As the Federal Reserve prepares for an imminent rate cut, many investors view this move as a potential bullish signal for the markets. But is this always the case? Understanding the underlying motivations behind the Fed’s decisions is crucial to navigating these shifts effectively.

Our latest research provides an in-depth analysis of how past Fed rate cuts have impacted risk assets. We delve into historical data to offer a comprehensive view of what might unfold in the current economic climate. By examining these patterns, we aim to equip well-informed investors with the insights needed to strategically adjust their portfolios.

While history may not always repeat itself, it often provides valuable lessons. Don’t miss out on this crucial analysis.

1. Overview

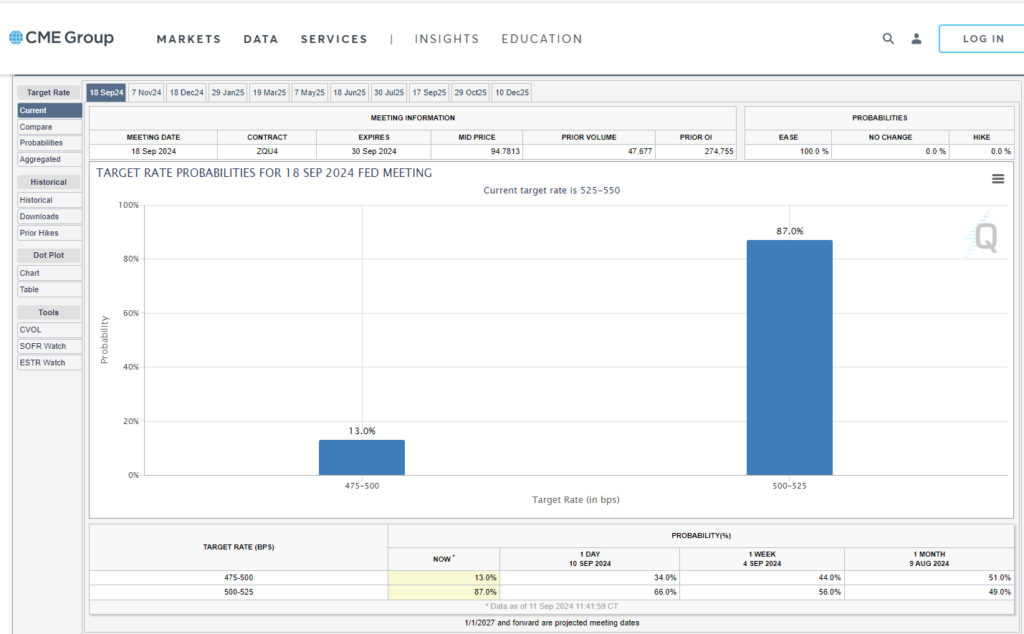

Fed Chair Jerome Powell’s recent speech at Jackson Hole indicates that the Fed is preparing for rate cuts, underscoring that “the time has come for policy to adjust.” The market is currently pricing on a 100% probability of a rate cut in September, with an 87% chance of a 25bp cut and a 13% chance of a 50bp cut.

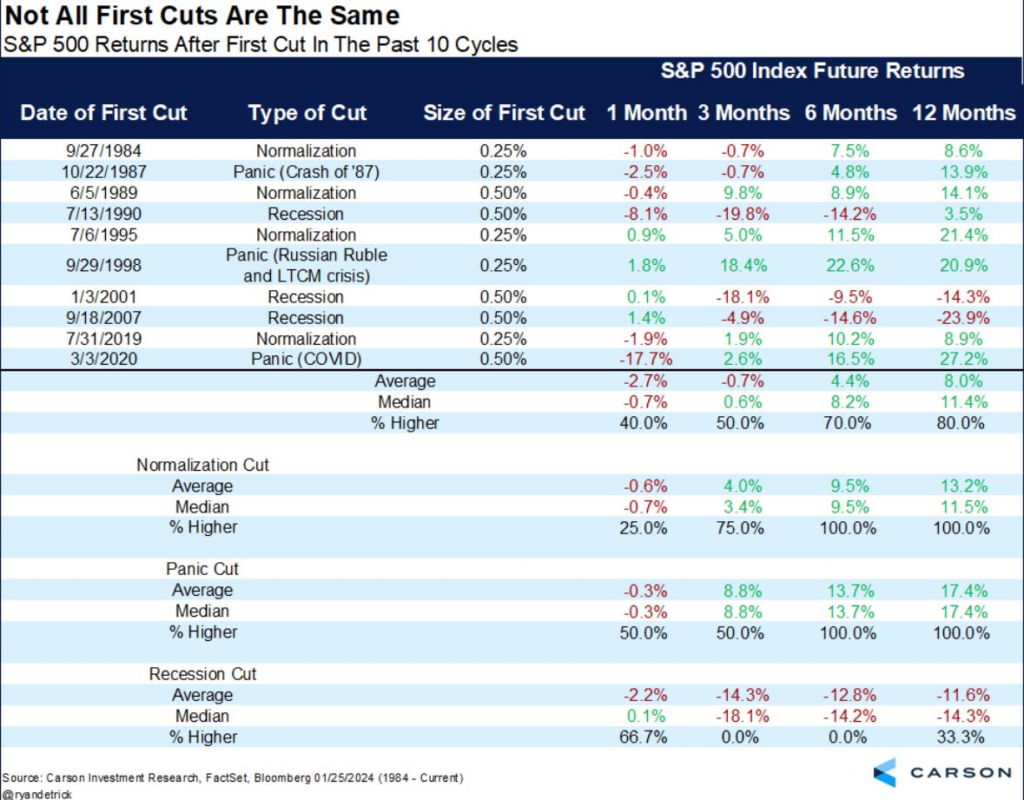

Typically, rate cuts are seen as bullish for risk assets, as lower interest rates tend to stimulate the economy and enhance liquidity in financial markets. Historically, initial rate cuts have often resulted in positive average returns, particularly after three months, provided there is no accompanying recession. Conversely, if the Fed is compelled to cut rates in response to macroeconomic weakness, the stock market may experience adverse effects.

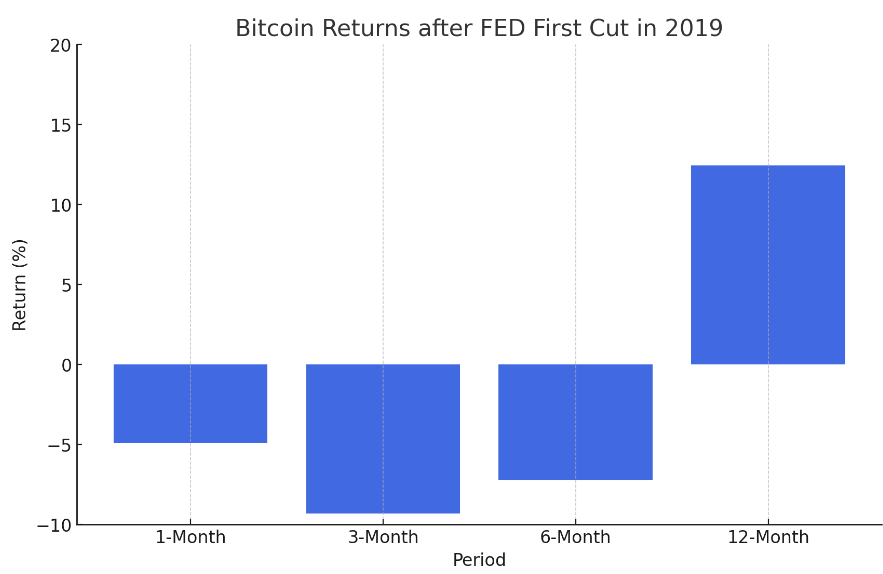

In the crypto market, the Fed’s pivot to rate cuts in 2019 initially led to declines in Bitcoin (as illustrated in the chart below). Following the Fed’s rate cut on September 19, 2019, market concerns about a potential economic downturn resulted in a 20% drop in Bitcoin within a week. Both rate cuts (the first in July and the second in September) were driven by economic uncertainties, global conditions, low inflation, and a desire to sustain economic expansion. Despite these short-term declines, Bitcoin demonstrated resilience and a strong recovery in the long term, ending with a significant positive return.

It is crucial to closely examine the underlying reasons behind the Fed’s rate cuts. A stimulative effect on asset prices is likely to be more pronounced if the cuts occur during a period of low inflation and robust economic activity. Conversely, rate cuts amid signs of economic fragility may signal potential trouble, leading investors to shift capital from riskier assets to safer investments, such as government bonds.

2. Current State of Play

Currently, officials are poised to lower interest rates to prevent a recession, aiming to guide the U.S. economy toward a “soft landing.” This scenario envisions a decrease in inflation while maintaining steady growth and low unemployment.

Many investors anticipate that the first rate cut will spark a bull run for Bitcoin. Lower interest rates often encourage investors to seek higher returns through riskier assets. However, the reaction of Bitcoin and other risk assets will depend on the broader economic context in which rate cuts occur.

Now there is plenty of economic data telling us the U.S not in a recession:

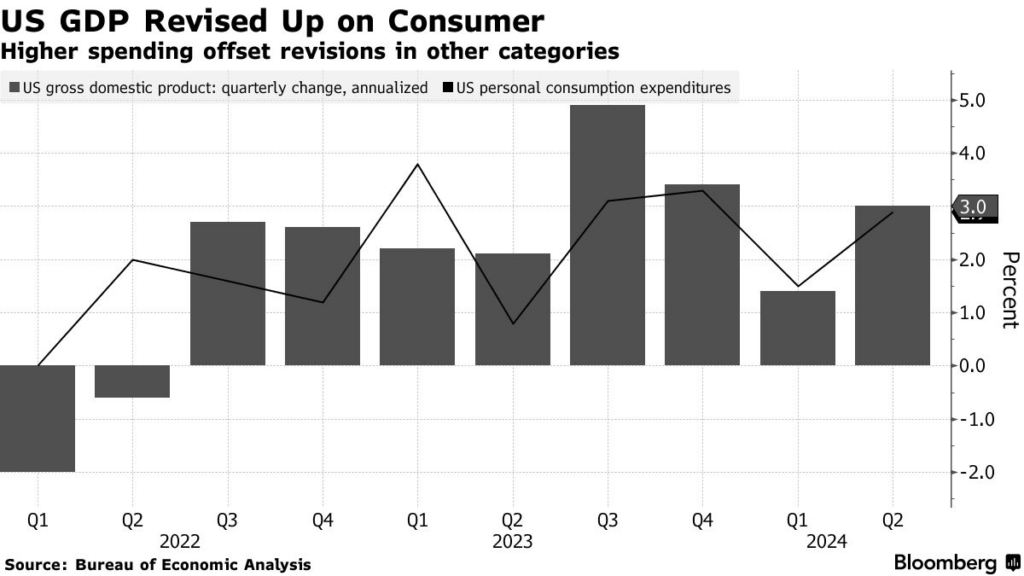

- GDP: The economy as a whole was chugging along at a decent clip, with growth clocking in at 3% in the second quarter, up from the previous estimate of 2.8%. Personal spending, a major driver of economic growth, increased by 2.9%, surpassing the earlier estimate of 2.3%.

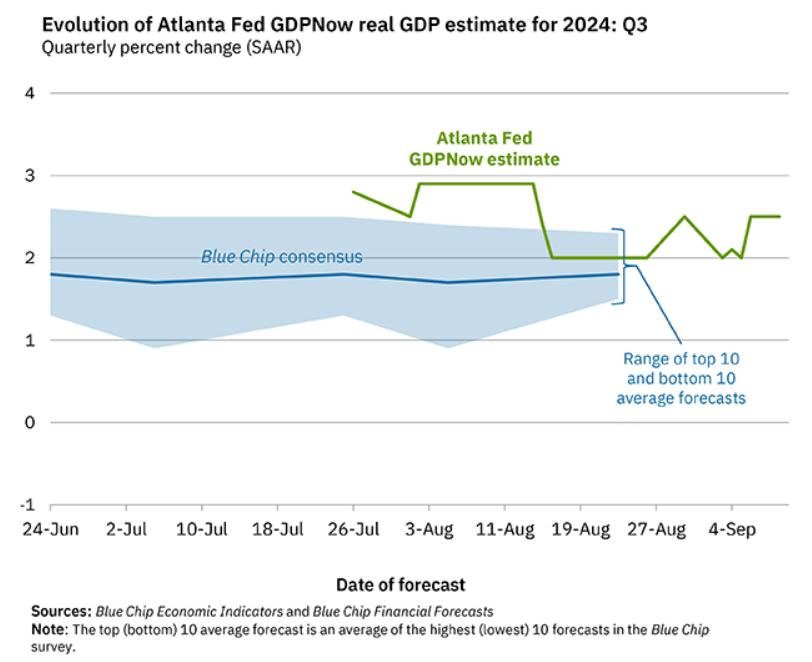

- Atlanta Fed GDP Now: The Atlanta Fed’s GDPNow model forecasts a GDP growth rate of 2.5% for the current quarter.

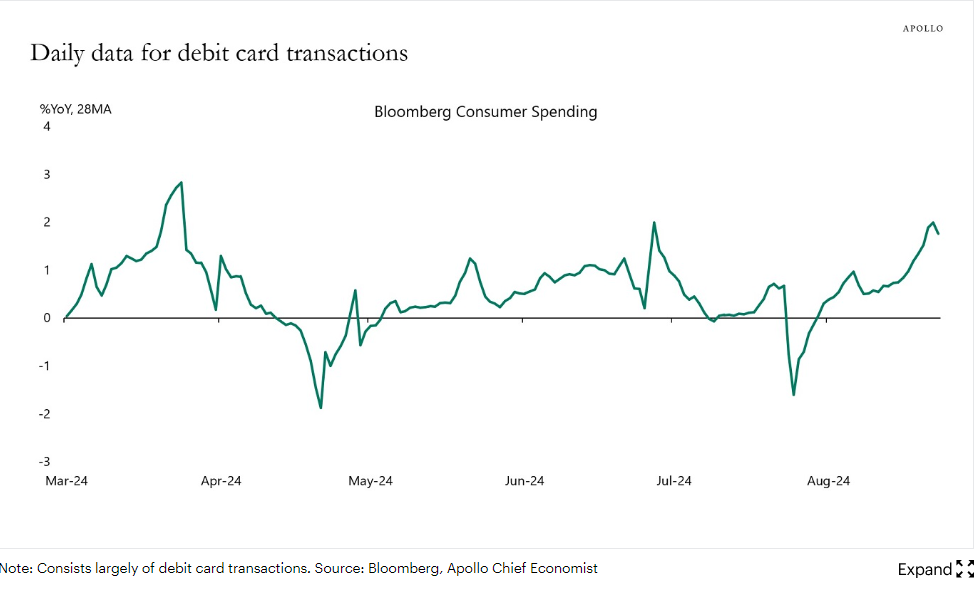

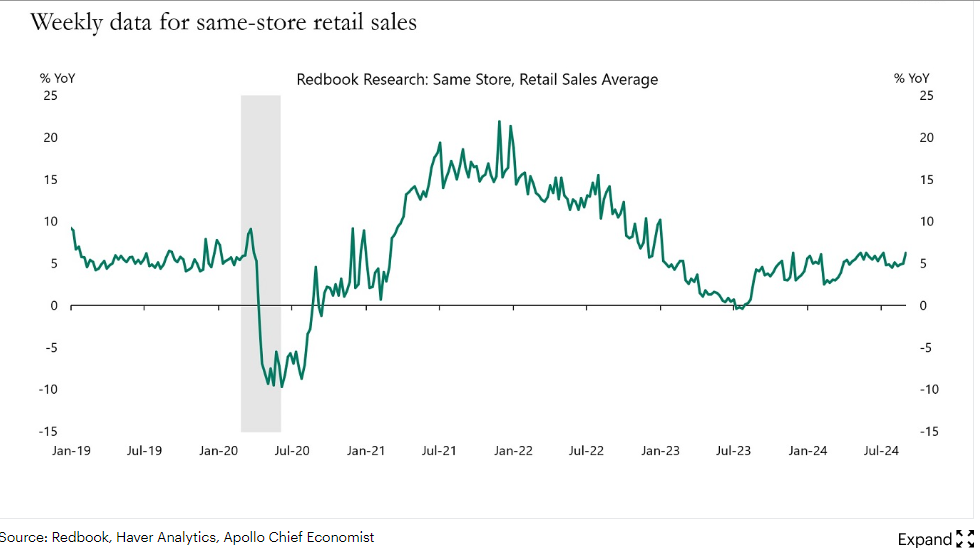

- Spending: Daily debit card transaction data show an acceleration in consumer spending. Additionally, weekly retail sales data have increased, indicating robust consumer activity.

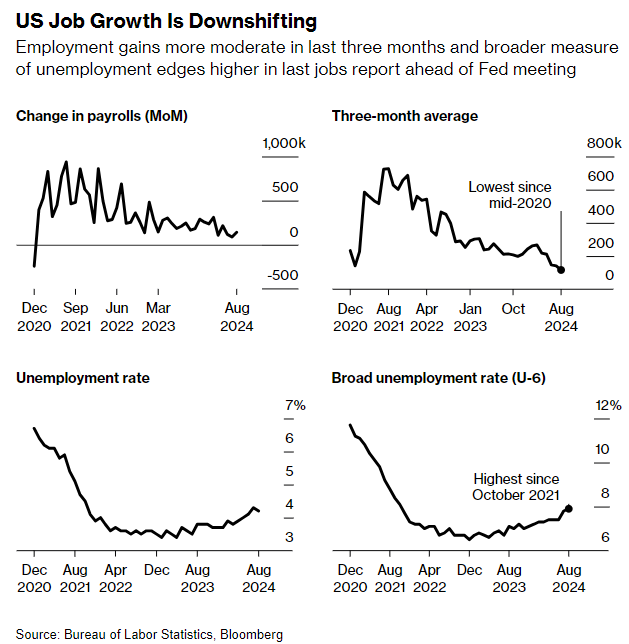

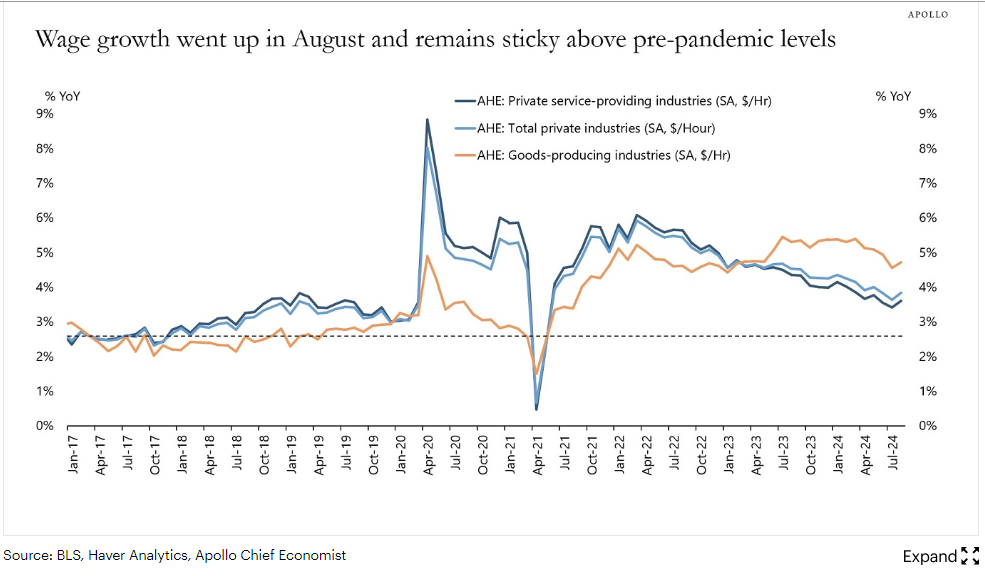

- Employment: The August payroll report revealed a slight decline in the unemployment rate from 4.3% to 4.2%. Job growth slowed to +142,000, while wage growth accelerated to 3.8%.

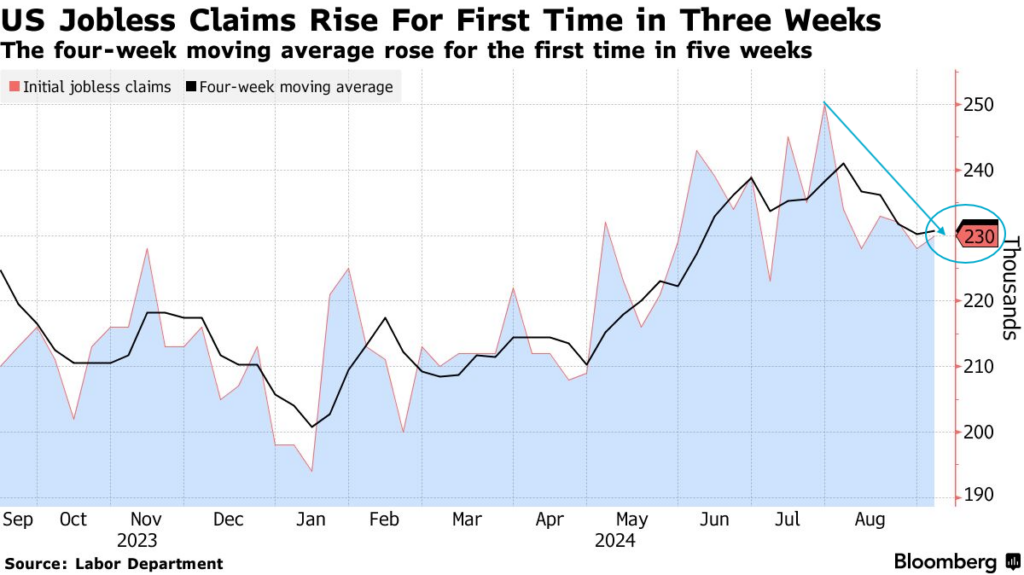

- JOBS: Despite the latest increase, the number of jobless claims and continuing claims has remained subdued for several weeks. This is consistent with a gradual slowdown in hiring. Despite labor market data suggesting some weakening, it does not signal a weak economy or an imminent recession. Instead, it highlights increasing risks rather than confirming a recessionary trend.

3. Closing Thoughts

Lower interest rates generally create a favorable environment for asset prices. They also make borrowing cheaper for investors, stimulating spending and further invigorating the economy.

The Fed’s decision to cut rates is driven by low inflation and a cooling job market. This easing cycle is not accompanied by a recession, which could initially boost all risk-on assets, including Bitcoin. However, these gains might be moderated by confounding major events such as elections and the respective policies of presidential candidates.

Regardless of the election outcome, substantial fiscal support is expected to follow, aiming to stimulate the economy. If the Democrats win, there may be increased spending on green initiatives and welfare, which could positively impact the market. If the Republicans win, there might be significant tax cuts for wealthy and publicly traded companies. Therefore, concerns about a recession may be mitigated by the fiscal plans of either party.

While the Fed’s actions are often viewed as a primary driver of Bitcoin’s price, it is essential to recognize that Bitcoin’s movements are fundamentally driven by demand. Macroeconomic factors and liquidity conditions are not the sole determinants of the crypto market’s behavior. Internal market dynamics, including market structure and demand-supply factors, play a critical role in influencing Bitcoin’s price movements.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.