1. Introduction

Aptos has positioned itself as a next-generation blockchain protocol, built upon the technical expertise and regulatory insights developed during Meta’s Diem project. As a disruptor in the Layer-1 blockchain ecosystem, Aptos combines cutting-edge technological innovation, significant institutional backing, and a strategic focus on scalability, security, and adoption.

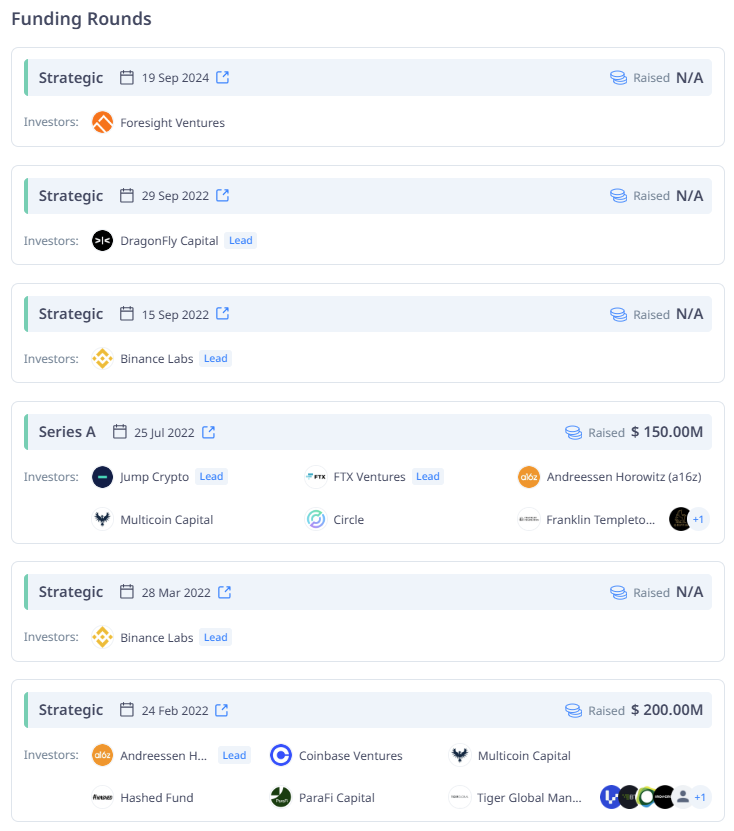

Aptos’ funding landscape highlights robust institutional support:

- Funding Rounds: Raised $350 million from top-tier investors, including Andreessen Horowitz (a16z), Jump Crypto, and Multicoin Capital.

- Ecosystem Integrations: Partnerships with platforms like BlackRock’s BUIDL Fund and Franklin Templeton’s FOBXX bring institutional-grade solutions to Aptos.

This article explores the immense potential and rapid growth of the Aptos ecosystem.

2. Aptos Network analysis

The Aptos network consistently demonstrates its ability to handle massive transaction volumes, underlining its scalability and resilience. Tested during periods of extreme network activity, it has proven its readiness to support high-throughput applications across gaming, social media, and DeFi.

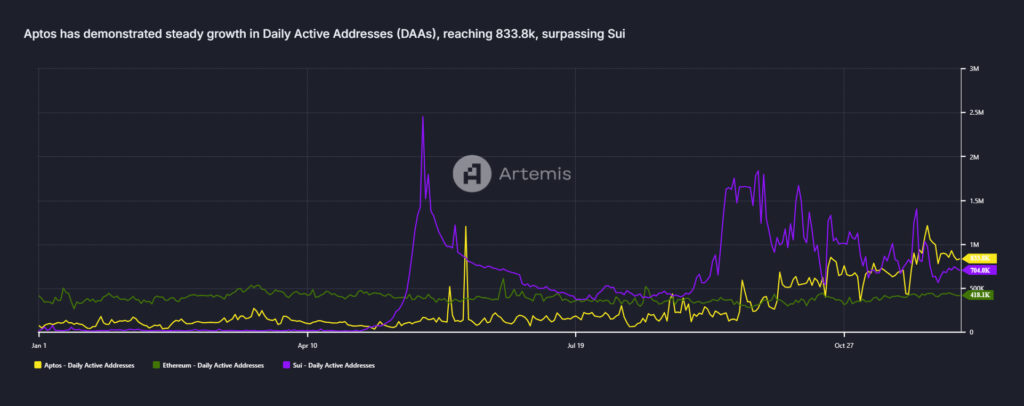

2.1. Aptos Daily Active Addresses

Aptos has achieved steady growth in Daily Active Addresses (DAAs), starting from modest levels but catching up to Sui by Q4 2024. With 833.8k DAAs, Aptos reflects increasing user adoption and strong ecosystem retention compared to competitors.

Unlike Sui, which experiences sharp drops in activity following major spikes, Aptos sustains its address growth, suggesting more durable user engagement. This consistent increase highlights the network’s ability to attract and retain users, laying a robust foundation for long-term ecosystem expansion.

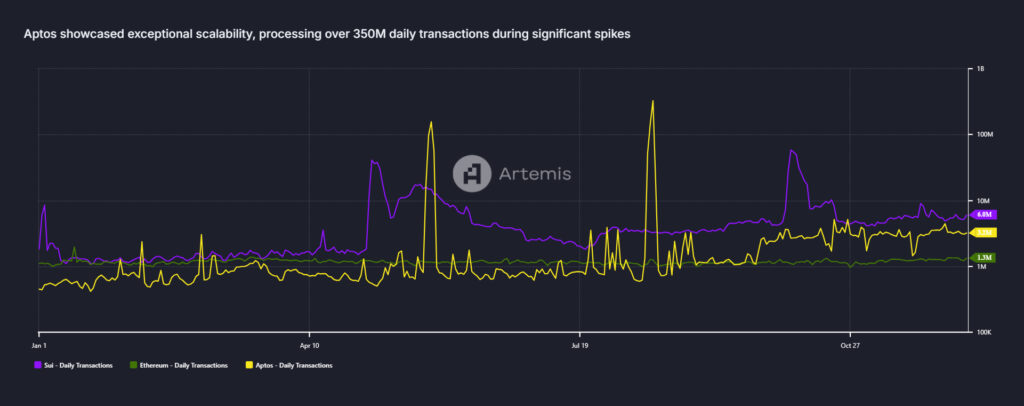

2.2. Aptos Daily transactions

Its scalability has been showcased through its ability to process over 350 million daily transactions during activity spikes in May 2024 and August 2024, surpassing competitors like Ethereum and Sui. These events highlight Aptos’ robust infrastructure and ability to manage extreme transaction loads, solidifying its position as a high-throughput blockchain.

- May 2024: The launch of Tapos Cat, an interactive game where players “tickled” a virtual cat, drove 325 million transactions over four days. The network maintained a sustained rate of over 2,200 transactions per second (TPS) for over 24 hours, peaking at 5,000 TPS.

- August 2024: A follow-up event introduced features like Super Cat mode and Mystery Boxes, resulting in 533 million transactions over three days. During this period, the network handled 12,000 TPS and onboarded over 20,000 blockchain accounts, showcasing its scalability and ability to engage users through gamified applications.

Following these spikes, daily transactions normalized to approximately 3.2 million. This normalization indicates that these surges were event-driven rather than reflective of sustained organic ecosystem growth. However, the network’s ability to handle these spikes positions Aptos as a scalable and reliable blockchain for diverse applications.

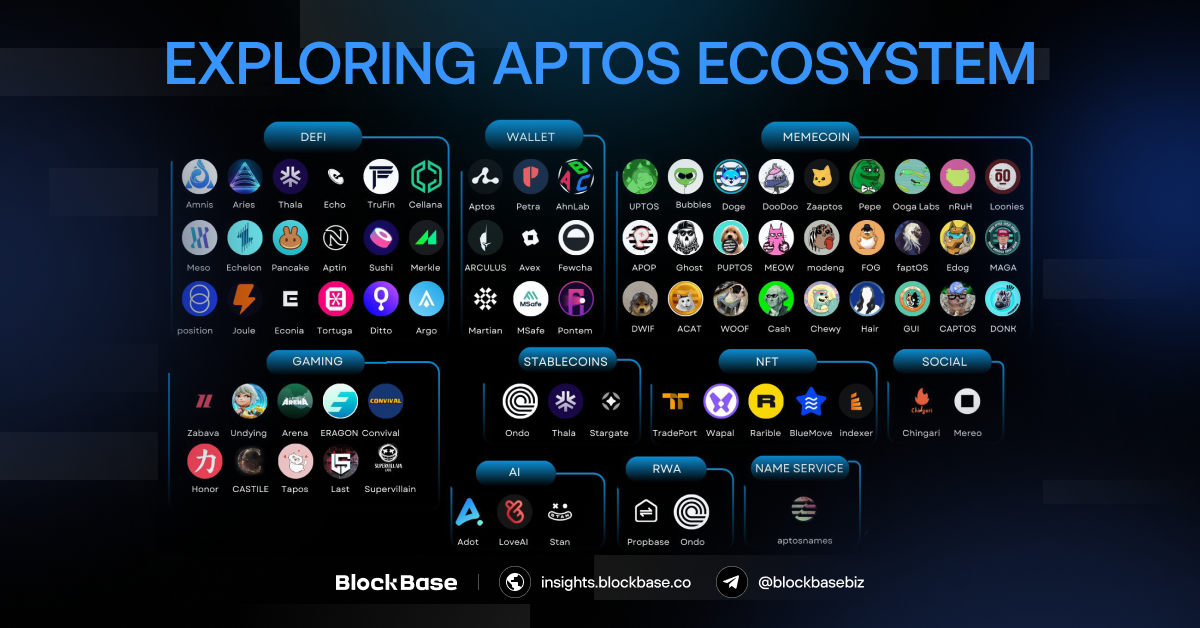

3. Aptos Ecosystem analysis

3.1. DeFi

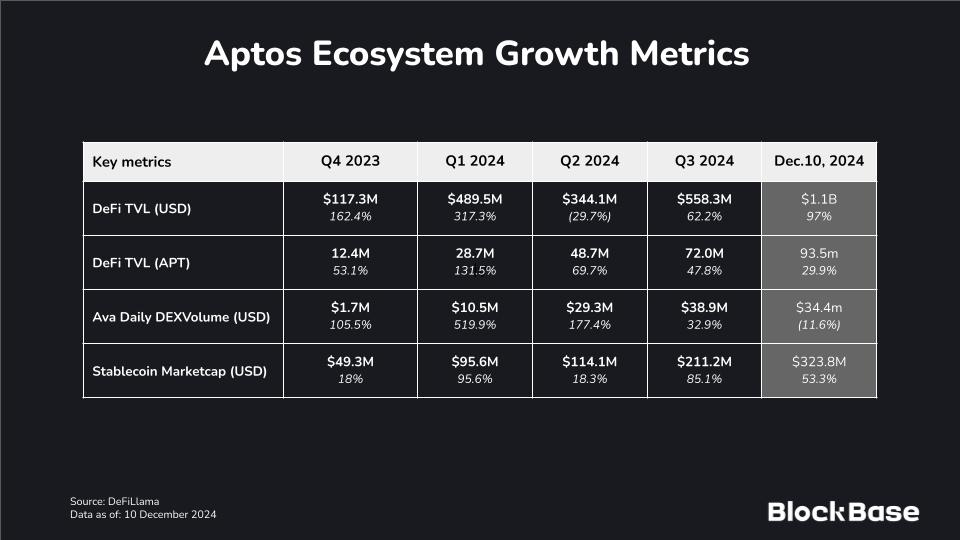

Aptos achieved a significant milestone in its ecosystem development by surpassing $1 billion in Total Value Locked (TVL) on November 12, 2024, maintaining this level consistently after that. This remarkable growth translates to a year-to-date increase of over 860% in USD terms and 650% in APT terms, signaling that the majority of the growth stems from heightened protocol usage rather than mere price appreciation of APT, which has risen by a modest 16% in the same period.

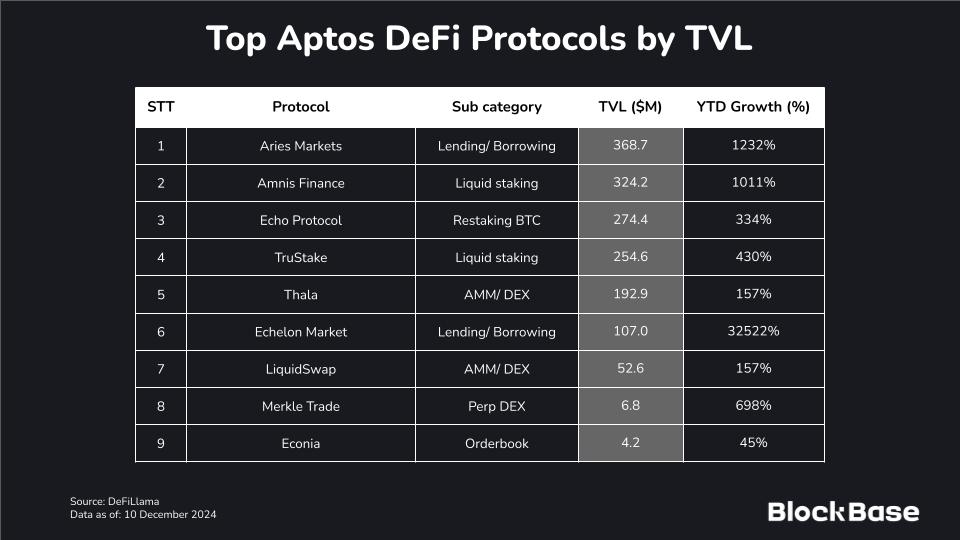

This surge in TVL reflects the dynamic expansion of protocols and innovative platforms across the Aptos ecosystem, which include:

- Aries Markets: A versatile DeFi protocol offering deposits, collateralized borrowing, token swaps (including with leverage), and margin trading. Its introduction of Efficiency Mode (E-Mode) in April 2024 allows a loan-to-value (LTV) ratio of up to 90% on selected assets. Aries also supports zero-loss conversions from LayerZero-bridged USDT to native USDT.

- Amnis Finance: A liquid staking protocol enabling users to mint amAPT by depositing APT. Staked amAPT (stAPT) accrues validator rewards, with additional features like lottery draws and “Lucky Wheel” incentives to engage users.

- Echo Protocol: Launched in August 2024, this protocol facilitates Bitcoin liquidity on Aptos through aBTC, a token bridged from the B^2 Network. Echo supports lending and borrowing across assets like BTC, USDT, and USDC.

- TruStake: Aptos’ liquid staking protocol allowing users to mint TruAPT, which accrues validator rewards and enhances staking flexibility.

- Thala Labs: Provides a suite of trading and yield products, including the over-collateralized stablecoin Move Dollar (MOD), various liquidity pools, and liquid staking options.

- Echelon Market: A permissionless money market platform offering lending, borrowing, swaps, and asset bridging with integrations such as LayerZero and Wormhole.

- Merkle Trade: The first-ever gamified omnichain perpetual DEX, combining trading with gaming elements.

- Econia: A hyper-parallelized on-chain order book for the Aptos network, enhancing trading efficiency and scalability.

3.2. Stablecoin

In October 2024, Tether introduced its native USDT token contract on Aptos, marking a pivotal milestone as the largest stablecoin by market capitalization integrated into the network. By December 10, 2024, the circulating supply of native USDT on Aptos reached 236 million, significantly surpassing the usage of previously available bridged alternatives.

Building on this momentum, Circle launched its native USDC token contract on Aptos in November 2024. As of December 10, 2024, the circulating supply of native USDC on Aptos stood at 35 million. To further enhance accessibility, the Aptos Foundation partnered with Stripe, enabling fiat-to-USDC conversions through Aptos-compatible wallets. This strategic collaboration simplifies onboarding for both new users and businesses, reinforcing Aptos’ position as a user-friendly blockchain ecosystem.

The deployment of native USDT and USDC underscores Aptos’ commitment to fostering a secure, scalable, and institutional-ready environment. By reducing reliance on bridged stablecoins, Aptos enhances network security, operational efficiency, and liquidity, aligning itself with the demands of global DeFi markets and institutional-grade solutions.

These deployments drive institutional adoption on Aptos:

- Franklin Templeton’s FOBXX Expansion: In October 2024, Franklin Templeton added Aptos to its supported blockchains for the on-chain U.S. Government Money Fund (FOBXX). By December 1, 2024, the circulating supply of BENJI tokens reached 371 million, with 21.2 million (6%) hosted on Aptos.

- BlackRock’s BUIDL Integration: In November 2024, BlackRock expanded its USD Institutional Digital Liquidity Fund (BUIDL) to Aptos, making it the only non-EVM chain integrated with the fund. By December 10, 2024, the circulating token supply of BUIDL stood at 555 million, with 1 million circulating on Aptos. Aptos offers a competitive management fee of 20 bps, lower than the 50 bps on Ethereum and other EVM chains.

- Bitwise’s Aptos Staking ETP: On November 19, 2024, Bitwise launched the Aptos Staking Exchange-Traded Product (ETP) on the Swiss SIX exchange under the ticker APTB. This ETP provides European investors with exposure to Aptos’ native token while offering staking rewards of approximately 4.7% net of fees.

3.3. RWA

- Propbase: A real estate platform tokenizing properties on Aptos, enabling fractional ownership and making real estate investments more accessible and transparent.

- Ondo Finance: Offers tokenized financial products such as the U.S. Dollar Yield (USDY), delivering high-quality, dollar-denominated yields by leveraging U.S. Treasuries and bank deposits.

- Nutrios: A platform tokenizing meal services, allowing users to access and invest in diverse culinary experiences.

3.4. Gaming/ Social

- Eragon: A decentralized app store optimized for mobile Web3 gaming, offering tools for seamless migration from Web2 to Web3 and keyless account access.

- Aptos Arena: A top-down shooter game introducing “Kill to Earn” mechanics, targeting a broad gaming audience with innovative reward systems.

- Supervillain Labs: A Web3 gaming studio driving innovation with a diverse portfolio, ranging from casual games to MMORPGs.

- Undying City: A mobile survival game built on Aptos, offering immersive gameplay and blockchain integration.

- Chingari: A Web3-enabled social network with over 200 million downloads, empowering users to create and engage with short-form video content and live streams.

- Stan: An esports and influencer engagement platform with over 10 million downloads, transforming fan interactions in India’s gaming community.

- AcornQuest: The first native quest and reward platform on Aptos, offering gamified experiences to incentivize user participation.

- BuidlerDAO: A Web3 talent and project network fostering collaboration and innovation across the Aptos ecosystem.

- Kade: A decentralized social network prioritizing user autonomy and data ownership.

3.4. NFT

- Wapal: A no-code NFT marketplace and launchpad simplifying the creation and trading of NFTs for both individual artists and large projects.

- Aptos Art Museum: The first metaverse art gallery in the Aptos ecosystem, providing a virtual space for showcasing digital art.

- BlueMove: A multi-chain NFT marketplace facilitating seamless NFT transactions with advanced features.

- Souffl3: An NFT ecosystem leader offering comprehensive services and tools for creators and traders.

- SeaShrine: An NFT marketplace integrating a GameFi DAO reward system, ensuring a secure and incentivized trading environment.

3.5. Artificial Intelligence

- Aptos Assistant: An AI-powered companion streamlining user interactions within the Aptos network, offering accessible and intelligent support.

- Overlai: A mobile AI photo protection app designed to safeguard creators’ digital content using cutting-edge AI technology.

- AIOZ Network: A decentralized platform integrating AI for Web3 storage, streaming, and enhanced user experiences.

- Nimble Network: The first modular AI orchestration network, facilitating efficient AI operations across the Aptos ecosystem.

- Panora: A smart DEX aggregator utilizing AI to optimize trading strategies and improve user experience.

4. Final thoughts

Aptos has demonstrated remarkable growth through key performance metrics, particularly in its ability to attract developers and institutional investors. Daily active addresses (DAAs) have shown steady increases, signaling sustained user activity, while the network has surpassed $1 billion in Total Value Locked (TVL)—a testament to the robust development of its decentralized finance (DeFi) ecosystem.

However, retail investor engagement remains a challenge. The recent launch of Emoji.Fun, a retail-oriented platform developed by Econia Labs, did not meet expectations. Low user adoption and underwhelming activity metrics highlight gaps in Aptos’ ability to resonate with retail participants. Addressing these shortcomings is essential to achieve a well-rounded and inclusive ecosystem growth strategy.

Looking ahead, the broader Aptos ecosystem remains robust, driven by strategic partnerships, substantial funding, and a steadfast focus on scalability and efficiency. These pillars position Aptos as a credible competitor to established Layer-1 giants like Ethereum and Solana.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.