Written by Jin

The term “crypto wallet” is a fundamental concept widely recognized in the cryptocurrency market. The use of crypto wallets by individuals or institutions has been steadily growing in popularity. This is a prerequisite for the development of the market, just as when you go to the shop, you need a wallet, and when you buy an asset, you need somewhere to store it.

Credit cards don’t store your money; they only contain information about your account ID. In reality, when you use an ATM to withdraw cash, the ATM card acts as a “key” to access your funds. The crypto wallet functions in a similar way, it doesn’t store your tokens/coins; it only carries information about your private key, which serves as proof that you own that wallet. This allows you to access your account on the blockchain. Unlike traditional banks, which are protected by laws and sometimes have reversible transactions, blockchain transactions cannot be irreversible; they are immutable. While this ensures a level of transactional integrity, it also places greater responsibility on users to be cautious and accountable for their actions.

DIFFERENT TYPES OF WALLETS

At present, crypto wallets have seen substantial enhancements since their inception, showcasing a broader range of formats, increased functionalities, and improved user interfaces and experiences. There are two primary types of wallets:

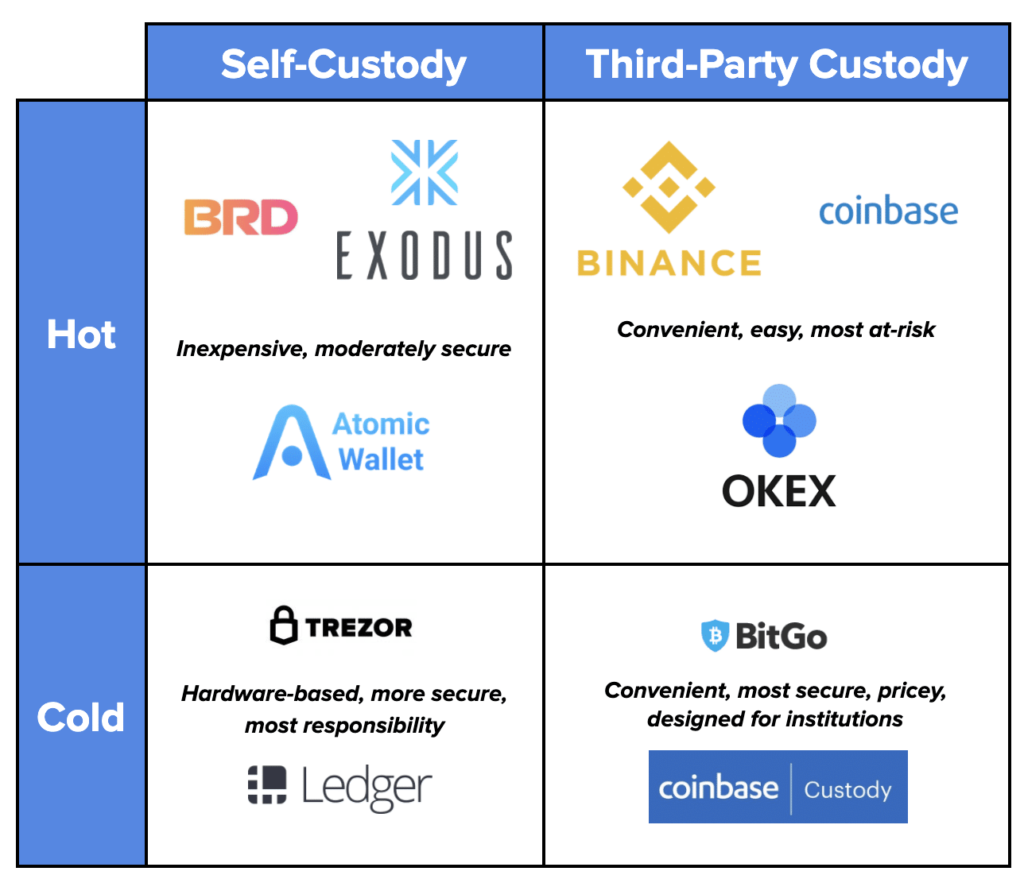

- Hot Wallet: as known as an online wallet, the keys are stored directly within the application and are active everywhere as long as the device connects to the internet.

- Cold Wallet: as known as an offline wallet, the keys are typically stored in a small hardware device like a USB (Ledger, Trezor, etc.), and for a transaction to be approved, the user needs to physically interact with the device.

Furthermore, wallets can be categorized into two types: Custodial and Non-custodial wallets:

- Custodial Wallet: Private keys are held by a third party, often financial institutions, investment funds, or asset custody platforms. These entities manage customers’ assets or handle delegated investments. An example is CEX platforms like Binance, Coinbase, Okex, etc.

- Non-Custodial Wallet: users hold their private keys and have complete control of their funds. This is the most widely used type of wallet globally. However, wallet management can sometimes be a barrier for many due to the ever-present risk of cyber attacks.

In June 2021, Ledger reported selling over three million hardware wallets. Users who hold a substantial amount of cryptocurrency and are not engaged in frequent trading often prefer using cold wallets like Ledger to store their digital assets.

DEMANDS FOR PROPERTY SELF-MANAGEMENT

Before the banking system became more sophisticated in the early 1900s, individuals usually manage their own assets. It wasn’t until the advent of e-commerce and the rise of international payments that the need for a reliable third-party intermediary became apparent and grew exponentially.

The emergence of intermediary organizations to ensure transactions at that time was absolutely necessary. You couldn’t simply carry a bag of cash or valuable assets like gold and precious metals from Vietnam to Japan or South Korea for shopping, expenses, or luxury purchases. Besides being inconvenient, this posed a risk to the individuals owning those assets. Additionally, one can imagine the scenario where that person would also have to incur extra costs for hiring bodyguards and upgrading protective equipment for their mobile assets. Fortunately, in the present time, the circulation of currency happens quite smoothly due to various reliable intermediary organizations.

However, if all goes well, with no new requirements arising, sending large sums of money to the other side of the world still requires a third party’s trust as to what the bank will do. They promise that it also means you trust the financial institutions in your home country to protect you in the event something goes wrong. However, in some cases you still don’t get what you want, because in some places banks won’t work on weekends or sometimes the amount you want to transfer will be limited. Convenience is sometimes a trade-off!

Also, what you should do if you want to transfer money across borders, or buy something you cannot trust the services of the country you are in or you live in of countries suffering from civil wars and the banks are under control of one side, and you are on the other side?

This once again increases the need for self-management of personal assets and this is also something that crypto wallet manufacturers or blockchain markets are trying to solve. There is a need for a solution to help users protect, manage and take responsibility for their own assets.

ARE CUSTODY APPS NECESSARY?

Yes!

With the development of fintech and innovation in young people’s approach to digital banking. Transferring money or depositing assets has gradually become a habit. Young generations in both developed and developing countries are gradually taking advantage of the convenience of banking and depositing their assets safely. They always appreciate the bank’s services and trust the laws of the host country.

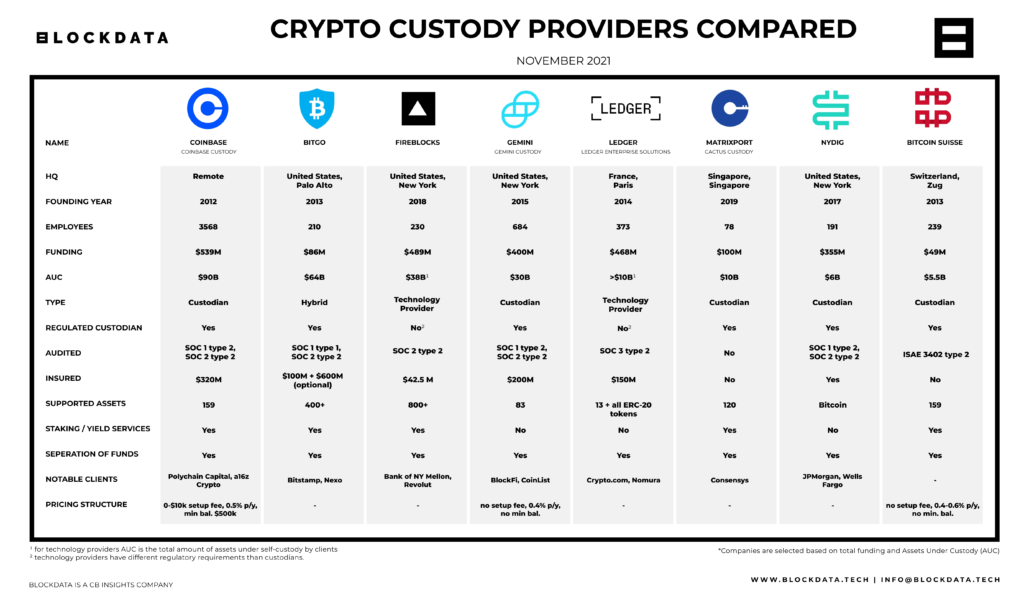

The same practice applies to large corporations and financial institutions. Therefore, it makes sense that many of them choose crypto custody services provided by trusted third parties. This allows them to reduce the risk of cyberattacks, while some custody providers use blockchain technology to help increase the efficiency of what they do best, such as FireBlocks.

However, there is a sad fact that the legal regulations on cryptocurrency custodians have not been developed and perfected, somewhere in the crypto landscape we still see stories of abuse of assets by people. customers for personal use such as FTX and Celcius. Admittedly, these platforms collapse quickly due to glitches, but the damage they bring is immense, in terms of assets and, above all, in terms of trust. for the cryptocurrency market.

However, with the development and improvement of the law, as well as blockchain technology, the monitoring and protection of users will definitely improve, and such unfortunate cases will not be easy to happen. Still outside. In addition, clients need to understand specific regulations, licenses and insurance policies, which will help them avoid financial loss due to misplaced trust.

MASS ADOPTION NEEDS WALLET

Cryptocurrency wallets have played an important role in the growth and spread of Web3. It is the main starting point for both the crypto economy in particular and the blockchain in general. Cryptocurrency wallet infrastructure providers will have a lot of power if they have a large number of users and have a good transaction volume on the link.

Currently, the main wallet monetization model is selling hardware devices (cold wallets like Trezor and Ledger), collecting a portion of fees from user activities such as transfers, using Dapps like DEXs, and lending platforms. In addition, the fact that wallets are the bottleneck of traffic on Web3, so the cost of marketing on their interface is also a healthy source of revenue.

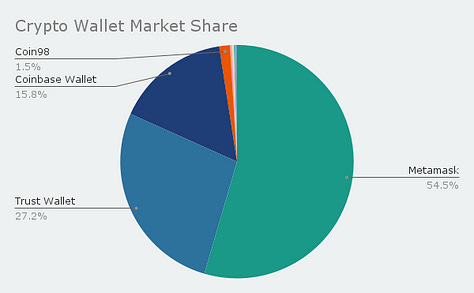

However, if you have a large number of users with huge daily transaction volume, the operating model of the crypto wallet will start to change, the wallet will start to create economic barriers and barriers to entry for new users. From there, the crypto wallets that dominate the market will start to profit and take advantage of them while the rest of the competitors struggle to survive.

For example:

After gaining a large number of users, Metamask began to develop exchange and aggregate features to start making profits, this is also a chicken and egg problem, when the network effect of Metamask is too large, the Dapps are now choosing to connect with Metamask wallet as the #1 priority due to the large number of available users, thus increasing the number of users using Metamask wallet.

ENDING

The internet is starting to show its popularity among the world population, with 5.3 billion daily users. And the cryptocurrency market is still quite small with just over 100 million daily users. The fact that more and more people are interested in this crypto market and participating in it will give a huge advantage to the infrastructure platforms, in which crypto wallets will be the most powerful and quickly adopted. best. It is also conceivable that any user needs a wallet to interact with any blockchain.

The future of crypto wallets will be very positive as the wallet will need to be fully tooled for OG users, while remaining intuitive and accessible for beginners. Moreover, surrounding factors such as low cost, good customer service, beautiful interface will be necessary to attract the younger generation.

Although crypto users today still face the complexities of managing seed phrases, cross-chain transactions, and security risks when using crypto wallets, thousands of developers is trying to grow the crypto industry by mitigating these weaknesses. This will lead to a “wallet war” as more and more vendors want to grab a piece of this big pie, but competition is always a prerequisite in the development process.