFTs.

- OpenSea Pro

- An advanced version of OpenSea targeting the professional trader customer segment.

- Aggregator platform incorporating data from 172 different exchanges, enabling users to efficiently track NFT values.

- Besides ETH, several ERC-20 tokens can also be utilized for bidding on OpenSea Pro.

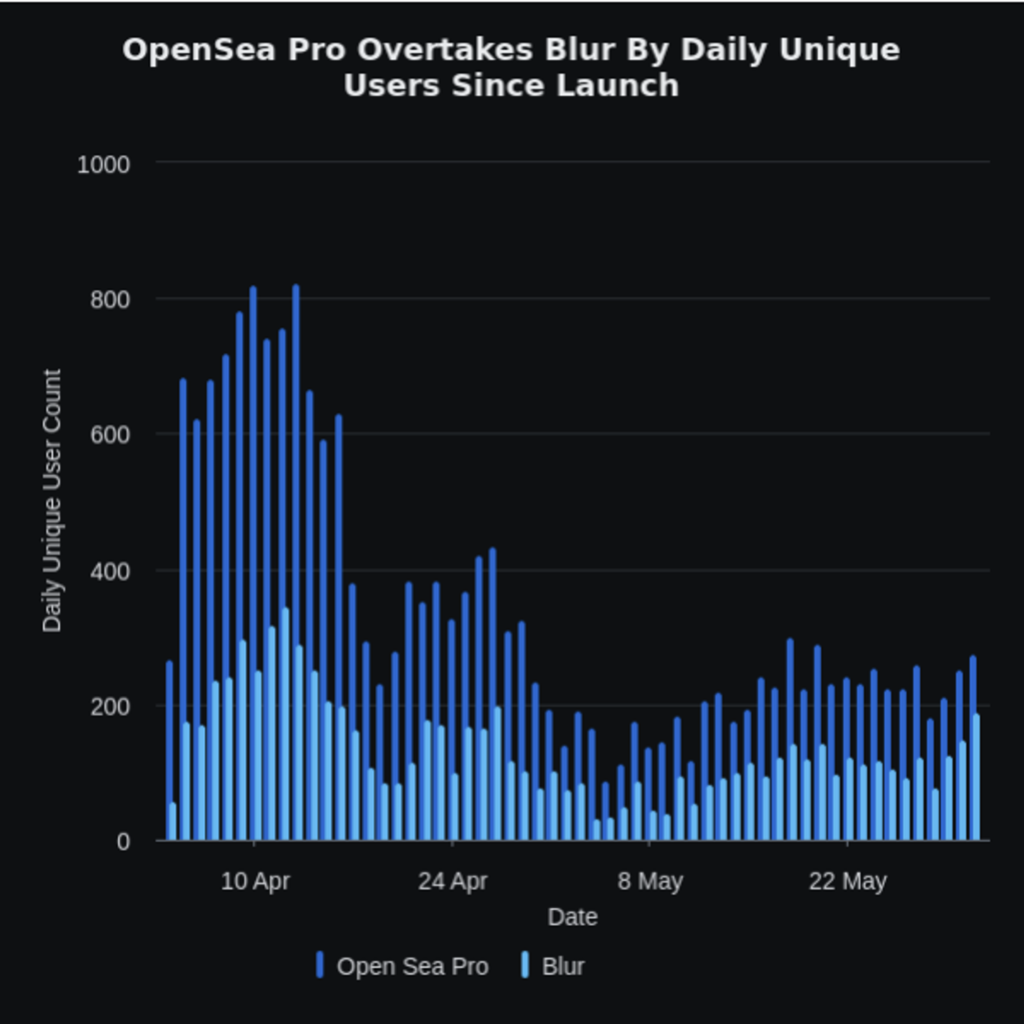

Comparison chart of the number of users between OpenSea Pro and Blur.

In terms of daily user numbers, statistics indicate that a majority of users tend to trade more on OpenSea Pro than on Blur, even though both platforms apply a 0% transaction fee policy to attract customers, and generally, their features are somewhat similar. The reason for this might be explained by the traders’ anticipation of OpenSea’s upcoming airdrop program, as the platform has not shown significant competitive signs since losing market share to Blur.

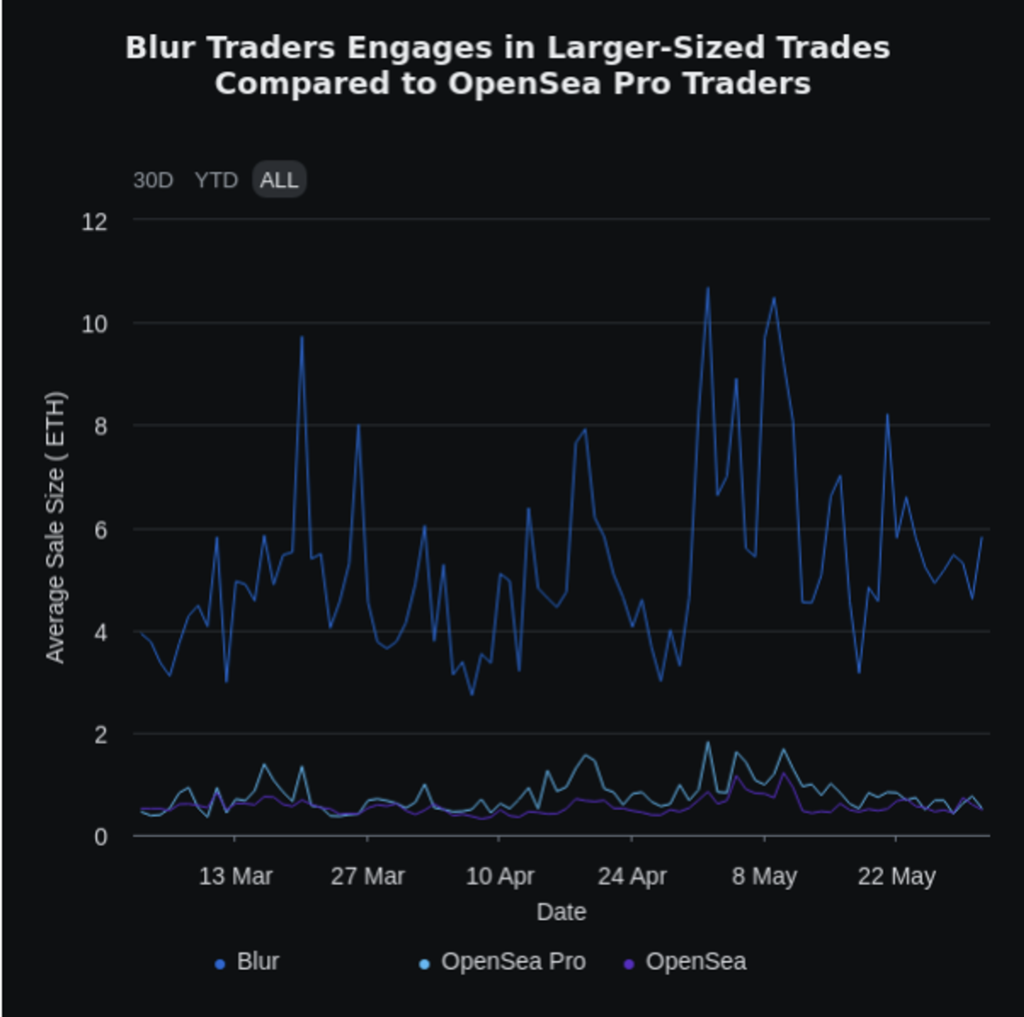

Comparison of trading trends between Blur and OpenSea Pro.

Looking deeper into trading behavior, the chart above shows that the majority of transactions on Blur are high-value NFTs. In the past 3 months, the average value for a transaction on Blur is 5.27 ETH. In contrast, for OpenSea Pro, an average transaction falls within the range of 0.56 ETH to 0.78 ETH. This suggests that Blur’s incentivizing policies have somewhat successfully attracted users to carry out high-value transactions on the platform.

In Conclusion

- Remarkable development due to a savvy marketing strategy has truly enabled Blur to achieve what no other exchange could before. Successive policies such as customer segmentation from the start, loyalty scoring for users, implementing airdrops, launching the Blend protocol to capture trends, and more have established the brand as the largest NFT trading platform in the market.

- While both platforms offer similar features, Blur seems to focus more on transaction volume and liquidity, whereas OpenSea Pro appears to dominate in terms of daily user numbers. The battle for market share is far from over.

It is indeed too early to definitively claim a long-term victory for Blur. Recent reports have raised questions about whether users are coming to Blur at this moment because they genuinely feel it is the best platform to experience or simply because of the ongoing airdrop program. If this program loses its appeal in the future, will people continue to use the product? Therefore, Blur needs to succeed in completely changing users’ habits to take more confident steps forward in the future.

Absolutely, competition is what drives progress and improvement. Users should always stand to benefit from healthy competition among platforms and products. When individuals or businesses believe they have reached a point of perfection or satisfaction, that’s precisely when competition becomes necessary to push boundaries and achieve further excellence. As traders and users, we can certainly look forward to ongoing improvements and enhanced user experiences in the future, addressing shortcomings that may have existed for a long time.