1. EigenLayer Executive Summary

Token Overview

- Ticker: $EIGEN

- Current Price: $3.22

- Market Cap: $677,439,347

- FDV: $5,381,770,249

- Sector: Restaking.

2. Due Diligence Summary

2.1. Overview

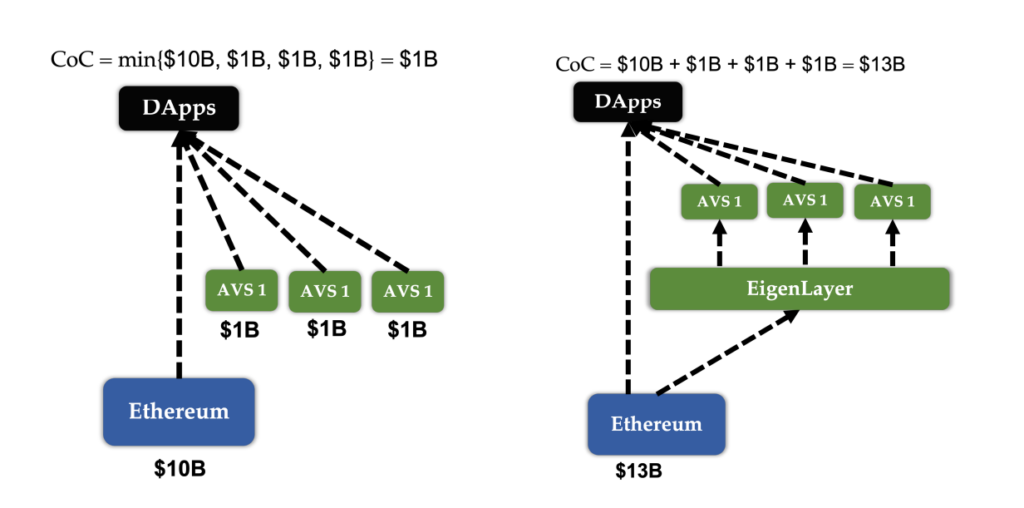

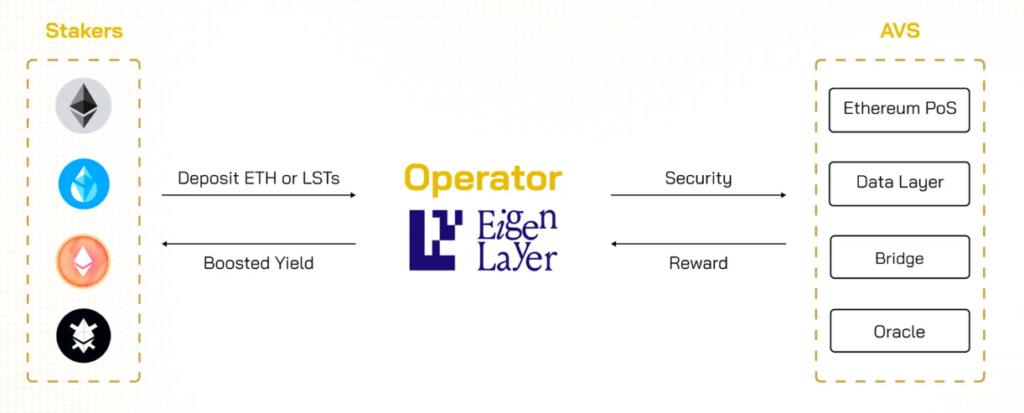

EigenLayer is a pioneering platform that has introduced the concept of Restaking, allowing for the repurposing of Staked Ether (ETH). By staking their native ETH or liquid staking tokens (LSTs) on EigenLayer, users can restake these assets to enhance the security of the broader cryptocurrency ecosystem and various decentralized applications built on the network, while also earning additional rewards.

The EigenLayer ecosystem is structured around three key participants:

- Restakers: These are users who leverage their existing ETH or staked ETH to bolster EigenLayer’s security framework. By committing their assets, they earn yield as a reward for their contribution.

- Actively Validated Services (AVSs): These encompass protocols and decentralized applications (DApps) that require enhanced security, which they obtain by utilizing the pool of restaked ETH within EigenLayer. AVSs compensate restakers with fees, effectively providing a yield for the security services rendered.

- Operators: These individuals play a crucial role in the EigenLayer system by managing the delegation of ETH and staked ETH from restakers to AVSs. In essence, they act as intermediaries, and in exchange for their operational services, they receive a commission

EigenLayer’s Innovation: Redefining Staking

- EigenLayer stands at the forefront of innovation with its groundbreaking re-staking mechanism. This novel approach enables the repurposing of staked assets, empowering a wide range of protocols, maximizing capital efficiency, and significantly bolstering security.

- By offering a highly adaptable infrastructure, EigenLayer fuels innovation, lowers the barriers to development, and cultivates a cohesive ecosystem characterized by enhanced security and seamless Web3 interoperability.

2.2. EigenLayer Competitive Landscape

2.2.1. Market Sector

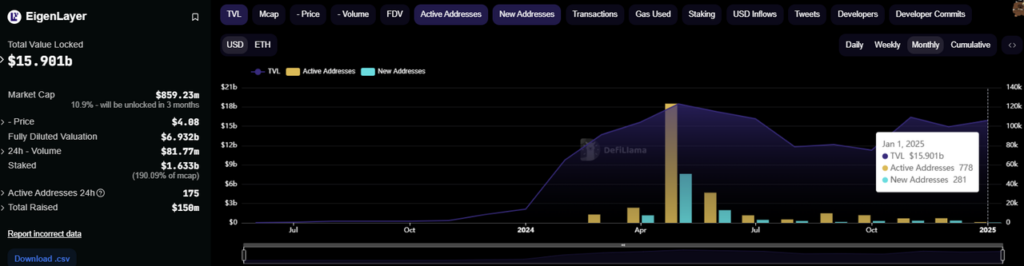

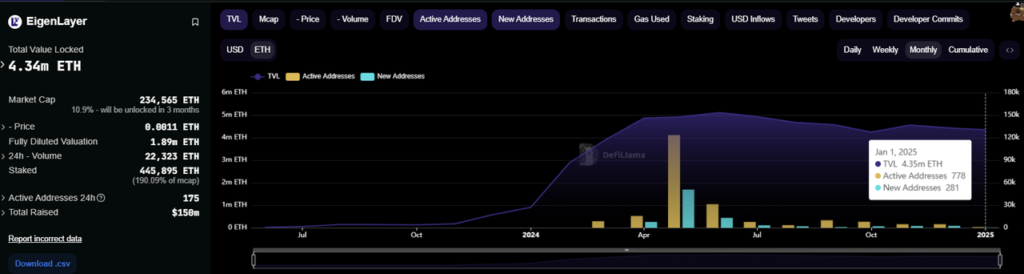

The scale of the ETH Restaking sector uses TVL figures as a basis for comparison to provide an overview of protocols. EigenLayer launched in June 2023 and by January 2024 had achieved absolute dominance in the restaking sector with 83% TVL market share ($15.9B), far surpassing Symbiotic (12%, $2.3B) and Karak (4.45%, $847M), with its attractiveness stemming from the %yield for users and a business model that optimizes costs and security for stakeholders compared to the other two projects.

| Market Share | Eigen Layer | Symbiotic | Karak |

| TVL | $15.901b | $2.323b | $847.23m |

| % Share TVL | 83% | 12% | 4.45% |

2.2.2. Key Metrics (Financial & On-chain Metrics)

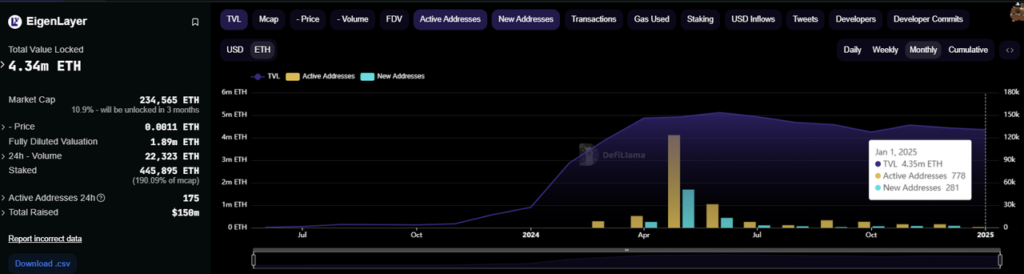

EigenLayer achieved a peak Total Value Locked (TVL) of $18.46 billion in May, corresponding to roughly 4.93 million Ether (ETH) stake. June witnessed a nuanced performance trend. While the USD-denominated TVL experienced a 7.3% decline from its May high, the ETH-denominated TVL demonstrated a robust 16% surge when viewed across the extended period leading to January 2025. Notably, even amidst a dip in ETH’s market value, the platform sustained a substantial staking volume exceeding 4 million ETH, indicative of strong user confidence in EigenLayer’s protocol.

The confluence of a bullish market environment and heightened yield offerings acts as a potent catalyst, effectively driving user acquisition and facilitating the expansion of ETH stake on the EigenLayer platform.

| 05/2024 | 06/2024 | %change | |

| TVL (USD) | $18.46B | $17.32B | -7.3% |

| TVL (ETH) | 4.93M | 5.11M | 16% |

| Active Address | 123.36k | 31.26k | –293% |

| New Address | 50.77k | 13.18k | -285% |

| Total Supply (4% inflation) | 1,700,682,499 | Allocation | Vesting | TGE | Sep-25 | Oct-25 | |||

| Investor | 501,701,337 | 29.50% | 1-year lockup, followed by 4% monthly vesting for 2 years | 0 | 0 | 20,068,053 | 1% | ||

| Early Contributors | 433,674,037 | 25.50% | 1-year lockup, followed by 4% monthly vesting for 2 years | 0 | 0 | 17,346,961 | 1% | ||

| Ecosystem Dev | 255,102,375 | 15% | Unlocked | — | 51,020,475 | 51020474.97 | 3% | ||

| Stakedrop 1 & 2 | 186,582,000 | 15% | Fully unlocked at TGE, 11% of the total supply is circulating, and 4% is allocated for future purposes | 186,582,000 | 186,582,000 | 186,582,000 | 11% | ||

| Stakedrop 3 | 64,465,000 | — | 64,465,000 | 64,465,000 | 4% | ||||

| Community | 255,102,375 | 15% | Unlocked at TGE, available for flexible use and transfer in the future | — | 127,551,187 | 255102374.9 | 15% | ||

| 8% | |||||||||

| Total TGE | 1,696,627,124 | ||||||||

| Circ Supply | 210,808,569 | 186,582,000 | 429,618,662 | 594584864.8 | |||||

| % of Total Supply | 12.396% | 10.97% | 25.26% | 34.96% | |||||

In September 2025, a projected token release is anticipated, introducing an additional 3% of the total supply designated for the Ecosystem, 4% for Stakedrop 3, and 15% for the Community into circulation. This would result in a total circulating supply of 25.26%, equivalent to approximately 429 million $Eigen tokens (as detailed in Column C of the table below).

Based on current projections, $Eigen Layer demonstrates the potential to achieve a return on investment (ROI) of 3x to 5x its Fully Diluted Valuation (FDV). This would translate to a feasible FDV range of $15 billion to $25 billion, aligning with the FDV valuations observed for prominent Layer 1 (L1) coins such as DOT, ATOM, and POL during the 2021 bull market.

| ROI forecast | x1 | x2 | x3 | x4 | |

| Price | $4.11 | $4.11 | $8.22 | $12.33 | $16.44 |

| Market Cap | $880,638,737 | $1,765,732,701 | $3,531,465,402 | $5,297,198,102 | $7,062,930,803 |

| Circulating Supply | 210,808,569 | 429,618,662 | 429,618,662 | 429,618,662 | 429,618,662 |

| Total Supply | 1,700,682,499 | 1,700,682,499 | 1,700,682,499 | 1,700,682,499 | 1,700,682,499 |

| FDV | $7,104,487,684 | $6,989,805,071 | $13,979,610,142 | $20,969,415,213 | $27,959,220,284 |

Upon analyzing the Restaking and Liquid Restaking sectors, it is observed that $EIGEN, $ETHFI, and $REZ exhibit FDV/TVL ratios below 0.5, suggesting potential undervaluation in comparison to their respective Total Value Locked (TVL). Conversely, PUFFER demonstrates a higher valuation, with an FDV/TVL ratio of 2.6.

Evaluating the market’s Fully Diluted Valuation (FDV) against the investor’s FDV reveals that investors have accrued unrealized profits exceeding a 2x Return on Investment (ROI). This is attributed to the tokens being subject to a lock-up period exceeding one year from the Token Generation Event (TGE), which effectively fosters long-term project development incentives and safeguards the interests of retail investors

| Token | Market Cap | Total Supply | FDV | TVL | FDV/TVL |

| Eigen Layer (EIGEN) | $599M | 1.68B | $5.7B | $14B | 0.4 |

| EtherFi (ETHFI) | $321M | 1B | $2B | $8.3B | 0.25 |

| Renzo (REZ) | $64M | 10B | $341M | $1.18B | 0.288 |

| Puffer (PUFFER) | $39.99M | 1B | $753.8M | $279M | 2.6 |

| Token | Avg Investor FDV | Unrealized Profit |

| EIGEN | $1B | 5.7x |

| ETHFI | $270M | 7.4x |

| REZ | $170M | 2x |

| PUFFER | $180M | 4.2x |

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.