Written by POT

In the contemporary financial landscape, the prominence and importance of cryptocurrencies, especially in the sharing economy, cannot be overlooked. The objective of this article is to explore the role of cryptocurrencies within the context of the sharing economy, and in doing so, offer practical recommendations for businesses contemplating the utilization of this payment method to tap into its potential.

Cryptocurrency and Sharing Economy

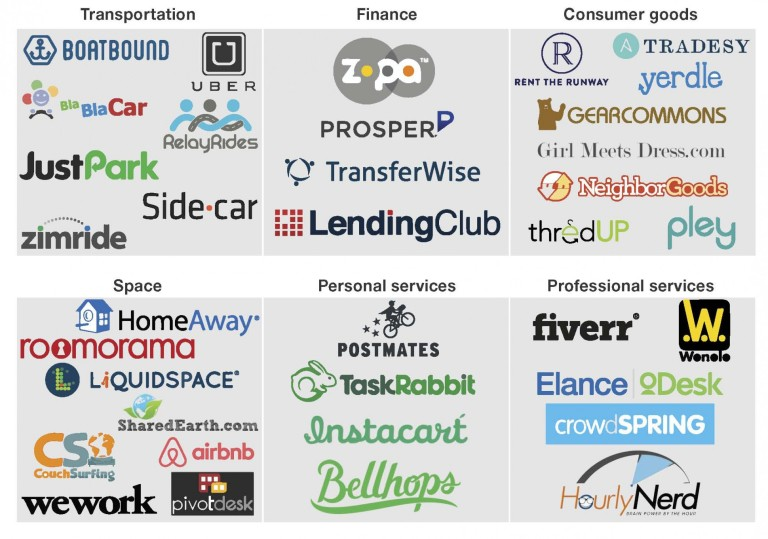

The sharing economy is a socio-economic system in which consumers participate in creating, producing, distributing, trading, and consuming goods and services. These systems come in various forms, often utilizing information technology and the Internet, especially digital platforms, to make it easier to distribute, share, and reuse surplus capacity in goods and services. Simultaneously, these platforms have opened up numerous income-generating opportunities for people from all walks of life. For example, well-known platforms like Grab and Airbnb have created a convenient space for individuals to share their resources, such as apartments, cars, tools, or job opportunities, then earn money.

Cryptocurrency, besides, enables users to carry out transactions swiftly and effortlessly. When compared to traditional payment methods such as banks or credit cards, cryptocurrency transactions are faster and more secure. This implies that you can bypass lengthy queues and steep fees linked to these conventional payment channels. Moreover, due to the decentralized nature of cryptocurrency, there is never a single point of failure, guaranteeing the safety and security of your assets at all times.

As the sharing economy continues to evolve, the integration of cryptocurrencies and blockchain technology is emerging as an intriguing new trend. The sharing economy is characterized by peer-to-peer transactions. Therefore, this model aligns well with the decentralized nature of cryptocurrencies, enabling direct transactions between parties without the need for intermediaries like banks.

Explore the benefits

- Faster transaction times: Cryptocurrencies operate on decentralized networks, enabling faster peer-to-peer transactions without the need for third-party verification. This can lead to quicker payment settlements for service providers, enhancing the overall user experience.

- Lower transaction fees: Traditional payment methods, such as credit cards and bank transfers, often come with high transaction fees, which can reduce the earnings of service providers in the sharing economy. Cryptocurrencies typically offer lower transaction fees, making them an attractive alternative for individuals and platforms.

- Increased security and reduced fraud risk: The decentralized and tamper-proof nature of blockchain technology, which underpins cryptocurrencies, can help to reduce the risk of fraud and chargebacks in sharing economy transactions. This can protect both service providers and users from potential financial losses.

- Global accessibility and Global micropayments: Cryptocurrencies are borderless and can be accessed and used by anyone with an internet connection. This allows sharing economy platforms to reach a global audience without dealing with the complexities of different fiat currencies and exchange rates. Besides, cryptocurrencies enable cost-effective micropayments, allowing users to pay for small services or digital content without incurring significant transaction fees.

Face the challenges

Cryptocurrencies have the potential to streamline and enhance these transactions, but there are also significant hurdles to overcome:

- Volatility in price: Cryptocurrencies are known for their price volatility. The value of a cryptocurrency can fluctuate dramatically over short periods, which can create uncertainty for both users and service providers in the sharing economy. Stability mechanisms, such as stablecoins pegged to fiat currencies, can help mitigate this challenge.

- Adoption and Awareness: While cryptocurrencies have gained popularity, they are not yet widely adopted in mainstream markets. For successful integration into the sharing economy, both providers and consumers need to be educated about cryptocurrencies and their benefits. Additionally, user-friendly platforms and interfaces should be developed to facilitate easy onboarding.

- Regulatory compliance: Regulatory Compliance: The sharing economy often operates in a legal gray area, and the addition of cryptocurrencies can further complicate regulatory matters. Governments and policymakers are still developing frameworks to govern cryptocurrencies, and navigating these regulations is crucial for sustainable integration.

- Technical integration: Integrating cryptocurrency payments into a sharing economy platform may require technical expertise and investment in new infrastructure. Platforms must weigh the potential benefits against the costs of implementing such a system.

Conclusion

Currently, there are well-known sharing economy platforms that accept cryptocurrencies as a means of payment, such as Travala, OpenBazaar, and CanWork. As consumers’ interest in cryptocurrencies continues to grow, it is highly probable that more sharing economy platforms in the future will also adopt digital currencies.

In conclusion, cryptocurrency’s role in the sharing economy holds both promise and challenges. It offers numerous benefits such as reduced transaction fees, faster cross-border transactions, and financial inclusion for the unbanked. The potential for innovative business models, enhanced privacy, and decentralized security further add to their appeal. However, regulatory compliance and user adoption remain a critical hurdle that requires careful navigation. As the cryptocurrency ecosystem continues to mature, collaboration between sharing economy platforms, regulators, and the crypto community will be essential to fully harness the transformative potential of digital assets in the dynamic landscape of the sharing economy.