TLDR

Ethena leads the decentralized stablecoin and yield sector, experiencing explosive growth in $USDe scale from $131 million to $6 billion (a 4,503% increase year-to-date). This surge has propelled it to the top 3 stablecoin market share, trailing only $USDT and $USDC.

$ENA addresses yield generation challenges by providing real yield derived from staked ETH ($stETH) and ETH. It also capitalizes on the shift in trust away from traditional finance (TradFi) banks (due to bank collapse risks and regulatory crackdowns on crypto via banks, impacting Tether and the broader crypto market) toward centralized exchanges (CEXs) and custodians, aligning with the core narrative of crypto.

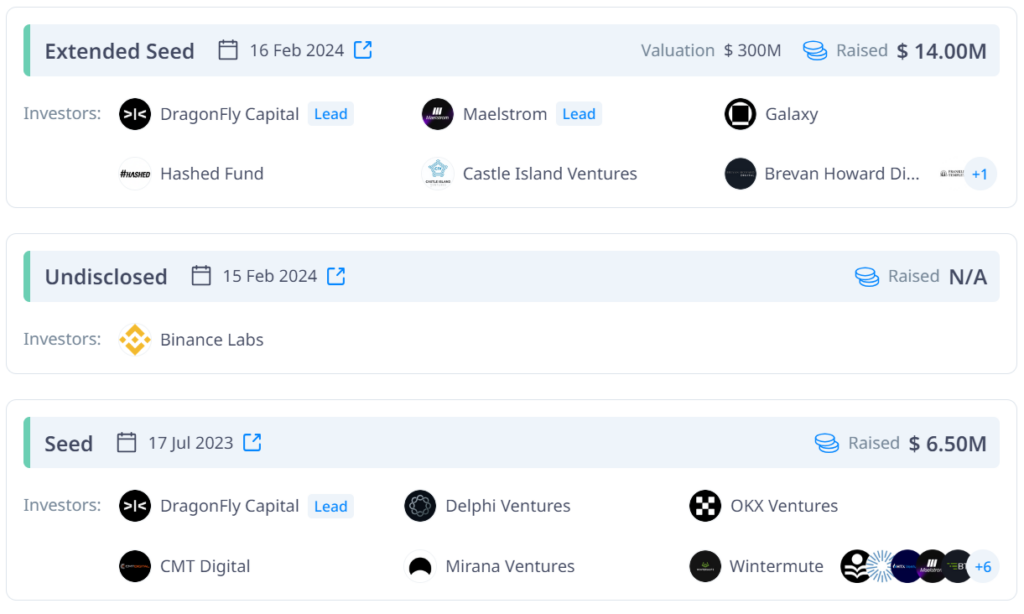

$ENA is backed by Tier 1 venture capital firms, having raised a total of $20 million. The most recent funding round valued the token at $0.02, resulting in a current return on investment (ROI) of 50x. These holdings are locked until April 2025, suggesting potential price manipulation to create FOMO (fear of missing out) before this date.

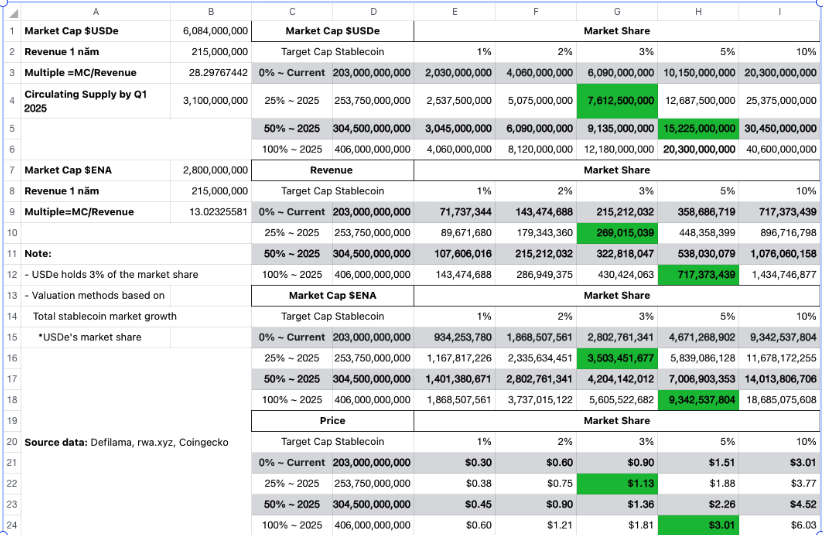

Based on projections, the stablecoin market share is expected to reach 25% in 2025. If $ENA captures 3% to 5% of this market, the $USDe stablecoin’s capitalization could increase from $7 billion to $15 billion, potentially driving $ENA’s price to $2.46-$4.09—a, a 2x to 4x increase from its current value.

1. Due Diligence Summary

1.1. Technology and Product

- Core Technology & Product

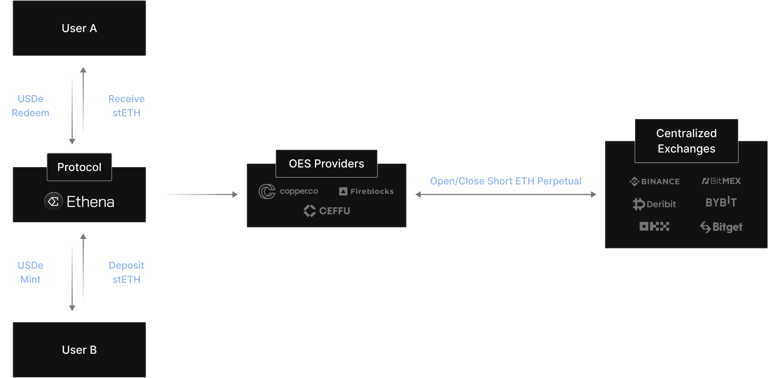

Ethena is a decentralized stablecoin protocol built on the Ethereum blockchain. Ethena’s main product is USDe, a synthetic dollar stablecoin that is backed by a diversified portfolio of crypto assets and corresponding short positions.

- Technology Overview

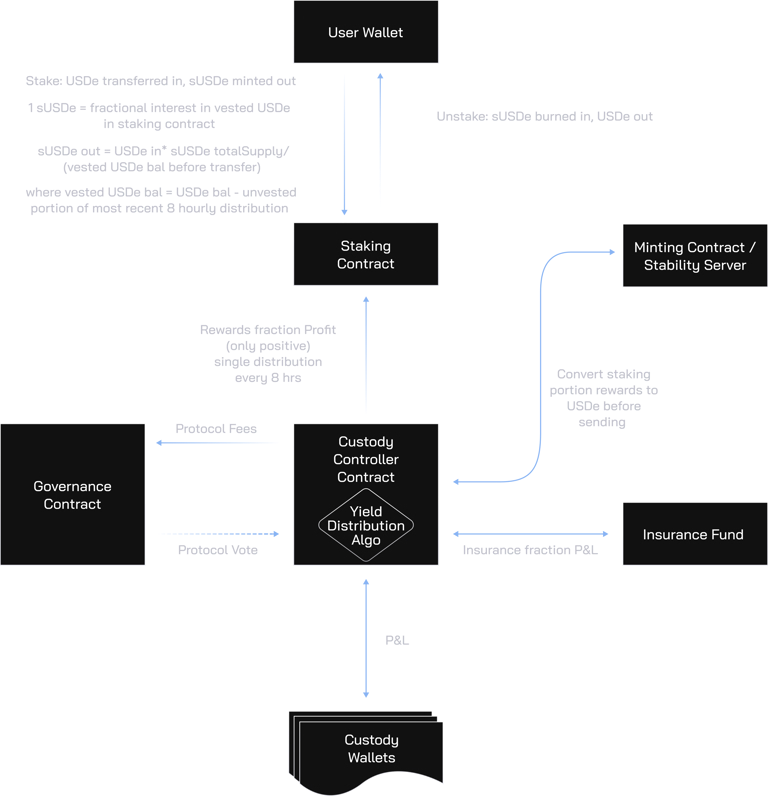

. Users stake USDe by depositing it into the Staking Contract.

. The Staking Contract then routes generate profits and staking rewards to the Custody Controller Contract.

. The Custody Controller Contract manages the distribution of profits, safeguards collateralized assets, and maintains stability through its proprietary Yield Distribution Algorithm.

. A portion of the profits is allocated to both the Insurance Fund and the Governance Contract.

. Users retain the flexibility to unstake their USDe or claim their staking rewards via the Staking Contract.

This comprehensive model ensures the price stability of the USDe stablecoin, provides staking benefits for users, facilitates decentralized governance through the Governance Contract, and mitigates potential risks through the Insurance Fund.

- Innovation Level

$USDe achieves price stability through a sophisticated delta-hedging strategy. This involves establishing non-leveraged short positions on derivatives exchanges, with the total value of these positions mirroring the value of collateral assets deposited by users into the protocol.

1.2. Competitive Landscape

- Market Sector – Stablecoin Decentralized

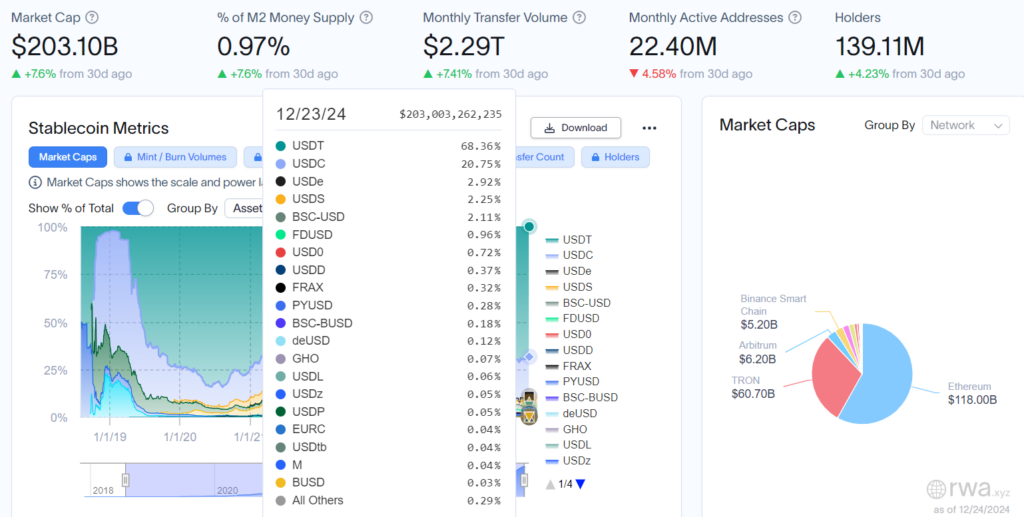

The stablecoin market is currently valued at $203.10 billion, demonstrating impressive growth of 62.5% year-over-year in December 2024. $USDT and $USDC continue to dominate, holding a combined 80% market share.

Since its launch in early 2024, Ethena Labs’ decentralized stablecoin, $USDe, has rapidly gained traction. Backed by a diverse range of collateralized assets, $USDe has experienced explosive growth in Total Value Locked (TVL), surging by 4,503%. Its innovative yield strategies have proven highly attractive to users, propelling $USDe into the top 3 stablecoins by market capitalization, currently at $6 billion, and displacing several established competitors.

- Key On-Chain Metrics

| Ethena | |

| TVL | $6B |

| %Stake sUSDe | 11.38% |

| % Collateral | 10.95% |

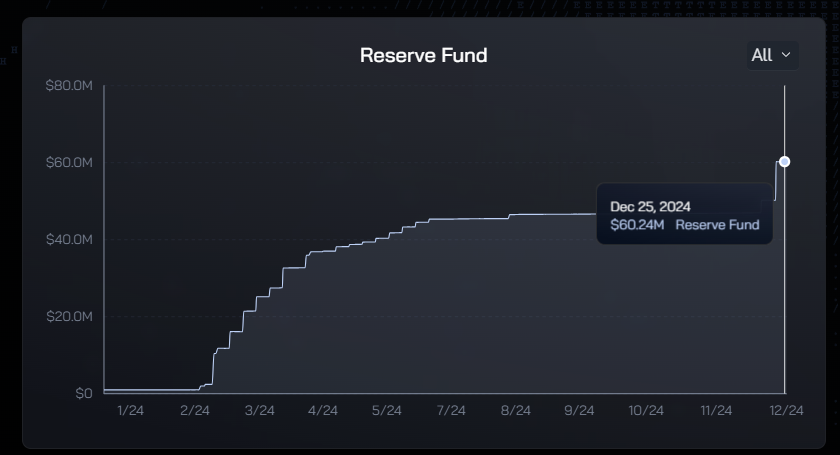

| Reserve Fund | $60M (1.2% Collateral) |

Ethena operates under a Stablecoin Yield model, focusing on the yield generated by both $USDe and the underlying collateral. Currently offering stable and attractive yields, Ethena appeals to users seeking a secure haven for their assets while earning passive income. This model is particularly attractive to those prioritizing safety while looking for yield opportunities.

$USDe maintains a 101.2% backing ratio through third-party custodians, with 1.2% held in highly liquid stablecoins to mitigate potential short-term volatility and ensure stability.

- Competitive Landscape

| Characteristics | Ethena | Usual | Sky | |

| Similarities | Stablecoin | $USDe (Fiat Stb, LST) | $USD0 (RWA) | $USDS |

| LST | $sUSDe | $USD0++ | $USDs | |

| Differences | Total Supply | 6B $USDe | 1.5B$USD0 | 4.6B$USDS |

| % Market Share (in TVL) | 33.96% | 8.59% | 32.76% | |

| Collateral | USDT, USDC, LST | $USYC , $BUILD, $USDC, $USDY | — | |

| Reserve Fund | 101% (Custody) | 100% on-chain | 100% | |

| Yield | $sUSDe | $USUAL | $SKY | |

| % Yield | 12% | 71% | 12% | |

In the decentralized stablecoin yield market, Ethena currently leads with a 33.96% share, followed by $SKY at 32.76%. However, the recently emerged $USUAL poses a significant threat, with its compelling yield model that could attract users away from both Ethena and Sky.

To maintain its competitive edge, Ethena needs to explore and implement new strategies to enhance user yields and prevent market share erosion to competitors like $USUAL.

1.3. Tokenomics analysis

- Total Supply: 15,000,000,000

- Circulating Supply: 2,937,500,000 (19.5%)

- Price: $1.03

- Market Cap: $3,077,237,909

- FDV (Fully Diluted Valuation): $15,713,555,282

- Total Raised Fund: $20.50M – Tier 1: Dragonfly Capital, Galaxy Ventures, Binance Labs…

- Latest Investor Round Price: $0.02/ENA ~ Valuation $300M, with a 50x ROI.

Token Use Case

- Protocol governance

- Staking

- Vote

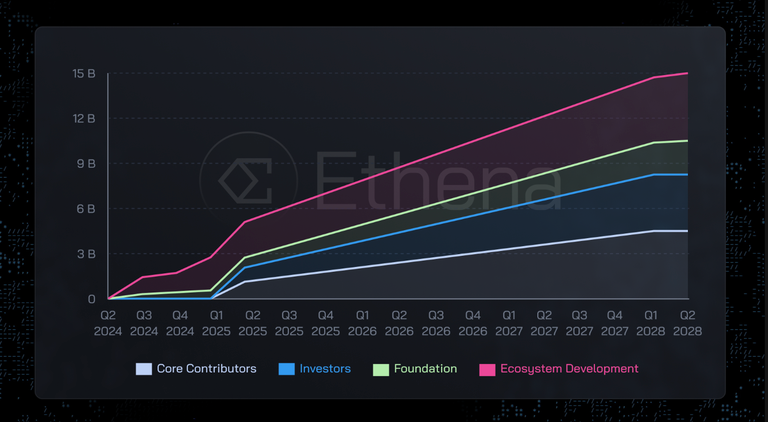

Token Allocation & Vesting

| Allocation | Lock | Vesting | |

| Core | 30% | Lock 1 year, unlock 25% in 04/2025, 0.93%/month of total supply | The remaining 75% vesting over 2 years |

| Investors | 25% | Lock 1 year, unlock 25% in 04/2025, 2%/month of total supply | The remaining 75% vesting over 3 years |

| Foundation | 15% | No lock, used to promote initiatives to expand | — |

| Eco Dev & Airdrops | 30% | No lock, 10% of total supply put into TGE, the remaining 20% develop the protocol | — |

1.4. Ethena Valuation

Forecast stablecoin market growth through the following scenarios: 25%, 50%, and 100% in 2025, at which point the $ENA Market Cap will have corresponding values ranging from $900M to $18B USD.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.