I. Overview

The top 80 holders of Bitcoin ETFs include a diverse array of hedge funds, asset managers, and institutional investors such as Millennium Management LLC, Susquehanna International Group, Jane Street Group, and ARK Investment Management. The involvement of these financial heavyweights marks a significant milestone for cryptocurrency adoption, underscoring the growing acceptance of Bitcoin as a legitimate and valuable asset class.

II. Market Impact

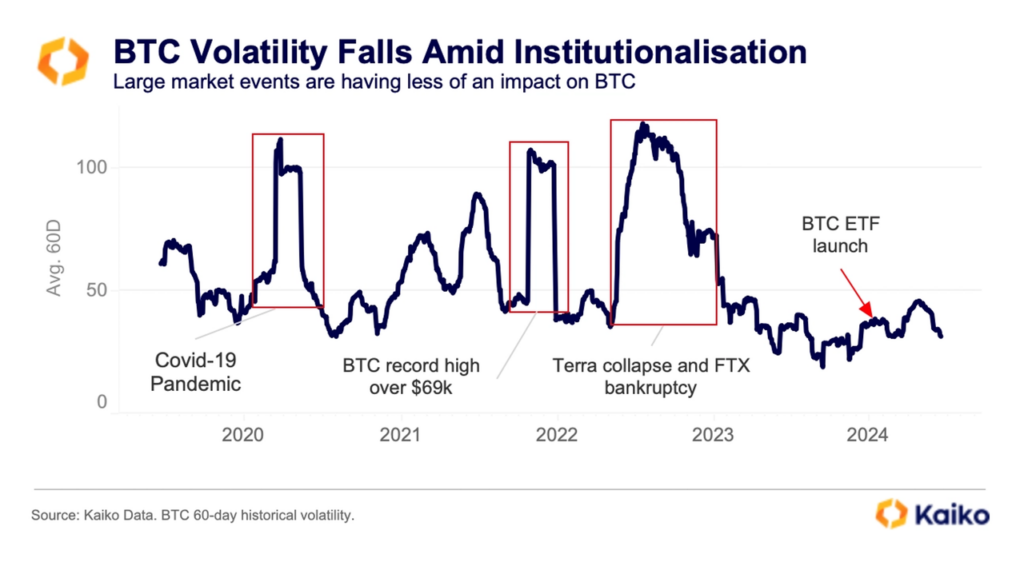

- Increased Liquidity and Stability: Institutional investments bring substantial liquidity, reducing volatility and fostering a more stable market environment. This can be observed in Bitcoin’s declining volatility, with its 60-day historical volatility remaining below 50% since early 2023, compared to past fluctuations exceeding 100%. Such stability can attract skeptics and mainstream investors who have hesitated to enter the crypto space.

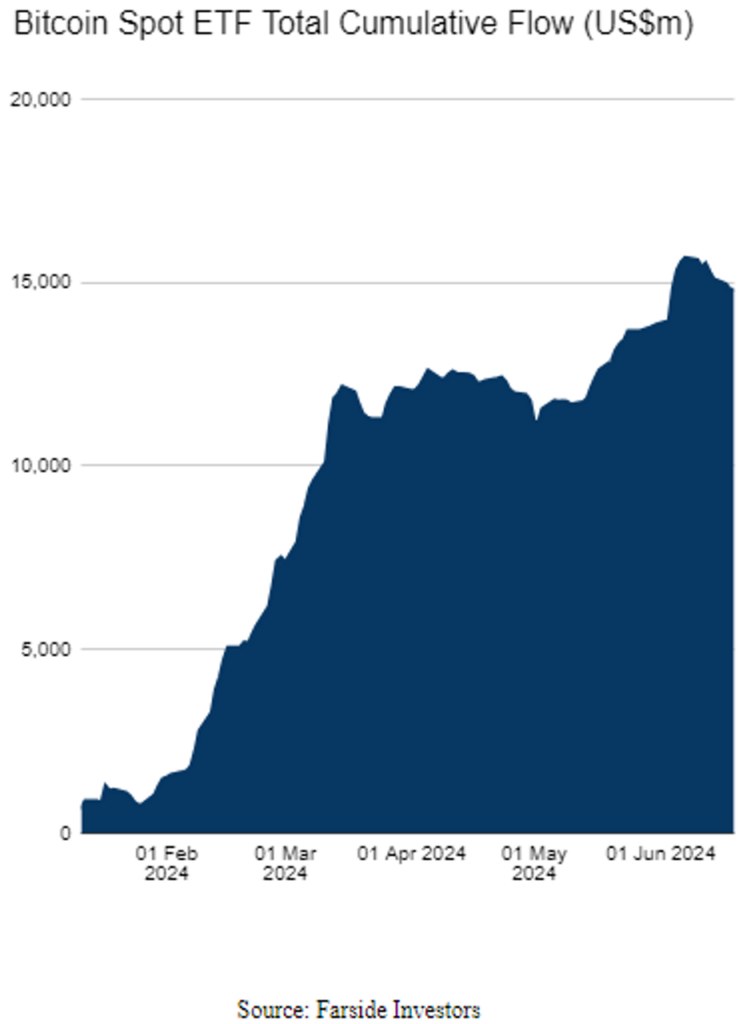

- Enhanced Credibility and Mainstream Adoption: the entry of reputable financial institutions into the Bitcoin ETF market enhances the credibility of cryptocurrencies. This legitimization can drive broader adoption among retail investors and traditional financial institutions, creating a positive feedback loop of increased investment and potentially more inflows into Bitcoin ETFs.

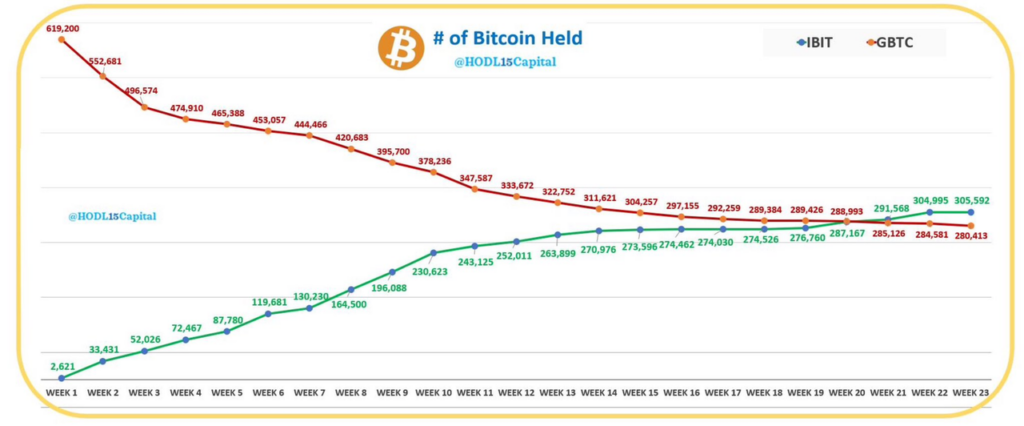

- Further highlighting this changing landscape is BlackRock overtaking Grayscale’s GBTC in terms of assets under management, with the $10 trillion asset manager now holding the title of the world’s largest spot Bitcoin ETF.

III. Future Prospects

The SEC filings not only highlight the present state of Bitcoin ETF investments but also provide a glimpse into the future of finance. The convergence of traditional finance and cryptocurrency is accelerating, and the implications are profound:

- Broader Adoption: As major financial institutions continue to invest in Bitcoin ETFs, we can expect significant shifts in market dynamics as these power players bring their influence and capital to the Bitcoin ETF arena.

- Regulatory Developments: Increased institutional involvement will inevitably attract more regulatory scrutiny. While this might introduce more stringent regulations, it will also provide a clearer and more secure framework for cryptocurrency investments, making the market more attractive to a broader range of investors and boosting the market.

- Innovation and Growth: The fusion of traditional financial expertise with cutting-edge blockchain technology will drive innovation. We can anticipate new financial instruments, improved security protocols, and more efficient market operations, contributing to the overall growth of the cryptocurrency market.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.

[…] Breaking news: The Changing Financial Landscape […]

Comments are closed.