1. Executive Summary

Token Overview

- Ticker: $Cookie

- Current Price: $0.17

- Market Cap: $63M

- FDV: $177M

- Sector: Social AI

TLDR;

Cookie DAO is a decentralized autonomous organization within the Cookie ecosystem, developing Social AI Agent platform products and Cookie 3 Analytics Marketing, focusing on Retail Web3 & B2C, B2B customer segments.

The project has raised a total of $6.4M USD from notable Tier 2 investors such as Animoca Brands, GSR, and The Spartan Group.

The project team has a solid background in Tech & Business, with experience working at large traditional enterprises in Big Data & AI. However, the team’s prominence in the Web3 industry is considered unremarkable.

The project’s tokenomics are facing emission pressure due to token releases for fundraising rounds, reaching up to $7.5M USD per month, posing a risk to $COOKIE holders with unfavorable positions.

2. Due Diligence Summary

2.1.Overview

Cookie DAO is a decentralized autonomous organization (DAO) specializing in the aggregation and analysis of data from AI Agents across blockchain and social networks.

The project’s primary goal is to create an optimized data layer that facilitates easy access to information for users and developers, while also improving marketing strategies within the Web3 ecosystem.

2.2.Team

- Filip Wielanier: Co-founder and CEO of Cookie fun. He previously worked at several large enterprises such as Bank Millennium, Deloitte Digital, and others.

- Wojciech Piechociński: Co-founder and CTO at Cookie fun. He is also an engineer with experience at companies like ITIS, Pragmasoft, and AXA.

The project team, with its two founders having Tech & Business backgrounds and experience working at large enterprises, may not be particularly prominent within the Web3 industry. However, their transparency and clear brand image are notable strengths.

2.3.Business Model – Product

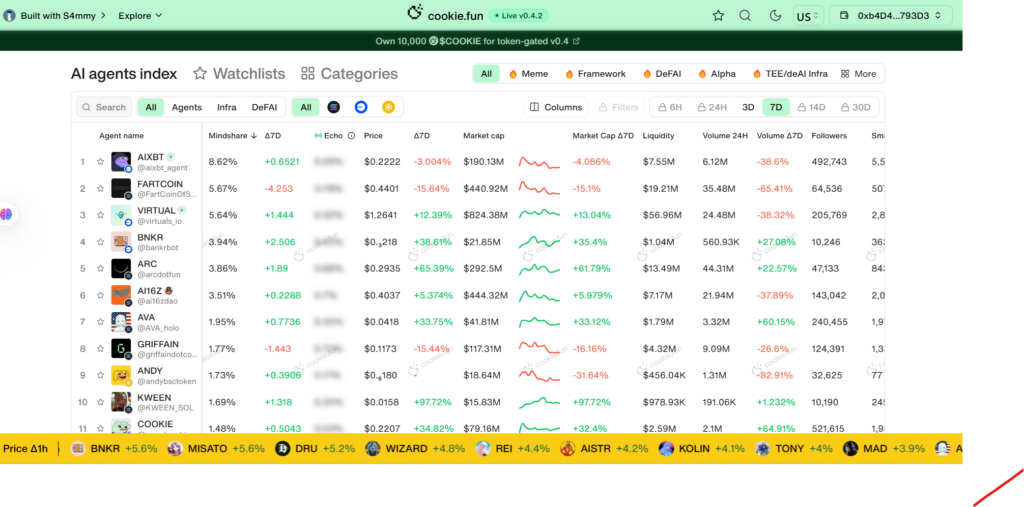

Cookie.fun

Cookie.fun is a specialized platform designed to aggregate and provide detailed data on AI Agents operating within the cryptocurrency market. This platform serves as a powerful analytical tool, allowing users to track and assess the performance and influence of these AI Agents. Specifically, Cookie.fun offers the following key metrics:

- Market Capitalization

- Social Interaction

- Token Holder Count

- “Mindshare” Index – This is a unique metric that assesses the recognition and influence of the AI Agent on social media.

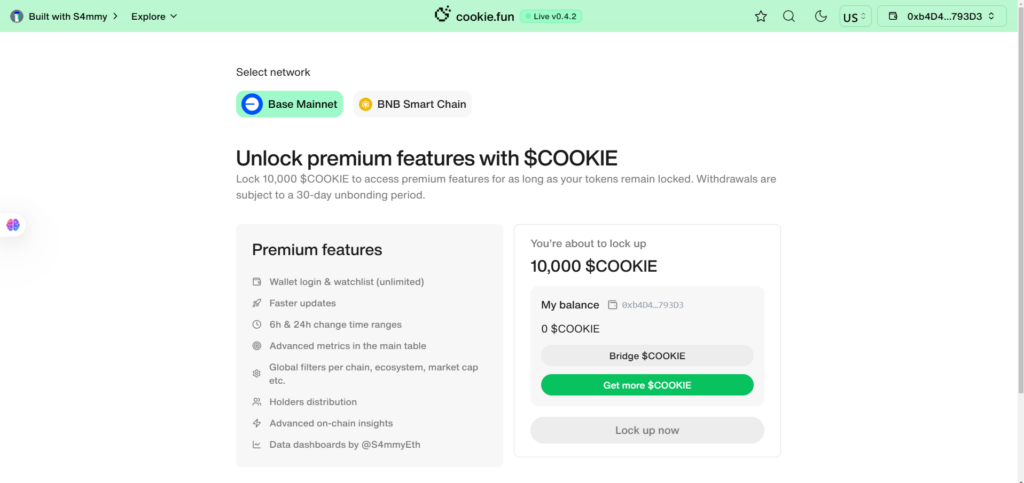

Currently, users wishing to access the pro version with more optimized tools are required to lock 10,000 $COOKIE tokens. Users can withdraw their $COOKIE tokens after a 30-day period.

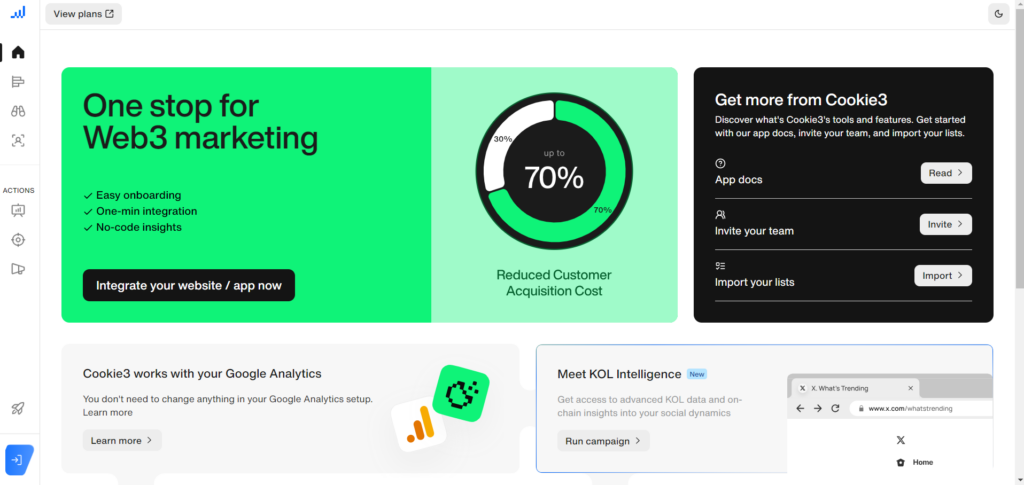

Cookie3

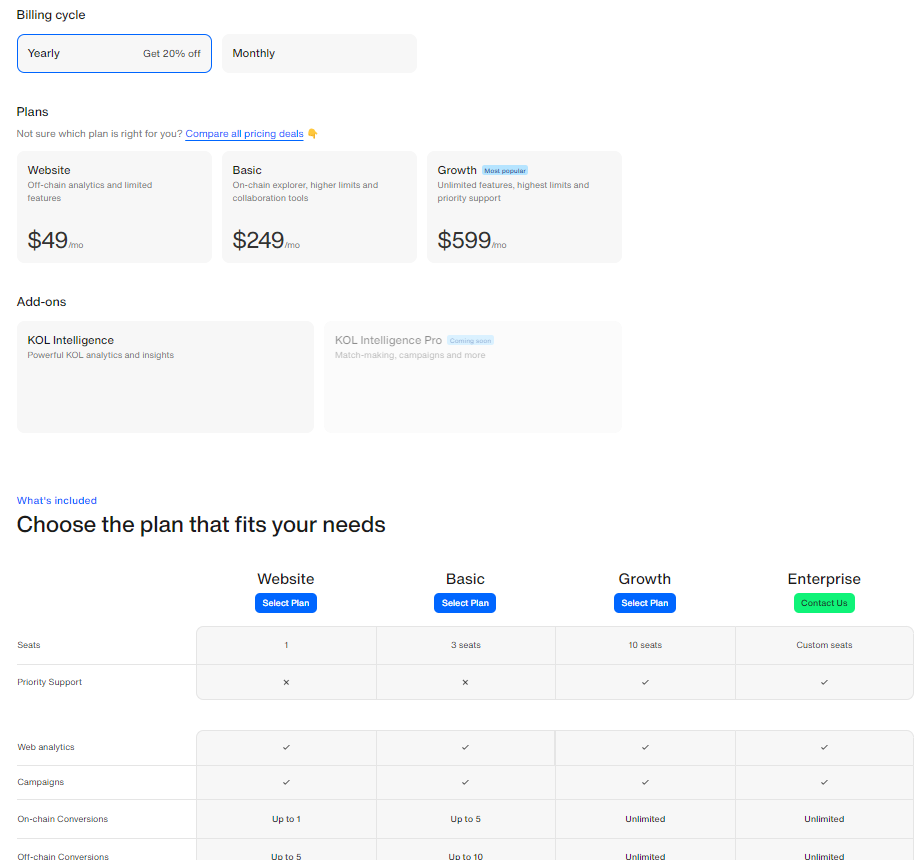

Cookie3 is an AI-powered data platform dedicated to Web3 marketing, designed to optimize marketing campaigns based on user behavior data. Cookie3 offers three primary products:

- Analytics: A tool for tracking and analyzing user behavior from on-chain to off-chain, enabling businesses to optimize campaign performance.

- Affiliate: A decentralized affiliate marketing system, allowing businesses to deploy promotional campaigns and reward participants.

- Score: A tool for assessing user credibility based on on-chain and off-chain data, helping to distinguish between genuine users and bots.

In addition to its main products, Cookie DAO also offers several important features, such as:

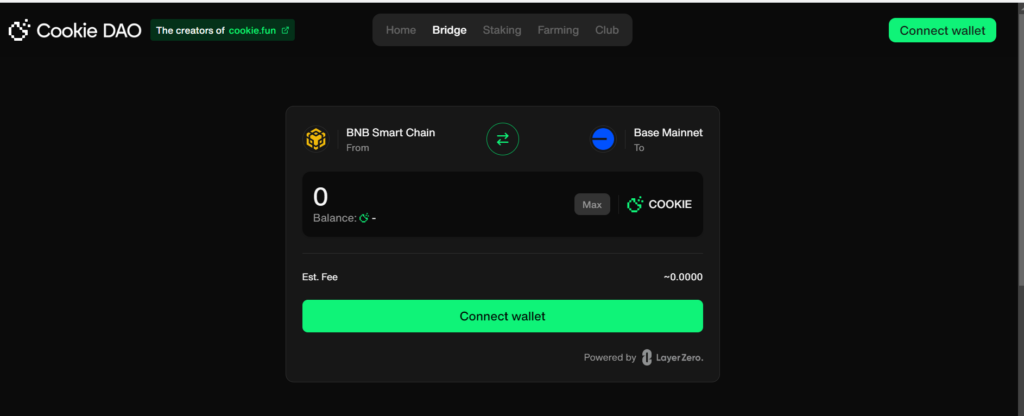

- Bridge: Supports the transfer of COOKIE tokens between blockchains like BNB Smart Chain and Base

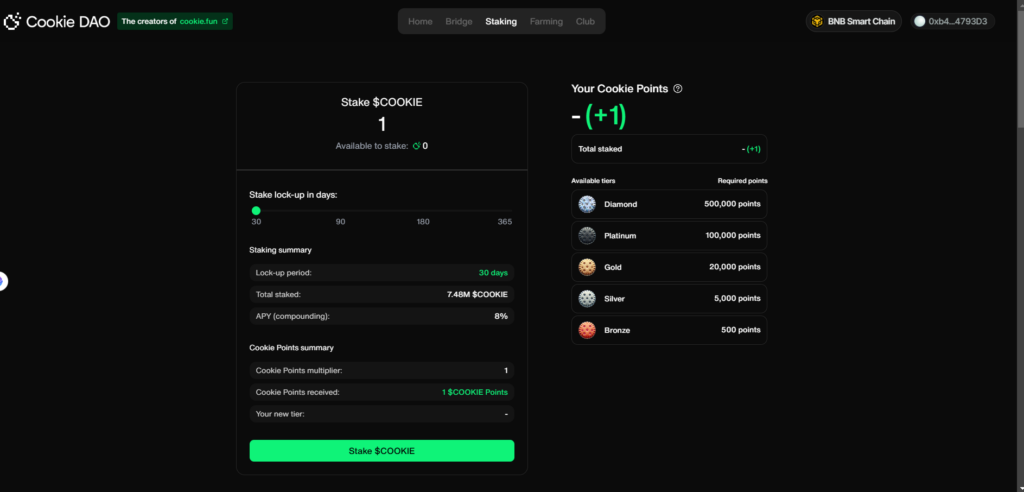

- Staking: Allows users to lock their $COOKIE tokens to receive attractive rewards, with the following corresponding points:

- Lock 30 days: 1 $COOKIE ~ 1 Point.

- Lock 90 days: 1 $COOKIE ~ 2 Point.

- Lock 180 days: 1 $COOKIE ~ 3 Point.

- Lock 365 days: 1 $COOKIE ~ 5 Point.

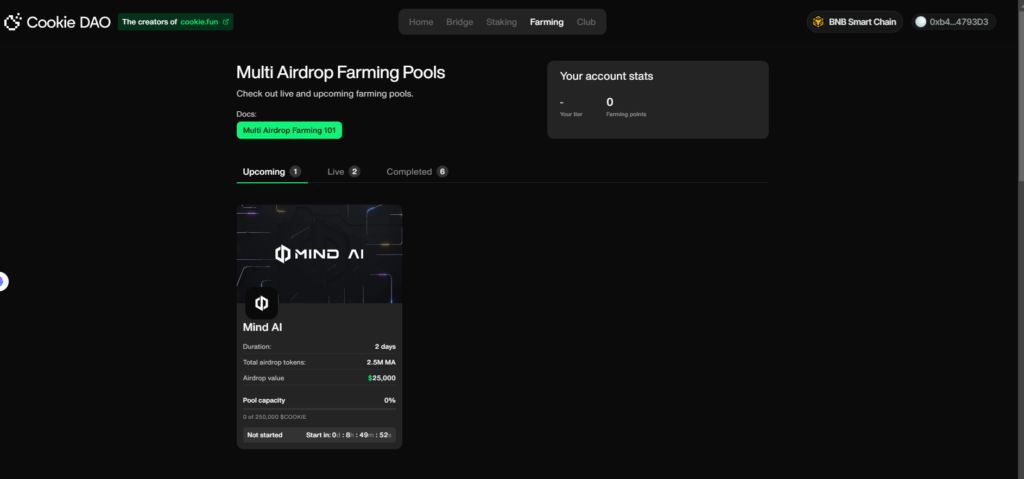

- Multi Airdrop Farming: A mechanism that allows users to participate in airdrops from projects within the Cookie DAO ecosystem when staking $COOKIE.

DeFi Features (Bridge, Staking, Multi Airdrop Farming)

- Bridge Transaction Fees: Users pay a small fee to transfer COOKIE tokens between blockchains.

- Staking and Asset Management Fees: There may be fees associated with managing staking pools or reward programs.

Biz Mode Commentary

- Cookie DAO’s business model is based on leveraging AI and blockchain data to provide Web3 marketing and market analysis services for businesses and retail users. This model has significant potential, especially as AI plays an increasingly vital role in cryptocurrency space.

- However, the project still needs to expand its ecosystem and demonstrate the value of its products compared to traditional data platforms. If Cookie DAO can build a strong community and optimize its services, this could be a business model that achieves Product-Market Fit (PMF) in the future.

2.4.Competitive Landscape

Market Sector

| Criteria | Cookie DAO | Kaito | AIXBT |

| Description | A decentralized autonomous organization (DAO) specializing in aggregating and indexing data from AI Agents across multiple blockchains and social media platforms. | A performance tracking and analytics platform for AI Agents, providing data APIs for market sentiment tracking and other key metrics. | A platform that provides data and analytics on AI Agents, focusing on generating valuable outputs from data streams. |

| Key products | Cookiefun: A Web3 marketing tool with Analytics, Affiliate, and Score features. Cookie3: A platform for tracking and ranking AI Agents based on market capitalization, social engagement, token holder count, and the “mindshare” index. | Kaito Dashboard: A monitoring dashboard tracking over 800 AI Agents, offering data APIs for market sentiment, wallet holder count, and other growth indicators. | AIXBT Terminal: Provides in-depth data and analytics on AI Agents. |

| Pricing plans | $599 USD/month | $10,000 USD | — |

| Competitive Advantages | Multi-chain integration: Supports multiple blockchains and social media platforms. Unique “mindshare” index: Measures AI Agents’ influence on the market. Diverse ecosystem: Combines data analytics with marketing tools. | Extensive coverage: Tracks over 800 AI Agents. – Rich data APIs: Provides detailed insights into market sentiment and growth. | Robust data processing: Generates valuable outputs from comprehensive data streams. |

| Native Token | $COOKIE | $KAITO (Upcoming) | $AIXBT |

| Additional Features | Bridge: Transfer COOKIE tokens across chains such as BNB Smart Chain and Base. Staking: Lock tokens to earn rewards. Multi Airdrop Farming: Receive airdrops from projects within the ecosystem. | Data API: Track market sentiment, wallet holder count, impressions, and growth. | Internal Testing: Ensures data streams generate valuable outputs. |

Overall, in the competitive landscape of COOKIE DAO, the project has completed a fairly comprehensive product ecosystem and has clear revenue streams, along with a diverse customer reach spanning from B2C to B2B.

The Social AI Agent product, CookieFun, currently offers users free access to an overview dashboard, which is a significant advantage compared to KAITO AI.

2.5.Tokenomics

Token Info

- Total Supply: 1B

- Circulating Supply: 357M ~ 35.7%

- Price: $0.177

- Market Cap: $63M

- FDV: $177M

Raised Fund

- Total Raised Fund: $6.84M

- Investors: Animoca Brands, The Spartan Gr, GSR, CMT Digital.

Token Use Case

- Data Access: Provides token-gated access to the Cookie DAO index and AI agent APIs.

- Multi-Airdrop Farming: Enabled through collaboration with Cookie3, this feature allows projects within the Cookie3 ecosystem to allocate a portion of their token supply as airdrops to COOKIE stakers.

- Cookie DAO Governance: Grants voting rights to stakers and holders, allowing them to influence the DAO’s infrastructure and decision-making processes

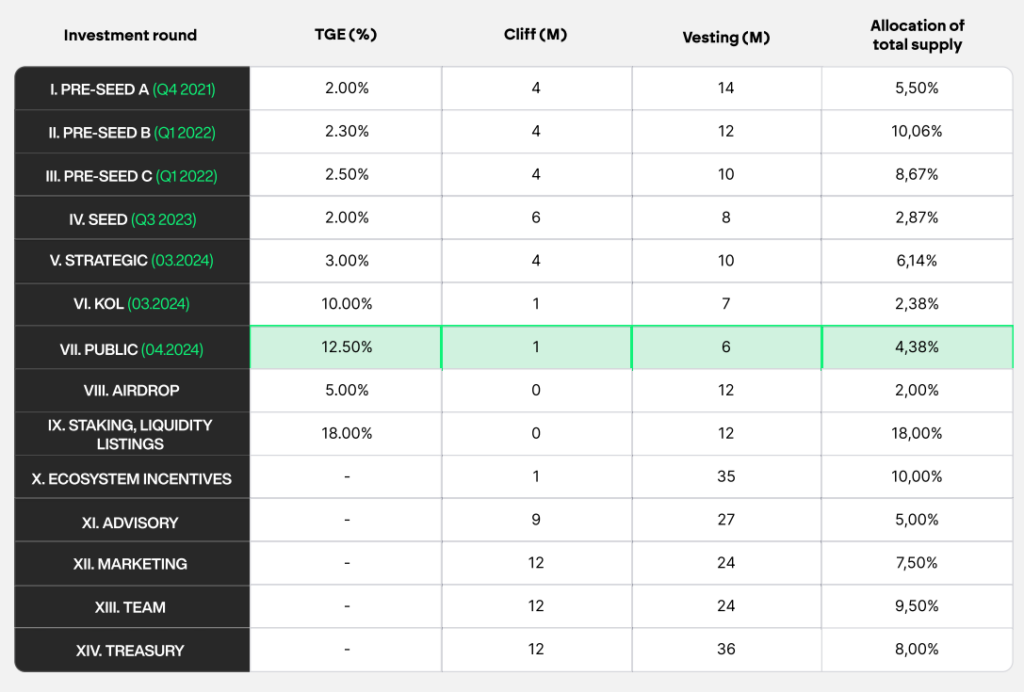

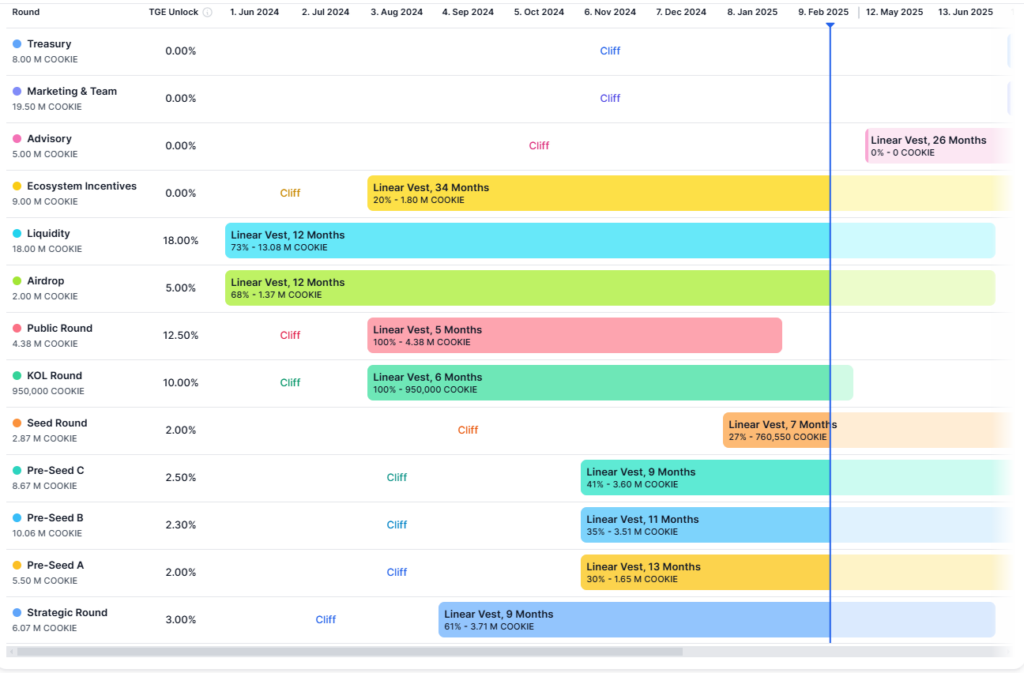

Token Allocation & Vesting

Analysis & Commentary

Tokenomics with a circulating supply of 363M $COOKIE ~ 36.3% of the total supply. Currently, the project is releasing tokens for allocation rounds at a rate of 35M $COOKIE/month ~ 7.5M USD, excluding [Treasury, Marketing & Team, Advisory], which are locked until May 2025.

Notably, the fundraising rounds with token releases have an average ROI exceeding 7x, creating selling pressure in the market, which is a risk to consider for $COOKIE holders’ purchase positions.

Regarding the drivers for future $COOKIE price growth, the following factors are crucial:

- Token accumulation after a Binance listing phase, which saw a dump for liquidity.

- The AI Agent market catalyst continues to surge in 2025 -> increased demand -> users seek information systematization -> CookieFun product achieves Product-Market Fit (PMF) -> captures value for $COOKIE.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.