As China’s economy faces slowing growth, deflationary pressures, and a fragile property market, the government has rolled out bold stimulus measures to reignite economic momentum. However, how effective will these policies be, and what should global investors pay attention to?

Our latest analysis breaks down the key components of China’s stimulus package and explores its potential ripple effects across global markets. As the world’s second-largest economy, any significant policy shifts could impact everything from commodity prices to international trade dynamics, offering both risks and opportunities for investors worldwide. Stay ahead of the curve and understand what China’s next moves mean for your portfolio.

1. How Is the Downturn Unfolding?

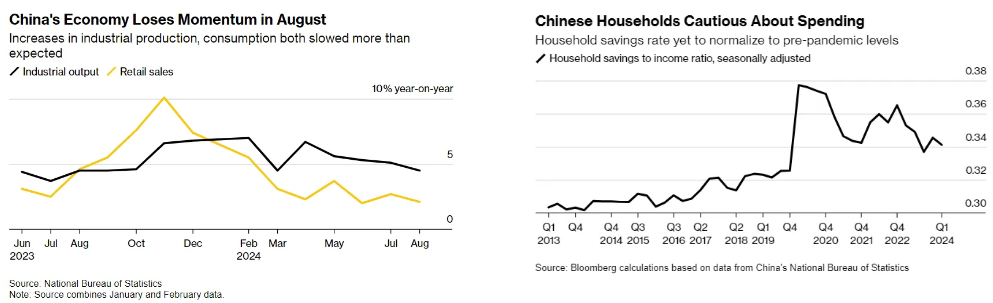

Recent official data reveals that production, consumption, and investment have all slowed more than economists anticipated, with credit demand remaining sluggish—highlighting weak confidence throughout China.

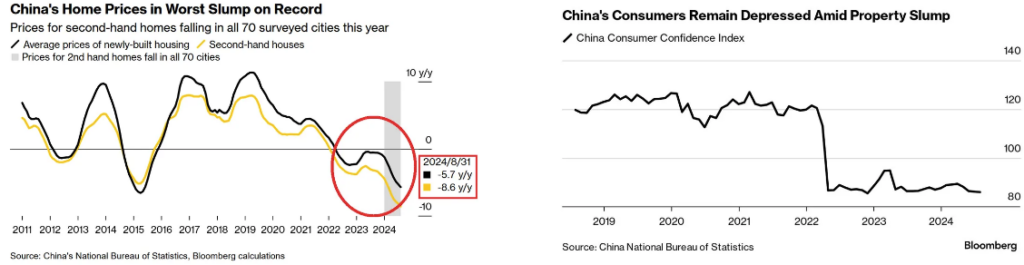

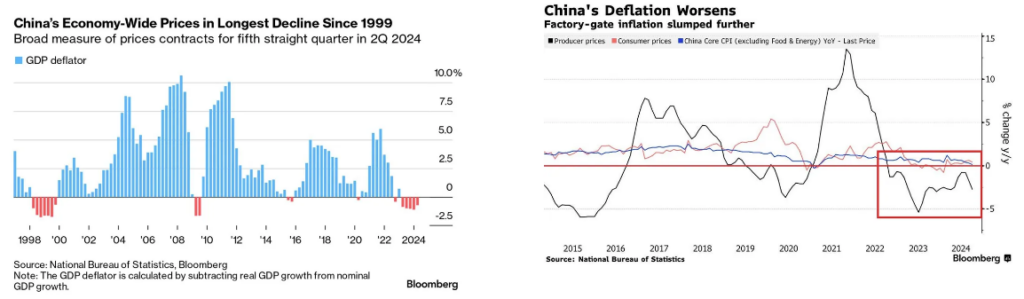

Deflation Concerns: Deflation risks the economy, as falling prices may cause consumers to delay purchases, reducing spending and stifling corporate revenues. This can lead to lower investment, wage cuts, layoffs, and potential bankruptcies for both families and businesses. China is experiencing its longest period of falling prices since 1999, with the GDP deflator — an economy-wide measure of prices —expected to remain negative for a sixth consecutive quarter, deepening producer price deflation and keeping consumer prices stagnant.

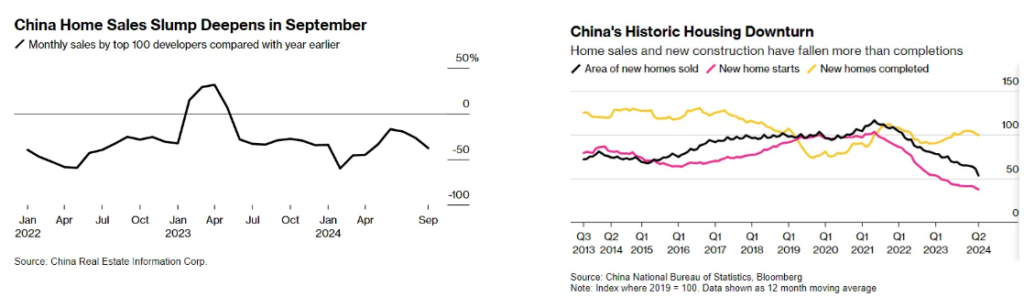

A Shaky Property Market: Despite government support, the decline in new home sales has accelerated in recent months. Both property prices and transaction volumes continue to contract, reflecting weak confidence that is dampening demand and threatening to push China into a deflationary spiral. The property slump has eroded household wealth, severely impacting consumer sentiment and spending.

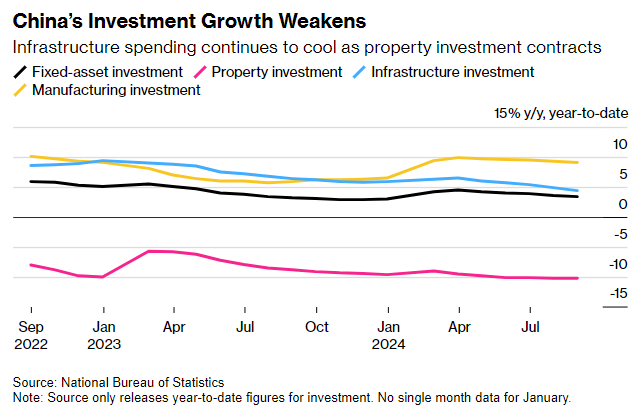

Weak Consumption: Businesses, particularly in key industrial sectors, have responded to the downturn by cutting production and reducing employment. Real estate investment contracted sharply in August, declining by 10.2%. Economic activity weakened across the board, with both consumption and investment falling more than expected.

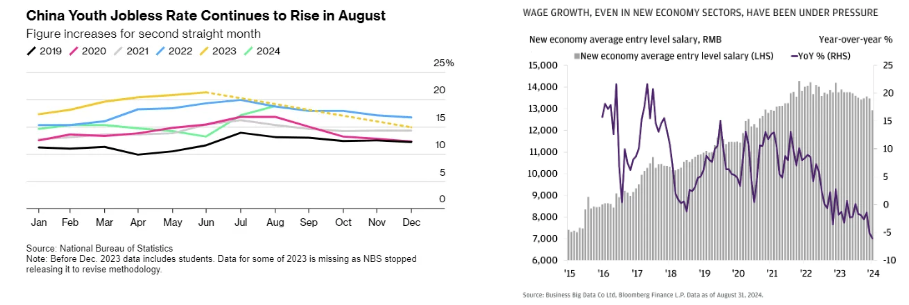

Faltering labor market: The labor market is showing further signs of strain, with layoffs increasing and suppressing wages due to declining corporate profits. Youth unemployment surged for the second consecutive month, reaching 18.8% in August, up from 17.1% in July. This is 3.5 times higher than the overall unemployment rate, reflecting companies’ reluctance to hire new workers or invest in future growth, adding to concerns about the economy’s trajectory.

Weak Domestic Demand: Amid a weakening economy, prolonged property downturn, and a faltering labor market, households are cutting spending and increasing savings, with the household savings rate reaching 31% in Q2. Moreover, industrial output has declined for four consecutive months, the longest stretch of weakness since 2021, while retail sales growth has similarly slowed as businesses slash prices in response to deflation.

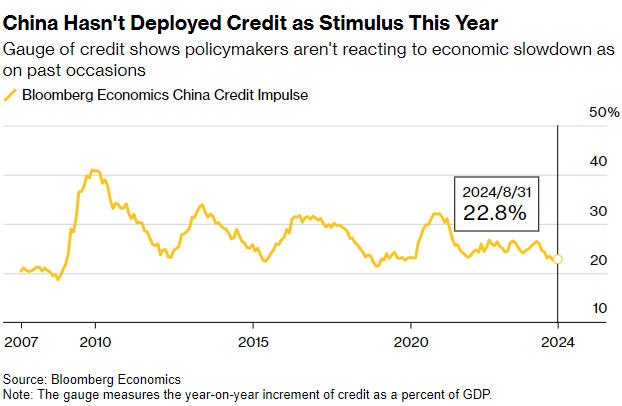

Weak Credit Demand: Despite multiple rate cuts, credit growth remains sluggish, reflecting low consumer and business confidence. If this trend persists, China may face a prolonged period of subdued growth due to weak domestic demand. The chart below highlights significant stimulus measures during past downturns, including the 2007-09 global financial crisis, slowdowns in 2012 and 2015, and the pandemic in 2020. However, the current credit impulse has declined since January 2024.

Taken together, these figures highlight weak consumer demand in China, raising concerns of a deflationary cycle where declining revenues, wages, and spending reinforce one another. This has led to increased calls for additional stimulus to prevent further economic deterioration.

2. China’s Latest Stimulus Measures

2.1. Beijing’s Policies

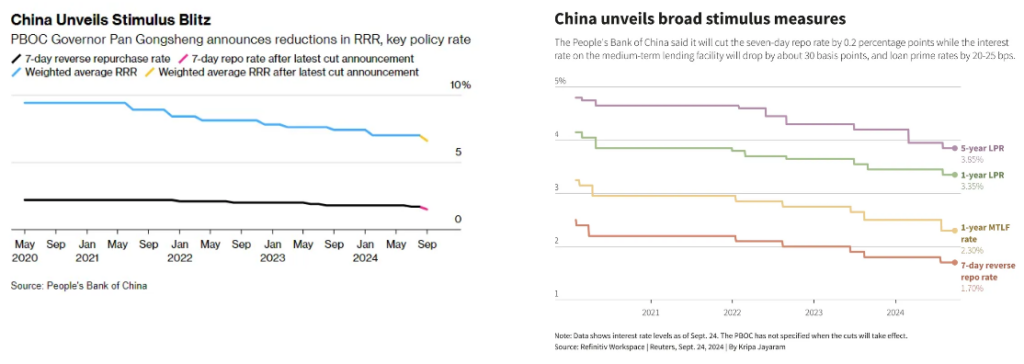

To stimulate the slowing economy and restore investor confidence, the People’s Bank of China introduced a series of measures aimed at boosting equity and property markets. These include monetary easing, rate cuts on outstanding mortgages, looser housing market restrictions, and a RMB 800bn fund to support the stock market. This fund will provide loans to asset managers, insurers, and brokers to buy equities, as well as to listed companies for stock buybacks.

Monetary Policy: The central bank cut the Reserve Requirement Ratio (RRR) for banks by 50 basis points, lowering the weighted average RRR to 6.6%. Some key interest rates were also reduced, unlocking liquidity and enabling banks to lend more and purchase government bonds to fund infrastructure projects.

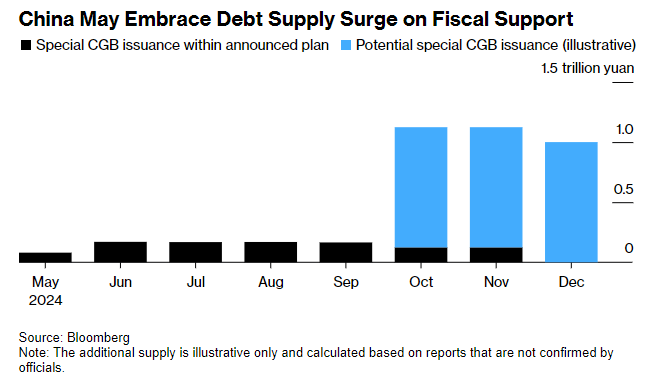

Fiscal Policy: The government is shifting its focus to fiscal spending to stimulate consumer demand. It plans to issue ultra-long sovereign bonds to finance infrastructure projects and support major initiatives, creating jobs and increasing income, alongside expanded public services and consumer subsidies.

2.2. Market Impact & Outlook

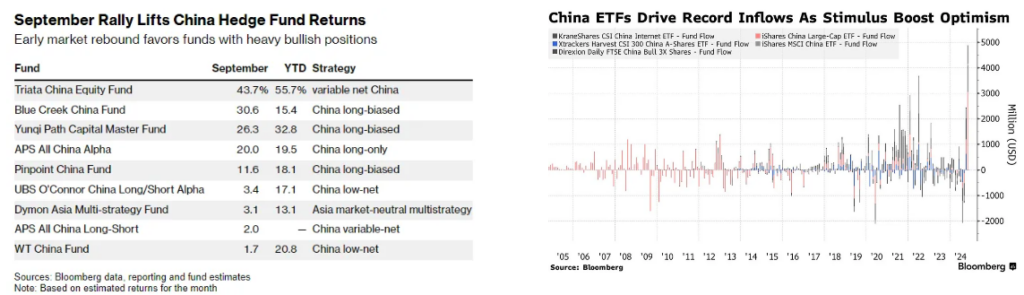

Following Beijing’s stimulus measures, the benchmark CSI 300 index surged 24% in five trading days, reopening 11% higher after a week-long holiday. However, a lack of deeper fiscal stimulus announcements led to the biggest one-day drop in over four years (-10%).

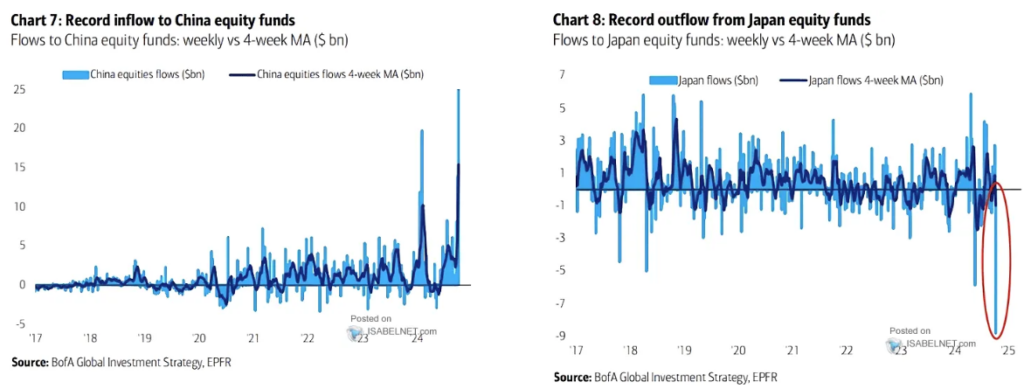

Beijing’s pivot to stimulus fueled strong stock buying by hedge funds and retail investors. Five leading ETFs focused on Chinese equities saw record inflows of $4.9 billion.

We see there’s plenty of optimism that could underpin a sustainable equity rally as:

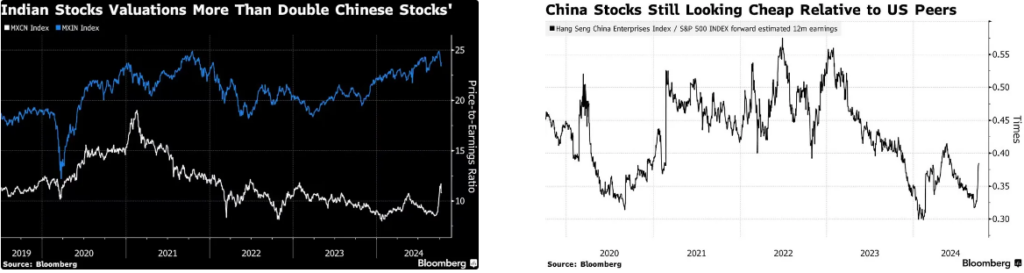

- Chinese equities are poised for further gains with continued policy support. Compared to Indian and U.S. markets, which have high relative valuations, Chinese stocks appear attractively priced. The India Index is valued at 24 times forward earnings — more than double that of the MSCI China Index.

- After a prolonged three-year selloff, Chinese markets are still undervalued. The Hang Seng China Enterprises Index trades at under 9 times forward earnings, roughly half the valuation of the S&P 500.

- Attractive valuations are drawing more investors. Chinese equity funds have seen record inflows, while Japanese stocks face significant outflows. Global investors are expected to increase exposure to Chinese markets.

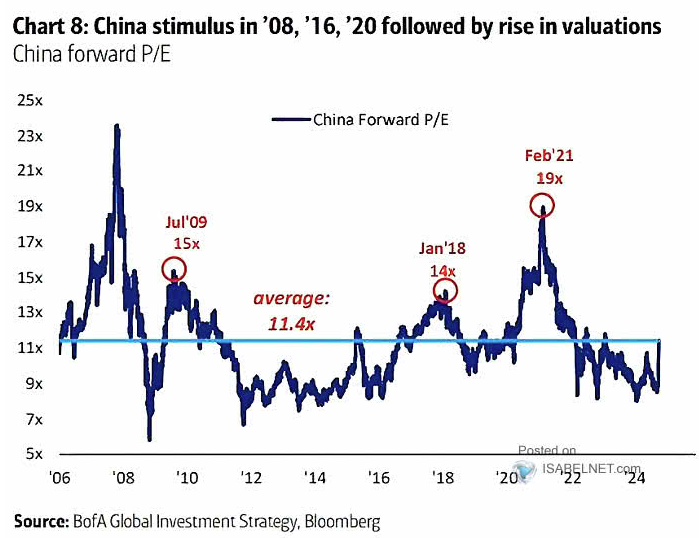

- Chinese equities are outperforming global peers, and sentiment is improving. A re-rating to historical valuation averages could still offer a significant upside even after the recent rally.

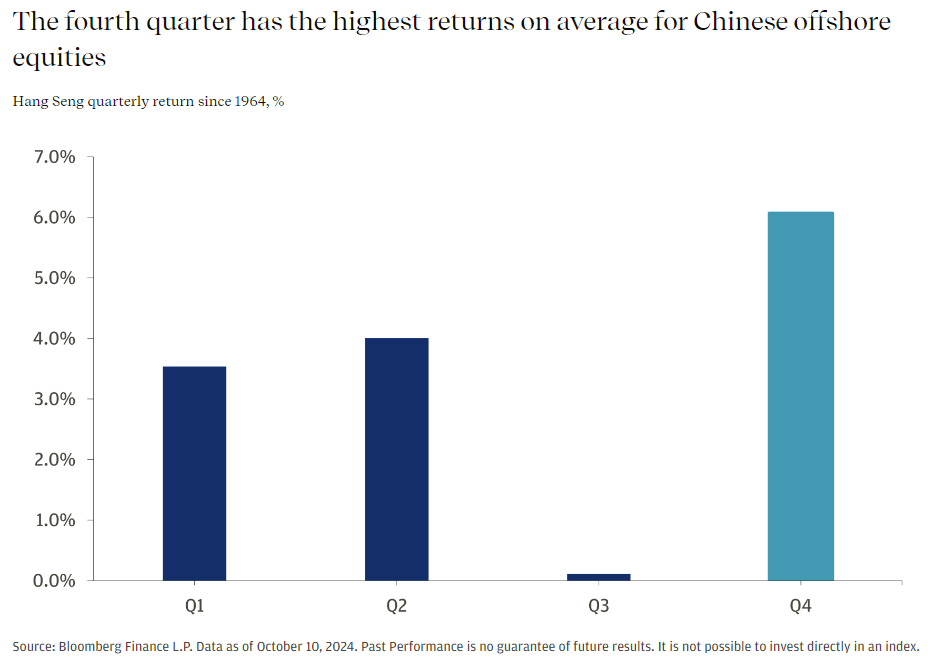

- Seasonal trends favor China in the fourth quarter. Since 1964, the Hang Seng Index has returned an average of 6.1% in Q4.

- Chinese equities are trading at 10.8x forward earnings, below the five-year average of 11.7x. If the MSCI China P/E ratio rises to 15-16x, this could represent a potential 40% upside.

3. Closing Thoughts

The new policies may provide a short-term boost to economic activity and consumer confidence. However, for a sustained recovery, additional policy measures, particularly more substantial fiscal easing, are needed. Targeting households through social welfare spending, rather than focusing solely on investment and infrastructure, will be key to stabilizing consumption and the broader economy.

If the rally continues and the economy improves, Chinese stocks could see significant upside. In the near term, Chinese shares appear attractive, and investor focus may shift back to these markets. Much will depend on the government’s efforts to stabilize the property market and economy. Key areas to watch include the real estate and consumer sectors, which are likely to benefit from further stimulus.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.