The U.S. labor market has become the focal point in the debate over whether the U.S. is facing a recession. In our latest study, we delve into core data analysis to clarify this issue and examine whether these concerns have been overstated. Let’s explore together the impact and significance of this for investors, the economy, and overall market sentiment.

1. Overview

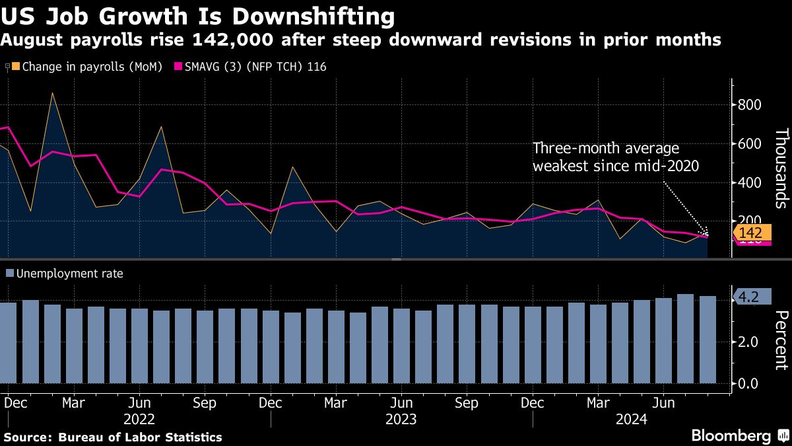

U.S. inflation has significantly moderated, reaching 2.5%, and is approaching the Fed’s target of 2%. As a result, the central bank’s focus has shifted toward labor market dynamics, following a period of slowing job growth and a rising unemployment rate, which increased from 3.4% to 4.2% over the past year.

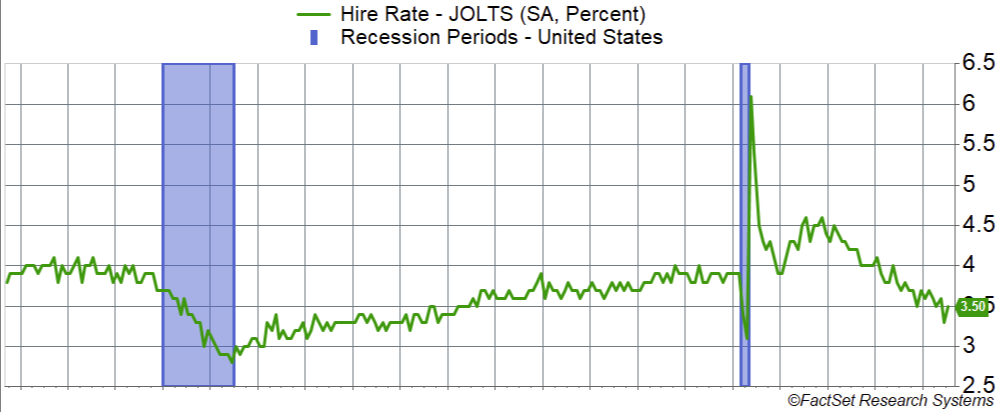

Hiring momentum has slowed, with the hiring rate—measured as hires as a percentage of total employment—retreating to 3.5%. Excluding the COVID-19 pandemic period, this is a level last seen in 2014.

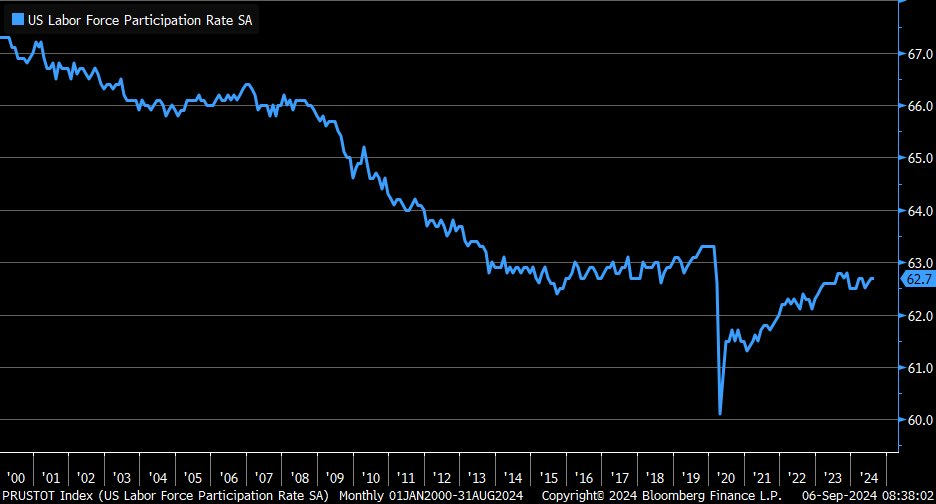

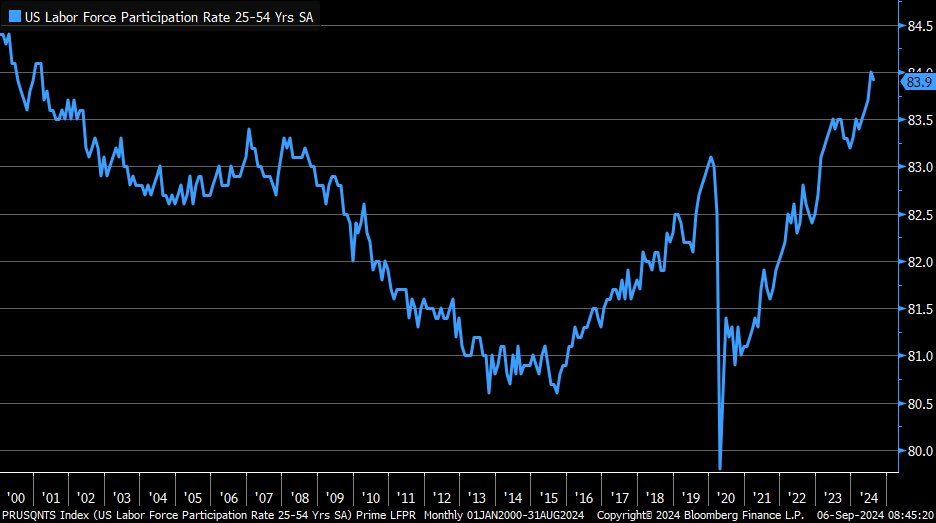

Despite the softening labor market, most indicators suggest it remains fundamentally stable. Firstly, the labor force participation rate has held steady at 62.7% as of August. The prime-age participation rate (ages 25-54) remains strong, hovering near its highest level since 2001 at 83.9%.

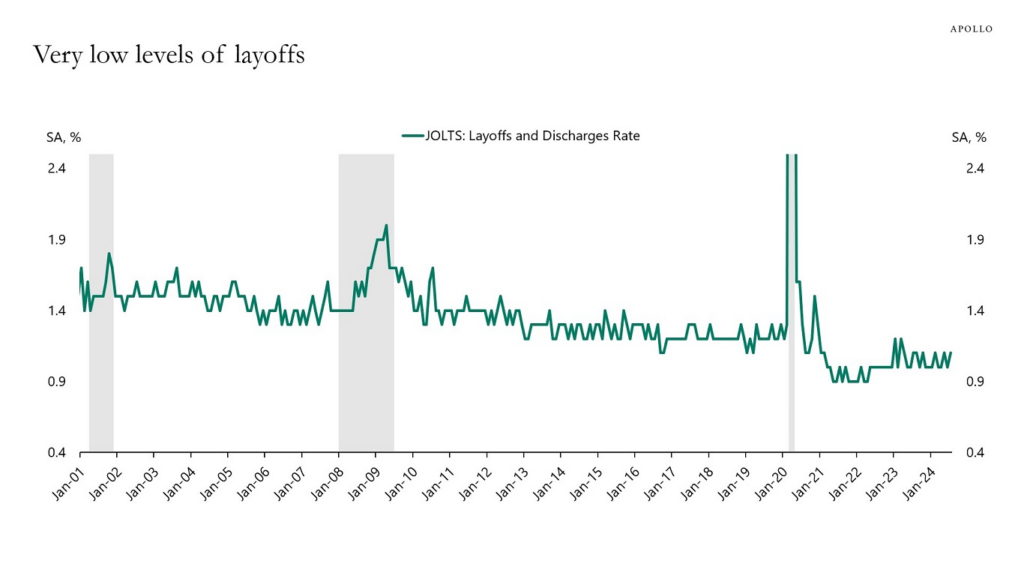

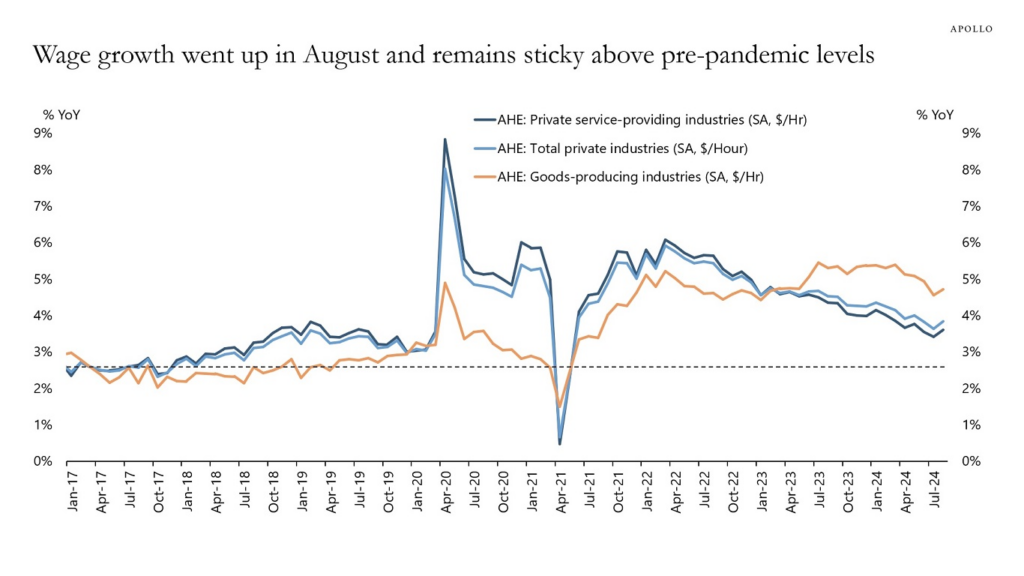

Secondly, layoffs continue to be historically low, with the layoff rate at 1.1%, below the pre-pandemic average of 1.2-1.3%. This supports continued wage growth, which is vital for sustaining consumer spending and economic growth.

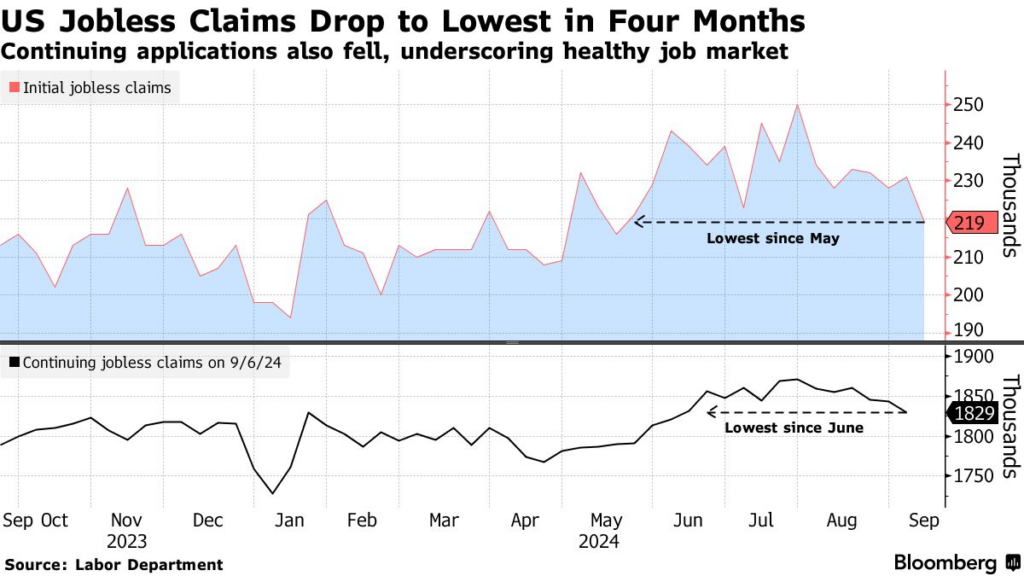

Finally, applications for unemployment benefits have declined, reaching 219,000 last week, the lowest since May. This suggests the labor market remains resilient despite the deceleration in hiring. Continuing claims, a proxy for the number of individuals receiving unemployment benefits, also dropped to the lowest level in three months. Initial claims have not shown an upward trend, a critical indicator that while labor market conditions are moderating, they are not deteriorating.

2. Closing Thoughts

While job growth has decelerated and unemployment has risen alongside a decline in job openings, sparking concerns of a potential recession, a closer examination of the labor market reveals a more nuanced picture. Key indicators as mentioned above suggest that underlying labor market conditions remain robust. We don’t see evidence that the U.S. is currently in a recession and no signs of a recession on the horizon in the jobs data yet.

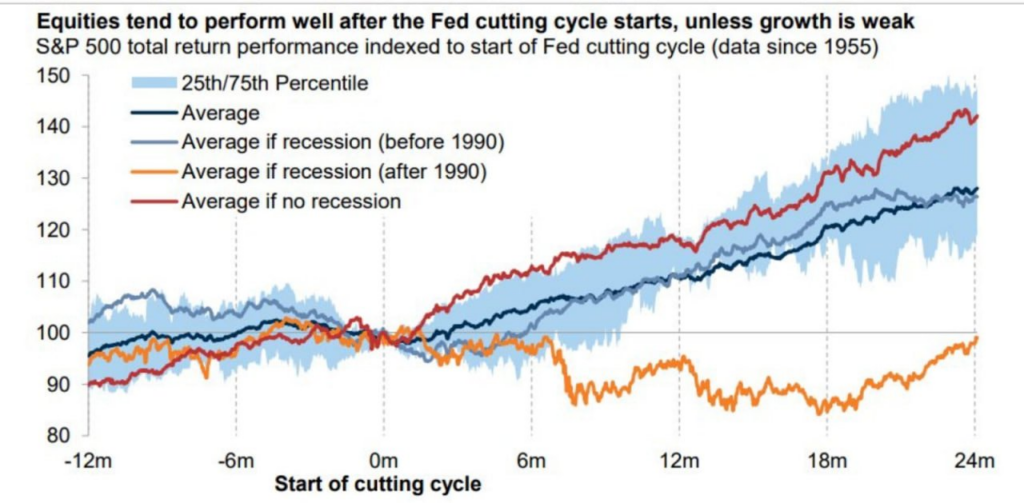

Now the overall macroeconomic environment creates a favorable environment for asset prices. Moreover, historical data shows that markets often perform well after major Fed rate cuts, particularly when supported by strong economic momentum, as is currently the case.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.