1. Bitcoin Market Update

1.1. Key cost basis & supply

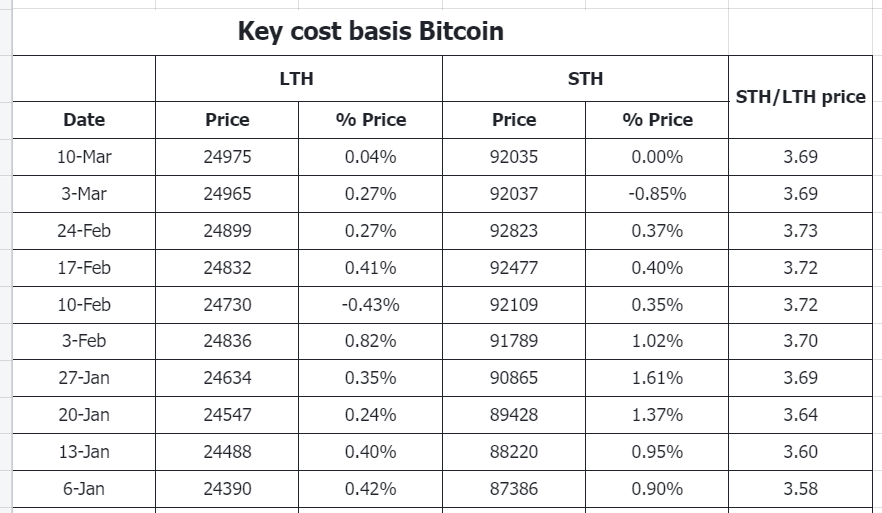

LTH

- Cost Basis: $24.97k, increased by +0.04%

- Supply: 14.328M, decreased by -0.24%

STH

- Cost basis: $92.035k, no change

- Supply: 5.506M, decreased +0.71%

LTH continues its distribution trend, as indicated by the LTH supply maintaining its downward trajectory, with a 7-day decrease of -0.24%. Conversely, the STH supply is increasing, showing a 7-day rise of +0.71%. From a broader perspective, the BTC price broke down the STH cost basis on February 24th, and to date, the price remains consistently below this level, indicating a prevailing bearish sentiment.

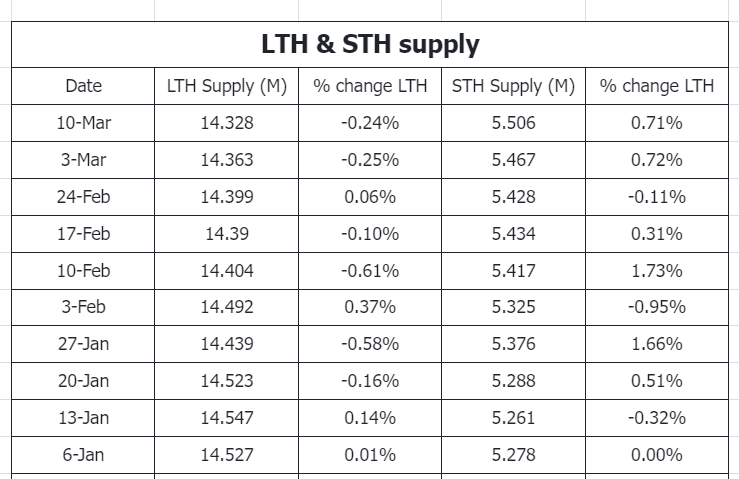

1.2. MVRV Z-Score

A drop in the MVRV Z-Score to 1.92 indicates a potential trigger for the upcoming re-accumulation period.

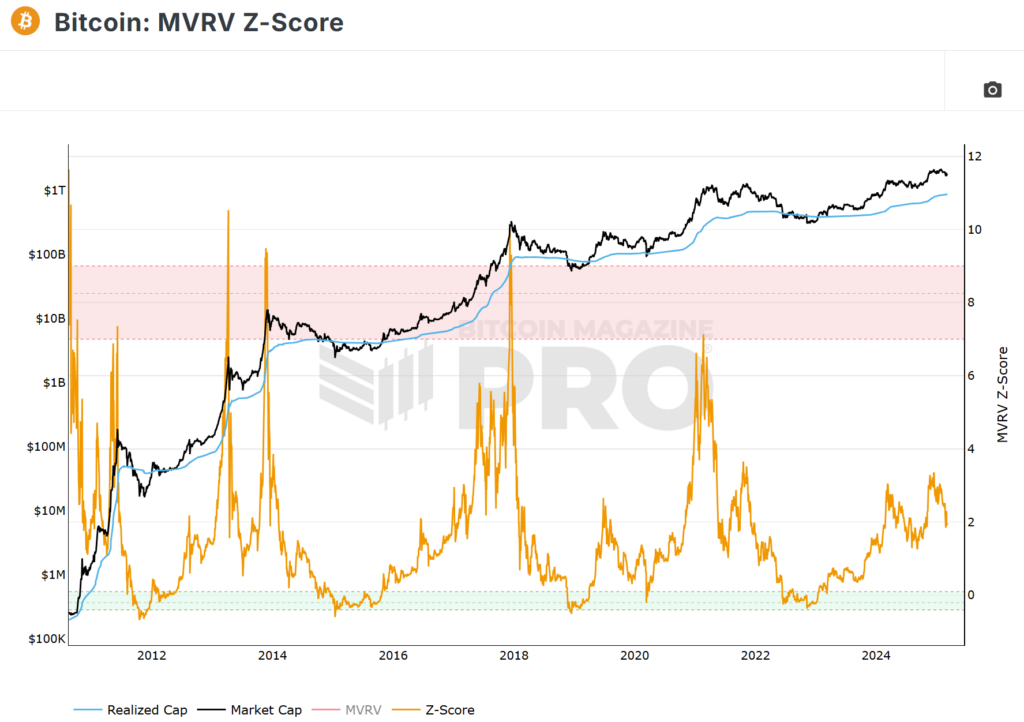

2. Stablecoin Update

The stablecoin market capitalization has reached $227.2 billion, showing a 1.25% rise, which translates to a $2.8 billion inflow.

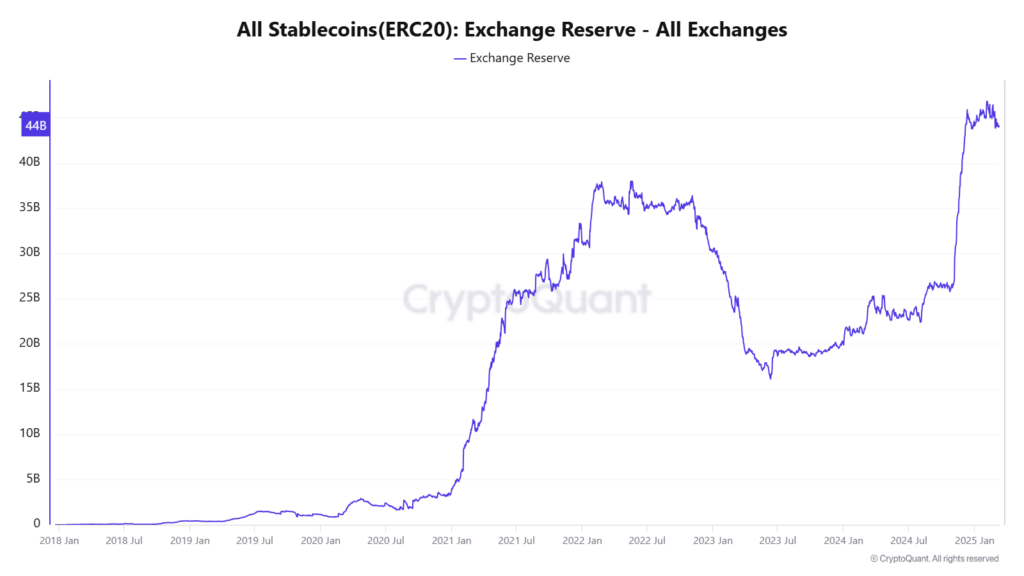

The stablecoin balance on exchanges has decreased to $44 billion, representing a 1.83% drop and a net outflow of $820 million.

Despite the minting of new stablecoins during the Crypto Summit, there’s been a lack of substantial inflow to stablecoin exchanges, suggesting limited buying activity. Instead, an outflow exceeding $820 million was noted, further solidifying the ongoing monthly trend of net outflows.

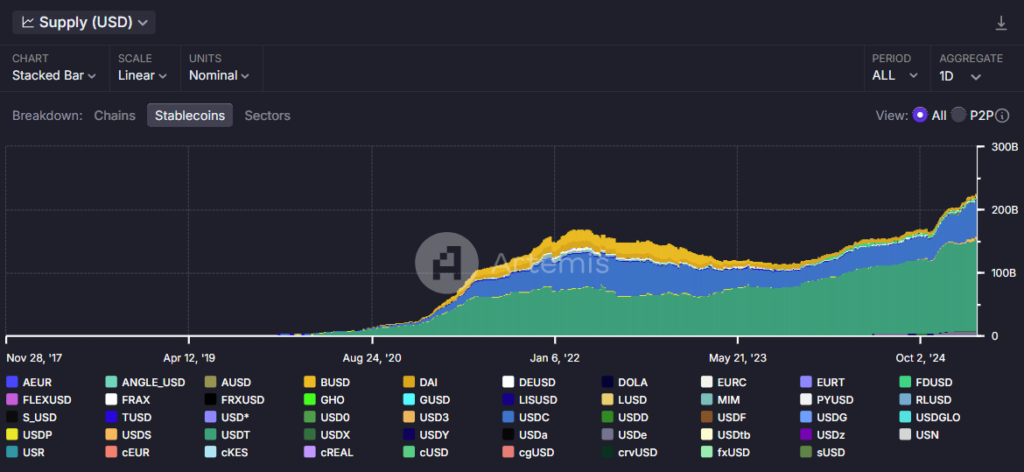

3. Ecosystem Flow Market Update

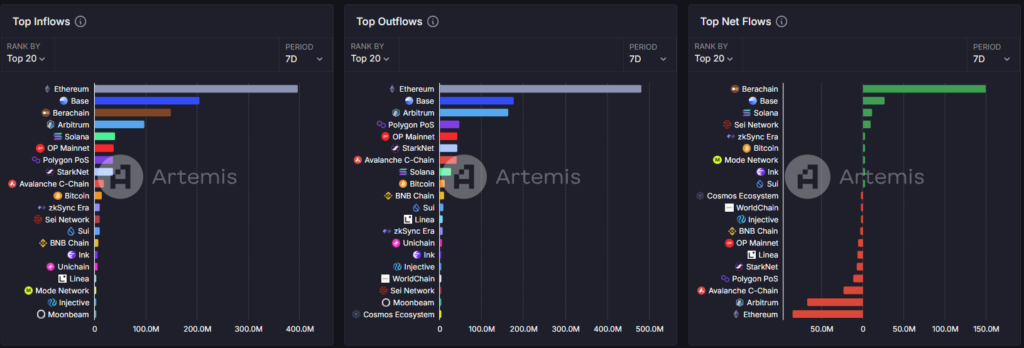

Data from Artemis indicates the 7-day inflow

- Berachain: $150.2M ($84.8M in stablecoin)

- Base: $27.1M

- Solana: $12.2M

- Sei: $9.8M

Berachain has seen a significant influx of capital, particularly stable coins from ETH and BASE, totaling $892.8 million over the last month. This surge in stablecoins suggests a robust DeFi environment, driven by diverse yield farming opportunities.

- TVL in BERA: 543.4M BERA, a 52.9% decrease

- TVL in USD: $3.27B, a +74% decrease

4. Market Maker Update

MM Wintermute portfolio: $527.2M

Profit-taking on various assets, estimated at over $100M (due to both reduced holdings and overall market price fluctuations, the exact dollar amount cannot be precisely determined).

- -$41.1M BTC (482.7 -> 4.3 BTC) -> 0% of portfolio

- -$37M SOL (843K -> 614.13K SOL) -> 15.9% of portfolio

- -$19.6M ETH (13.32K -> 4.49K ETH) -> 1.87% of portfolio

- -$8.9M WBTC (345.73 -> 241.75) -> 3.9% of portfolio

Following profit-taking, stablecoin holdings significantly increased from $60.3M to $132.8M, now representing 25.2% of the portfolio.

Assets with increased holdings (value >$5M):

- ONDO increased by 46%, from 15.31M to 22.37M ONDO ($21.4M)

- ENA increased by 1164%, from 1.76M to 22.25M ENA ($9.8M)

- BNB increased by 792%, from 1.17K to 10.44K BNB ($6.2M)

- AI16Z increased by 78.7%, from 15.14M to 27.06M AI16Z ($5.6M)

5. Conclusion

A shift towards a defensive stance is observed, with profit-taking on several top assets in the portfolio exceeding $100M and an increased allocation to stablecoins from 10.3% to 25.5%.

Notable increases in holdings were observed for assets with a value exceeding $5M (equivalent to 0.95% of the portfolio): ONDO continued to accumulate over the past two weeks, along with ENA, BNB, and AI16Z.