1. Recommendation & Position Summary

Bubblemaps is an emerging on-chain analytics platform with a competitive edge in visualizing complex on-chain data into intuitive insights. It enables non-technical traders and technical investigators to explore relationships between wallets and token flow movements, identifying potential risks (e.g., insider trading, market manipulation) through dynamic, interactive “bubble maps”—a key differentiator from competitors relying on static tables and text-heavy reports.

$BMT has a circulating supply of ~26% and a market cap of $25M, currently undervalued compared to peers like Arkham (MC ~$270M), given its unique product positioning and revenue upside potential from converting its large freemium user base to paid subscriptions.

Analysts recommend initiating a [BUY SPOT] position in the $0.08–$0.09 price range, with a 10% NAV allocation. The base case target within 6 months is $0.20–$0.25, driven by an expected 3-10% conversion rate to paid users. A stop-loss is suggested below ~$0.06.

2. Project Snapshot

Over 500k monthly active users (MAU) and 1M monthly website visitors, renowned for uncovering on-chain scams (e.g., 96% of HAWK token supply manipulated by the team, Melania meme coin turning followers into liquidity).

Core features include:

- Bubble Charts: Each wallet is represented as a bubble, with size indicating token holdings and connecting lines showing transaction flows between wallets.

- Magic Nodes & Wallet Cluster Detection: AI-powered technology automatically identifies suspicious wallet clusters—essential for detecting scams or insider manipulation.

- Timeline & Heatmap: Tracks token distribution history, ownership concentration, and transaction intensity.

- Anomaly Alerts: Automatically highlights unusual behaviors, such as ownership concentration.

USP: Instead of competing across all analytics categories, Bubblemaps focuses on visualizing data through intuitive graphics, delivering deeper insights than competitors at a lower cost.

| Platform | USP | Business Model | Price | Funding Raised | Backers |

| Bubblemaps | Visual “bubble” graphics | Freemium + paid tiers to unlock premium features (cross-chain clustering, P/L analytics, AI cluster scoring) | $10–$100/month | $3.2M | INCE, Stake, M6, Hasheur |

| Nansen | Wallet labeling + smart money tracking | Subscription-based SaaS | $149+/month | $88M | a16z, Skyfall |

| Arkham | Identity-based bounty system | Tokenized data marketplace using ARKM token | Not fixed | $12M | Founders Fund, Coinbase |

| Lookonchain | Wallet alerts via Twitter | Ads / report sales | Free | N/A | N/A |

Recent Key Development: Launch of the Intel Desk—a platform for on-chain investigation governance through BMT token voting, enabling the community to propose investigations into suspicious wallets or anomalous tokens.

Bottom Line: Proposers of investigation ideas are rewarded with BMT tokens from the Ecosystem Fund. Intel Desk is comparable to Arkham’s Intex Exchange model (using ARKM tokens) to incentivize Web3 “bounty hunters”.

| Metric | Value |

| Token Price | $0.10 |

| Market Capitalization | $25M |

| FDV | $96M |

| 24h Trading Volume | $106.7M |

| Circulating Supply | 256.2M BMT (25.6% of total supply) |

| Monthly Website Visits | >1.0 million |

| Monthly Active Users | ~500,000 |

| Supported Chain | 10 chuỗi (ETH, Solana, BNB, Polygon…) |

| X Impressions | ~10 millions/month |

| Funding Raised | $3.2 millions (across 2 funding rounds) |

Revenue Model & Incentive Mechanisms:

- Currently operates a freemium model with paid subscriptions (~$10–$100/month) for individuals and tailored packages for organizations. Key revenue streams include:

- Premium analytics packages (payable in BMT or stablecoins, with discounts for BMT payments).

- API access fees for integrated platforms.

- Custom analytics development services.

- On-chain training courses and certifications.

- Commercial partnerships with exchanges and trading platforms.

Note: Advanced features (e.g., AI cluster scoring, profit analysis, multi-chain wallet mapping) are unlocked only for users holding 5,000–10,000 BMT, creating real demand for the token.

- Unique Incentive Structures: Holders who stake tokens and actively use the platform gain benefits, including:

- Higher API call limits.

- Early access to new visualization features.

- Discounted subscription fees for services.

- Participation in governance decisions. These create stronger token economic fundamentals.

3. Investment Thesis

- Pillar 1: Product-Market Fit and Long-Term Scalability with the Market

Impressive adoption metrics (~500,000 MAU, >1 million monthly visits, 200,000 new accounts within 3 days post-TGE).

- Pillar 2: Token-Utility Flywheel Driving Demand as User Base Expands

The $BMT token is central to the ecosystem, unlocking premium features, enabling proposal and voting participation on Intel Desk, and offering discounts through holding/staking. => This creates a closed-loop value mechanism: user growth → more proposals → increased demand for $BMT to vote.

- Pillar 3: Current Valuation Deeply Discounted Compared to Peers

- A large, untapped user base (500k MAU, currently leveraging a freemium model to gain mindshare). Assuming 3-10% MAU conversion to paid users within the first 12 months, the model projects:

- Base Case (5% conversion from 500k MAUs & $20 ARPU) yields $6M ARR, corresponding to a fair valuation of $150M–$210M (based on a 25x–35x multiple range).

- A large, untapped user base (500k MAU, currently leveraging a freemium model to gain mindshare). Assuming 3-10% MAU conversion to paid users within the first 12 months, the model projects:

| Scenario | Conv. Rate | Payers from 500.000 MAU | Blended ARPU (US $/m) | MRR (US $m) | ARR (US $m) | Probability | Implied FDV (US $m) with 25×-35x |

| Bear | 3% | 15,000 | 10 | 0.15 | 1.8 | 30% | 45M -63M |

| Base | 5% | 25,000 | 20 | 0.5 | 6 | 50% | 150M – 210M |

| Bull | 10% | 50,000 | 30 | 1.5 | 18 | 20% | 450M – 630M |

Table: Estimated annual revenue for Bubblemaps under various user conversion and ARPU scenarios (~500k monthly active users).

P/E Valuation Check-Point

- Arkham has a public token with a high FDV/Revenue multiple (≈53×).

- Nansen and Dune have private equity valuations; multiples of 25–33× reflect VC assessments for the Web3 data sector.

| Project | Stage | Users | Last Valuation | Run‑Rate Rev.* | FDV/Rev. |

| Arkham (ARKM) | Public token | 150k+ users | $792m FDV | est. ≈ 15m | ≈ 53× |

| Nansen | Series B (equity) | 4–5k paying customers (2021) | $750m | est. ≈ 25–30m | 25–30× |

| Dune Analytics | Series B | 2m community analysts | $1b | ≈ 30m | ≈ 33× |

- Pillar 4: BNB Chain Support & Smart Growth Strategy for Community and Partner Integration

- Bubblemaps’ TGE via BNB Wallet saw overwhelming demand (13,500% oversubscription) and secured $400k in support for community campaigns. Allocating 30M BMT tokens through Binance’s HODLer Airdrop attracted the market’s largest retail user community.

- Beyond BNB, Bubblemaps has integrated with 10 major blockchains (e.g., ETH, Solana, Base) to expand its reach across ecosystems, with ambitions to become the leading cross-chain visualization tool through LayerZero’s OFT standard.

- Bubblemaps has integrated its widget/API into platforms like Etherscan, Photon, Pump.fun, CoinGecko, DEX Screener, and Jupiter, enabling users to access bubble charts instantly (particularly valuable for memecoin traders).

- The community growth strategy leverages educational content, transparency, and viral engagement on X through exposé threads on tokens like $TRUMP, $MELANIA, and insider wallets.

4. Growth Catalysts & Timeline

Intel Desk (H1 2025): Community-Governed Investigation Portal & Token Burn Mechanism

- Intel Desk is an on-chain investigation hub where users stake BMT to propose and vote on prioritized cases. The “investigate-to-earn” model ties platform utility to token demand:

- BMT is used for voting, turning community activity into buying pressure.

- 26% of the total supply is allocated as rewards for participants, boosting engagement and amplifying reach through high-profile investigations.

Multi-Chain Expansion (Q2/2025): Each integration brings new users, partners (wallets, explorers), and real-time data streams to the platform.

Advanced AI Analytics (Q3/2025): Launch of expanded AI modules, upgrading Magic Nodes into fraud alert tools and automated related-wallet clustering. These features enhance retention and attract technical/enterprise users, creating new revenue streams.

DeFi Protocol Visualization (Q4/2025) – Targeting Institutional Clients: Release of tools for mapping LP ownership, governance token distribution, and portfolio risks in lending pools or DAOs.

Strategic Partner Integration & Expansion (Ongoing to 2026): Integration with major CEXs, DeFi dashboards (e.g., Zerion), and L1/L2 explorers, positioning Bubblemaps where users research tokens.

5. Valuation & Price Targets

Bottom line: The base case ($0.23) offers >2× ROI, while the bull case indicates a potential 4–5× return.

| Scenario | Target Price | 6-Month ROI | Key Assumptions | Probability |

| Bull | ~0,25 USD | ≈ +130 % | Intel Desk & premium features gain strong traction; crypto market recovers; staking/burn demand absorbs token unlocks. | 30% |

| Base | ~0,15 USD | +50–60 % | Moderate growth; sideways crypto market; token unlocks balanced by natural demand. | 50% |

| Bear | ~0,06 USD | ≈ –30 % | Weak engagement; token unlocks combined with bearish market; insufficient demand to absorb supply. | 20% |

6. Key risks & Mitigations

Key Risks & Mitigations

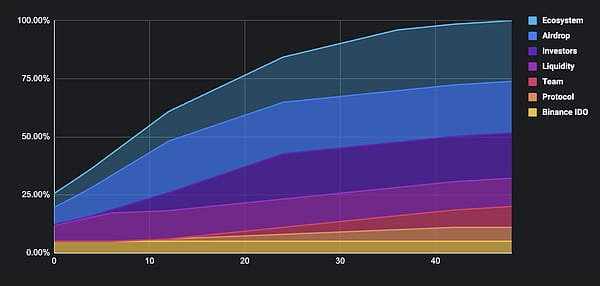

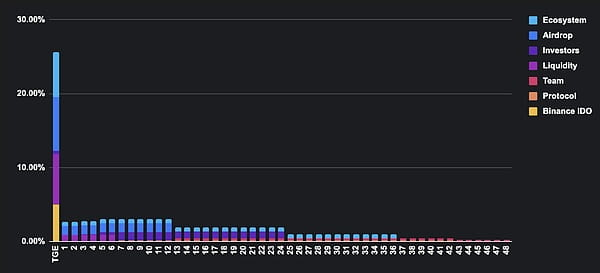

- June 2025 (investor vesting begins) and March 2026 (team cliff ends).

- Estimated >90–100M $BMT (~9–10% of supply) may enter the market by September 2025, with a cumulative ~100M BMT from the ecosystem fund by Q3/2026.

Mitigations

- Promote “earn-and-lock” mechanisms (Intel Desk token burn, staking with 10–15% APR) to create demand and absorb new supply.

- Announce new product roadmaps and integrations before unlocking milestones to stimulate buyer demand.

Weak Narrative (Blockchain Analytics Sector): Limited ability to create trends that drive retail FOMO.

Selling Pressure from Airdrops & HODLer Programs

- 22% of airdrop supply vests linearly over 12 months; 30M BMT (3%) distributed via HODLer Airdrop.

- Mitigations: Allow BMT to be used for premium package payments, incentivizing airdrop recipients to hold tokens to save on fees; implement Intel Desk rewards to recycle BMT.

7. Position Sizing & Implementation Plan

Entry Zone

- Initiate or increase position when the price is within $0.08–$0.09 (prioritize accumulating below $0.09 during market corrections).

- Allocation limit: Maximum 10% of NAV.

Position Size & Execution

- Split orders into 2–3 tranches to mitigate risk.

Profit-Taking Targets

- TP1: ~$0.20 (2x profit) – Exit 30–40% of the position.

- TP2: ~$0.30 (3x profit) – Exit an additional 30% or move stop-loss to breakeven.

- TP3: Above $0.35 – Flexibly locks in profits when the risk-reward ratio becomes unattractive.

- Stop-Loss: $0.06 (≈ –30% from entry).

Risk Management & Reassessment

- Review position after each major catalyst (e.g., Intel Desk launch, new chain integrations).

- If catalysts underperform or trading volume drops significantly, reduce position to ≤5% of NAV.

- Upon reaching TP1, allocate 50% of tokens to staking for 7–15% APR, retaining the remainder for trading. Prepared for Investment Committee review.(Strictly confidential – not for distribution).

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.