The crypto market is experiencing a euphoric period, marked by Bitcoin’s price soaring to $35,000, its highest level since April 2022. The optimistic market sentiment is a result of Depository Trust and Clearing Corporation’s (DTCC) listing BlackRock’s iShares on their website. The listing has fueled the increase in token prices in the entire market, with speculation that the spot bitcoin ETF will be approved soon.

Although BlackRock’s ishares Bitcoin Trust (IBTC) briefly disappeared from the website and reappeared in the following hours, this action had no significant impact on market sentiment; Bitcoin experienced only a minor price decrease in response. The DTCC offers settlement and clearing services for financial markets, including the NASDAQ. Being listed on the DTCC is a standard procedure for launching an ETF, but it usually occurs within a week of the fund’s actual trading commencement. Despite market speculation, the DTCC clarified that being listed simply indicates that an agent bank has requested a DTCC identifier for an ETF fund, and the DTCC may process the transaction at an undetermined date in the future following SEC approval. In addition, a Reuters report revealed the IBTC listing was added to the DTCC’s site in August but was only widely noticed a few days ago.

On the flip side, the U.S. Court of Appeals has issued an order for the Securities and Exchange Commission (SEC) to review Grayscale’s spot Bitcoin ETF application. Even though the SEC can still reject the application, they must now provide a fresh rationale that isn’t linked to previous reasons (such as the lack of tight connectivity between the Bitcoin futures market and the spot market).

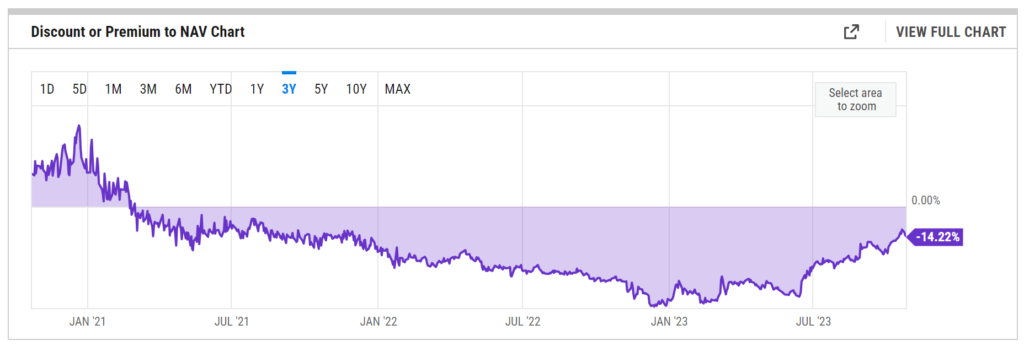

The price of GBTC saw a decline following the Terra collapse and hit its lowest point, dropping to 50% of its value earlier in the year. However, it began to rise steadily after the submission of spot Bitcoin ETF applications by traditional financial companies like 21Shares, Ark, BlackRock, Bitwise, VanEck, Wisdomtree, and others. In just a few months, GBTC’s price has surged by 30%, reducing the discount to 14.22%. Grayscale Bitcoin Trust (GBTC) currently stands as one of the largest Bitcoin funds globally, but its shares won’t be directly redeemed for BTC until it is converted to a spot Bitcoin ETF.

The approval of a spot Bitcoin ETF or BlackRock’s ishares by the SEC is anticipated to open the doors to significant inflows into the cryptocurrency market. According to Alex Thorn, the Head of Firmwide Research at Galaxy Digital, an ETF could see a minimum of $14.4 billion of inflows in year one, ramping to $38.6 billion inflows in year three. At those levels, BTC/USD could see a 75% appreciation the year following approvals. Furthermore, introducing a spot Bitcoin ETF is expected to trigger various layers of financial activities within the sector, including the development of ETF options, futures, and futures options.

Luke Nolan, a Research Associate at CoinShares, highlighted that a spot Bitcoin ETF would simplify institutional investors’ access to Bitcoin exposure. It would eliminate the need for concerns about holding keys or safeguarding seed phrases, which typically entail additional costs for institutions to establish an in-house solution for managing their cryptocurrency holdings.

Notably, after the creation of gold spot ETFs, trading volumes across a variety of gold instruments, ranging from the ETFs themselves to underline spot to futures and options, both OTC and listed, along with correlative proxies, increased by orders of magnitude over the years that followed. Will the spot bitcoin ETF follow a similar development path, just like what happened with gold spot ETFs over the years that followed their creation?