1. Bitcoin Market Update

1.1. Market key cost basis & supply

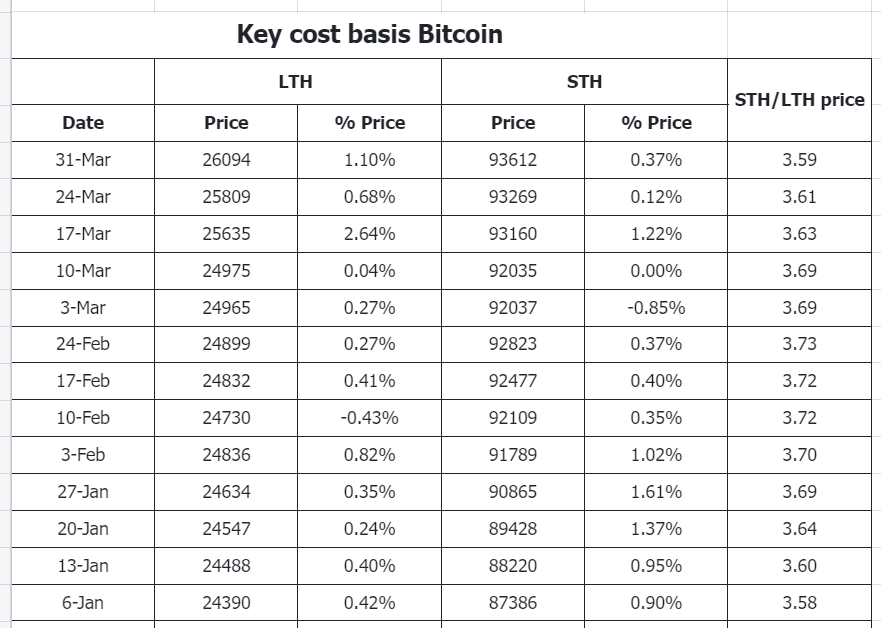

LTH

- Cost basis: $26.09k, up 1.1%

- Supply: 14.639M, up 0.4%

STH

- Cost basis: $93.612k, up 0.37%

- Supply: 5.204M, down -1.05%

Analyst Assessment

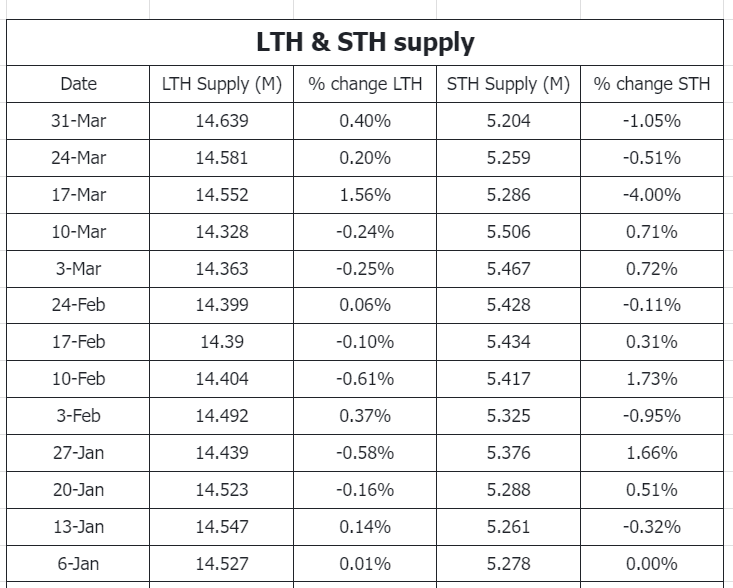

- Over the past month, BTC moved within a range of $78k – $95k. The increasing trend of LTH Supply and the decreasing trend of STH Supply indicate that a portion of Bitcoin is shifting from STH hands to LTH hands -> This is a positive signal, as it reflects a “accumulation” sentiment.

- LTH: Maintaining positive sentiment, with LTH Supply slightly increasing and LTH Cost Basis remaining stable -> indicating that selling pressure from the previous period has gradually decreased, replaced by gradual accumulation, supporting a bullish trend.

- According to data from Glassnode, BTC is currently in the early stages of Accumulation Wave 2 with +278K BTC -> further accumulation time is needed.

- Distribution Wave 1: LTHs distributed -929k BTC

- Accumulation Wave 1: LTHs accumulated +817k BTC

- Distribution Wave 2: LTHs distributed -1.11M BTC

- Accumulation Wave 2: Currently +278k BTC

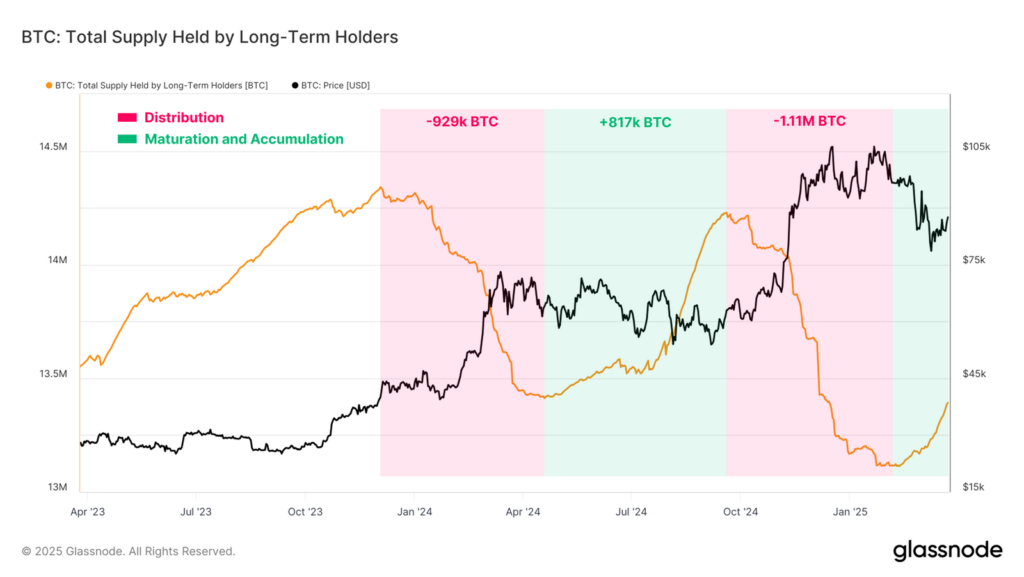

1.2. MVRV Z-Score

The Z-Score decreased from approximately 3.5 (late 2024) to around 1.5 – 2 (early 2025), indicating that selling pressure has subsided, and the market is transitioning to the next accumulation phase, and currently maintaining a value of 1.7.

2. Stablecoin market update

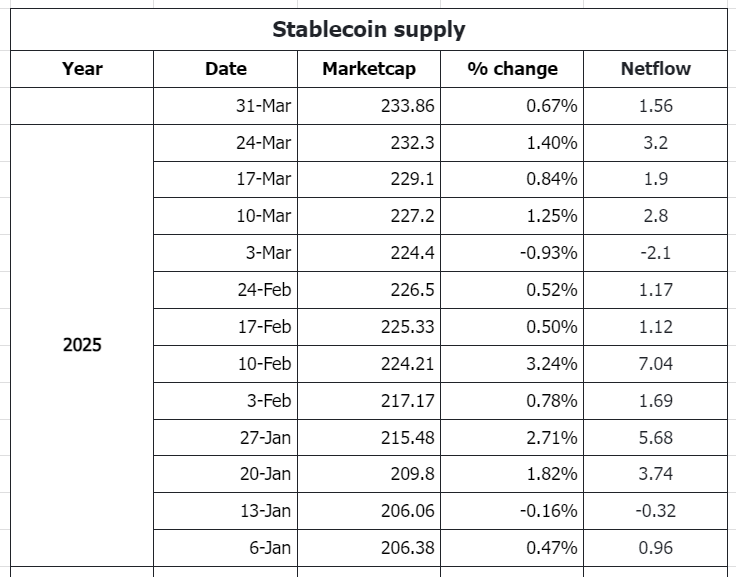

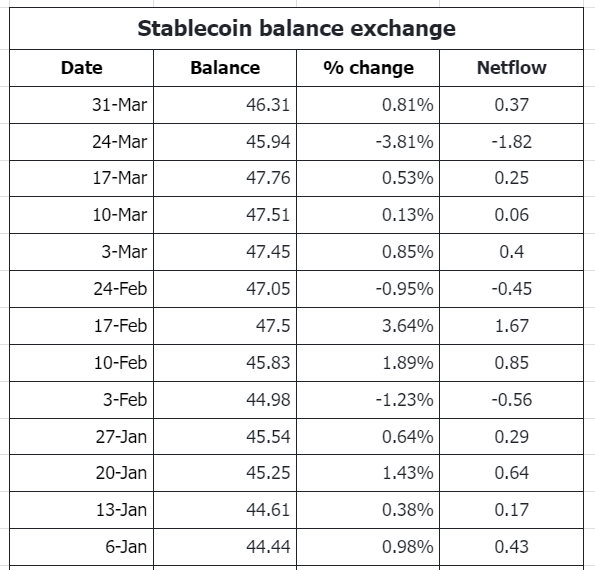

(1) Stablecoin marketcap: $233.86B, recording a 0.67% increase, equivalent to +$1.56B inflow.

(2) Stablecoin balance on exchanges: $46.31B, up 0.81% with +$370M net inflow.

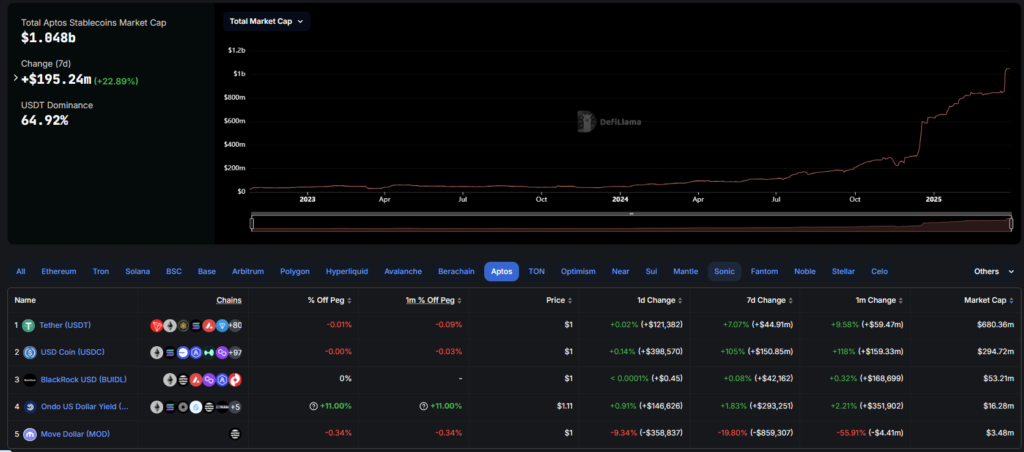

(3) Aptos is notable for its strong growth in stablecoin marketcap on its network this past week, +22.9% with +$195.2M net inflow.

3. Ecosystem flow update

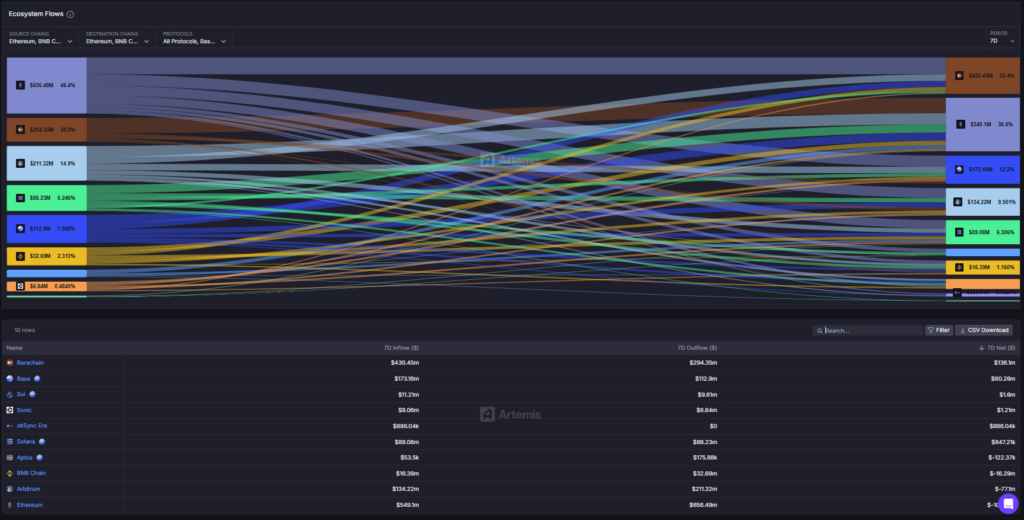

According to Artemis, 7D inflow:

- Berachain: $136.1M, primarily USDC stablecoin.

- Base: $60.3M, primarily ETH.

- Sui: $1.6M, primarily USDC stablecoin -> Walrus, a storage project that raised $140M, backed by a16z, recently had its TGE listing, leading to a flow comeback to the network. 7D volume surged back to $1.15B (+17.7%).

4. Onchain Movement

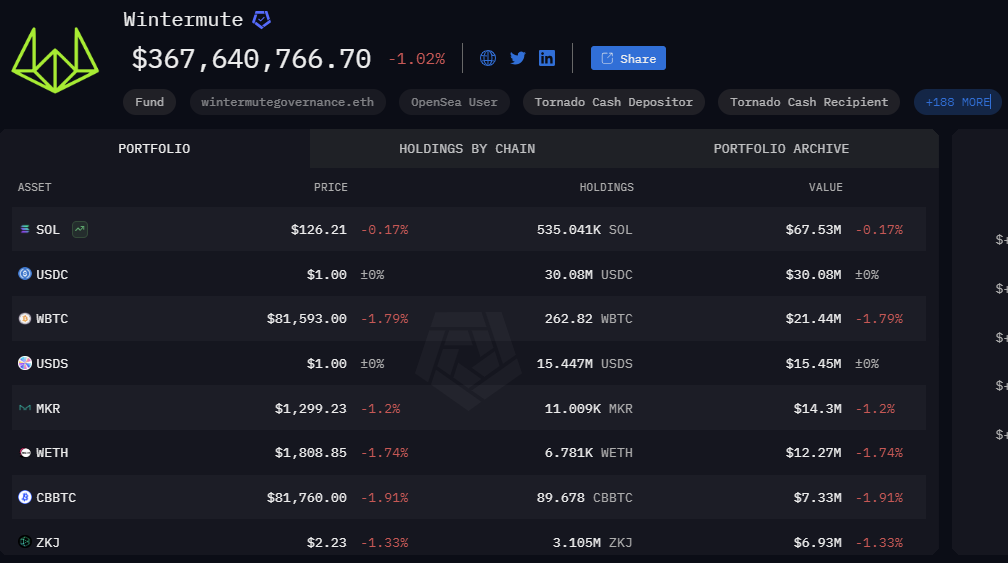

MM Wintermute: portfolio: $367.6M, significant decrease.

- Volatility decreased significantly this past week, with holdings of top assets declining sharply.

- BTC: decreased from 763.79 to 355.02 (recording a net outflow of $35.12M).

- SOL: decreased from 595.14K to 581.5K (recording a net outflow of $8.35M).

- Stablecoin: decreased from 71.56M to 52.87M (recording a net outflow of $18.69M).

- Notable total net outflow: $62.16M.

Analyst Assessment

- Significant reduction in BTC exposure, with holdings down by over -53.5%.

- Meanwhile, SOL holdings have not fluctuated significantly, around -2.3%.

- Additionally, some DEX assets have experienced sharp declines in holdings, including FARTCOIN, AI16Z, VIRTUAL, which have not been previously mentioned.

- Indicating a bearish sentiment from the Market Maker.

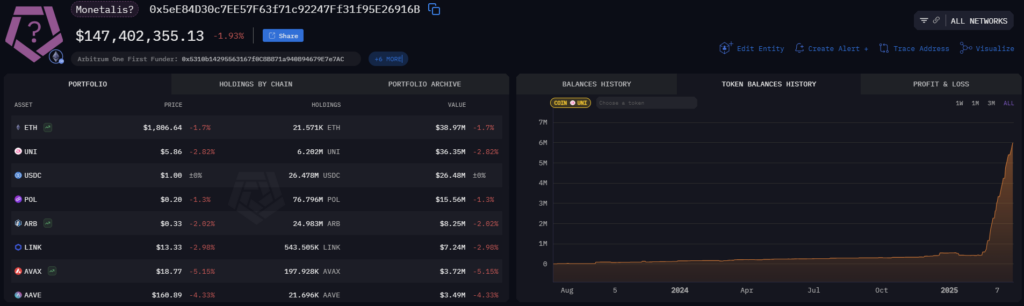

Onchain UNI

The whale wallet mentioned in last week’s report continues to increase its holdings, with a 1.2M $UNI increase (+24% of holdings) this past week.

Wallet address: 0x5eE84D30c7EE57F63f71c92247Ff31f95E26916B

5. Conclusion

Onchain BTC, Volatility remains relatively insignificant. According to weekly updates and data from Glassnode, BTC is currently in the early stages of Accumulation Wave 2 with +278K BTC -> further accumulation time is needed, estimated until early Q3/25.

- Distribution Wave 1: LTHs distributed -929k BTC

- Accumulation Wave 1: LTHs accumulated +817k BTC

- Distribution Wave 2: LTHs distributed -1.11M BTC

- Accumulation Wave 2: Currently +278k BTC

Fund flows continue to reinforce the market inflow trend over the past 4 weeks, $233.86B, recording a 0.67% increase, equivalent to +$1.56B inflow. Notably, Aptos recorded strong stablecoin marketcap growth on its network this past week, +22.9% with +$195.2M net inflow.

[…] a reduction in trading price, moving from $84,000 to $81,565. Notable industry figures, such as Mike McGlone from Bloomberg, echoed the cautionary sentiment, highlighting potential for further challenges to assets like […]

Comments are closed.