1. Crypto Market Bitcoin Update

1.1. LTH & STH

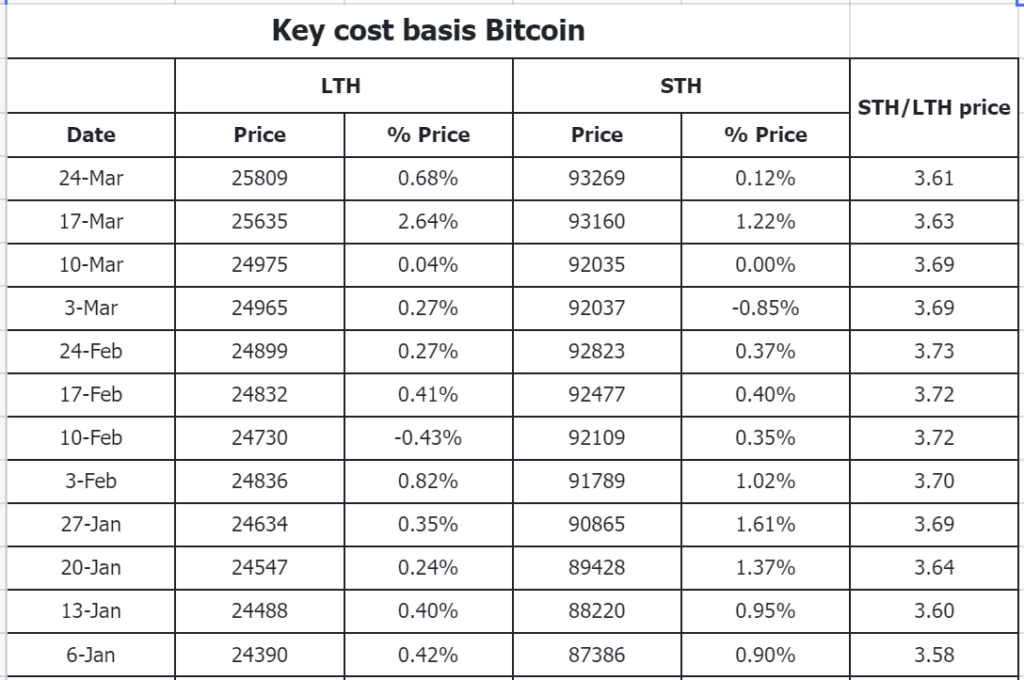

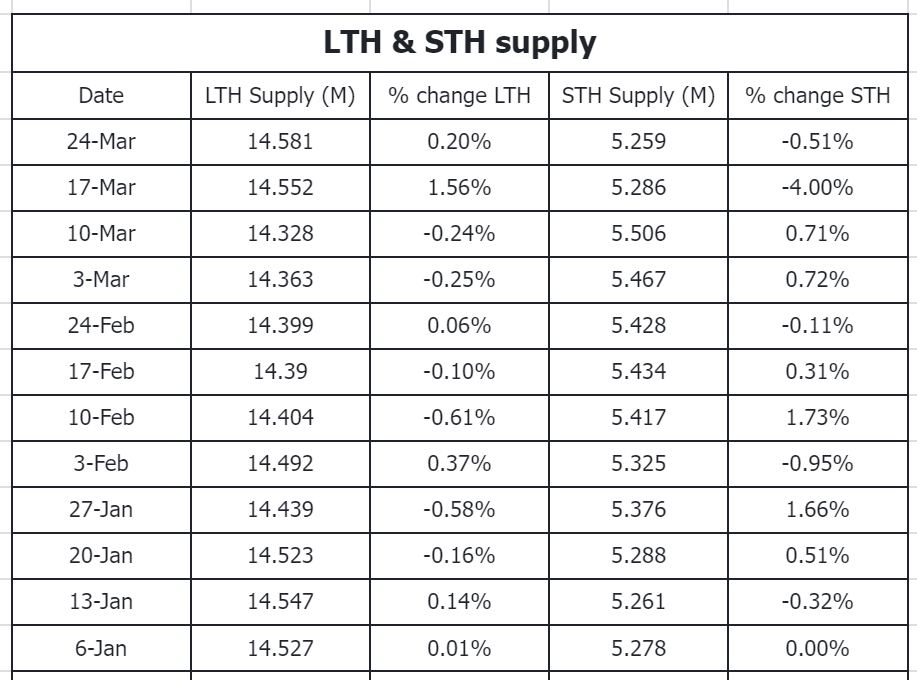

LTH (Long-Term Holders)

- Cost basis: $25.8k, up 0.68%

- Supply: 14.581M, up 0.2%

STH (Short-Term Holders)

- Cost basis: $93.27k, up 0.12%

- Supply: 5.259M, down -0.51%

Analysis

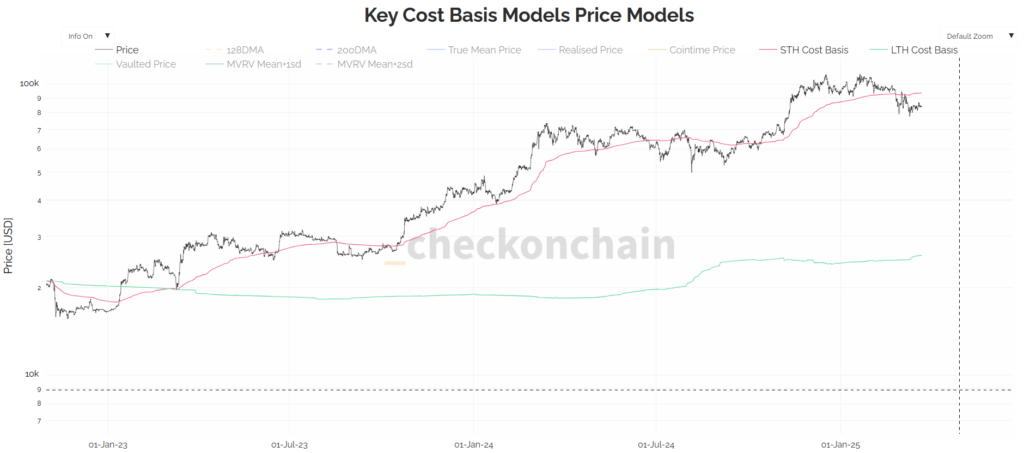

- Over the past three weeks, within the context of Bitcoin fluctuating between $78k and $95k, the increasing trend of LTH Supply and the decreasing trend of STH Supply indicate that a portion of Bitcoin is shifting from STH hands to LTH hands. This is a positive signal, as it reflects an ‘accumulation’ sentiment.

- LTH is maintaining a positive sentiment, with a slight increase in LTH Supply and a stable LTH Cost Basis, suggesting that selling pressure from the previous period has gradually decreased, replaced by steady accumulation, supporting an upward price trend.

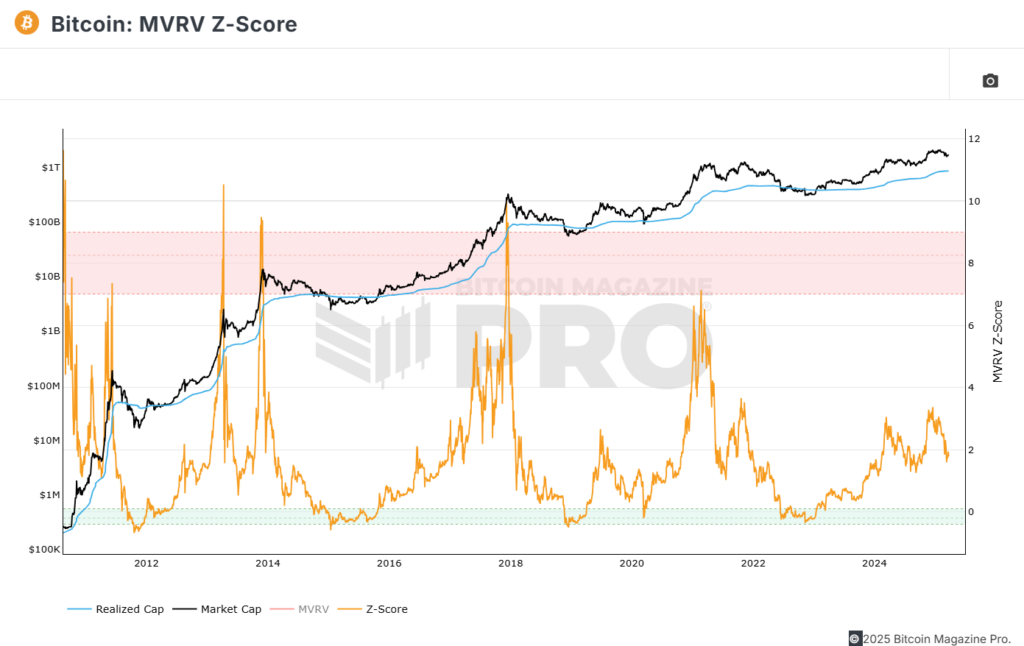

1.2. MVRV Z-Score

The Z-Score decreasing from around 3.5 (late 2024) to approximately 1.5 – 2 (early 2025) indicates that selling pressure has subsided, and the market is transitioning to the next accumulation phase.

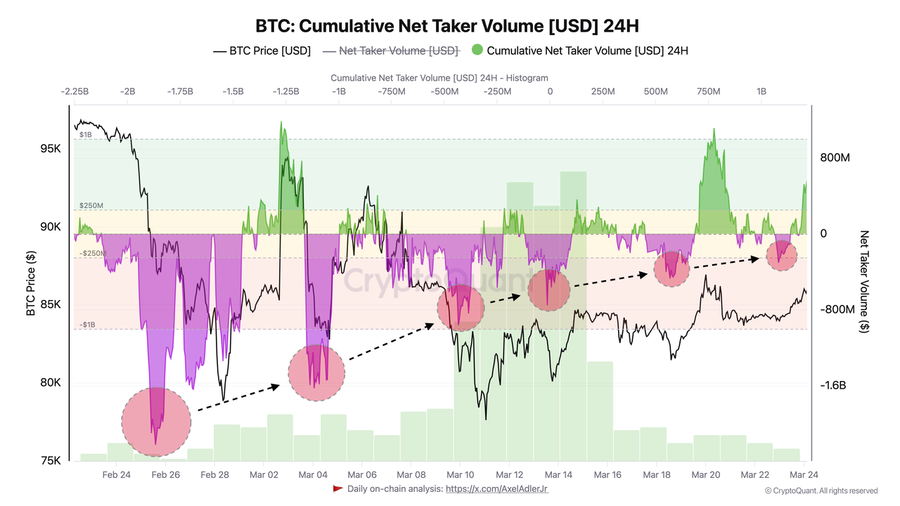

1.3. Cumulative Net Taker Volume

Reinforcing the argument that selling pressure has subsided, the 24H Cumulative Net Taker Volume also indicates that strong BTC selling activity has decreased significantly.

Therefore, in the absence of negative market or macroeconomic catalysts this week and throughout April, this suggests that a recovery trend has the potential to unfold within a month.

2. Stablecoin Update

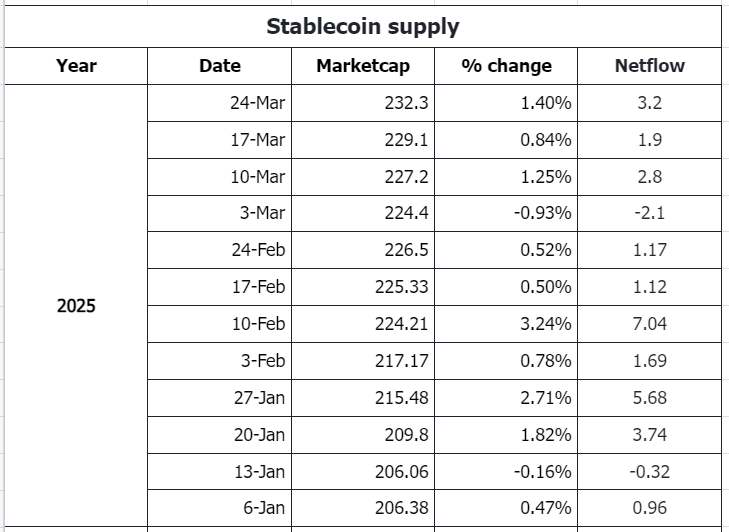

- Stablecoin marketcap: $232.3B, recording a 1.4% increase, corresponding to a +$3.2B inflow.

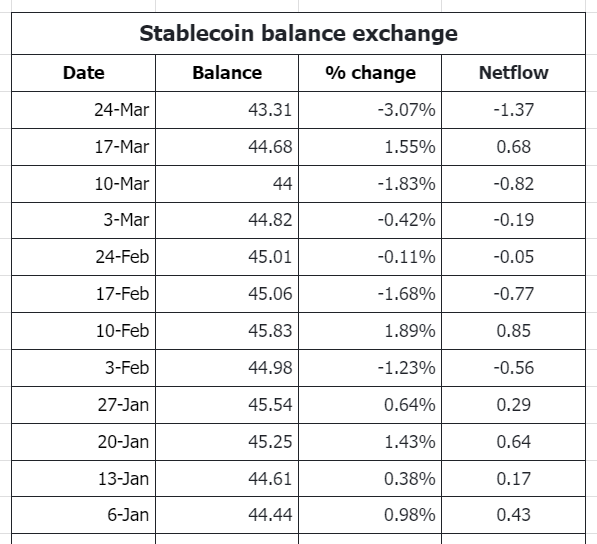

- Stablecoin exchange balance: $43.31B, down -3.1% with a $1.7B net outflow.

New stable coin inflows into the market continue and are quite positive.

Despite the increase in supply, stablecoin balances on exchanges decreased by -$1.37B. This suggests that the majority of the new $3.2B stablecoins are being held on-chain, reflecting an accumulation sentiment, preparing for future buying opportunities on CEX or focusing on opportunities on DEX.

3. Onchain Movement

3.1. Onchain UNI

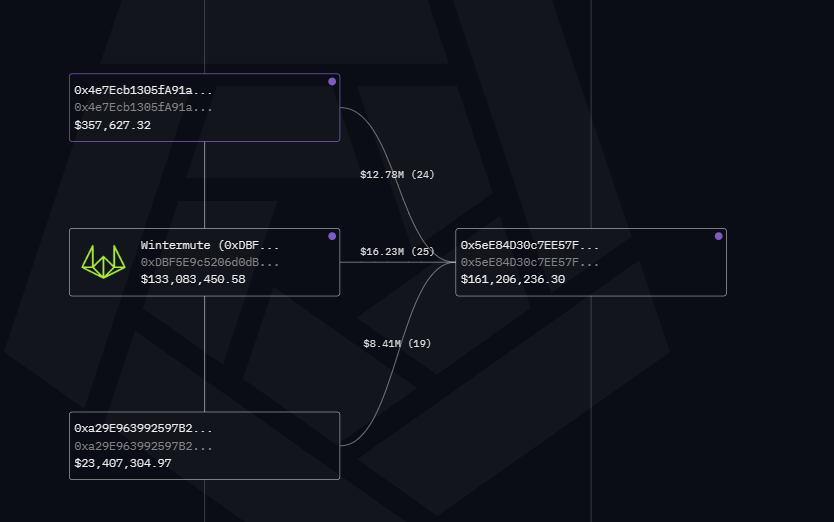

A whale wallet has been detected increasing its UNI holdings by more than 10x, from 430K to 5M ($35.3M), since mid-February.

Current UNI holdings account for 22% of the wallet’s portfolio, and the wallet primarily accumulates UNI through OTC purchases with Market Maker Wintermute Trading and B2C2 Group.

Wallet address : 0x5eE84D30c7EE57F63f71c92247Ff31f95E26916B

3.2. Onchain HYPE

A smart money wallet (likely MM Wintermute) has been detected accumulating $HYPE, currently holding 4.176M HYPE ($70M), including 552.9K HYPE from the airdrop and distributions to numerous new wallets mentioned below.

(Between TGE on November 29th and November 30th, they deposited $48,95M USDC into the HyperLiquid spot market, presumably to buy HYPE. However, they didn’t spend the entire amount – likely closer to 30M USDC.)

- 0x24cf9d52cfcad0d2a0f2aeae2e85696420ac6b80 – Holding 250,184.19 Hype

- 0x14a872e2564aa6e4ce108cdb427dbac794590016 – Holding 592,184.18 Hype

- 0x9f3b90f03dbe29c31ed1d05d7f6515248b9de2cf – Holding 462,204.18 Hype

- 0xeaf97d4ac9d2cdd09df78d00fe9015aa27267af8 – Holding 352,284.18 Hype

- 0x26aa510e4fa99b207b9da5702f348b994f013ecf – Holding 150,285.19 Hype

- 0x89f3f64a8ab9787dc9c9769b2c044557fb6523b0 – Holding 342,582.19 Hype

- 0xdaaeb593f0ca48772902be38a8a3928917dc97df – Holding 391,492.68 Hype

- 0xa3c2fd2cc26060a254e596dddf0970de956ea3d7 – Holding 191,492.18 Hype

- 0xe36eebf15b7b5042d86885641f5b040a8d07ae18 – Holding 603,193.19 Hype

- 0xeb995c082dd1249fde261fa7c0b1c0a04fda86c9 – Holding 840,240.18 Hype

4. Conclusion

The selling pressure from long-term holders has eased and transitioned to accumulation over the last three weeks. This positive market signal implies that barring any adverse market or macroeconomic events this week and throughout April, a recovery could materialize within a month.

Notably, despite a $3.2 billion increase in stablecoin supply, exchange stablecoin balances saw a $1.37 billion net outflow in the past week. This also indicates a cautious sentiment among investors. Consequently, the focus should be on monitoring projects and narratives on decentralized exchanges (DEX), as capital is concentrated there rather than on centralized exchanges (CEX), until exchange stablecoin balances show a significant increase.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.